With the roughly $60 billion acquisition of Pioneer Natural Resources, Exxon Mobil Corp. is cementing itself as the global leader in unconventional oil and gas. That’s a far cry from 2010, when executives said Exxon was late to the unconventional party.

Spring, Texas-based supermajor Exxon Mobil agreed to acquire Irving, Texas-based Pioneer Natural Resources in an all-stock deal valued at $59.5 billion, or $253 per share, on Oct. 11. Including the assumption of Pioneer’s net debt, the approximate total enterprise value of the deal is around $64.5 billion.

The shale megadeal will deliver Exxon more than a decade of incremental drilling runway in the heart of the Permian Basin, America’s top oil-producing region.

For some analysts and company executives, the blockbuster shale deal brings back memories of Exxon’s $36 billion acquisition of unconventional gas player XTO Energy in 2010. But Exxon Chairman and CEO Darren Woods emphasized how far Exxon has come since the days of the XTO deal.

“This is night and day from where we were,” Woods said in an internal company message filed with the U.S. Securities & Exchange Commission.

“If you go back to [2009], that was an acquisition to fill a gap that we had in our capability set,” he said.

The XTO deal gave Exxon exposure to unconventional oil and gas development in the prolific Permian. But the XTO acquisition didn’t happen without headaches: while the deal realistically had more potential than Exxon anticipated at the time, oversupply weighed on commodity prices and undermined the value of the deal, Woods said.

Former Exxon CEO Rex Tillerson previously called the XTO transaction "ill-timed.”

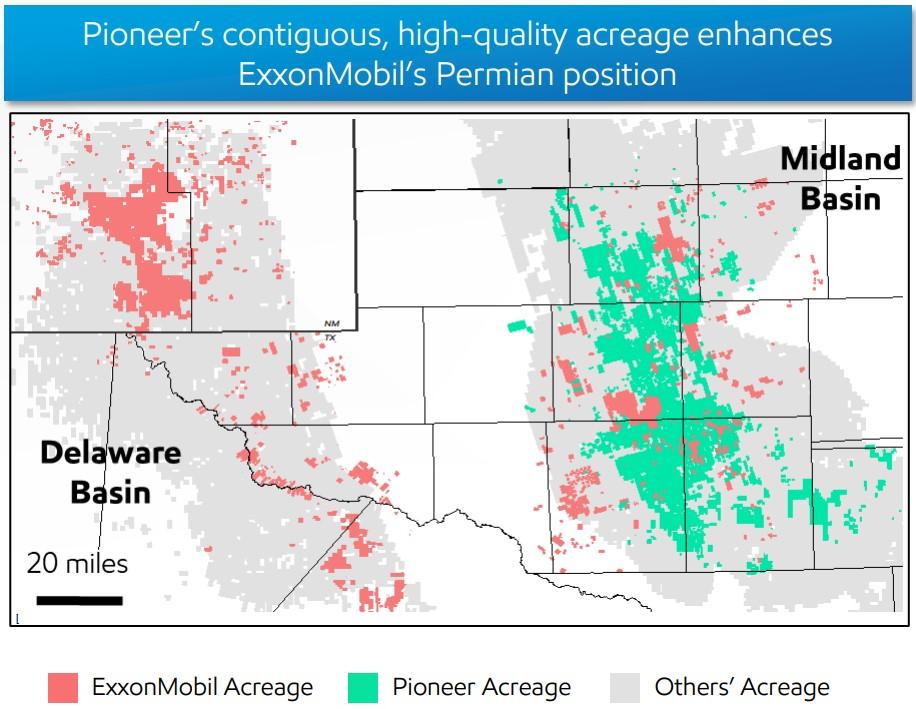

But Exxon recognized how important unconventional oil and gas development would be for the industry going forward, so the company didn’t shy away from the Permian. Exxon’s Permian footprint got a lot deeper after a transformative $6.6 billion acquisition of the Bass family’s Delaware Basin acreage in early 2017.

Woods said that Exxon has learned a lot about the Permian and unconventional oil and gas development since inking those deals. The company’s contiguous, blocky acreage position in the Delaware Basin has enabled Exxon to drill longer laterals than many of its competitors in the basin.

Exxon has drilled three- and four-mile laterals to maximize resource recovery and lower drilling costs on its Delaware acreage, Senior Vice President Neil Chapman said on an Oct. 11 call with media.

The supermajor has also fine-tuned a cube development strategy in the Permian, where multiple horizontal wells are drilled in stacked intervals from a single surface location.

“We now have an understanding of a play in a resource that I would say is as good as, if not better than anybody else out there,” Woods said.

“I see this as a completely different situation,” Chapman added.

RELATED

Exxon Acquiring Pioneer for $60B as Permian Oil Takes Center Stage

Replicating success

With another multibillion-dollar bet on the Permian, Exxon aims to deploy more than a decade of shale lessons learned on Pioneer’s premium acreage position in the core of the Midland Basin.

Exxon’s roughly $60 billion acquisition will add Pioneer’s 856,000 net acres in the Midland Basin to Exxon’s 570,000 net Permian acres.

The transaction also extends Exxon’s runway for future drilling in the basin. Pioneer holds about 6,300 net locations of high-quality drilling inventory in the Midland—wells generating a 10% return at WTI prices below $50/bbl, according to estimates from Enverus Intelligence Research.

By adding Pioneer’s blocky Midland acreage footprint, Exxon aims to drill longer three- to four-mile lateral lengths there in the future, Chapman said. Increasing cube development on the acreage will also deliver greater resource recovery and capital efficiency on Pioneer’s acreage, he said.

Chapman also sees potential to lower drilling costs on a more contiguous acreage position in the Midland.

“It allows us to move the drilling rigs a very short distance at a time,” Chapman said. “All of this brings us cost savings.”

After closing the Pioneer deal, Exxon now expects its Permian production to be approximately 1.3 MMboe/d. By 2027, Exxon aims to grow production up to 2 MMboe/d (>75% liquids).

Roughly 45% of Exxon’s global upstream volumes will come from U.S. production after closing the Pioneer deal.

The Pioneer acquisition is expected to close in the first half of 2024.

RELATED

Recommended Reading

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Waha NatGas Prices Go Negative

2024-03-14 - An Enterprise Partners executive said conditions make for a strong LNG export market at an industry lunch on March 14.

Kinetik Holdings Enters Agreement to Pay Debt

2024-04-04 - Kinetik Holdings entered an agreement with PNC Bank to pay down outstanding debt.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Summit Midstream Sells Utica Interests to MPLX for $625MM

2024-03-22 - Summit Midstream is selling Utica assets to MPLX, which include a natural gas and condensate pipeline network and storage.