After closing a $4.5 billion acquisition of Earthstone Energy, Permian Resources isn’t ruling out more large-scale M&A. But the growing E&P also sees running room for its small-scale ground game strategy in the Delaware Basin.

Midland, Texas-based Permian Resources Corp. added around 740 net acres in the Delaware Basin across 20 grassroots transactions during the third quarter, the company disclosed in its latest earnings report.

“Those are, I think, the most attractive acquisition opportunities we look at—often right ahead of the drill bit and really, really accretive,” said Will Hickey, co-CEO of Permian Resources, during the company’s third-quarter earnings call.

The incremental, small-ball acquisitions in the Delaware Basin “represent a pretty unique value proposition” for Permian Resources today, Hickey said.

The small-ball market for bolt-on deals has remained steady over the years for Permian Resources, which formed through the combination of Centennial Resource Development Inc. and Colgate Energy Partners III LLC in September 2022.

The smaller deals are largely driven by independent private sellers or family-owned Permian Basin oil companies. And prices for these smaller deals don’t swing as wildly with the ups and downs of the volatile oil and gas price cycles compared to the broader M&A market, Hickey said.

Gaining additional scale in the northern Delaware Basin through the Earthstone Energy acquisition makes the opportunity set for Permian Resources’ ground game effort even more attractive.

“A larger footprint creates more opportunities for bolt-on acquisitions, for trades, et cetera,” he said.

RELATED

Could Permian Resources Shop Midland Assets After $4.5B Earthstone Deal?

Dealing in the Delaware

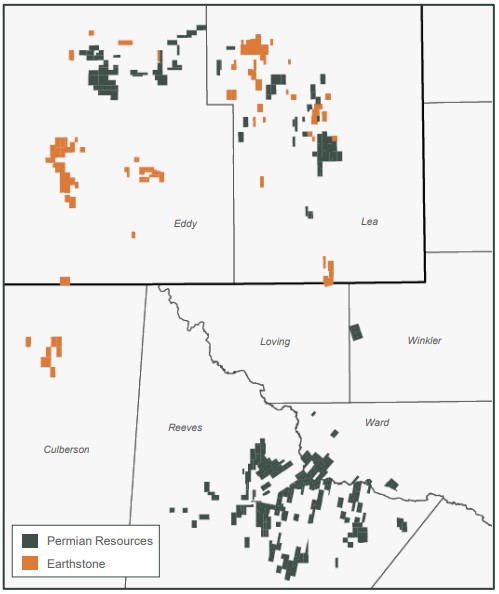

The Earthstone acquisition included acreage and assets in the Permian’s Midland Basin. But Permian Resources’ acquisition strategy is wholly focused on the Delaware Basin, where the company is deploying the vast majority of its development capital for future drilling.

Permian Resources reiterated its plans to shift drilling rigs from Earthstone’s Midland acreage and to reallocate that capex into the Delaware. As part of the company’s development plan, over 90% of capital spending will be deployed in the Delaware, Hickey said.

Compared to the Midland Basin—much of which has been scooped up at premium prices by the largest majors and super-independents—the Delaware Basin remains a much more fragmented play.

The northern Delaware, including Lea and Eddy counties, New Mexico, has seen a flurry of M&A and development; Recent buyers include Matador Resources and Civitas Resources.

E&Ps like Permian Resources, Vital Energy, Continental Resources and Vitol-backed VTX Energy have been active consolidators in the southern Delaware portion of West Texas.

The Delaware Basin has seen a lot of dealmaking activity so far this year, and Permian Resources took a look at all of those opportunities, Hickey said. But no deals made sense for the company outside of the large-scale Earthstone acquisition.

“We’re continuing to see the small-ball ground game to be the most attractive opportunities that are the highest rate of return, the most inventory-accretive and ultimately set us best up for long-term value creation,” Hickey said.

“I’d say larger stuff, at some point down the road, could make sense again,” he said.

RELATED

CEO: Vital Energy Sees ‘A Lot More Opportunity’ for Permian M&A

Lateral moves

Permian Resources achieved its best operational quarter to date in the third quarter as unit costs fell and well results improved, according to analysts at Truist Securities.

Total average production came in at 172,000 boe/d during the third quarter; oil volumes averaged approximately 89,800 bbl/d.

The company continued to see increases in drilling efficiencies, with drilled and completed feet per day both increasing quarter over quarter. That helped drive an approximately 5% reduction in well costs on a per lateral foot basis, Permian Resources reported.

Several operators are working to drill longer laterals to try to squeeze as much oil out of their shale rock as possible.

RELATED

Chord Energy Goes Long: Bakken E&P Investigating Four-mile Laterals

After closing its massive $60 billion acquisition of Pioneer Natural Resources, Exxon Mobil Corp. aims to drill more four-mile laterals on a much larger acreage footprint in the Midland Basin.

Permian Resources thinks its acreage position is best-suited for 2-mile lateral development today.

“It is our belief still today that a 2-mile lateral is the optimal, most capital efficient or risk-adjusted return lateral length in the Delaware,” Hickey said.

Permian Resources co-CEO James Walter said the push for longer laterals by some operators has been one of necessity, as E&Ps push into the margins of the basin and into their next tiers of drilling inventory.

“We’re in the fortunate position we’re still drilling our core-of-the-core acreage that’s extremely high quality and will be for a long time,” Walter said.

But as drilling technology improves over time—and Permian Resources gets more efficient at drilling Delaware wells—the company will continue to look at opportunities for 2.5-mile or 3-mile laterals.

“There’s probably some small places where we could do things to incorporate longer laterals if we chose to do so,” Hickey said. “But that’s not a big part of the near-term business plan for us.”

RELATED

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.

How Diversified Already Surpassed its 2030 Emissions Goals

2024-04-12 - Through Diversified Energy’s “aggressive” voluntary leak detection and repair program, the company has already hit its 2030 emission goal and is en route to 2040 targets, the company says.