In a rare natural gas deal, a private investor group led by family offices has taken ownership of Wyoming-focused PureWest Energy in a blockbuster acquisition.

The Rocky Mountain natural gas producer merged with an entity sponsored by the private consortium of investors called PW Consortium in a $1.84 billion cash transaction.

Denver-based PureWest Energy LLC’s existing management team and employees will remain in place and the company’s board will be reformed with PW Consortium representatives following the closing of the deal.

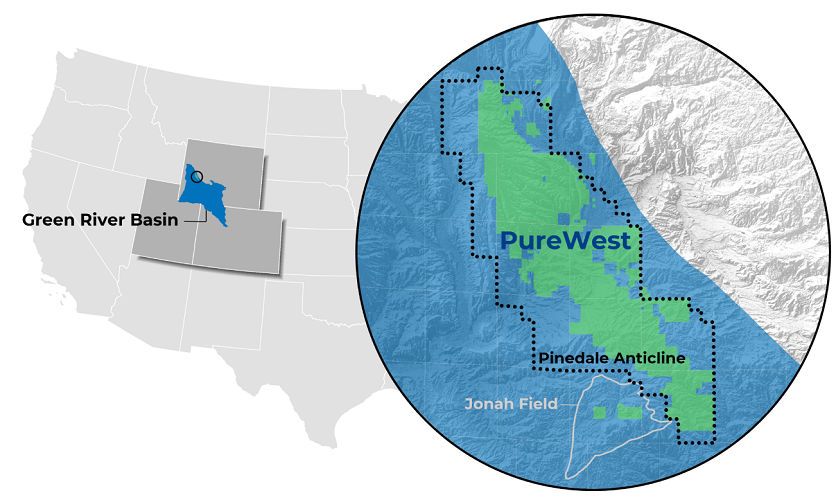

In a news release, PureWest CEO Chris Valdez said the private investor group’s backing will further strengthen the company’s natural gas platform in Wyoming’s Green River Basin.

“Our team has successfully consolidated operations on the Pinedale Anticline, showcasing a sustainable inventory runway,” Valdez said. “Moreover, we have positioned our brand as a prominent market leader in low methane certified gas and earned recognition as the best workplace in Denver.”

PureWest has amassed more than 110,000 net acres in and around the gassy Pinedale and Jonah Fields in Sublette County, Wyoming.

As of May 1, PureWest averaged equivalent gross production of 650 MMcf/d from approximately 3,400 operated wells in the Green River Basin, according to the company’s website.

Following the merger, PureWest “plans to increase its high-margin production through development,” company President and CFO Ty Harrison said.

E&Ps have announced several oil-focused transactions in the Lower 48 this year, but volatility in U.S. natural gas prices has slowed the M&A market for gas-focused deals.

Henry Hub natural gas prices are expected to average $2.66/MMBtu in 2023, down more than 58% from an average of $6.42/MMBtu last year, according to the latest estimates published by the U.S. Energy Information Administration on June 6.

RELATED: Oil, Gas Price Volatility Slows Upstream M&A Market

Family office interest

Harrison said that the unique capital structure of the deal, which includes family office equity and securitized debt, positions the company for long-term value creation.

The company closed on a third asset-backed securitization as part of the transaction, which included offering and selling $200 million worth of notes through a private placement.

PW Consortium members include A.G. Hill Partners LLC, Cain Capital LLC, Eaglebine Capital Partners LP, Fortress Investment Group, HF Capital LLC, Petro-Hunt LLC and Wincoram Asset Management, according to the release.

PureWest also divested some producing wellbores to investment vehicles managed by Wincoram as part of the deal.

PureWest was represented by Evercore as exclusive financial adviser and Vinson & Elkins as legal counsel. PW Consortium was represented by Guggenheim Securities as sole financial adviser and O'Melveny & Myers LLP, David B. Denechaud PLLC and Jackson Walker LLP as legal counsel.

Guggenheim also served as the sole book-running manager and placement agent for the debt offering.

RELATED: Wyoming-Focused PureWest Grows Market for Certified Gas through New Partnership

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.