As Permian Resources acquires Earthstone Energy for $4.5 billion—and prioritizes investment in the Delaware Basin—Earthstone’s Midland Basin assets could hit the market. (Source: Shutterstock.com)

Permian Resources is capping off its first year in operation with a $4.5 billion deal to acquire Earthstone Energy, adding even more scale in the northern Delaware Basin.

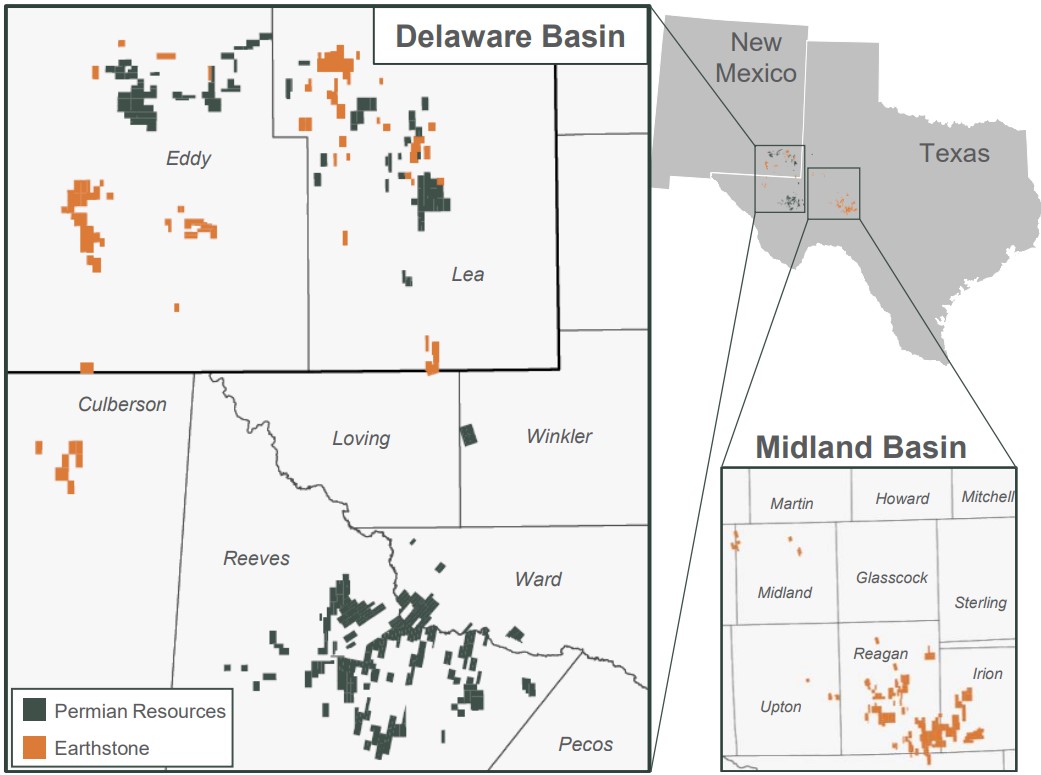

Midland-based Permian Resources Corp.—formed through the combination of Centennial Resource Development Inc. and Colgate Energy Partners III LLC in September 2022—is growing its Permian Basin footprint by around 223,000 net acres by scooping up The Woodlands-based Earthstone.

On a pro forma basis, the combined company will have more than 400,000 net acres and approximately 300,000 boe/d in the Permian.

The $4.5 billion transaction, which includes Earthstone’s net debt, also adds about 56,000 net acres largely contiguous with Permian Resources’ footprint in the northern Delaware Basin.

The deal also includes Earthstone’s position in the Permian’s Midland Basin, but nearly all of Permian Resources capital spending will be directed into the Delaware.

Permian Resources and Earthstone are currently operating 11 drilling rigs in aggregate across the Permian Basin; Nine of those rigs are operating in the Delaware, Permian Resources co-CEO Will Hickey said during an Aug. 21 conference call with analysts.

Once combined, the company plans to move at least one of Earthstone’s Midland rigs into the Delaware. Next year, Permian Resources intends to deploy 90% of its capital spending into projects in the Delaware—particularly into Lea and Eddy counties, New Mexico, and Reeves and Ward counties, Texas.

“This is a Delaware Basin company,” Permian Resources co-CEO James Walter said on the call. “That’s how we think about the focus going forward.”

Last week, Earthstone and non-op partner Northern Oil & Gas closed a $1.5 billion acquisition of Novo Oil & Gas’ Delaware Basin assets. Novo was backed by private equity firm EnCap Investments.

The deal will vault Permian Resources’ pro forma market capitalization up to around $10 billion, ahead of E&Ps such as Matador Resources and Civitas Resources.

After the combination—and after Earthstone sells its final chunks of acreage in the Eagle Ford Shale—Permian Resources will be the third-largest pure-play Permian E&P behind Pioneer Natural Resources and Diamondback Energy, according to Enverus Intelligence Research Director Andrew Dittmar.

“Given the ramp up in the valuations in private equity assets over the last year, public company M&A is starting to look like a more attractive proposition for buyers to build scale versus targeting private equity deals,” Dittmar wrote in an Aug. 21 report.

Analysts at TD Cowen said with the additional scale, Permian Resources itself is still well-positioned for an eventual sale to a larger operator.

RELATED: Permian Resources Buys Earthstone Energy for $4.5 Billion

Monetizing the Midland

As Permian Resources prioritizes investment in the Delaware Basin, the combined company intends to continue tapping Earthstone’s Midland Basin production in the near term.

“We like that Midland Basin asset for the free cash flow that it spits off,” Walter said. “That asset’s a free cash flow machine.”

Near term, Permian Resources plans to let the Midland asset decline under a one-rig program. Free cash flow generated from the Midland Basin will be reinvested into projects in the Delaware with higher returns.

But over time, there could be opportunities for Permian Resources to explore strategic alternatives for the Midland Basin asset.

“That’s not something we’re doing at the present time or plan to do so immediately,” Walter said. “But I think over time, we’d obviously explore if there’s ways to extract additional value from the Midland Basin.”

“The [Midland] assets were acquired at near PDP value and given our constructive view on pricing we believe a potential sale could be accretive,” Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co. LLC, wrote in an Aug. 21 report.

Earthstone is currently shopping other portions of its portfolio: The company aims to sell off its final Eagle Ford acreage in Karnes and Gonzales counties, Texas, according to marketing materials from Opportune Partners LLC.

A sale in South Texas would represent a full exit of the Eagle Ford play for Earthstone.

RELATED: Earthstone Shops Eagle Ford Assets as E&P Eyes South Texas Exit

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.