Aerial view of the Williston Basin in the Bakken. (Source: Shutterstock)

Bakken E&P Chord Energy Corp. continues to enjoy the fruits of three-mile laterals, benefiting from both higher production and shorter drilling times in the third quarter compared to the two-mile analogs the E&P is moving away from.

Of the 45 wells the company placed online in third-quarter 2023, more than half were three-mile laterals. In the entire first half of 2023, a total of 37 wells were placed and only 19% of those were three miles long.

“This accomplishment is even more impressive when evaluating on a two-mile equivalent basis, which amounts to a 42% increase in well delivery in half the time,” said Chord President and CEO Daniel Brown during the company’s Nov. 2 third-quarter earnings call.

Brown also addressed recent M&A trends, including Chevron Corp.’s purchase of Williston E&P Hess Corp., saying the company would be open to buying or selling under the right circumstances.

The company’s focus, however, is on its drilling program and squeezing as much oil as possible out of the rock.

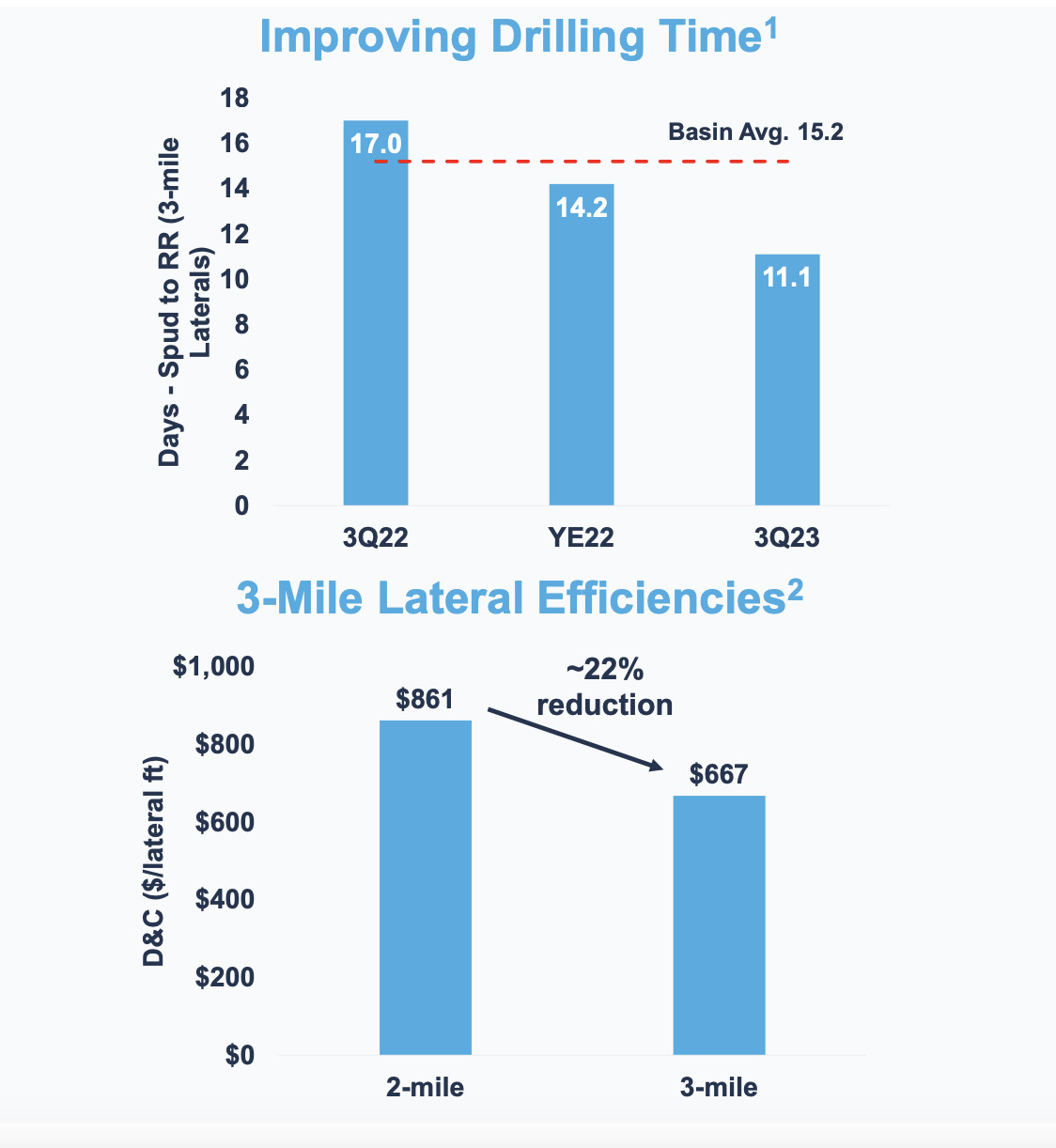

For three-mile wells, Chord assumes the third mile is only 80% as productive as the first two miles, Brown said, with a 40% EUR uplift for a 50% longer lateral and 20% more drilling and completion costs.

“However, with effective completion and clean out practices, we believe the volume response could be nearly proportional to the percentage of the third mile that's cleaned out,” Brown said.

RELATED

The Third Mile: Chord Energy’s Longer Laterals Pay Off in Bakken

Chord also reduced its three-mile well drilling times compared to third-quarter 2022 by 25%—approximately 11 days per well.

Given the success of drilling three-mile laterals, Brown said the company is investigating expanding into four-mile laterals.

“There's certainly geometries we've got that would really lend themselves to doing four-mile laterals,” Brown said. “I'll tell you if you sort of rewind the clock, …moving into three laterals was a big step into the unknown, and we would have had lots of concerns about it. But certainly, the three-mile program, to date, has...been very successful. We're excited about it moving forward.”

The company reported average third-quarter oil volumes of 101,400 bbl/d and overall production averaged 176,000 boe/d, which exceeded analyst expectations and consensus projections, Chord executives said.

Chord said its oil volumes exceeded the company’s guidance by 4.5% at the midpoint and total volumes were 3.8% above midpoint guidance.

In the third quarter, Chord “delivered a beat and raise,” according to a Nov. 1 report by Mark A. Lear, an analyst at Piper Sandler.

EBITDA and free cash flow came in ahead of Piper Sandler and consensus expectations, Lear said. Chord returned 75% of free cash flow in third quarter 2023 with a base and variable dividend of $2.50/share and $112 million of stock buyback.

“The company continues to see strong performance from its three-mile lateral drilling program and estimates economics in [the] western basin is comparable with core two-milers,” Lear said.

Underpinned by strong production, the company generated $207 million of adjusted free cash flow, of which 75% will be returned to shareholders under its return of capital framework, Brown said.

Looking ahead, the company expects its 2024 annual decline rate to increase slightly due to Chord’s 2023 oil production growth.

“As we start to see the benefits of the shallower declines associated with our growing proportion of producing three-mile wells, we expect this increase in decline to reverse towards the end of 2024 and into 2025,” Michael Lou, executive vice president and CFO of Chord, said on the call.

For full-year 2023, Chord expects to generate approximately $1.73 billion of adjusted EBITDA and $800 million of adjusted free cash flow.

Chord Energy also announced a new $750 million share repurchase program, increasing the existing $300 million program in which there was $114.8 million of capacity remaining as of Sept. 30. In the third quarter, Chord repurchased 703,862 common shares for a total repurchase price of $112.3 million.

Addressing M&A trends

As the market for consolidation picks up, Chord Energy is staying open to further consolidation, whether in-basin or outside of the Bakken, following its acquisition of XTO Energy’s assets earlier this year in the Williston Basin.

“We plan to participate in consolidation as we move forward—whether that means we are the consolidator or the consolidatee, either way is okay,” Brown said. “We believe in being part of a larger equity story, and we'll look for sensible opportunities to do that.”

Staying in the Bakken would be a “very natural thing for us to look at,” Brown said, citing the company’s subsurface knowledge, operational capabilities and ability to convert drilling spacing units from two-mile laterals to three.

While outside consolidation is still open to discussion, Brown emphasized to analysts that the company is staying “clear-eyed” to the higher risk involved.

Recommended Reading

Stice: Diamondback’s Small Company Culture Suits Big M&A Appetite

2024-05-01 - Diamondback Energy CEO Travis Stice tells analysts that the company’s nimble nature is among its top qualities, allowing for rapid growth and the successful integration of Endeavor Energy this year.

Comstock Adds Four Whopper Wildcats; Takes Western Haynesville to 450K

2024-05-01 - Comstock Resources' four newest wells, which IP’ed at more than 35 MMcf/d, were landed at up to 19,400 feet total vertical depth.

Marketed: Wylease Niobrara Shale Cloud Peak Opportunity

2024-04-30 - Wylease LLC has retained EnergyNet for the sale of working interest in the Niobrara Shale of Converse County, Wyoming in the Cloud Peak 3874-8-5-1NH.

Marketed: Wylease Niobrara Shale Opportunity

2024-04-30 - Wylease LLC has retained EnergyNet for the sale of working interest in the Misty Moon Lake 3874-17-20-1NH of Converse County, Wyoming.

Berry Bolts On More California Assets as Kern County M&A Continues

2024-03-06 - As Berry Corp. continues its aggressive hunt for growth opportunities outside of California, the E&P made a second bolt-on acquisition in Kern County in the fourth quarter.