A historic amount of Permian consolidation is altering the landscape of rig deployments across the basin.

With Occidental Petroleum Corp.’s $12 billion bid to acquire private Midland Basin E&P CrownRock LP, the total transaction value in Permian Basin assets has now eclipsed $100 billion for 2023, according to figures compiled by Wood Mackenzie.

That’s up significantly from the previous peak of $65 billion transacted across the Permian in 2019.

“This transaction cements an absolute banner year in Permian acquisitions and divestments spend,” said Robert Clarke, vice president of upstream research at Wood Mac, in a press note.

“Coupled with other mega 2023 deals like Exxon Mobil and Pioneer, it solidifies Permian scale and multi-decade longevity as a ‘must have’ trait for U.S. majors and super-independents,” he said.

Outside of the massive Exxon-Pioneer and Occidental-CrownRock deals, the Permian has seen a frenzy of smaller M&A by small- and mid-cap E&Ps.

Companies including Civitas Resources, Permian Resources, Ovintiv Inc., Vital Energy and Matador Resources spent billions of dollars adding scale across the Permian’s Midland and Delaware basins this year.

Most of these large-scale transactions have focused on deepening E&P’s portfolios of undeveloped Permian drilling inventory.

Producers across the basin have been racing to buy up high-quality drilling locations—locations that can generate a return on investment even at depressed oil prices; Tier 1 inventory breakevens generally range between $40/bbl and $50/bbl.

RELATED

Private Equity Exits Hit Five-year High with Occidental Deal for CrownRock

Inventory preservation

A significant amount of Permian M&A activity in 2023 has been fueled by private equity firms monetizing their upstream investments.

As part of that trend, Occidental’s acquisition of CrownRock, backed by private equity firm Lime Rock Partners, pushes this year’s upstream private equity exits to a five-year high of about $30 billion.

For the private E&Ps looking for an exit, the name of the game has been adding runway for a while, said Matthew Bernstein, senior shale analyst at Rystad Energy.

“Really, if you’re going to survive as an attractive target to be acquired, there needs to be a little more discipline for the sake of inventory preservation,” Bernstein said. “That’s what we’re expecting to see more of from the private E&Ps in the coming couple of years, as well.”

Public E&Ps have widely deployed a buy-and-cut strategy when acquiring private equity-backed Permian producers.

When an acquisition is complete, drilling rig activity on the acquired asset is typically slashed drastically compared to pre-deal levels.

RELATED

Middle Innings: Shale E&Ps’ Slow Struggle to Woo Back Investors

That’s because companies aren’t in a hurry to pursue aggressive spending to ramp up production and drill through their top-tier inventory. Preserving inventory is the goal.

But this buy-and-cut strategy has yielded notable effects on the oilfield services and midstream sectors.

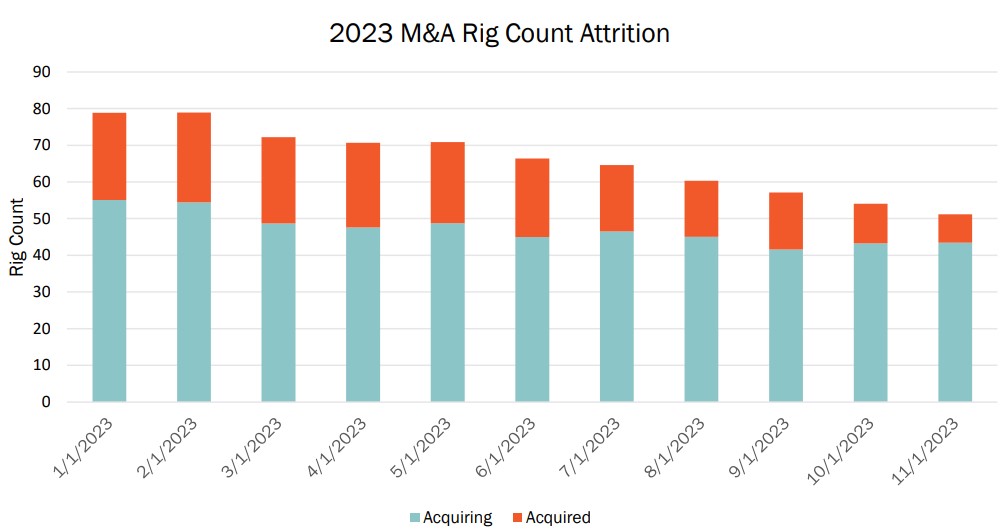

Acquired private operator rig counts were reduced by nearly 70% in 2023 due to Permian upstream consolidation, according to data compiled by East Daley Analytics.

E&P capital discipline and inventory preservation are superseding reactivity to market fundamentals, East Daley said. Despite rising commodity prices, the total Permian Basin rig count fell by 24% from January through November.

East Daley expects consolidation to continue reducing the Permian Basin rig count through 2030.

And if the trend continues at a similar rate to what was seen this year, Permian oil volume growth would be reduced by 7%.

RELATED

ProPetro CEO: Next-gen Equipment Demand High Despite Market Headwinds

Shale barons

Larger companies, such as Exxon and Chevron, have largely adopted the buy-and-cut strategy to see more opportunity to grow their shale oil production.

Consider Exxon’s acquisition of Pioneer Natural Resources: Exxon will have so much inventory and resources that it plans to grow production faster than Pioneer would have seen on a standalone basis, Bernstein said.

Exxon’s previously stated goal before acquiring Pioneer was to grow Permian oil and gas output to 1 MMboe/d by 2027. Exxon now expects its Permian production to grow to approximately 1.3 MMboe/d after closing the Pioneer deal.

By 2027, the Texas-based major aims to boost its Permian volumes up to 2 MMboe/d.

“They have enough of a long-term runway and enough of a diversified business at a corporate level where that’s something you’re really able to do,” Bernstein said.

Chevron’s $53 billion acquisition of Hess Corp. was mainly about getting into offshore Guyana—the world’s hottest oil discovery. Hess owns a 30% interest in the prolific Stabroek Block offshore Guyana; Exxon holds a 45% interest and China’s CNOOC Group owns the remaining 25%.

But Chevron is also getting deeper in shale by acquiring Hess’ sizable Bakken portfolio in North Dakota. The company’s Bakken production is expected to average 200,000 boe/d by 2025, before plateauing around that level for nearly a decade, executives have said.

RELATED

Which Occidental Assets Will Hit Chopping Block After $12B CrownRock Deal?

Recommended Reading

Ithaca Deal ‘Ticks All the Boxes,’ Eni’s CFO Says

2024-04-26 - Eni’s deal to acquire Ithaca Energy marks a “strategic move to significantly strengthen its presence” on the U.K. Continental Shelf and “ticks all of the boxes” for the Italian energy company.

Apollo to Buy, Take Private U.S. Silica in $1.85B Deal

2024-04-26 - Apollo will purchase U.S. Silica Holdings at a time when service companies are responding to rampant E&P consolidation by conducting their own M&A.

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.