Chevron CEO Mike Wirth, left, and Exxon Mobil CEO Darren Woods continue to pursue Permian Basin production even as upstream revenues fall in a flat commodity market. (Source: Hart Energy, CERAWeek)

Exxon Mobil Corp. and Chevron Corp. reported a drop in second-quarter profits — combined, a $4.1 billion drop — as the U.S. supermajors weathered volatile commodity markets that have similarly affected their smaller peers.

Exxon booked earnings of $7.88 billion during the second quarter, down 31% from $11.43 billion last quarter. Compared to the same quarter in 2022, Exxon’s earnings plummeted 55% from $17.85 billion, the Spring, Texas-based oil giant announced July 28.

California-based Chevron was in the same boat. With earnings of $6.01 billion for the quarter, Chevron was down 8% from the company’s first quarter haul of $6.57 billion — and 76% from $11.62 billion earned a year ago, the company announced July 28.

Both companies said that lower upstream realizations and a decline in margins on refined product sales negatively impacted second-quarter earnings. Despite that, both companies continue to run at flank speed in the Permian Basin, pumping record volumes.

Exxon noted that lower natural gas realizations had adverse effects on quarterly profitability.

Natural gas prices spiked to more than $9/MMBtu last summer after Russia’s invasion of Ukraine significantly disrupted global energy markets.

Since then, gas prices have fallen dramatically: Henry Hub natural gas prices are expected to average $2.62/MMBtu, or $2.72 per thousand cubic feet, during 2023—down from an average of $6.42/MMBtu, or $6.67 per thousand cubic feet, in 2022, according to data from the Energy Information Administration.

In prepared remarks, Exxon CEO Darren Woods said that natural gas prices moved back inside their 10-year range during the second quarter due to higher supply, reduced demand and milder weather.

Exxon saw total upstream earnings of $4.58 billion in the second quarter, down 29% from $6.46 billion last quarter and 59% from $11.37 billion a year ago. Exxon’s U.S. upstream earnings totaled $920 million, down from $1.63 billion last quarter and $3.75 billion a year prior, Exxon said.

For Chevron, U.S. upstream earnings totaled $1.64 billion, down from $1.78 billion last quarter and $3.37 billion a year ago. International upstream earnings were about $3.3 billion.

Analysts had anticipated that Exxon and Chevron would face more headwinds in the second quarter than the last—and significantly more challenging environment than last year, when the oil and gas industry raked in outsized profits.

Exxon’s preliminary results filed with the Securities and Exchange Commission in early July signaled that earnings from natural gas realizations and refining margins would each come in around $1 billion lower than forecasts, analysts at TD Cowen wrote in a research report.

Despite headwinds from low commodity prices, Chevron’s brought in a stronger second quarter that topped consensus estimates on earnings per share and cash flow metrics, Morgan Stanley Research analysts reported after Chevron released preliminary results last weekend.

RELATED: Analysts: Exxon-Denbury Deal Adds Meaningful CCS Scale for the Future

Pumping the Permian

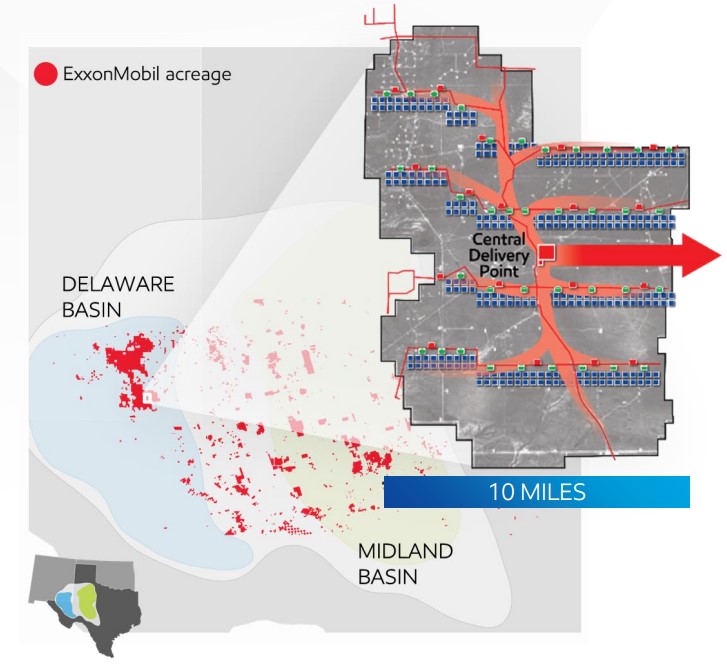

Both Exxon and Chevron reported record oil and gas production in the Permian Basin, the top oil-producing region in the Lower 48.

Exxon’s Permian production grew to a record 620,000 boe/d during the second quarter, Exxon CFO Kathy Mikells said in prepared remarks. That’s up from 615,000 boe/d of Permian output during the first quarter.

RELATED: Full Throttle: Chevron Hits Record Permian Production in 2Q

Exxon’s total production is up 20% year over year, with the growth being driven by the Permian and Guyana; gross production in Guyana reached a record 380,000 bbl/d during the second quarter.

Chevron’s Permian Basin production of 772,000 boe/d set a new quarterly record—11% higher than the same quarter a year ago, the company disclosed in a surprise filing on July 23.

The company’s Permian oil and gas output increased by about 55,000 boe/d quarter-over-quarter, crushing some analyst predictions.

“We expect next quarter’s production to be roughly flat before growing again in the fourth quarter, on track with our full-year guidance,” Chevron CEO Mike Wirth said in the company’s prepared remarks.

Roughly half of Chevron’s Permian production is company-operated; the balance is non-operated or tied to royalty production.

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.