Associated gas production from the nation’s key oil basins is growing. (Source: Shutterstock)

Associated gas production from the nation’s key oil basins is growing, and analysts expect the gassy trend to continue.

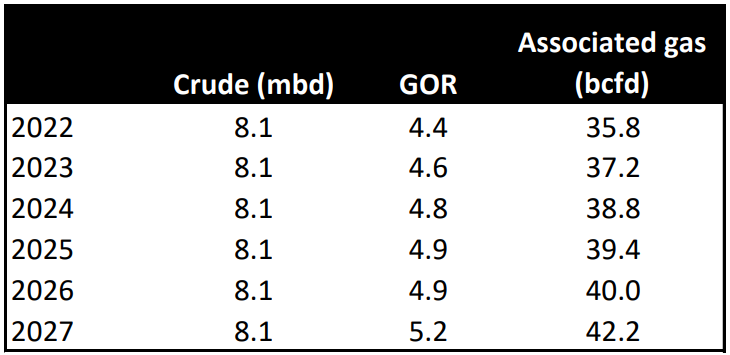

There is approximately 36 Bcf/d of associated wet gas output coming from four major U.S. shale basins – the Permian Basin, the Eagle Ford Shale, the Niobrara Basin and the Bakken – according to data from Bernstein and the Energy Information Administration (EIA).

That’s from an average 8.1 MMbbl/d in crude oil production coming from those four plays.

Associated gas production from these oil-rich regions has grown between 5% and 8% per year since 2017 and is expected to continue rising.

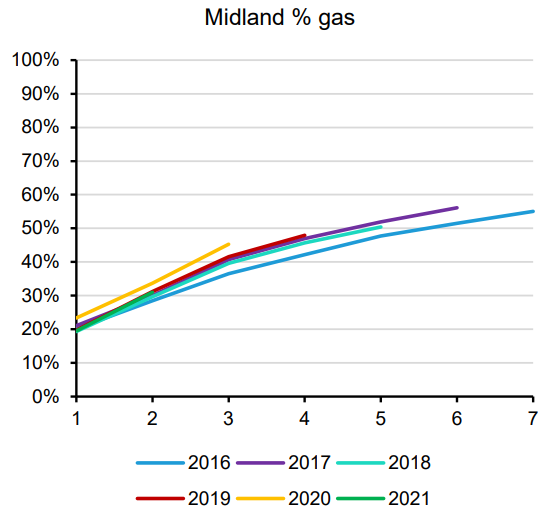

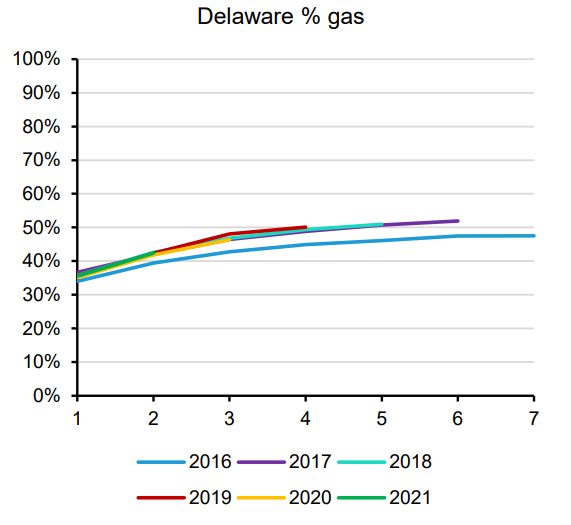

In the Permian, the gas-oil ratio (GOR) has grown around 4% per year since 2017, according to Bernstein’s analysis.

Even if crude oil production were to remain flat, associated gas output from the Permian, the Eagle Ford, the Niobrara and the Bakken are forecast to grow by between 1 Bcf/d and 1.5 Bcf/d, according to Bernstein’s analysis.

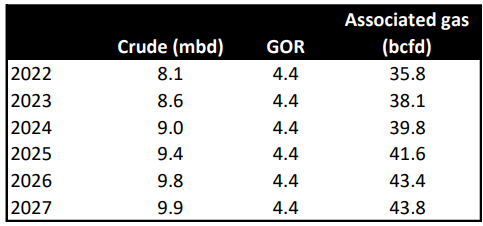

Based on Bernstein’s crude production growth forecast of 1.8 MMbbl/d from 2022 through 2027, associated gas output could grow even faster at the current GOR.

Natural gas production from the Permian Basin, the nation’s premier liquids play, is forecast to reach a record 22.51 Bcf/d in May, according to the EIA’s latest Drilling Productivity Report published on April 17.

Wet gas output from the Eagle Ford, the Niobrara and the Bakken is also expected to grow month over month, according to EIA data.

Growth in Lower 48 gas production is being led by the Haynesville Shale in Louisiana and East Texas, where output is expected to reach 16.82 Bcf/d in May.

Gas output is rising and U.S. oil wells are getting gassier as the industry faces a period of low prices.

Henry Hub natural gas prices are expected to average $2.94/MMBtu in 2023, down over 50% from an average of $6.42/MMBtu last year, EIA reported on April 11.

Crude production from oil basins is also expected to grow month over month. Crude oil output from the Permian is forecasted to grow by 13,000 bbl/d to reach 5.69 MMbbl/d in May.

Oil output growth will be led by the Bakken, which is slated to add 17,000 bbl/d to reach nearly 1.18 MMbbl/d next month.

RELATED

EIA Raises Crude Price Forecast, Slashes Natural Gas Price Outlook

Gas glut, inventory issues

Oil producers around U.S. shale plays, but particularly in the mighty Permian Basin, are searching for liquids-weighted inventory to extend their drilling runways.

Much of the core inventory in the Permian’s Midland and Delaware basins has been picked through, and private E&Ps are amassing acreage in the more fringe areas of the play.

Analysts say that it’s becoming increasingly competitive for publics to find and acquire core Permian inventory.

Earlier this month, Ovintiv Inc. agreed to scoop up three EnCap-backed privates in the Northern Midland Basin for $4.275 billion.

Matador Resources Co. closed a $1.6 billion bolt-on acquisition in the Delaware Basin last week.

Exxon Mobil has reportedly held preliminary discussions on potential M&A with Permian pure-player Pioneer – a deal with the potential to reshape the Permian.

“Inventory depth is probably not quite what everyone’s expected, and folks are scrambling to shore it up with acquisitions,” said Dan Pickering, chief investment officer at Pickering Energy Partners, at the World Oilman’s Mineral & Royalty Conference on April 11.

RELATED

Analysts: Shale M&A Opportunities Shrink After Ovintiv’s $4.2 Billion Permian Deal

Recommended Reading

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

Houston Natural Resources to Rebrand to Cunningham Natural Resources

2024-11-08 - Now rebranded as Cunningham Natural Resources Corp., the company will continue its focus on traditional oil and gas opportunities and energy transition materials.

US Oil, Gas Rig Count Holds Steady for Record Third Week

2024-11-08 - The oil and gas rig count was steady at 585 in the week to Nov. 8, Baker Hughes said on Nov. 8. Baker Hughes said that puts the total rig count down 31 rigs, or 5% below this time last year.

SM, Crescent Testing New Benches in Oily, Stacked Uinta Basin

2024-11-05 - The operators are landing laterals in zones in the estimated 17 stacked benches in addition to the traditional Uteland Butte.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.