After taking advantage of a disjointed global gas market in 2022, U.S. producers have faced a mild season for winter weather and high storage levels this year. (Source: Shutterstock)

The U.S. Energy Information Administration (EIA) again slashed its outlook for domestic natural gas prices as oversupply and weak demand continue to pressure the sector.

For crude the news was better: the EIA-revised forecast bumped WTI crude price up by $2.14/bbl after OPEC’s decision to cut oil production from May through the end of 2023 in early April.

Henry Hub natural gas prices are expected to average $2.94 per million British thermal unit (MMBtu) in 2023, the EIA reported in its April Short-Term Energy Outlook on April 11. The new price was down more than 2.5% from the EIA’s March outlook, which expected Henry Hub gas prices to average $3.02/MMBtu this year.

It’s also a far cry from prices seen last summer, when Henry Hub prices soared above $9/MMBtu after Russia’s invasion of Ukraine caused severe disruptions to global gas markets.

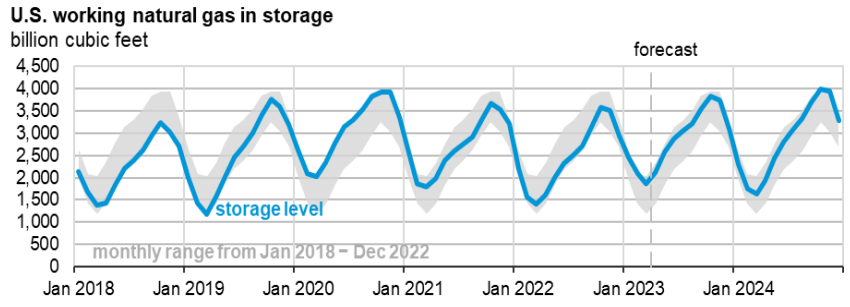

“With inventories remaining above the five-year average in 2023, we expect natural gas prices to average less than $3/MMBtu for 2023, a more than 50% decrease from last year,” the EIA said.

Henry Hub spot prices are expected to average about $2.65/MMBtu during the second quarter before rising back above $3 in the third and fourth quarters, EIA data shows.

RELATED

Sub-$2 Gas on Horizon As Supply Growth Swamps Natural Gas

With gas glut, prices stuck

After taking advantage of a disjointed global gas market in 2022, U.S. producers have faced a mild season for winter weather and high storage levels this year.

Natural gas inventories ended the withdrawal season, which runs from November through March, 19% above the five-year storage average, the EIA said.

Following injection season, which runs from April through October, gas inventories are forecast to be 6% above the five-year average.

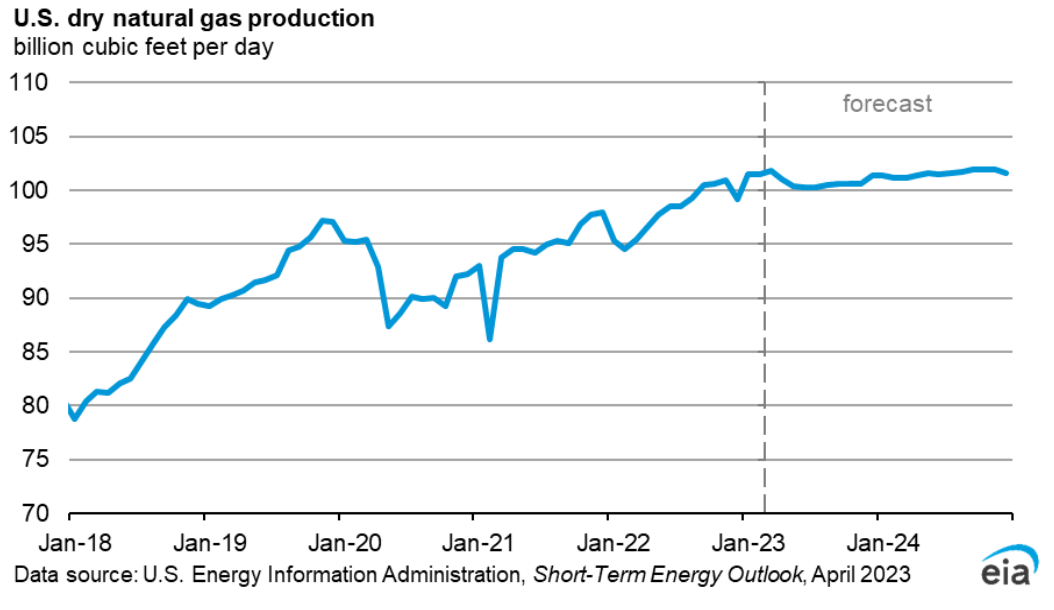

U.S. gas production during the first quarter was led by associated gas volumes from the liquids-heavy Permian Basin and by the Haynesville Shale, which has set new output records this year.

Gas production is expected to decline in April and May due to pipeline maintenance in West Texas and in the Northeast. Overall, the EIA expects total U.S. gas production to remain relatively flat in 2023.

Several gas producers are responding to price signals by slashing drilling activity and slowing production growth.

Haynesville E&Ps, including Chesapeake Energy Corp. and Southwestern Energy Co., are decreasing gas production and cutting rigs in the gassy play. Chesapeake’s view is prices won’t rebound until 2025, vice president of Haynesville operations David Eudey said at Hart Energy’s DUG Haynesville conference in March.

RELATED

Southwestern Energy Plans Oil, NGL Growth as Gas Prices Slump

Oil gets OPEC bounce

OPEC and its allies surprised markets by announcing plans to cut oil production by another 1.2 million barrels per day (MMbbl/d) on April 2, pushing global crude prices higher.

The EIA now forecasts Brent crude oil spot prices to average about $85/bbl in 2023, up over $2/bbl from last month’s forecast.

WTI crude prices are expected to average $79.24/bbl this year, up from March’s forecast of $77.10/bbl.

“The higher price forecast reflects a forecast for less global production in 2023 and a relatively unchanged outlook for global oil consumption,” the EIA said.

Recent shakiness in the banking sector could result in lower-than-forecasted economic and oil demand growth, which could push oil prices lower, the EIA said.

RELATED

For OPEC, the Time Was Right to Move the Markets, Experts Say

Recommended Reading

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.

EIG’s MidOcean Closes Purchase of 20% Stake in Peru LNG

2024-04-23 - MidOcean Energy’s deal for SK Earthon’s Peru LNG follows a March deal to purchase Tokyo Gas’ LNG interests in Australia.

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

2024-02-28 - Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.