Oil wells in the Bakken Shale basin of North Dakota. (Source: Shutterstock)

Permian Basin M&A opportunities are shrinking after a historic wave of consolidation in the basin, so analysts believe E&Ps will look at deepening their portfolios in other areas of the U.S.

One of those non-Permian locations could be the Bakken play. Chevron Corp. is getting into the Bakken through its $60 billion acquisition of Hess Corp. It’s also where private E&P Grayson Mill Energy is reportedly exploring a sale valued somewhere around $5 billion.

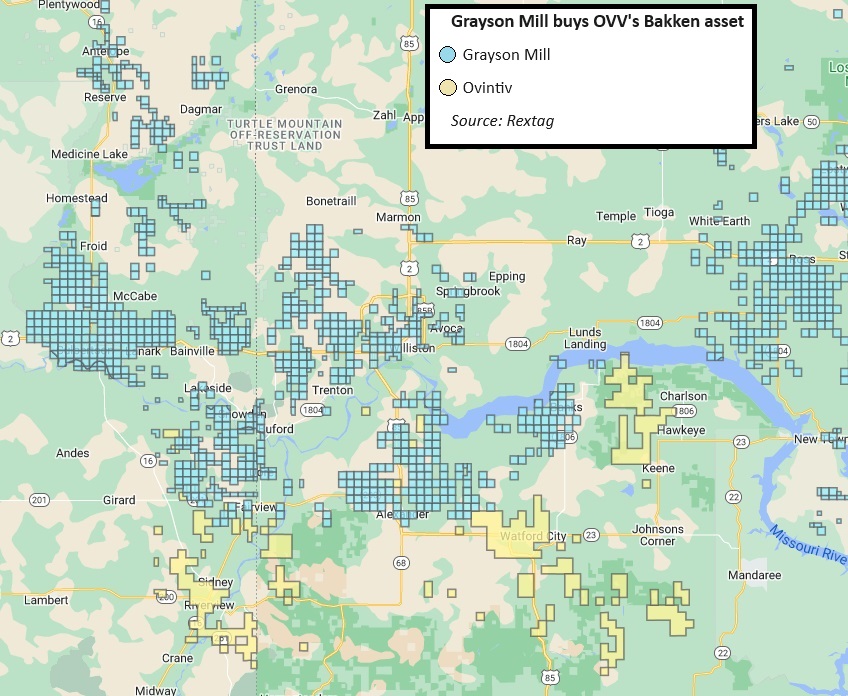

Grayson Mill, backed by Houston-based private equity firm EnCap Investments LP, has grown a sizable portfolio in the Bakken since first entering the basin through a $900 million acquisition from Equinor in 2021.

The Equinor acquisition included the company’s operated and non-operated acreage—about 242,000 net acres in North Dakota and Montana—and production of around 48,000 boe/d; WTI was about $60/bbl at that time.

Grayson Mill added more scale in the basin by bolting on Ovintiv’s Bakken assets for $825 million last year. The Ovintiv transaction added 46,000 net acres in North Dakota and output of approximately 37,000 boe/d; WTI was about $80/bbl.

Analysts at Capital One Securities said it’s difficult to nail down Grayson Mill’s current net production rate at this point, but the bank estimates a range between 80,000 boe/d and 100,000 boe/d (~60 oil).

“We think the $5 billion price tag referenced frankly looks steep and would peg fair value in the [$3.5 billion to $4.5 billion] range, depending on the net production level,” Capital One Securities analysts reported.

EnCap declined to offer specifics on any plans to sell Grayson Mill. EnCap Managing Partner Jason DeLorenzo told Hart Energy the firm has many well-performing portfolio companies that it may take to market in the next 12 to 24 months.

“Grayson Mill is one of those companies,” DeLorenzo said.

RELATED

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

Striking a Chord

Grayson Mill is one of the more productive E&Ps in the Bakken compared to other large operators in the area, according to a J.P. Morgan analysis of Enverus Intelligence Research data.

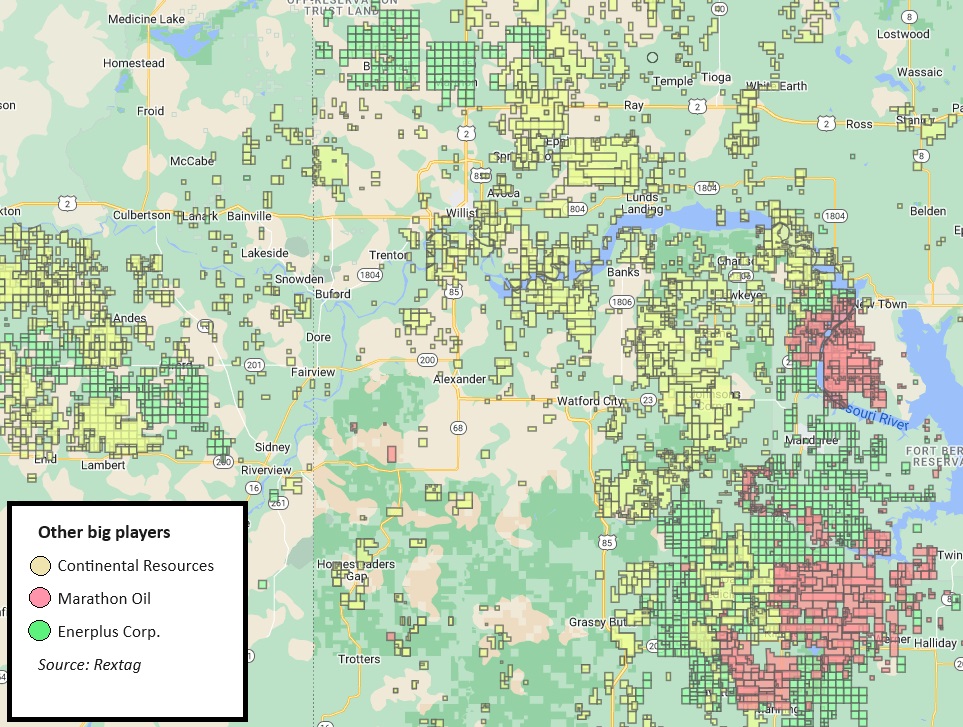

Based on six-month cumulative output per foot, Grayson Mill ranked only behind Enerplus Corp. in 2023 oil productivity—and the company ranked ahead of other major E&Ps including Marathon Oil Corp., Hess Corp., Chord Energy and Continental Resources.

Grayson Mill is currently operating three drilling rigs in the Bakken, according to the J.P. Morgan analysis.

If Grayson Mill hits the market, which E&Ps might be interested in carving out the assets? Capital One believes Chord Energy would be the most logical buyer.

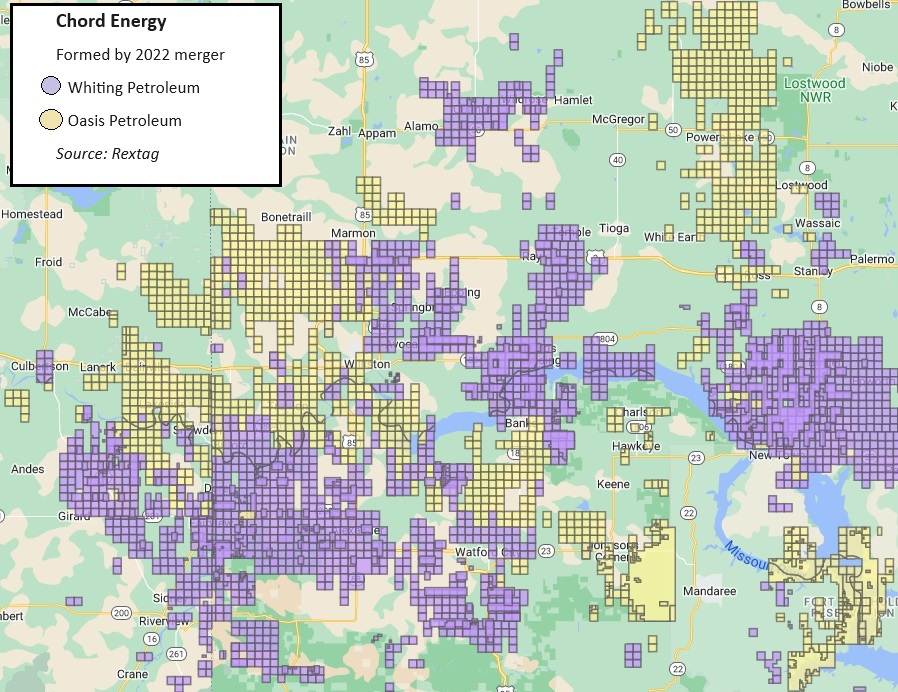

Chord, formed through the public-public merger of Whiting Petroleum and Oasis Petroleum in 2022, has been offloading non-core assets to focus its portfolio on the Williston Basin.

Given the sizable geographic overlap between Chord and Grayson Mill, as well as Chord’s continued desire to get deeper in the Bakken, Chord does make sense as a potential buyer.

The current price being shopped, around $5 billion, might be too big of an asking price for Chord to pay. But if Chord was able to pay “a significantly lower price,” the bank thinks a deal would likely make sense.

Chord has a clean balance sheet with essentially zero net debt, so the company “could easily finance a large portion of the acquisition” with cash and debt, Capital One said. Chord could also include some amount of equity consideration to keep a leverage ratio comfortable at around 1.5x.

A huge amount of the recent M&A activity in the upstream space has been about extending inventory duration.

But a deal between Chord and Grayson Mill would be more about maximizing free cash flow, boosting shareholder capital returns and capturing benefits of scale and synergies—rather than deepening Chord’s core drilling inventory, according to Capital One.

Chord’s strategy would likely involve paying as close to proved developed producing value as possible for the assets and to let technology—like longer three-mile lateral wells—and oil prices drive upside from the deal, the bank said.

Chord told Hart Energy that as a public company it is prohibited from speculating on potential M&A.

“What we can say generally is that we remain open to opportunities that will add value to our portfolio,” Chord said in a statement.

RELATED

Chord Energy Goes Long: Bakken E&P Investigating Four-mile Laterals

Fence line field report

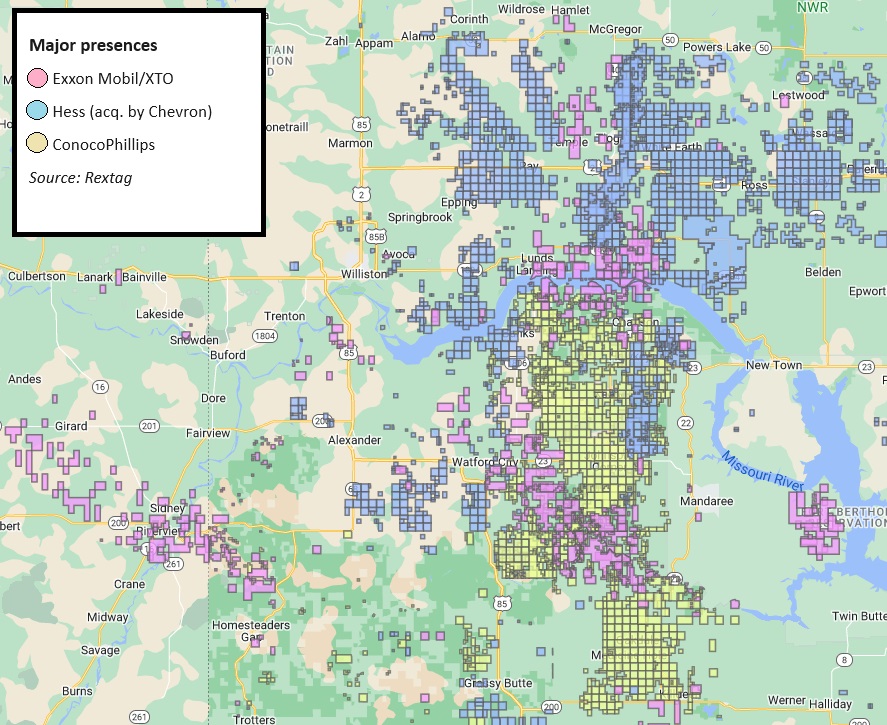

Several other major E&Ps have acreage adjacent to or near Grayson Mill’s assets in the Bakken. U.S. majors Exxon Mobil Corp., through its subsidiary XTO Energy, and ConocoPhillips both have existing footprints in the basin.

And Chevron is picking up around 190,000 boe/d of mostly oil production in the Bakken through its acquisition of Hess Corp.

The area is also home to several smaller—but still massive—oil and gas companies, like Marathon Oil, Continental Resources and Enerplus. All three are among the top producers in the Bakken, according to Enverus data.

The scarcity-fueled rush for drilling inventory led to a $144-billion deluge of deals during the fourth quarter of 2023, per Enverus figures. Full-year 2023 upstream deals totaled $192 billion.

Recommended Reading

Kinder Morgan Nominates Deloitte’s Amy Chronis to Board

2024-04-03 - Amy Chronis, currently a senior partner with Deloitte, will stand for election along with Kinder Morgan’s current directors at the company’s annual meeting on May 8.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Northern Oil and Gas Ups Dividend 18%, Updates Hedging

2024-02-09 - Northern Oil and Gas, which recently closed acquisitions in the Utica Shale and Delaware Basin, announced a $0.40 per share dividend.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.