The cost of supply for North American shale producers is expected to continue rising, according to a recent analysis by Enverus Intelligence Research. (Source: Shutterstock.com)

Remaining top-tier shale drilling inventory across North America could be in shorter supply than previously estimated, according to an analysis by Enverus Intelligence Research.

Analysts, investors and oilmen alike often debate how much undeveloped drilling runway remains in North America’s top shale basins. Obviously, opinions vary widely.

By most analyses, U.S. shale production is still several years from reaching its peak. Analysts at Enverus raised its U.S. supply forecast by 1 MMbbl/d to 14 MMbbl/d by 2030, incorporating geologically viable inventory that private Permian Basin E&Ps will drill once proven inventory is exhausted.

The shale patch is driving production growth right now: U.S. crude production is expected to reach a record 13 MMbbl/d this month, according to projections by Rystad Energy cited by The Wall Street Journal.

But there’s generally a broad consensus that the U.S. is somewhere in the middle innings of the dramatic ballgame that is North American shale.

Gone are the early days of the fracking boom, where operators would chase production growth and drill wells at nearly any cost. Rampant cost inflation and declining well productivity across the U.S. shale patch are making drilling wells much more expensive.

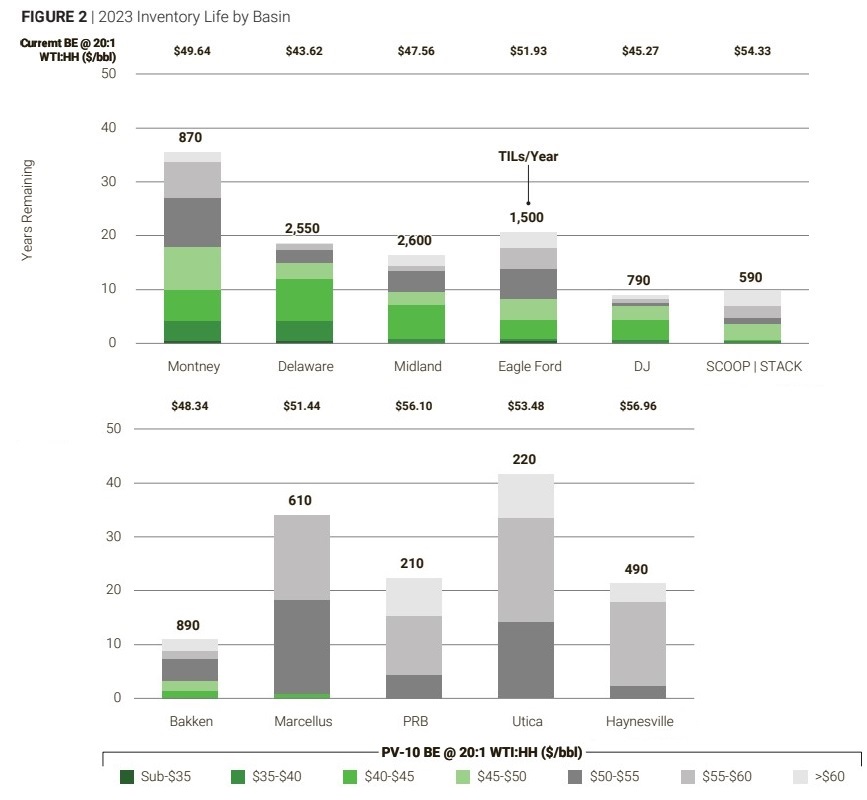

Last fall, Enverus estimated there were 125,000 remaining undeveloped locations able to break even below a $40/bbl WTI price across North America.

But those estimates fell about 45% year-over-year in the firm’s latest analysis, driven by cost inflation and productivity degradation. Enverus estimates around 75,000 Tier 1 drilling locations—at a sub-$45/bbl WTI—remain across North America.

At current activity levels, the firm estimates that’s about six years of remaining Tier 1 drilling locations.

“We’ve just sort of reached a point of maturity in U.S. shale,” Dane Gregoris, managing director at Enverus Intelligence Research, told Hart Energy. “Wells aren’t getting better incrementally. In fact, they’re probably getting worse.”

“Therefore, the cost of supply is going to be increasing—outside of service costs,” he said.

The Permian contains about 74% of the remaining Tier 1 locations, while the Eagle Ford Shale holds just 10%.

While the estimated number of remaining Tier 1 locations might be shrinking, Enverus’ analysis found an ample runway of Tier 2, 3 and 4 locations that “should alleviate fears of a structural decline in U.S. production or activity levels over the next 15 years.”

But oil prices will need to be in the range of $70/bbl to $90/bbl WTI in order to maintain North American activity levels and supply growth, according to the report.

“We are in a period, we think, over the next 10 years where you’re going to see an increasing cost of supply of North American oil and gas, frankly,” Gregoris said. “That’s a bit of a foreign world versus where we were the last 20 years, when costs continued to get cheaper and cheaper in the industry.”

RELATED: Middle Innings: Shale E&Ps’ Slow Struggle to Woo Back Investors

Natural gas inventory

The report found multiple decades of natural gas resources across North America that can break even below at a $3/MMBtu Henry Hub price.

Some of the cheapest locations for gas are in Appalachia’s Marcellus and Canada’s Montney shales. The Marcellus and Montney make up more than 80% of the locations with breakevens below $2.75/MMBtu Henry Hub.

The Haynesville Shale accounts for a quarter of the locations that break even between $2.75/MMBtu and $3/MMBtu.

Enverus estimates that only four years of gas drilling locations with sub-$2.75/MMBtu Henry Hub breakevens remain in the Haynesville, the Eagle Ford and the Midcontinent.

RELATED: The Future of Shale: ‘The Brainiac Stuff is Coming’

Recommended Reading

Ithaca Deal ‘Ticks All the Boxes,’ Eni’s CFO Says

2024-04-26 - Eni’s deal to acquire Ithaca Energy marks a “strategic move to significantly strengthen its presence” on the U.K. Continental Shelf and “ticks all of the boxes” for the Italian energy company.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

Making Bank: Top 10 Oil and Gas Dealmakers in North America

2024-02-29 - MergerLinks ranks the key dealmakers behind the U.S. biggest M&A transactions of 2023.