Oil and gas output growth from key U.S. basins is expected to slow next month, according to new figures. The Energy Information Administration (EIA) said crude and natural gas production growth is slated to fall in most of the basins in the Lower 48 from June to July in its latest Drilling Productivity Report published June 12. (Source: Shutterstock.com)

Oil and gas output growth from key U.S. basins is expected to slow next month, according to new figures.

The Energy Information Administration (EIA) said crude and natural gas production growth is slated to fall in most of the basins in the Lower 48 from June to July in its latest Drilling Productivity Report published June 12.

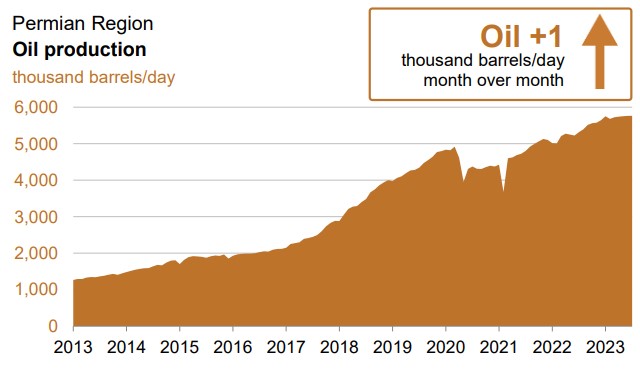

The largest drop in crude production growth is expected to occur in the Permian Basin, the Lower 48’s top oil-producing region. Crude oil output is expected to grow by only about 1,000 bbl/d month-over-month in July.

Permian producers added approximately 11,800 bbl/d of incremental crude supply from May through June, per EIA data.

Despite the relatively meager output gains, Permian oil production is expected to hit a record 5.763 MMbbl/d next month.

Oil production is anticipated to grow in other basins but at a slower pace: crude output from the Bakken play in the Williston Basin will grow by roughly 7,000 bbl/d month-over-month—down from about 12,500 bbl/d of incremental growth from May to June.

After growing by more than 4,200 bbl/d in June, oil production in the Eagle Ford Shale will decrease by around 5,000 bbl/d next month, the EIA forecasted.

Niobrara oil output is forecasted to rise by around 4,000 bbl/d in July, compared to approximately 5,400 bbl/d of additions from May through June.

Oil producers are contending with higher labor and material costs that have crunched profit margins, as well as investor demands to return profits to shareholders, Reuters reports.

RELATED: Permian, Haynesville Driving U.S. Oil, Gas Production Growth

Gas growth to slow

Growth in natural gas production is also slated to fall across the Lower 48 next month.

Appalachia gas production grew by around 72.5 million cubic feet per day (MMcf/d) month-over-month from May to June but is expected to rise by only 25 MMcf/d from June to July, per EIA figures.

Alongside the decrease in oil production, gas output in the Eagle Ford is slated to fall by about 4 MMcf/d in July.

Even growing at a slower pace, gas production from the Haynesville Shale and the Permian Basin is slated to set new records next month.

Natural gas output in the Haynesville is forecasted to grow by about 4 MMcf/d to a record 16.645 Bcf/d in July. Production in the gassy shale basin had grown by nearly 75 MMcf/d in the previous month.

Operators primarily drill in the Permian for oil, but the basin is getting gassier over time as the play matures. The Permian’s associated gas production will rise by about 60 MMcf/d to hit a record 22.88 Bcf/d in July. That’s after growing Permian gas output by around 74 MMcf/d from May to June.

Gas producers capitalized on high commodity prices in 2022 but have faced oversupply, weakened demand and above-average levels of storage so far this year.

Henry Hub natural gas prices are expected to average $2.66/MMBtu in 2023, down more than 58% from an average of $6.42/MMBtu last year, according to the EIA’s latest estimates.

Last week, the U.S. oil and gas rig count fell for a sixth week in a row to its lowest level since April 2022, according to data from services company Baker Hughes.

The U.S. rig count fell by one to 695 week-over-week; drillers added a single oil rig, while gas-directed rigs fell by a count of two.

RELATED: Rockies Gas Producer PureWest Acquired for $1.84 Billion

Recommended Reading

Equitrans Midstream Announces Quarterly Dividends

2024-04-23 - Equitrans' dividends will be paid on May 15 to all applicable ETRN shareholders of record at the close of business on May 7.

PrairieSky Adds $6.4MM in Mannville Royalty Interests, Reduces Debt

2024-04-23 - PrairieSky Royalty said the acquisition was funded with excess earnings from the CA$83 million (US$60.75 million) generated from operations.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.