When oil majors start becoming the buyers, it opens up a Pandora’s box of possible M&A targets, says Enverus' Andrew Dittmar. (Source: Shutterstock)

Exxon Mobil Corp. acquiring Permian Basin juggernaut Pioneer Natural Resources could fuel other massive deals in the oil patch, experts say.

Spring, Texas-based Exxon Mobil is reportedly nearing an agreement to acquire Irving, Texas-based Pioneer in a deal potentially worth $60 billion; however, The Wall Street Journal notes that deal negotiations between the two Texas oil giants could still fall through.

Based on the progression of the swirling rumors and how stock investors have responded to those rumors, experts believe the Exxon-Pioneer megadeal could come together this time.

“I think it is going to happen. It feels too baked at this point,” said Dan Pickering, founder and chief investment officer of Pickering Energy Partners.

“The last rumor, [Pioneer] stock was up 5%, 6%,” he said. “This time, it’s up 11%. I think this deal’s moving ahead.”

Pioneer’s stock price grew from $214.96 per share to nearly $237.43 per share on Oct. 6, according to Yahoo Finance data.

A potential deal would bring together two of the biggest players in the Permian Basin, America’s top oil-producing region and the main driver of U.S. oil production growth.

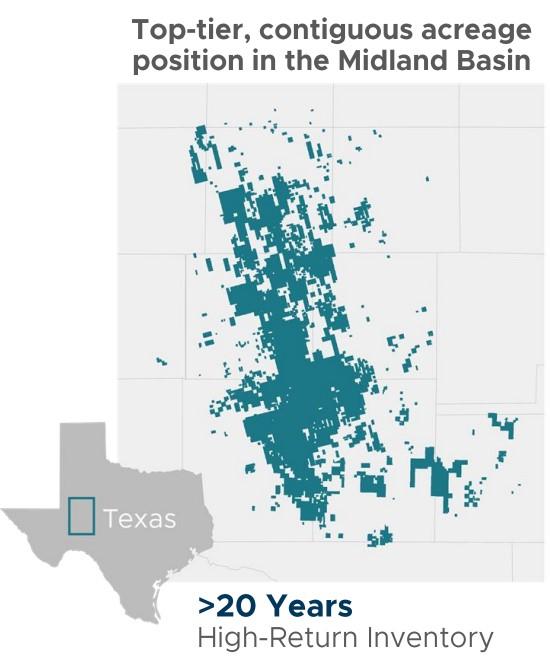

Andrew Dittmar, director at Enverus Intelligence Research, said Pioneer has long been seen as an attractive large-scale M&A target for Exxon—due to the massive scale, quality and undeveloped inventory depth of Pioneer’s position in the Midland Basin.

Pioneer is the largest producer in the Midland with the company’s crude oil production averaged 369,000 bbl/d during the second quarter, while total production came in at 711,000 boe/d.

Exxon also holds a sizable footprint in the Permian. And the U.S. supermajor has aggressive growth plans for the Permian, which Exxon has positioned as one of its main pillars of global oil production for decades to come.

Exxon’s Permian production grew to a record 620,000 boe/d during the second quarter up from the 615,000 boe/d seen a quarter prior.

The company plans to boost its Permian production up to 1 million boe/d by 2027. But getting to that production level organically, as opposed to inorganically through M&A, would be challenging for Exxon.

“For 1 million barrels and the amount of inventory that they have, they’d have to chew through it to get there,” Dittmar told Hart Energy. “It wouldn’t necessarily have left them with the running room they want once they got to that 1 million barrels, if that’s their goal to sustain it for long term.”

RELATED

Exxon Reportedly in Advanced Talks to Buy Pioneer Natural Resources

Megadeal Momentum

With the Exxon-Pioneer agreement potentially working its way through the pipeline, analysts and experts wonder: Could a $60 billion shale megadeal spur other large-scale M&A by other majors and large-cap independents?

“I think it forces the entire sector to think, ‘Where am I going to be?’” Pickering said. “The logical debate becomes, ‘Well, if Exxon is doing this, should I be doing it?’”

Rather than pursue large-scale acquisitions, E&Ps, by and large, have opted to direct their abundant cash flows toward shareholder returns in recent years.

Matthew Bernstein, senior shale analyst at Rystad Energy, colloquially refers to the current period of capital discipline by the shale industry as “Shale 3.0”—which stands in stark contrast to the earliest days of fracking innovation and the drill-at-any-cost boom by E&Ps in the years that followed.

Could a deal the size of Exxon-Pioneer usher in the start of a new era of U.S. shale marked by large-scale consolidation?

“While capital discipline would still reign supreme, the “Shale 4.0” era would be unmistakably marked by consolidation,” Bernstein said.

“It would see high-spending supermajors, already in possession of large portions of the tight oil inventory, consolidate swathes of shale resources under their hold,” he said.

There are a relatively small number of acquisition opportunities of this scale that would push the needle for Exxon and its large peers. And as consolidation in the Permian Basin continues, fear of missing out, or FOMO, could fuel other large deals.

“The momentum begets momentum,” Pickering said.

RELATED

ECC 2023: Shale Investors Won’t Ever Reward Production Growth Again

Exclusive: Permian M&A's Future Up in the Air, Says Rystad [WATCH]

Who, When, Where Next?

When oil majors start becoming the buyers, it opens up a Pandora’s box of possible M&A targets, Dittmar said. That could include giants of the industry like ConocoPhillips or Occidental Petroleum.

Smaller E&Ps with highly concentrated Permian positions, such as Coterra Energy and Devon Energy, could also be attractive targets for future Permian M&A, Dittmar said.

The Permian is the Lower 48’s most prolific shale oil play today, so Pickering expects to see the most near-term consolidation play out across that basin.

As the Permian gets increasingly bought up and developed, E&Ps will start looking at more mature U.S. shale plays, like the Bakken. Companies might increasingly look at adding international exposure, too.

“You start thinking about ‘What’s next?” Pickering said. “The what’s next is multi-basin.”

RELATED

Analysts: Top-Tier Drilling Inventory Shrinking as Well Costs Rise

Recommended Reading

Stonepeak Joins Shizen to Form Asian Onshore Wind Platform

2024-03-26 - Stonepeak will have an 80% interest in the onshore wind energy platform, with Japan-based Shizen retaining the remaining 20% interest.

Bunge, Chevron Announce FID on Oilseed Processing Plant

2024-03-05 - Bunge Chevron Ag Renewables' facility will be used to manufacture low carbon renewable fuels from oilseed.

Avangrid Begins Construction on its First California Solar Farm

2024-04-10 - Avangrid’s Camino Solar project will generate 57 megawatts of power, the equivalent of the power needs of about 14,000 U.S. homes.

EE North America, Montauk Sign Biogenic CO2 Delivery Deal

2024-02-14 - EE North America and Montauk Renewables signed a contract for the delivery of 140,000 tons per year of biogenic CO2, which will be turned into e-methanol.

Chevron, Brightmark JV Opens RNG Facility in Arizona

2024-04-10 - Eloy RNG produces RNG using anaerobic digesters at the Caballero Dairy in Arizona, Brightmark said April 10.