Gas drilling operations in Harrison County, Ohio (Source: Shutterstock)

Buyers are “starved” for top-tier natural gas assets, experts say. With Henry Hub gas prices near record lows, many owners haven’t been willing to sell.

But natural gas-focused M&A activity is poised to ignite as new U.S. LNG exports come online, gas demand grows and the outlook for commodity prices improves, said Daniel Crowley, a managing director for investment bank Houlihan Lokey’s oil and gas group.

“We have a nice contango in the curve. We have a starved buyer universe,” Crowley said during Hart Energy’s DUG GAS+ Conference and Expo. “We’re really setting ourselves up for a significant increase in A&D activity.”

The upstream sector saw a massive spike in M&A activity in 2023, including multibillion-dollar acquisitions by both U.S. supermajors Exxon Mobil Corp. and Chevron Corp.

Dealmaking has spilled over into 2024, centered on the Permian Basin of West Texas and New Mexico.

The vast majority of recent upstream deals have centered around oil-producing assets and acreage.

Oil prices, generally speaking, have been more stable than natural gas prices over the past year. Price stability has helped fuel a greater volume of transactions for oily assets.

Natural gas prices have been much more volatile: Henry Hub prices should average around $2.36/Mcf this year, a 10% decline from 2023 and a 64% decline from 2022 levels.

Henry Hub prices averaged $6.67/Mcf in 2022, when energy markets were stretched thin between Russia’s invasion of Ukraine and the global economy reemerging from the COVID-19 recession.

Gas-price instability caused a disconnect between what buyers were willing to pay for gassy assets and terms sellers were willing to accept.

But with greater clarity on future gas demand, LNG export growth and increasing prices, gas deals have started to cross the finish line.

The biggest example is Chesapeake Energy’s combination with Southwestern Energy in a $11.5 billion merger.

Both Chesapeake and Southwestern have footprints in Appalachia and in the Louisiana Haynesville Shale. The merger is expected to create the nation’s largest pure-play gas producer.

In the Haynesville, Rockcliff Energy II sold to Tokyo Gas Co. and partner Castleton Commodities in a $2.7 billion deal. The deal gives Tokyo Gas and its U.S. upstream subsidiary, TG Natural Resources, a deeper footprint in East Texas.

There are quite a few other gassy properties being shopped around the Haynesville, including notable packages from Chevron and Tellurian.

But Appalachia, with its low-cost and bountiful gas supplies and unique infrastructure challenges, could also be a hotspot for gas-weighted M&A in the next two years, Crowley told Hart Energy.

“In the conversations I have with some producers in Appalachia, people are very carefully watching that contango and sort of queueing up to come to the market at the right time,” Crowley said.

RELATED

Aethon Cuts Rigs but Wants More Western Haynesville Acreage

Growing in Gasland

Pennsylvania, West Virginia and Ohio boast an interesting mix of gas- and liquids-rich fairways attracting investment from producers.

Since the advent of horizontal drilling and fracking techniques, Appalachia operators have largely targeted the gassy Marcellus Shale play.

But the area has long been known for crude oil potential: Drake’s Well striking oil near Titusville, Pennsylvania, in August 1859, kicked off a bonanza that effectively birthed the U.S. oil industry.

Across the border in Ohio, not far west of Titusville and Oil Creek, operators are bringing online some gushing new horizontal oil wells.

But gas is still king in Appalachia, and the basin is home to some of the nation’s largest natural gas producers.

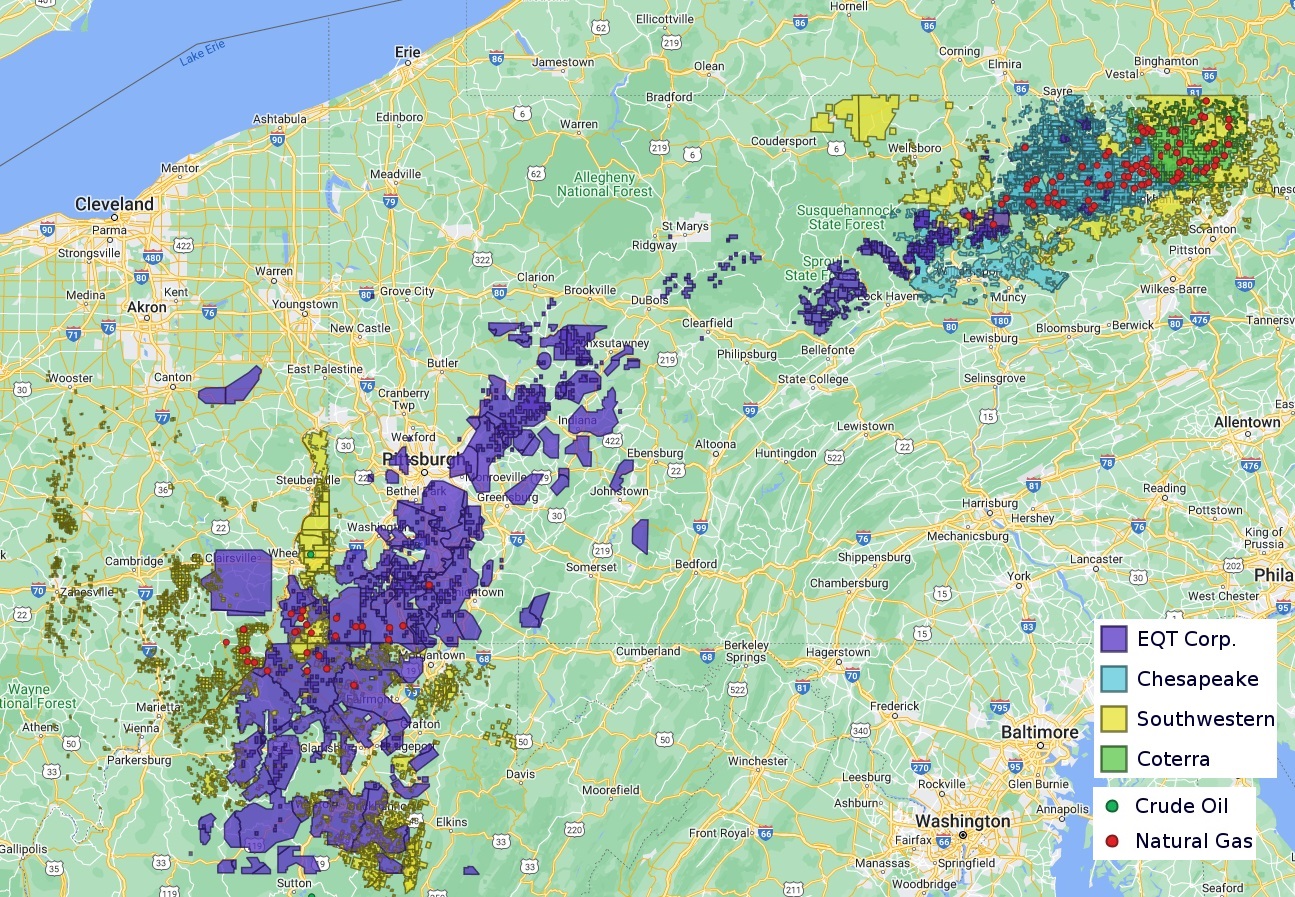

Both EQT Corp. and Southwestern, two of the nation’s largest and most productive gas operators, own leasehold spread across Pennsylvania, West Virginia and Ohio.

Large-cap publics Chesapeake and Coterra Energy both have large footprints in northeast Pennsylvania.

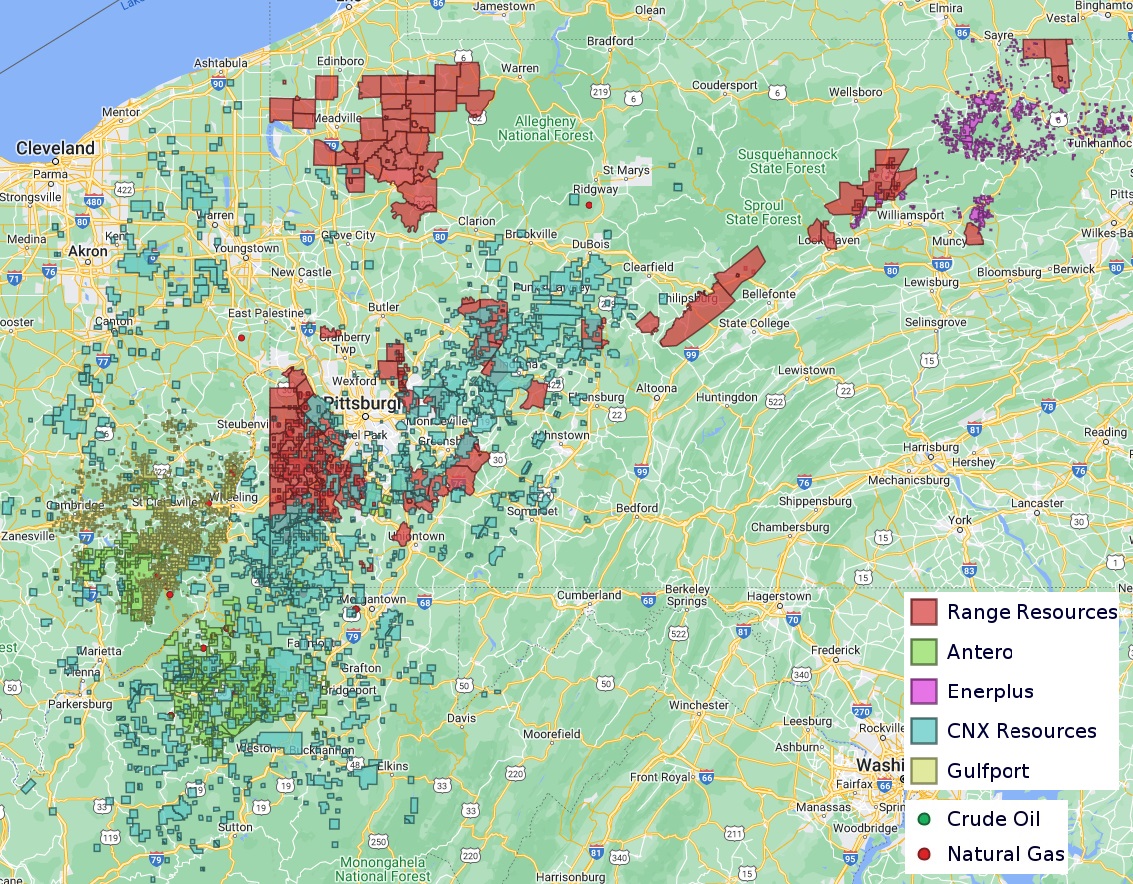

Several small- and mid-sized producers, including Range Resources, Antero Resources, CNX Resources and Gulfport Energy, are playing in Appalachia.

Investors have been hot on several of these names in the past year—but they’ve been particularly hot on Gulfport, which has seen its stock price spike over 100% in the past 12 months.

Enerplus, which recently agreed to a nearly $4 billion sale to Chord Energy to create a larger Williston Basin player, also owns a legacy non-operated position in northeast Pennsylvania.

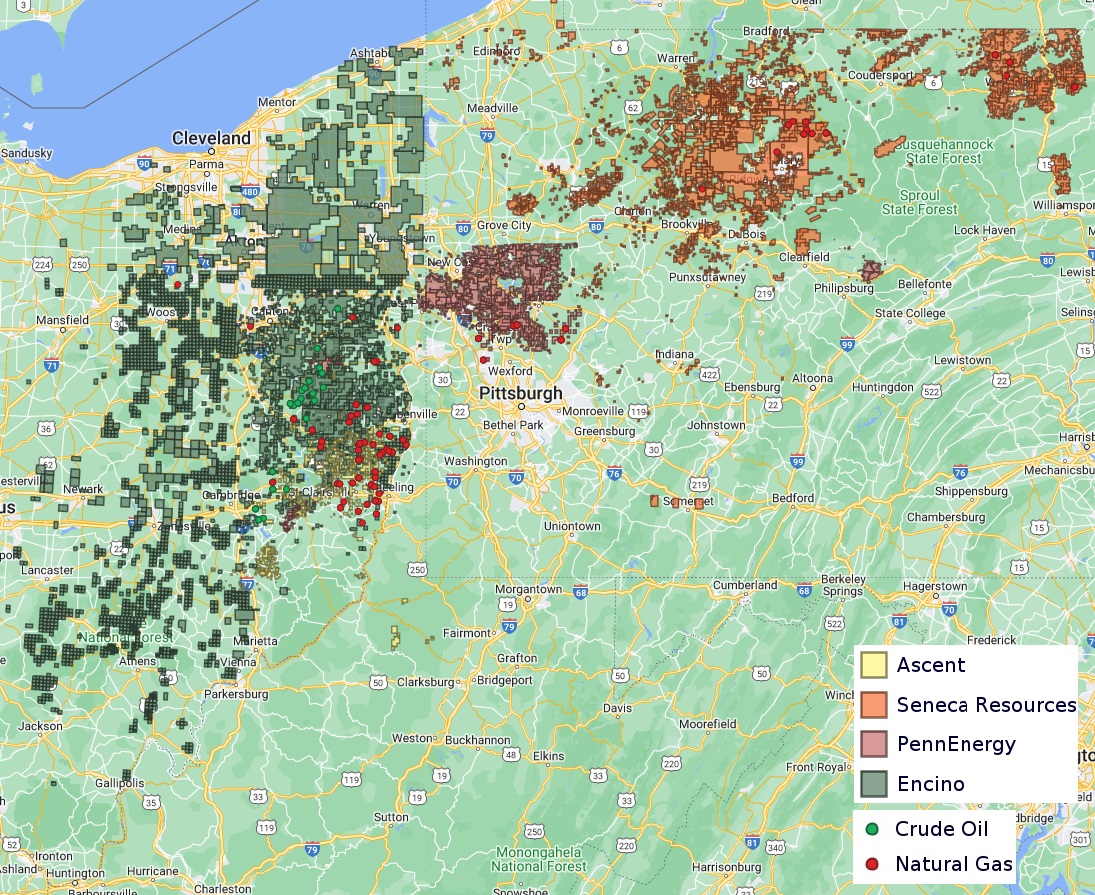

Several interesting private E&Ps inhabit Appalachia as well, and hold blocky acreage positions: Ascent Resources, Encino Energy, PennEnergy Resources and Seneca Resources, the E&P segment of National Fuel Gas Co.

Ascent and Encino’s EAP Ohio are two of the top players operating in the Ohio Utica oil window, along with the exploring pioneer EOG Resources, state data show.

Across the entire Appalachia Basin, Crowley has identified roughly two dozen companies that could be logical sellers, or sell off non-core Appalachia asset packages, over the next two or so years. Private equity-backed E&Ps probably make up about half of that list, he said.

By private equity standards, several of the investments in Appalachia E&Ps are relatively mature—some sponsors have held onto their Appalachia investments for 10 years to 12 years at this point, Crowley said. PE firms may look to monetize their investments.

The second bucket of potential dealmaking could stem from non-core divestitures by E&Ps doing other large deals.

EQT is currently marketing a large non-operated position in the Pennsylvania Marcellus Shale, reportedly valued at about $3 billion. Chesapeake operates the assets.

As Enerplus combines with Chord and prioritizes investment in the North Dakota Bakken shale, questions remain about what will become of Enerplus’ legacy non-op interests in northeast Pennsylvania.

And once the merger between Chesapeake and Southwestern closes, there could be other non-core Appalachia properties that fall out of their combined portfolio.

The third category of potential Appalachia dealmaking could focus on the small- to mid-cap publics generating a healthy amount of investor buzz.

Several of these names have significantly outperformed their larger gas-weighted peers, including Gulfport (stock price up ~101% year over year), CNX Resources (up ~47% yoy), Range Resources (up ~30% yoy) and Antero (up ~20% yoy).

“Some of the smaller public operators in Appalachia are logical candidates to be taken out or merged into somebody else,” Crowley said.

“I wouldn’t be the least bit surprised if we see at least one of those transactions incremental to Chesapeake-Southwestern happening in the next year or two,” he said.

A smattering of smaller private, family office-owned oil and gas companies that operate in Appalachia that could set up a fourth bucket of potential M&A in the coming years.

RELATED

Analysts: Why Are Investors Snapping Up Gulfport Energy Stock?

Midstream matters

One of the most unique challenges to executing M&A transactions in Appalachia is the midstream component.

Looking back at some of the biggest M&A deals inked across Appalachia in recent years, most included some component of midstream capacity, Crowley said.

Chesapeake’s acquisition of Chief E&D Holdings enabled the combined firm to boost gas production by sharing midstream assets.

EQT’s acquisition of Alta Resources Development in 2021 included integrated midstream assets. Similarly, the company’s Tug Hill deal, which closed last year after a long delay by the Federal Trade Commission, included XcL Midstream assets.

Most recently, EQT is paying $5.5 billion in stock to acquire Equitrans Midstream, the developer behind the controversial and politicized Mountain Valley Pipeline project.

Integrating midstream in M&A transactions isn’t as big of a hang-up in other basins. Some operators, such as Occidental Petroleum, are looking to divest midstream interests to pay down other debts.

But midstream access is a key consideration in Appalachia dealmaking.

“Appalachia is basically producing right on the brink of its takeaway capacity, so everybody’s competing for offtake,” Crowley said. “Having control of your midstream is important to protect yourself in that regard.”

RELATED

EQT Deal to ‘Vertically Integrate’ Equitrans Faces Steep Challenges

Oily Ohio Action

Natural gas prices are so low that producers including EQT, Chesapeake, Aethon Energy and others are shedding rigs and reducing drilling or completions activity in gassy areas around the U.S.

Some opportunistic Appalachia E&Ps are shifting capital spending away from the gassy Marcellus toward oil- and liquids-rich fairways in the Utica shale and Point Pleasant formations.

Operators, analysts and investors are hot on crude oil wells being delineated and tested in the Ohio Utica oil window.

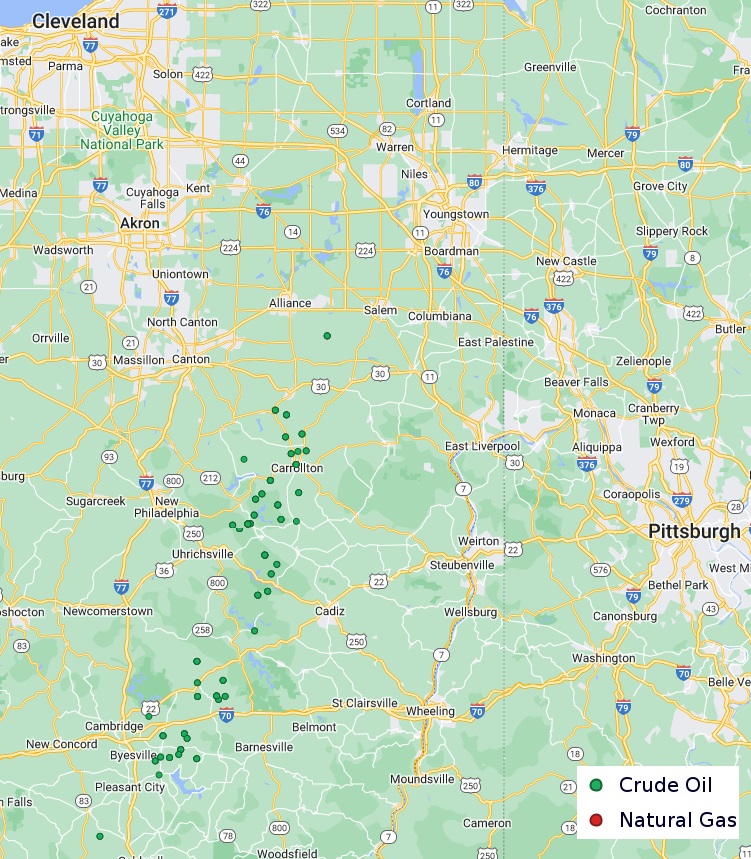

EOG, EAP Ohio and Ascent have drilled some of the most productive oil wells in the Ohio Utica so far. But other E&Ps are getting in on the oily Ohio action, according to data published by Ohio’s Department of Natural Resources (ODNR) in March.

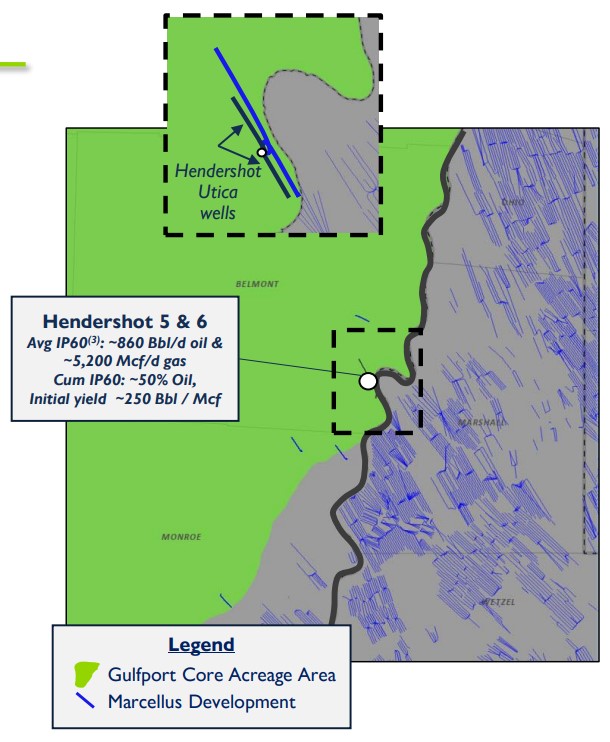

Gulfport reported “strong” oil production from a two-well Hendershot pad in Belmont County, Ohio, which came online last year, the company said in first-quarter earnings.

Hendershot 5 and 6 produced an average of 782 bbl/d during the fourth quarter of 2023, the pad’s first full quarter in production, per ODNR figures.

The initial results delineate between 50 and 60 liquids-heavy drilling locations across Gulfport’s existing acreage—about two years of drillable inventory.

While Southwestern(SWN) is focused much more on gas production, the company has quietly drilled wells with considerable oil production.

SWN Production Ohio LLC reported production from three Guernsey County wells that went to sales in mid-November:

- Posey A 1H produced 57,400 bbl, or 1,275 bbl/d, over 45 days, per ODNR data;

- Posey A 3H produced 50,732 bbl, or 1,127 bbl/d, over 45 days; and

- Posey B 5H produced 37,517 bbl, or 834 bbl/d, over 45 days.

Infinity Natural Resources (INR) is another private E&P that’s been buying up oily acreage in Ohio after initially focusing on dry gas production in southwest Pennsylvania.

INR has drilled some of the most prodigious oil wells in the Ohio Utica, with initial production rates rivaling wells drilled by EOG, Ascent and Encino, ODNR data show.

In February, the Ohio Oil and Gas Land Management Commission awarded a bid to Infinity to lease two parcels of land and drill in Salt Fork State Park in Guernsey County.

“[Infinity has] done a nice job of transforming themselves from what was originally this dry gas-focused business into a company that, I’m guessing, generates a significant majority of its current revenue and value from oil production,” Crowley said.

RELATED

Recommended Reading

Energy Transfer Asks FERC to Weigh in on Williams Gas Project

2024-04-08 - Energy Transfer's filing continues the dispute over Williams’ development of the Louisiana Energy Gateway.

Apollo Buys Out New Fortress Energy’s 20% Stake in LNG Firm Energos

2024-02-15 - New Fortress Energy will sell its 20% stake in Energos Infrastructure, created by the company and Apollo, but maintain charters with LNG vessels.

Williams CEO: Louisiana Energy Gateway Start Temporarily in Limbo

2024-03-21 - Williams CEO Alan Armstrong said the project still moving forward after hitting a snag in a dispute with Energy Transfer but lacks a definitive start date.

Canada’s First FLNG Project Gets Underway

2024-04-12 - Black & Veatch and Samsung Heavy Industries have been given notice to proceed with a floating LNG facility near Kitimat, British Columbia, Canada.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.