Earthstone Energy Inc. is marketing an Eagle Ford asset as the E&P sheds non-core properties and prioritizes investment in the Permian Basin.

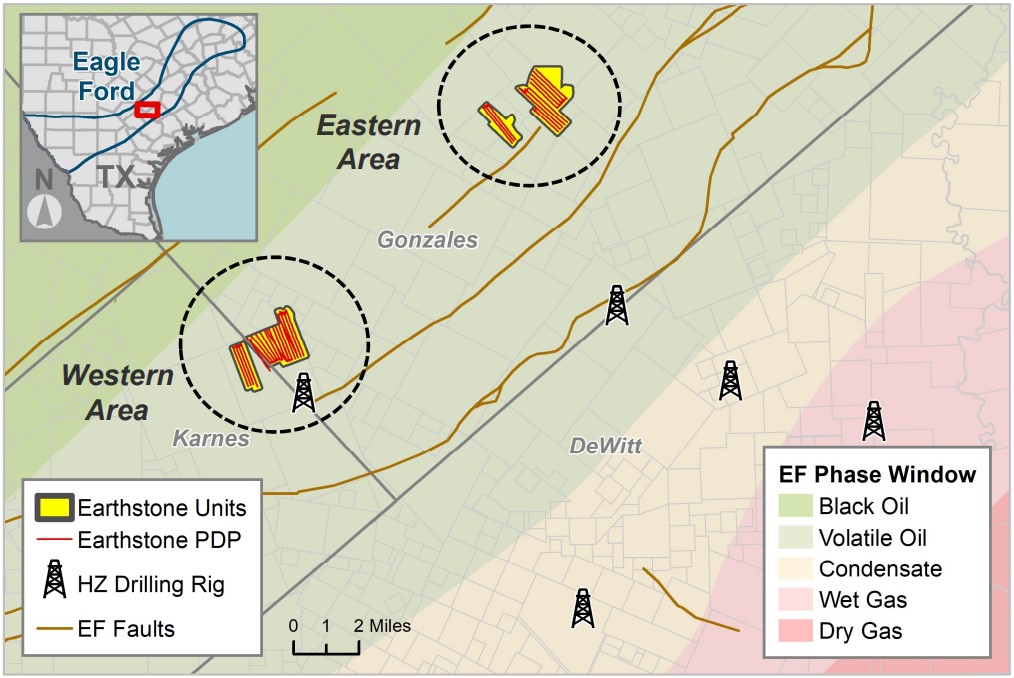

The Woodlands, Texas-based Earthstone is offering to sell production and acreage in northeast Karnes County, Texas, and in southern Gonzales County, Texas, according to marketing materials.

Earthstone has retained Opportune Partners LLC as exclusive financial adviser for the sales process.

The Eagle Ford asset includes low-decline net production of around 1,300 boe/d (83% oil) from 33 horizontal wells. Opportune said the PV-10 value of the asset’s PDP is around $95.5 million.

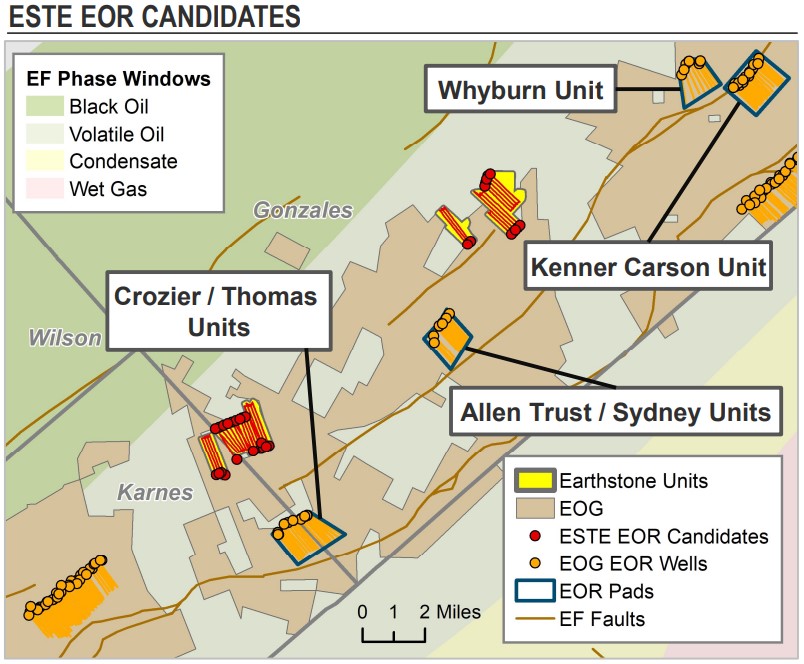

The 33 operated PDP wells are also being marketed as high-quality candidates for EOR. The wells are situated in an “EOR fairway” with more than 200 EOR projects from Houston-based EOG Resources Inc. offsetting the position, marketing materials show.

Developing EOR projects on the Eagle Ford asset is expected to add around 3.2 MMboe of incremental reserves.

The opportunity also includes eight proved undeveloped drilling locations—three targeting the Lower Eagle Ford and five in the Austin Chalk.

A sale of the Eagle Ford asset would represent a full exit of the play for Earthstone, marketing materials indicate.

Earthstone declined to comment on its sales process in the Eagle Ford.

RELATED: Enverus: Eagle Ford Upstream Deal Activity Soars in Q1

Permian prowl

Earthstone reduced its scale in the Eagle Ford in recent years. The company held approximately 3,000 net leasehold acres in the Eagle Ford as of the end of 2022, down from 12,700 acres at the end of 2021, according to data from Earthstone regulatory filings.

In July 2022, Earthstone sold Eagle Ford interests in Fayette and Gonzales counties, Texas, for a cash consideration of about $25.6 million before closing adjustments. The deal included a non-operated asset in the Eagle Ford which Earthstone sold alongside the operator’s sale, Earthstone said in an investor presentation.

Meanwhile, the E&P has focused its growth in the prolific Permian Basin—the Lower 48’s top oil-producing region.

Earthstone entered the northern Delaware Basin in February 2022 with its acquisition of Warburg-backed Chisholm Energy in a deal valued at $604 million.

The company later acquired Midland Basin assets from private E&P Bighorn Permian Resources LLC in an $860 million deal.

In August 2022, Earthstone added New Mexico assets from Titus Oil & Gas Production LLC and Titus Oil & Gas Production II in a $627 million transaction.

The deals continued in 2023. Earthstone announced plans in June to scoop up Delaware Basin assets from Delaware Basin E&P Novo Oil & Gas for $1 billion; Earthstone is acquiring 66.66% of Novo, while Minneapolis-based Northern Oil & Gas is snagging the remaining 33.33% interest for $500 million. After closing the Novo deal, Earthstone will have more than 223,000 net acres and proved reserves of 460 million boe in the Permian, President and CEO Robert Anderson said during the company’s second-quarter earnings call on Aug. 3.

RELATED: Exclusive Q&A: NOG’s Non-Op M&A Strategy ‘Will Keep Us Very Busy,’ CEO Says

Four of the company’s five drilling rigs will be focused on the northern Delaware, he said.

“Our recent announcement and pending close of the Novo acquisition supplements this strategy with our asset base shifting further to focus on the prolific Northern Delaware Basin to which the large majority of our capital activity will be dedicated going forward,” Anderson said.

Andrew Dittmar, director at Enverus Intelligence Research, said Earthstone isn’t the only public E&P streamlining its portfolio focus around the Permian.

Houston-based Callon Petroleum Co. recently exited the Eagle Ford in a $551 million sale to Ridgemar Energy Operating LLC, backed by Carnelian Energy Capital Management LP.

The company also acquired Delaware Basin assets from Percussion Petroleum Operating II LLC for $249 million in cash and approximately 6.3 million shares. The $1.13 billion in collective A&D, closed in July, positions Callon as a Permian Basin pure-play E&P.

Earthstone’s transition to a Permian pure-play E&P and exiting the Eagle Ford could also be attractive for investors and analysts, Dittmar said. There could also be opportunities for the company to realize increased cost synergies if its operations were concentrated in a single basin, as opposed to spread across multiple regions.

And when it comes to acquiring undeveloped inventory for future drilling, E&Ps big and small continue to tap the Permian, he said.

Growth in U.S. oil production is being driven by volumes from the Permian. The International Energy Agency forecasts U.S. crude output will grow to 13.6 MMbbl/d in 2028—primarily led by light tight oil developments from the Permian.

RELATED: Ovintiv Integrates $4.2B Midland Basin Acquisition in Q2

More monetization

Earthstone divested more than $100 million of its non-core assets in the past year. That includes about $56.1 million in non-core property sales during the first half of 2023—$54.2 million of which occurred during the second quarter, Securities & Exchange Commission filings show.

And as the company grows in the Delaware Basin, Earthstone has pruned part of its Midland Basin portfolio. In May, Earthstone divested around 1,280 acres and 44 producing wells in Midland County, Texas, and about 800 undeveloped acres in Reagan County, Texas, for net proceeds of $56 million.

The company also sold about 38,000 net acres and 780 gas-weighted vertical wells in the Sugg Ranch and Hunt fields for $21 million last year.

Earthstone also plans for another roughly $100 million in non-core divestitures over the next 12 months to 18 months, CFO Mark Lumpkin said on the call.

“It's not sizable, but there are things that would streamline our operations for sure,” Lumpkin said. “We don't know if we're going to be successful in selling assets, but we'll sell what makes sense to sell.”

RELATED:Diamondback Eyes Further Sales After Exceeding $1B Divestiture Target

Recommended Reading

CERAWeek: AI, Energy Industry Meet at Scary but Exciting Crossroads

2024-03-19 - From optimizing assets to enabling interoperability, digital technology works best through collaboration.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

Axis Energy Deploys Fully Electric Well Service Rig

2024-03-13 - Axis Energy Services’ EPIC RIG has the ability to run on grid power for reduced emissions and increased fuel flexibility.

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.