A drilling rig near Williston, North Dakota, in the heart of the Williston Basin. (Source: Shutterstock)

The combination of Chord Energy and Enerplus Corp. will give Chord another decade of drilling runway in the Bakken Shale.

But the deal also heralds the end of a long Bakken run for Enerplus, which bet big on the emerging U.S. horizontal play nearly two decades ago.

Houston-based Chord Energy, born out of the 2022 merger between Whiting Petroleum and Oasis Petroleum, is scaling up again with a nearly $4 billion cash-and-stock acquisition of Enerplus.

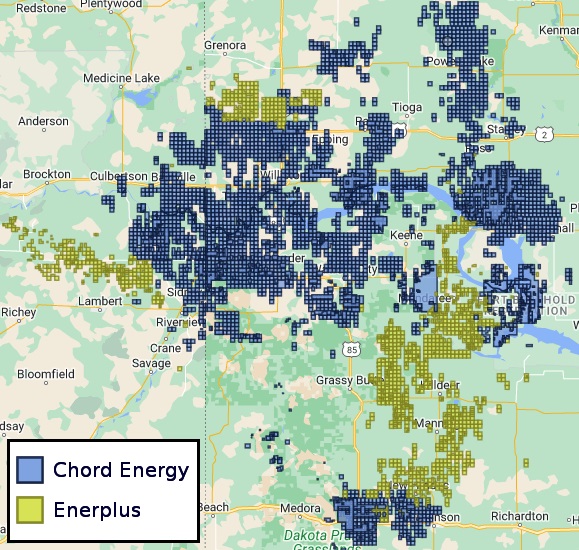

Analysts say the combined company is poised to become the largest operator in the Williston Basin, with 1.3 million net acres and combined production of 287,000 boe/d.

Combined, Chord and Enerplus should have some of the best inventory of any E&P in the Bakken, Chord President and CEO Danny Brown said during a Feb. 21 conference call with analysts discussing the transaction.

“Our combined position represents approximately 10 years of low-cost development at the current pace, with significant upside beyond that,” Brown said.

Andrew Dittmar, senior vice president at Enverus Intelligence Research, said the deal extends Chord’s portfolio of economic drilling locations at a $50/bbl oil price—a range that investors generally prioritize.

Enerplus has around six years of high-quality inventory remaining at its current development cadence, compared to Chord’s own four years of runway, per Enverus figures.

“That doesn’t seem like a big difference, but anything companies can do to extend this metric has been well received by investors,” Dittmar said.

Both E&Ps have over a decade of inventory when it comes to less economic locations at a $60/bbl oil price.

Those more expensive locations are less appetizing for investors—but they’ll add value as the lowest-cost inventory continues to be depleted and activity shifts to higher-cost areas, Dittmar said.

The deal will yield a bigger Chord, moving the Williston E&P amongst large-cap peers with a pro forma market valuation of around $11 billion.

RELATED

Chord Buying Enerplus to Create a Bakken Behemoth

Waking a sleeping giant

The U.S. upstream sector is awash in M&A, and much of the consolidation has taken place in the Permian Basin. The prolific field spanning across West Texas and New Mexico is the top crude oil-producing region in the nation.

Some of the Permian’s oldest and largest producers—Pioneer Natural Resources, Endeavor Energy and CrownRock LP—have been plucked off the board by larger E&Ps in a matter of months.

Top-tier Permian acreage is trading for a premium: Exxon Mobil is paying nearly $65 billion to acquire Pioneer, including Pioneer’s net debt. Diamondback Energy’s $26 billion acquisition of Endeavor Energy Resources was the largest buyout of a private upstream company ever, according to Enverus research.

Other companies, like Chord, have tried to find value outside of the premium Permian. And the bet on the Bakken is a major validator for a shale play once declared dead by North Dakota state officials.

Until around 2000, operators largely considered the Williston Basin’s Bakken formation to be a bailout zone.

When a well targeting a different formation wasn’t going to pay, drillers tapped the Bakken for what little the super-tight shale rock would give up. Investors might recoup some of the money they spent.

But the outlook for the Bakken changed with horizontal drilling and fracking techniques pioneered in Montana and North Dakota by operators like Burlington Resources, Continental Resources and Lyco Energy.

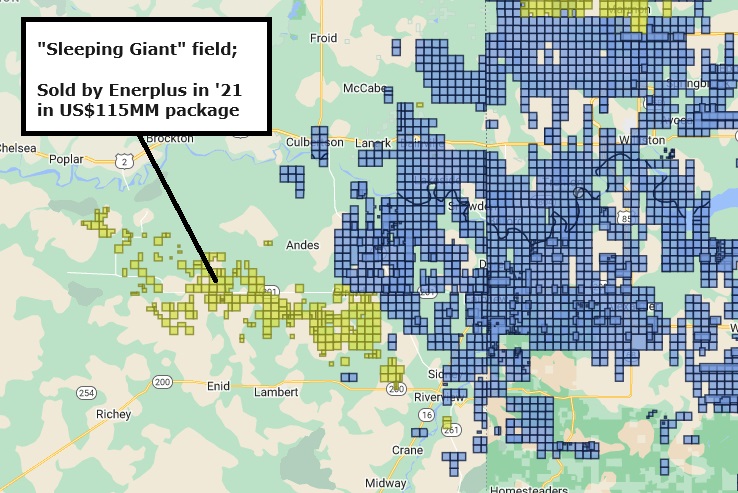

The pioneering efforts by early Bakken players were enough to convince Canadian operator Enerplus. In 2005, Enerplus inked a $421 million deal to acquire Lyco—including Lyco’s light oil-producing assets from its “Sleeping Giant” project area in northeastern Montana.

The Lyco transaction also marked Enerplus’ entry into the U.S., and the Calgary-based company has had operations stateside ever since.

Enerplus later sold its legacy positions in the Sleeping Giant field, as well as interests in North Dakota, in 2021 for $115 million.

The Sleeping Giant field, a driver of Enerplus’ strategic entry into the U.S. market, eventually became a “non-strategic” part of the portfolio.

RELATED

So long, Susquehanna?

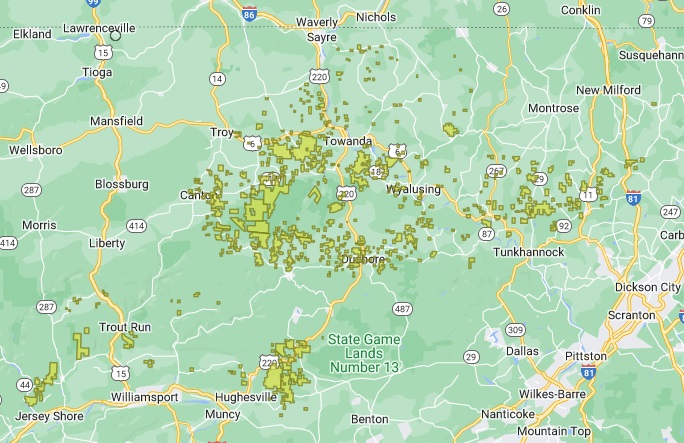

Company executives at Chord and Enerplus talked at length about how the merger will create a top-tier Williston Basin operator. They barely discussed Enerplus’ natural gas interests in Appalachia.

Enerplus has non-operated natural gas interests across Susquehanna, Bradford, Wyoming, Sullivan and Lycoming counties, Pennsylvania.

The company’s natural gas production in the Marcellus averaged 145 MMcf/d during the third quarter of 2023, down 12% year-over-year and a 6% decrease sequentially.

The dip in production was a result of “limited capital activity directed to the asset in 2023” following a steep collapse in natural gas prices, Enerplus said in its most recent earnings report.

Enerplus’ Marcellus portfolio only represents about 2% of the combined company’s pro forma EBITDA, Brown said on the call.

“It’s a very small part of the overall company,” Brown said.

It might be small but it’s got style, sitting within a “great” and “core” spot of the Appalachian Basin, he said.

Brown didn’t offer direction on whether or not Enerplus’ Marcellus natural gas interests would be put up for sale; the companies will evaluate “all aspects of our portfolio on should they stay in or should they not stay in,” he said.

RELATED

Is Grayson Mill the Next Bakken Domino to Fall After Chevron-Hess?

Recommended Reading

NOV Announces $1B Repurchase Program, Ups Dividend

2024-04-26 - NOV expects to increase its quarterly cash dividend on its common stock by 50% to $0.075 per share from $0.05 per share.

Repsol to Drop Marcellus Rig in June

2024-04-26 - Spain’s Repsol plans to drop its Marcellus Shale rig in June and reduce capex in the play due to the current U.S. gas price environment, CEO Josu Jon Imaz told analysts during a quarterly webcast.

US Drillers Cut Most Oil Rigs in a Week Since November

2024-04-26 - The number of oil rigs fell by five to 506 this week, while gas rigs fell by one to 105, their lowest since December 2021.

CNX, Appalachia Peers Defer Completions as NatGas Prices Languish

2024-04-25 - Henry Hub blues: CNX Resources and other Appalachia producers are slashing production and deferring well completions as natural gas spot prices hover near record lows.

Chevron’s Tengiz Oil Field Operations Start Up in Kazakhstan

2024-04-25 - The final phase of Chevron’s project will produce about 260,000 bbl/d.