Diamondback Energy reached its non-core divestiture target during the second quarter—and the Permian Basin pure-play might not be done marketing assets.

In July, Midland, Texas-based Diamondback Energy Inc. divested a 43% equity ownership in the OMOG crude oil gathering system, the company disclosed in second-quarter earnings released after markets closed on July 31.

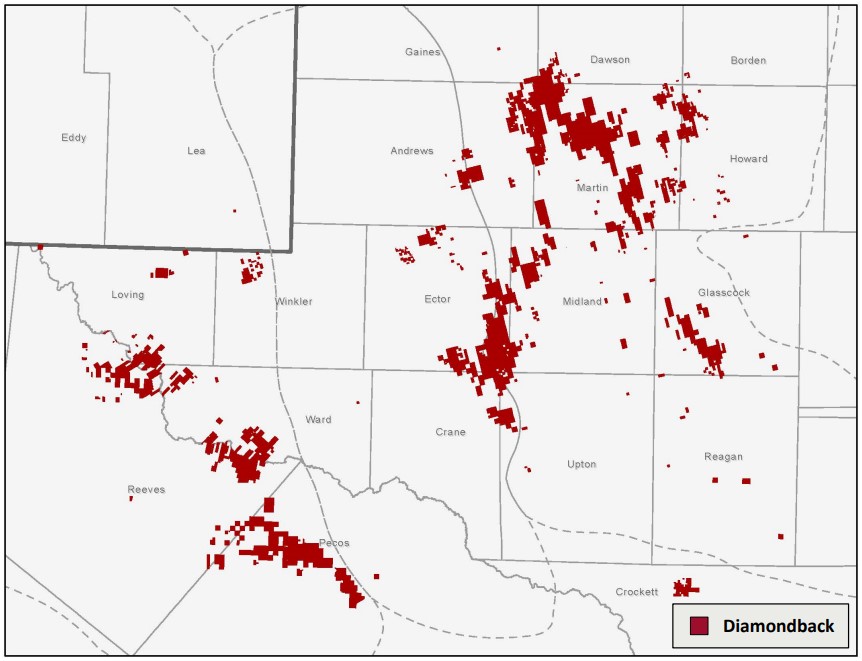

OMOG JV LLC operates about 400 miles of crude oil gathering and regional transport pipelines, as well as approximately 350,000 bbl of crude storage in Midland, Martin, Andrews and Ector counties, Texas, according to Diamondback regulatory filings.

The divestiture generated gross proceeds of $225 million to Diamondback, the company said.

Diamondback has announced or closed $1.1 billion in non-core asset divestitures since launching the sale program. The company had previously planned to raise $500 million through asset sales but upped its 2023 divestiture target to $1 billion earlier this year.

Despite exceeding its $1 billion divestiture target by year-end, Diamondback might be looking to monetize more assets.

In a July 31 research report, analysts at TD Cowen noted that Diamondback ended the second quarter with $742 million in assets held for sale—suggesting that “further proceeds are likely on the way that would favorably build cash reserves towards further capital returns.”

That’s up from $143 million in assets held for sale reported in first-quarter earnings in May.

Diamondback also ended the second quarter with $587 million in equity method investments on its balance sheet.

“[Diamondback] did not increase its non-core asset sale target but continues to have significant value in its midstream assets and equity method investments that may be monetized down the road,” Siebert Williams Shank & Co. Managing Director Gabriele Sorbara noted in an Aug. 1 report.

Diamondback is using proceeds from its asset sales in part to pay down debt: The company’s total debt fell to around $6.7 billion in the second quarter, down from about $7 billion in the previous quarter.

The company aims to continue deleveraging in the third quarter through free cash flow generation, proceeds from divestitures that are set to close and reducing its income tax receivable.

Diamondback highlighted its divestitures but also made headway on blocking-and-tackling leasing during the quarter, Diamondback President and CFO Kaes Van’t Hof said on the company’s Aug. 1 earnings call with analysts.

The company spent $145 million on second-quarter property acquisitions related to Permian Basin leasing activity.

“We've been looking at leasing some of the deeper rights in the Midland Basin across some of our positions, so that's tied to some of those purchases in the cash flow statement,” Van’t Hof said.

Diamondback’s business development team is also making offers on undeveloped interests and non-operated positions the company doesn’t own in its operating areas.

RELATED

Diamondback Closes Permian Divestitures, Eyes More Midstream Sales

Shareholder returns, service cost deflation

Diamondback committed to returning a minimum of 75% of its free cash flow back to investors through dividends and share buybacks.

The Permian E&P exceeded its target in the second quarter, with shareholder returns representing approximately 86% ($473 million) of quarterly free cash flow.

Diamondback did not declare a variable dividend for the quarter, as expected, Sorbara said. But the company boosted its quarterly base dividend by 5% up to $0.84 per share. The second-quarter dividend is payable on Aug. 17 to Diamondback stockholders of record as of Aug. 10.

The company also repurchased over 2.4 million shares of its outstanding common stock for $321 million during the quarter; Diamondback has bought back nearly 400,000 shares for $54 million so far in the third quarter, the company reported.

Year to date, Diamondback has repurchased about 5.36 million shares.

Diamondback has “line of sight to significant capex reductions through the remainder of the year, which will result in higher expected free cash flow at current commodity prices,” Chairman and CEO Travis Stice said in a July 31 letter to shareholders.

The E&P anticipates that capital spending will fall by around 5% to between $650 million and $700 million in the third quarter as Diamondback begins to see the benefits of lower well costs and lower drilling activity. The company also expects to see cash capex fall further in the fourth quarter.

“Both raw materials (including steel, diesel and sand) and service costs continue to decline, setting us up for lower completed well costs as we head into 2024,” Stice said.

Cash spending in the second quarter totaled $711 million, which fell in the upper half of the company’s quarterly guidance.

RELATED

Recommended Reading

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

Cronos Appraisal Confirms Discovery Offshore Cyprus

2024-02-15 - Eni-operated block partner TotalEnergies says appraisal confirms the presence of significant resources and production potential in the block.

Orange Basin Serves Up More Light Oil

2024-03-15 - Galp’s Mopane-2X exploration well offshore Namibia found a significant column of hydrocarbons, and the operator is assessing commerciality of the discovery.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.