Editor's note: This is article has been updated with analyst commentary.

Permian Resources Corp. will acquire Earthstone Energy Inc., uniting the two midcap companies in an all-stock transaction valued at $4.5 billion.

The purchase price, including debt, is roughly twice Earthstone’s market capitalization.

The transaction, which comes after extensive M&A by Earthstone including a recently closed $1.5 billion transaction, strengthens Permian Resources’ position “as a leading Delaware Basin independent E&P” with over 400,000 net acres, the company said in an Aug. 21 press release.

Permian Resources’ pro forma production will increase to approximately 300,000 boe/d, the company said, and enhance its free cash flow profile.

Truist Securities called the deal the “best transition of the year,” in an Aug. 21 commentary.

“We believe the ~2.8x EV/EBITDA or ~$32k/flowing boe deal to be one of the most accretive seen in the past several quarters and sets up PR as one of the strongest Permian companies,” Truist analyst Neal Dingmann wrote. “In our view, there appears to be numerous synergies with the combination and the proforma acreage will be some of the best in the entire Permian. The major pushback will be the overhang due to the ownership of 49%/48% by each of the companies' largest-shareholders.”

Permian Resources largest shareholder is Riverstone Holdings LLC, while Earthstone’s largest shareholder is EnCap Investments LP.

RELATED: Earthstone, NOG Close $1.5B Acquisition of Novo Assets

Permian Resources said the deal adds inventory in the E&Ps’ existing core acreage in New Mexico and is accretive to key financial metrics before synergies, Permian Resources said.

The acquisition increases Permian Resources’ position in the Permian Basin by approximately 223,000 net acres to more than 400,000 net acres and adds approximately 56,000 net acres of “high-quality, stacked-pay reservoirs, largely offset to Permian Resources’ existing acreage” in Lea and Eddy counties, New Mexico.

Earthstone’s remaining acreage is located in the Midland Basin, and the company expects to primarily harvest free cash flow from this asset at current commodity prices.

The deal is expected to be accretive to free cash flow per share by an average of more than 30% per year during the next two years and more than 25% per year during the next five years and 10 years, Permian Resources said.

Under the terms of the transaction, each share of Earthstone common stock will be exchanged for a fixed ratio of 1.446 shares of Permian Resources common stock. Permian Resources said its leverage will be less than 1.0x at closing.

“We believe the acquisition of Earthstone represents a compelling value proposition for our shareholders and strengthens our position as a premier Delaware Basin independent E&P,”

said Will Hickey, co-CEO of Permian Resources. “Earthstone’s Northern Delaware position brings high-quality acreage with core inventory that immediately competes for capital within our portfolio.”

Hickey said the company has also identified multiple ways to leverage its Delaware Basin expertise and incremental scale “to improve upon these assets across the board, including approximately $175 million of annual synergies.”

“Permian Resources has a proven integration track record, and we believe the successful execution of these cost savings will create incremental value for both Permian Resources and Earthstone stakeholders,” he said.

Robert Anderson, Earthstone’s president and CEO, said the combination of the two companies’ assets will create an even stronger large-cap E&P companys uniquely positioned to drive “profitable growth and development” in the Permian Basin.

“In less than three years, we have grown Earthstone from a small-cap E&P company producing approximately 15,000 Boe per day to one with a production base of over 130,000 boe per day, delivering significant value enhancement for shareholders along the way,” Anderson said. “Our success directly reflects our outstanding employees’ dedication, hard work and perseverance. I personally thank each and every one of our employees. I could not be prouder of the Earthstone team and the company we have built together.”

Transaction details

The all-stock transaction represents an implied value to each Earthstone stockholder of $18.64 per share based on the closing price of Permian Resources common stock on Aug. 18 —a premium of roughly 15% and more than $1 above Earthstone’s 52-week high stock prices.

Permian Resources will issue approximately 211 million shares of common stock in the transaction. After closing, existing Permian Resources shareholders will own approximately 73% of the combined company and existing Earthstone shareholders will own approximately 27%.

The transaction has been unanimously approved by the Permian Resources’ and Earthstone’s boards and is expected to close by year-end 2023, subject to customary closing conditions, regulatory approvals and shareholder approvals.

Permian Resources’ and Earthstone’s largest shareholders, which currently own approximately 49% and 48% of each respective company’s outstanding shares, have executed a voting and support agreement in connection with the transaction.

At close, Permian Resources’ board will expand to 11 directors, including the addition of two representatives from Earthstone.

Permian Resources’ executive management team will lead the combined company with the headquarters remaining in Midland, Texas.

Jefferies LLC and Morgan Stanley & Co. LLC are serving as co-lead financial advisers and Kirkland & Ellis LLP is serving as legal adviser to Permian Resources.

RBC Capital Markets LLC and Wells Fargo Securities LLC are serving as financial advisers and Vinson & Elkins LLP is serving as legal adviser to Earthstone.

Recommended Reading

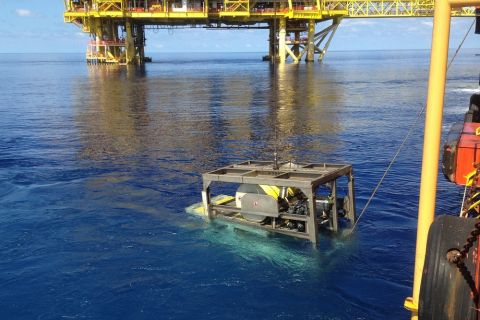

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.

Curtiss-Wright to Deploy Subsea System at Petrobras' Campos Field

2024-02-12 - Curtiss-Wright and Petrobras will combine capabilities to deploy a subsea canned motor boosting system at a Petrobras production field in the Campos Basin.

AI Advancing Underwater, Reducing Human Risk

2024-03-25 - Experts at CERAWeek by S&P Global detail the changes AI has made in the subsea robotics space while reducing the amount of human effort and safety hazards offshore.

Forum Energy Signs MOU to Develop Electric ROV Thrusters

2024-03-13 - The electric thrusters for ROV systems will undergo extensive tests by Forum Energy Technologies and SAFEEN Survey & Subsea Services.