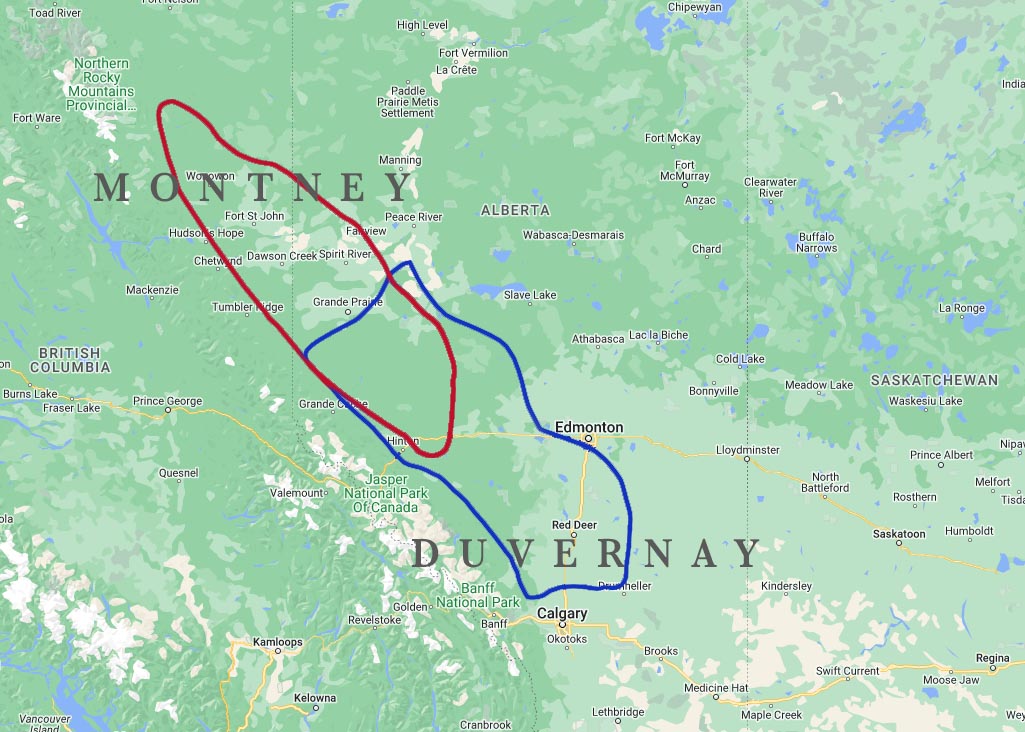

Natural Resources Canada describes the Montney and Duvernay shales as primarily natural gas and NGL plays, with relatively small oil production. The Montney, in British Columbia and Alberta, and the Duvernay, in Alberta, are the two prominent geological formations comprising the Western Canadian Sedimentary Basin.

The Montney Shale’s natural gas resources are estimated to be among the largest in the world, and production numbers continue to rise. From 2010 to 2022, natural gas volumes in the Montney grew to an average 8.06 Bcf/d from approximately 0.82 Bcf/d. Over that same period, production from the Duvernay grew to approximately 0.58 Bcf/d.

As of 2022, natural gas from the Montney and Duvernay regions represented 50% of Canada’s total natural gas production. Natural Resources Canada says — according to all scenarios in the Canada Energy Regulator’s latest “Canada’s Energy Future 2023” (EF2023) report — that the area is expected to contribute more than 60% of domestic gas production by 2030.

Favorable financials

Mark Sadeghian, senior director for North American energy at Fitch Ratings, said that although natural gas production is an important factor in assessing the outlook for Canada’s shale developments, condensate is the key to the economics in the core of the play. Condensate’s value comes from its use as a diluent to blend Western Canadian Select (WCS), one of North America’s largest heavy crude oil streams.

“There is a symbiosis between local condensate production and oil sands bitumen production,” he said.

Locally produced diluent economics are attractive because they compete with more expensive imports from the U.S., Sadeghian said, noting that higher oil sands production potentially increases demand for condensate from the Duvernay and Montney.

“We don’t anticipate dramatic production growth anytime soon, but there is certainly room to grow with recent pipeline expansions, including the pending TMX [Trans Mountain Expansion] pipeline,” he said.

Regional natural gas pricing, which historically has been under stress due to system constraints, may also be set to improve.

“We think there will be some system improvements and some tightening balances coming from LNG—both south of the border and in Canada,” he said. “When Canada LNG comes onstream, that will be supplied through regional Canadian gas, and that should help balances. Also, there is a fair amount of new LNG export capacity coming up on the Gulf Coast, which could tighten up balances regionally through interconnects.”

“As always,” he said, “weather is still a dominant factor when it comes to gas pricing, so we will want to see what things look like on the ground when we get there.”

Developing the Duvernay

While financial analysts take a wait-and-see approach, forward-looking producers are laying plans for expansion. Calgary-based Crescent Point Energy, Canada’s seventh-largest E&P company and the largest acreage holder in the Kaybob Duvernay Shale, is optimistic about the region’s potential. Over the last few years, the company has transformed its portfolio and added to its positions in the reservoirs to enable consistent production growth from its Alberta Montney and Kaybob Duvernay shale acreage.

Crescent Point Energy COO Ryan Gritzfeldt said the characteristics of the plays give the company top-tier economics, and the quick payback periods of less than a year at current pricing make the economics exceptionally strong.

The company has assessed the Duvernay and Alberta Montney and found them both attractive. “The Montney offers multiple benches that contribute to significant resource in place, and because the Duvernay is over-pressured, it yields significant initial production rates and enables considerable reserves recovery,” Gritzfeldt told Hart Energy.

“What attracted us to this region is the liquids weighting,” he said. “We wanted to target the condensate- and liquids-rich window of the Kaybob Duvernay and the volatile oil window in the Alberta Montney.”

When Crescent Point first acquired Kaybob Duvernay acreage in 2021, the asset was averaging about 30,000 boe/d. The company’s 2024 production forecast for the Duvernay is 50,000 boe/d

“We knew, when we studied the reservoir, we could enhance results and lower costs,” he said. “When we did that, we started adding to our position in the play in late 2022 and early 2023 and now have 500 premium drilling locations in the Kaybob Duvernay.”

Crescent Point also targeted the volatile oil window of the Alberta Montney for acquisitions, entering the play in spring 2023. Production was about 38,000 boe/d, Gritzfeldt said, “but we knew the quality of those assets was outstanding.”

With that acreage and recently acquired assets of Hammerhead Resources, the company is now the dominant player in the Alberta Montney volatile oil window with 350,000 net acres (close to 550 net sections), giving it 1,400 premium drilling locations at conservative spacing. Total production from the company’s Montney wells is expected to hit 95,000 boe/day in 2024.

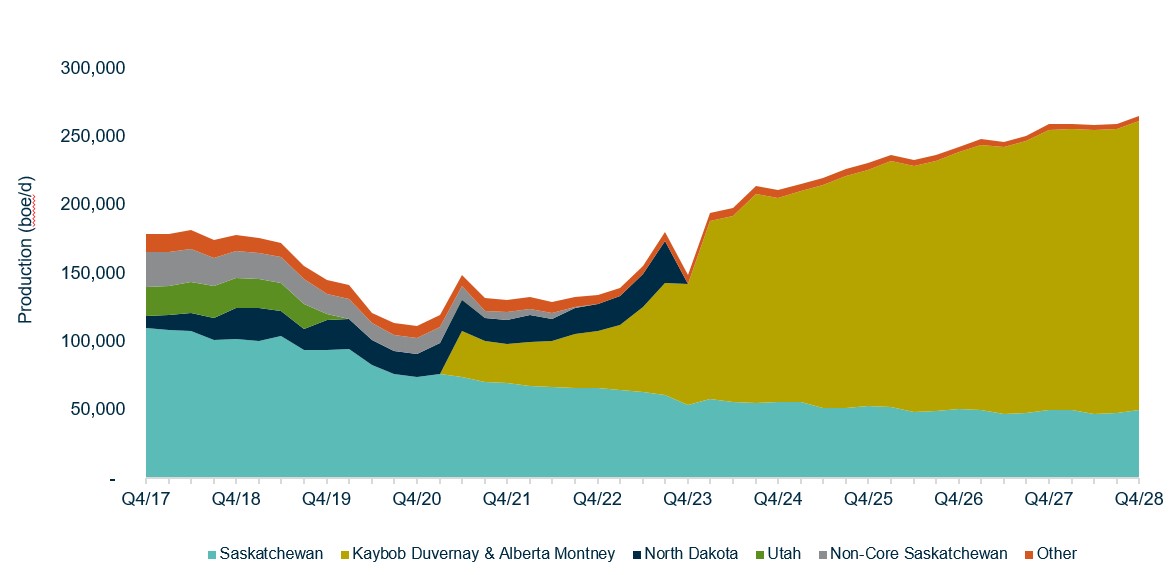

“We refer to the Montney and Duvernay as ‘short-cycle’ assets—assets that have high initial production, quick payouts, and very strong rates of return, but come with some decline,” he said. Crescent Point has combined these with its “long-cycle” assets in Saskatchewan, which are waterflood and polymer-flood assets that have low decline and high net back, and generate long-term free cash flow.

“Over the past three years or so, we have pivoted the portfolio of the company,” he said. “Now, with the premium short-cycle shale assets combined with long-cycle assets, we have a balanced, resilient portfolio that can deliver sustainability and growth for years to come with more than 20 years of premium drilling inventory.”

Gritzfeldt said these two sets of shale assets will attract about 80% of corporate capital in 2024 and will constitute approximately 70% of 2024 corporate production.

“So, 140,000 boe/d of our 204,000 boe/d in 2024 will be from the Duvernay and Montney,” he said. “This grows about 50% to almost 210,000 boe/d, about 80% of corporate production by 2028, according to the company’s five-year plan.”

Maximizing the Montney

While Crescent Point is combining assets in the two plays in its portfolio, 100% of the production from ARC Resources comes from its Montney acreage. The largest Montney producer and the third-largest gas producer in Canada with an average 1.3 Bcf/d, ARC is continuing to invest in the Montney and is convinced that it holds the key for consistently increasing production.

In a June 2023 presentation to investors, President and CEO Terry Anderson said the E&P is a pure-play Montney producer for a reason.

“The Montney is one of the most profitable and one of the largest resource plays in North America. We know the Montney better than anyone … and that is a strategic advantage,” Anderson said.

A decade ago, ARC leadership had the foresight to transition away from what Anderson called “old conventional assets” to “the new world-class Montney resource play.” ARC drilled the first Montney horizontal well in 2005 and, with it, kicked off its Montney boom. The company began acquiring large swaths in sweet spots, rounding out its position with the Kakwa acquisition, the final piece of the puzzle, two years ago. Now, ARC holds more than 1 million acres of high-quality Montney resource.

Anderson pointed out that, in 2014, ARC averaged 110,000 boe/d from 5,700 well bores (60% gas and 40% liquids). Today, the company averages 350,000 boe/d from 1,700 well bores with the same 60:40 split. Now, he said, the company is poised to pursue new business opportunities like LNG and deliver even greater value to shareholders.

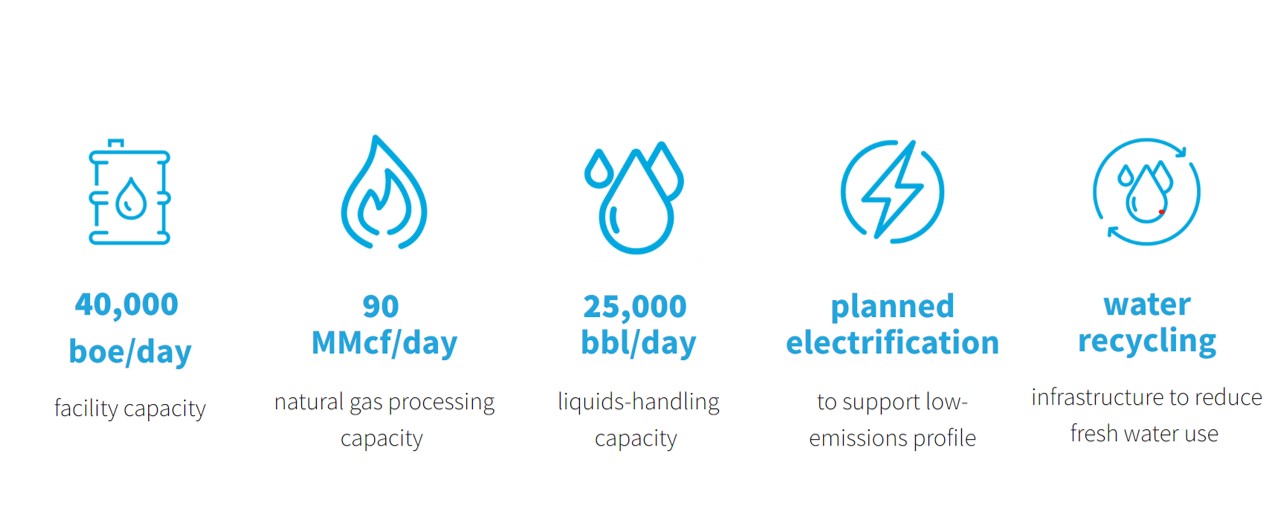

The company’s five-year plan is a disciplined program that balances capital allocation in phased development with a three-year cadence between development projects. For example, Attachie Phase 1, the leading development opportunity within the company’s portfolio, will be fully onstream in 2025, followed by Phase 2 in 2028. According to Anderson, free cash flow per share is expected to triple from about $1.60 in 2024 to $4.80 in 2028.

“Our asset portfolio has the potential to easily grow to 500,000 boe/d and remain flat for decades,” he said. “We are very fortunate to be in a position to not have to worry about inventory duration or asset quality.”

ARC also is working to link to end markets at the lowest possible cost through a diversified transportation portfolio with natural gas connectivity to Malin, Oregon, in the northwest U.S., Chicago in the Midwest, Dawn in southern Ontario, and Henry Hub on the Gulf Coast.

An agreement with Cheniere Energy, signed in November 2023, commits ARC to supplying 140,000 MMBtu/d of natural gas to Texas for a term of 15 years. The agreement is tied to commercial operations of the first train of the Sabine Pass Stage 5 Expansion Project, anticipated in 2029. This will allow ARC to export gas to Europe. Plans are in place for 25% of production to move eventually into international markets.

This is significant, Anderson said, because the world needs more Canadian natural gas to address energy security, affordability and reliability — and to help lower global emissions.

“We need to do more as a country,” he said. “This is an important part of our business.”

Recommended Reading

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

Endeavor Integration Brings Capital Efficiency, Durability to Diamondback

2024-02-22 - The combined Diamondback-Endeavor deal is expected to realize $3 billion in synergies and have 12 years of sub-$40/bbl breakeven inventory.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

CEO: Magnolia Hunting Giddings Bolt-ons that ‘Pack a Punch’ in ‘24

2024-02-16 - Magnolia Oil & Gas plans to boost production volumes in the single digits this year, with the majority of the growth coming from the Giddings Field.