Global demand growth for crude is expected to slow significantly by the end of the decade as the world shifts to cleaner energy technologies, according to the International Energy Agency (IEA). (Source: Shutterstock.com)

Global demand growth for crude is expected to slow significantly by the end of the decade as the world shifts to cleaner energy technologies, according to the International Energy Agency (IEA).

Oil demand around the globe is slated to grow by 6% between 2022 and 2028 to reach 105.7 MMbbl/d, the IEA said in its oil 2023 medium-term market report published June 14.

However, annual demand growth is expected to collapse from around 2.4 MMbbl/d this year to approximately 400,000 bbl/d in 2028.

Demand will be impacted in particular by a declining use of crude oil for transportation fuels, like gasoline and diesel, as a global energy crisis spurs greater adoption of electric vehicles and biofuels.

“Road transport fuels, long the backbone of oil demand, will struggle to surpass their pre-crisis peak as energy efficiency improvements and substitution weigh heavily,” the IEA wrote in the report.

Despite the expected slowdown in demand growth, continued increases in petrochemical feedstocks and air travel will continue to drive growth in overall oil consumption.

Increasing demand and consumption of petrochemicals in emerging economies will more than offset the anticipated contraction in other advanced economies.

“The petrochemical sector will remain the key driver of global oil demand growth, with liquified petroleum gas (LPG), ethane and naphtha accounting for more than 50% of the rise between 2022 and 2028 and nearly 90% of the increase compared with pre-pandemic levels,” the IEA wrote.

The global oil market could meaningfully tighten in the short term as OPEC and its allies cut production and limit the upswing in supplies.

Brent crude prices are expected to average $79.54/bbl in 2023 before rising to an average of $83.51/bbl in 2024, according to the latest estimates from the Energy Information Administration (EIA).

RELATED: EIA: Lower 48 Oil, Gas Production Growth to Slow in July

U.S., Permian to fuel supply

While the OPEC+ alliance holds most of the spare capacity to be the globe’s swing producer, non-OPEC oil-producing nations dominate the medium-term capacity expansion plans.

Non-OPEC countries are expected to boost global supply by around 5.1 MMbbl/d by 2028, led by additions from the U.S., Brazil and Guyana.

U.S. crude production will grow to 13.6 MMbbl/d in 2028—primarily led by light tight oil developments from the Permian Basin.

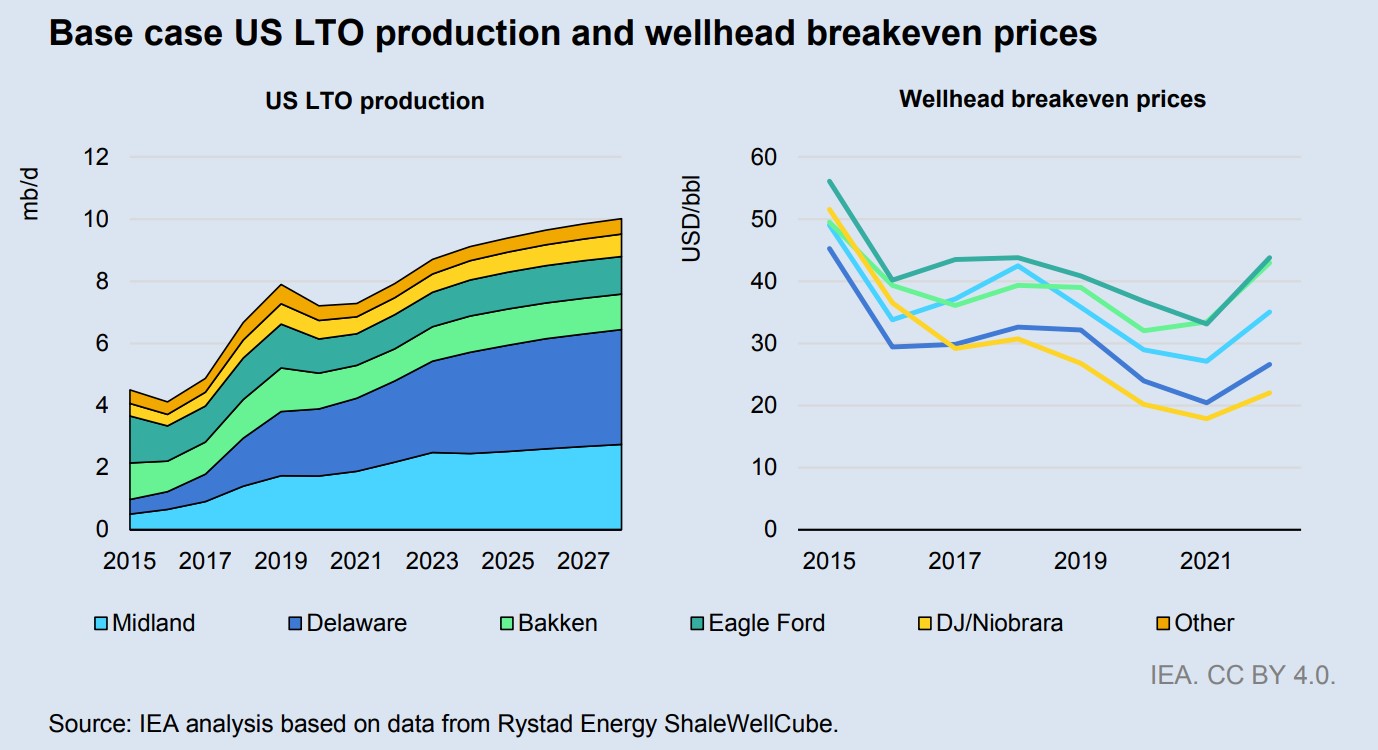

Light tight oil production in the U.S. will grow by around 2.1 MMbbl/d over the six-year period to 10 MMbbl/d. Over the same time frame, U.S. conventional onshore output is set to decline by 550,000 bbl/d.

U.S. shale production growth will average a bit under 4% per year, with the Permian contributing 80% of the output gains.

Despite the growth outlook, some U.S. shale producers have faced higher labor and material costs that have crunched profit margins emerging from the COVID-19 pandemic.

“Equipment availability, lower reinvestment rates, productivity challenges and increased costs have squeezed the industry’s ability to respond and skewed risks to the downside,” the IEA wrote.

U.S. Gulf of Mexico oil production is slated to grow by 140,000 bbl/d between 2022 and 2028 to 1.9 MMbbl/d. Gulf of Mexico output is expected to peak in 2026 at 2.1 MMbbl/d after nine major new projects are started up, per the IEA.

Recommended Reading

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.

Tellurian Executive Chairman ‘Encouraged’ by Progress

2024-03-18 - Tellurian announced new personnel assignments as the company continues to recover from a turbulent 2023.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Enerflex Appoints Thomas B. Tyree to Board

2024-03-12 - Tyree currently serves on Antero Resources’ board and recently served as chairman of Northwoods Energy LLC in 2023.