Montney

ARC Resources Divests Non-core, Non-Montney Assets

ARC Resources did not provide additional information on the divested assets, which the company said had results in proceeds of $59.2 million.

Tourmaline’s $950MM Crew Energy M&A Drills Deeper In Montney

Tourmaline Oil is adding high-quality drilling locations in Canada’s Montney Shale with the CA$1.3 billion (US$950 million) acquisition of Crew Energy Inc.

ConocoPhillips’ Blowout: Permian, Eagle Ford, Bakken Output Rises

ConocoPhillips reported a notable uplift in Eagle Ford Shale production during the second quarter, while volumes in the Permian, Bakken and Canada’s Montney Shale also grew.

Ovintiv to Boost 2024 Free Cash Flow to Nearly $2B

Ovintiv management reported its on track to generate $1.9 billion in 2024 free cash flow but skirted a question about the company’s possible pursuit of Midland Basin E&P Double Eagle.

Montney Pure-play Advantage Energy Makes $326MM Acquisition

Calgary-based Advantage Energy is acquiring undeveloped inventory and around 14,100 boe/d of production in a CAD$450 million (USD$326.77 million) deal with a private seller.

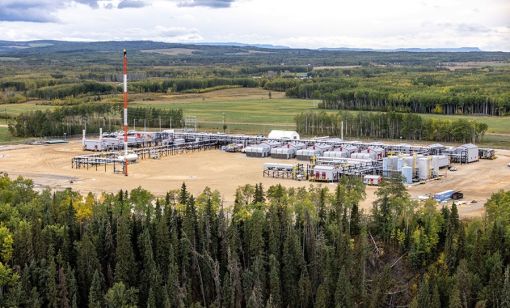

Production from Canada’s Montney, Duvernay Gains Momentum

The dust has settled on acquisitions, and the leading players have publicized five-year plans that demonstrate a commitment to increasing production from Canada’s premier shale plays.

Crescent Point Buying Alberta Montney E&P in $1.86 Billion Deal

Crescent Point is extending its premium drilling inventory in the Alberta, Canada, Montney Shale with a roughly US$1.86 billion (CA$2.55 billion) acquisition of Hammerhead Energy.

Cheaper Canadian Oil, Gas Valuations Lure Potential US Buyers North

The largely untapped potential of Canadian shale is a draw for investors.

Ovintiv CEO McCracken: Magnifying Margins

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.

The OGInterview: Ovintiv Magnifies Margins [WATCH]

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.