With its roughly $60 billion blockbuster deal to acquire Pioneer Natural Resources, Exxon Mobil aims to deploy its Delaware Basin drilling strategy onto Pioneer’s massive Midland Basin position.

The all-stock transaction, valued at approximately $59.5 billion excluding the assumption of Pioneer’s net debt, will bring together two of the largest oil and gas producers in the Permian Basin.

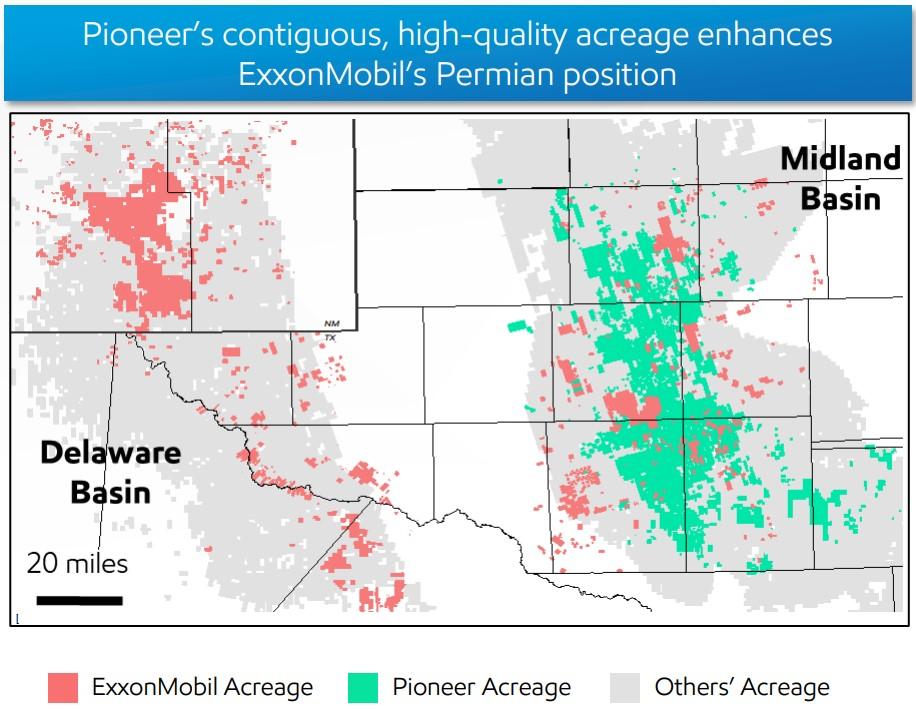

Spring, Texas-based Exxon Mobil Corp. has 570,000 net acres spread across both the Delaware and Midland basins, the U.S. supermajor said Oct. 11.

The transaction will add Irving, Texas-based Pioneer Natural Resources’ 856,000 net acres in the core of the Midland Basin.

Exxon has a large, contiguous acreage footprint in the Permian’s more western Delaware Basin. The blocky acreage position enables Exxon to drill longer lateral lengths, like four-mile laterals, on its Delaware footprint, Exxon Senior Vice President Neil Chapman said on an Oct. 11 call with media.

“Pioneer have the largest contiguous acreage in the Midland Basin by a long, long way,” Chapman said. “It is in the runway of the highest Tier-1 acreage in the Midland Basin.”

The company plans to apply its advancements in drilling technology and well design onto Pioneer’s massive acreage footprint in the heart of the Midland Basin.

“Most people are drilling one- to two-mile laterals,” Chapman said. “We can have just one drilling rig to drill the whole of the four miles—and that’s obviously a big cost saving.”

Exxon has also improved oil recovery from its Permian footprint by fine-tuning a cube development strategy—where operators drill multiple horizontal wells in stacked intervals from a single surface location—for several years.

“The first cube was [drilled] in 2018, maybe the back end of 2017,” Chapman said. “We’re most experienced in that space and I think that’s something additional we will bring to the Pioneer acreage.”

Exxon has laid out aggressive growth plans for its Permian production. The company previously aimed to ramp up Permian output to 1 million boe/d by 2027.

After closing the Pioneer deal, Exxon now expects its Permian production to be approximately 1.3 million boe/d. By 2027, the company aims to grow production up to 2 million boe/d (>75% liquids).

Roughly 45% of Exxon’s global upstream volumes will come from U.S. production after closing the Pioneer deal.

The transaction will also deepen Exxon’s runway for future drilling in the Permian. Pioneer holds about 6,300 net locations of high-quality drilling inventory in the Midland—wells generating a 10% return with WTI prices of below $50/bbl, according to estimates from Enverus Intelligence Research.

RELATED

Exxon Acquiring Pioneer for $60B as Permian Oil Takes Center Stage

Stocking up

The all-stock deal is valued at approximately $59.5 billion, or $253 per share—a nearly 18% premium over Pioneer’s closing stock price of $214.96 per share on Oct. 5.

Darren Woods, chairman and CEO at Exxon, said the all-stock nature of the deal helps better insulate Exxon from the ups and downs of the oil and gas commodity cycle.

“We kind of thought about it from the standpoint of the transaction currency grows with the commodity cycle and declines as the commodity cycle comes off,” Woods said. “Therefore, we’ve got some insulation from that exposure.”

The current value of Exxon’s stock—about 10% off of its all-time high—also made it an attractive currency to tap for the Pioneer deal.

“You obviously expect to offer a market premium for an asset of this quality,” Chapman said. “Obviously, we’ve looked at the movements in stock prices. We believe it’s a really good time to act.”

Fueling the M&A fire

As the market digests the $60 billion megadeal between Exxon and Pioneer, experts believe other oil companies could pursue large-scale M&A in the Permian Basin.

Analysts at Truist Securities “anticipate further consolidation in the upstream space given the limited inventory and the inexpensive price of most smaller E&Ps versus both the larger operators and historical valuations,” according to an Oct. 11 research report.

Rather than pursue large-scale acquisitions, E&Ps, by and large, have opted to direct their abundant cash flows toward shareholder returns in recent years.

But the massive Exxon-Pioneer combination could usher in a new era for the U.S. shale industry, marked by large-scale consolidation, said Matthew Bernstein, senior shale analyst at Rystad Energy.

Dan Pickering, founder and chief investment officer of Pickering Energy Partners, said the Pioneer-Exxon deal could cause a bit of FOMO by other operators.

“The momentum begets momentum,” Pickering said.

RELATED

Analysts: Exxon-Pioneer Deal Could Usher in Shale M&A Flurry

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.