Canada

Shale Plays , Natural Gas liquids (NGL) , Natural Gas , Crude Oil , Acquisitions & Divestitures

Analyst: Chevron Duvernay Shale Assets May Sell in $900MM Range

E&Ps are turning north toward Canadian shale plays as Lower 48 M&A opportunities shrink, and Chevron aims to monetize its footprint in Alberta’s Duvernay play.

Shale Plays , Trends

Chevron's Duvernay Sale Seen Attracting Mid-sized Canadian Shale Operators

As Chevron Corp. markets its Duvernay shale assets, the U.S. oil major is most likely to find a buyer among a handful of mid-sized Canadian firms looking to capitalize on the region.

Shale Plays , Rig Counts , Trends

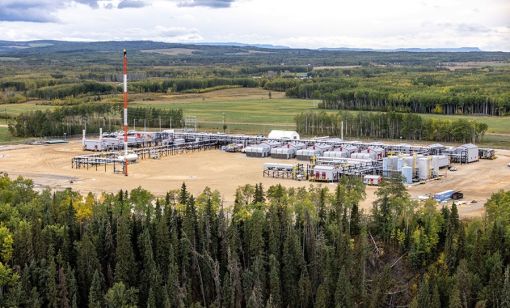

Production from Canada’s Montney, Duvernay Gains Momentum

The dust has settled on acquisitions, and the leading players have publicized five-year plans that demonstrate a commitment to increasing production from Canada’s premier shale plays.

Acquisitions & Divestitures

Flurry of Deals from Canada to the Permian Basin Close Out 2023

Several Canadian E&Ps are adding scale and undrilled inventory in prolific resource plays in Alberta, while in the Permian Basin, Ring Energy finalized an acquisition in the Central Basin Platform.

Acquisitions & Divestitures

Crescent Point Buying Alberta Montney E&P in $1.86 Billion Deal

Crescent Point is extending its premium drilling inventory in the Alberta, Canada, Montney Shale with a roughly US$1.86 billion (CA$2.55 billion) acquisition of Hammerhead Energy.

Shale Plays , Exploration & Production , Crude Oil , Natural Gas , Investment , International

Cheaper Canadian Oil, Gas Valuations Lure Potential US Buyers North

The largely untapped potential of Canadian shale is a draw for investors.

Liquefied Natural Gas (LNG) , Exploration & Production , Mergers , Natural Gas

Ovintiv CEO McCracken: Magnifying Margins

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.

Exploration & Production , People , Liquefied Natural Gas (LNG) , Acquisitions & Divestitures , The OGInterview

The OGInterview: Ovintiv Magnifies Margins [WATCH]

Ovintiv President and CEO Brendan McCracken has beefed up the E&P’s portfolio with a major acquisition in the Permian and added exposure to the lucrative Canadian LNG market.

Shale Plays

Analysts: Top-Tier Drilling Inventory Shrinking as Well Costs Rise

The cost of supply for North American shale producers is expected to continue rising, according to a recent analysis by Enverus Intelligence Research.

Acquisitions & Divestitures

Murphy Oil Closes $104MM Divestiture of Non-Core Canada Assets

Murphy Oil sold non-core assets in western Canada for $104 million in cash, with proceeds earmarked for new development in Africa and Asia.