Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Dealmaking in the Eagle Ford topped $5 billion in the first quarter – the highest value transacted in the South Texas shale play in nearly a decade.

U.S. upstream M&A totaled $8.6 billion across 16 deals during the first quarter of 2023, according to data from Enverus Intelligence Research.

The Permian Basin, the Lower 48’s top oil and gas producing basin, typically hoards the headlines when it comes to large oil and gas deals. But the Eagle Ford emerged as an unexpected leader in the first quarter as buyers, including international players, searched for oil-producing assets.

“Last quarter was an outlier in terms of the deal targets and types for upstream transactions,” said Andrew Dittmar, director at Enverus. “Rather than public E&Ps focusing on buying undeveloped inventory in the Permian Basin from private companies, most of the deals targeted mature assets in the Eagle Ford and included more public-to-private transactions plus a corporate merger.”

The last time Eagle Ford transaction value topped $5 billion in a quarter was back in fourth-quarter 2013, according to Enverus data.

RELATED

Oil, Gas Price Volatility Slows Upstream M&A Market

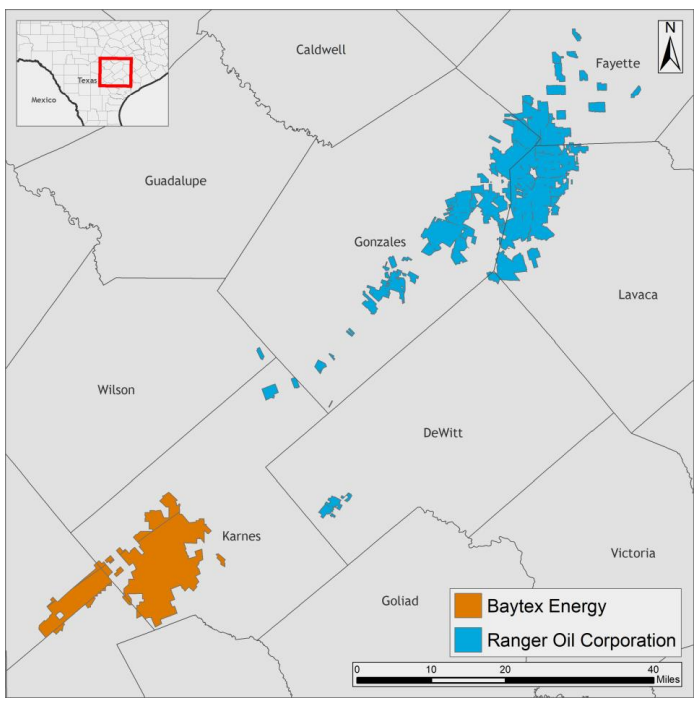

The largest U.S. upstream deal in the first quarter was Calgary-based Baytex Energy’s $2.5 billion acquisition of Houston-based Ranger Oil Corp.

The Ranger deal would materially increase Baytex’s scale in the Eagle Ford, adding 162,000 net acres and production ranging from 67,000 boe/d to 70,000 boe/d. The deal is expected to close later this quarter.

Oklahoma City-based Chesapeake Energy Corp. also made two large sales in the Eagle Ford in the quarter. Chesapeake recently agreed to sell about 172,000 net acres and 2,300 wells in the black oil portion of its Eagle Ford asset to U.K.-based INEOS Energy for $1.4 billion—part of Chesapeake’s journey to become a pure play natural gas producer.

In January, Chesapeake entered into an agreement to sell its Brazos Valley footprint to WildFire Energy I LLC for $1.425 billion.

Chesapeake said in its earnings report on May 2 that it had closed $2.8 billion in sales in the play and “remains actively engaged with other parties regarding the rest of its Eagle Ford position.”

Chesapeake’s sales to WildFire and INEOS were the third- and fourth-largest upstream transactions seen in the first quarter, respectively.

“We view the Eagle Ford as an optimal place to buy production-heavy assets, and some inventory, but it is generally not the ideal play for companies needing a big chunk of undeveloped acreage to be looking,” Dittmar said.

RELATED

The Eagle Ford Shale Takes Flight

E&Ps search for Permian inventory

Deal activity in the Eagle Ford rebounded as buyers searched for oily production and close access to Gulf Coast refining and export markets.

But when it comes to buying undeveloped acreage for inventory runway, E&Ps from the supermajors to independent oil companies are still coming to the Permian Basin.

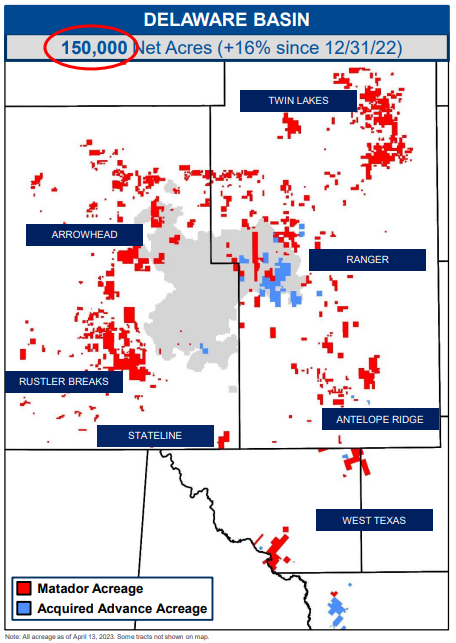

One example: Dallas-based Matador Resources’ $1.6 billion acquisition of EnCap Investments LP-backed Advance Energy Partners Holdings, which closed in April.

The Advance deal included producing properties and undeveloped locations in the Delaware Basin’s Lea County, New Mexico, and Ward County, Texas. Advance’s position added 18,500 net acres and more than 100 MMboe of reserves to Matador’s portfolio.

Matador’s acquisition of Advance was the second-largest deal in the first quarter, according to Enverus.

Permian dealmaking also started off hot in the second quarter: In early April, Ovintiv Inc. agreed to scoop up three EnCap-backed privates in the Northern Midland Basin in a cash-and-stock deal valued at $4.725 billion.

“Most public companies are in need of inventory, and the land held by private E&Ps is where they can find it. However, adding these locations comes at an increasing cost,” Dittmar said. “Top-tier locations in the Permian nearly always garner more than $2 million each now, and some deals have approached the $3 million per location mark.”

Also during the first quarter, Midland-based Diamondback Energy signed agreements to divest 19,000 net acres in Glasscock County, Texas, and about 4,900 net acres in Ward and Winkler Counties, Texas, for $438 million. On May 1, Diamondback reported that it had closed the transaction.

Diamondback’s non-core divestiture in the Permian was the fifth-largest upstream transaction in the first quarter.

RELATED

Diamondback Doubles Asset Sales Target to $1B, Reveals More Midland M&A

Recommended Reading

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

E&P Highlights: March 11, 2024

2024-03-11 - Here’s a roundup of the latest E&P headlines, including a new bid round offshore Bangladesh and new contract awards.

Sangomar FPSO Arrives Offshore Senegal

2024-02-13 - Woodside’s Sangomar Field on track to start production in mid-2024.

Sinopec Brings West Sichuan Gas Field Onstream

2024-03-14 - The 100 Bcm sour gas onshore field, West Sichuan Gas Field, is expected to produce 2 Bcm per year.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.