Occidental Petroleum is getting longer in the Midland Basin and adding deeper Barnett drilling targets through a $12 billion acquisition of CrownRock LP.

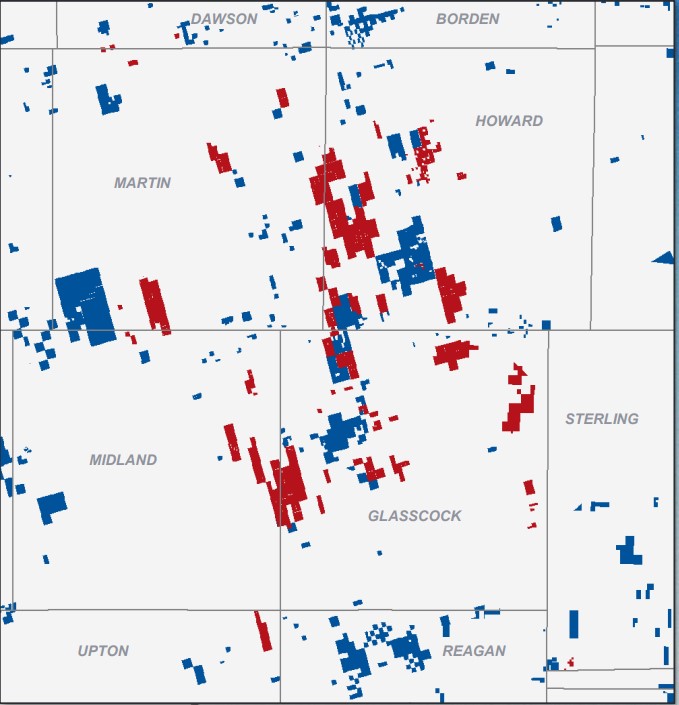

CrownRock, a joint venture between CrownQuest Operating LLC and Lime Rock Partners, holds one of the most attractive acreage positions among private E&Ps in the Permian Basin, analysts say.

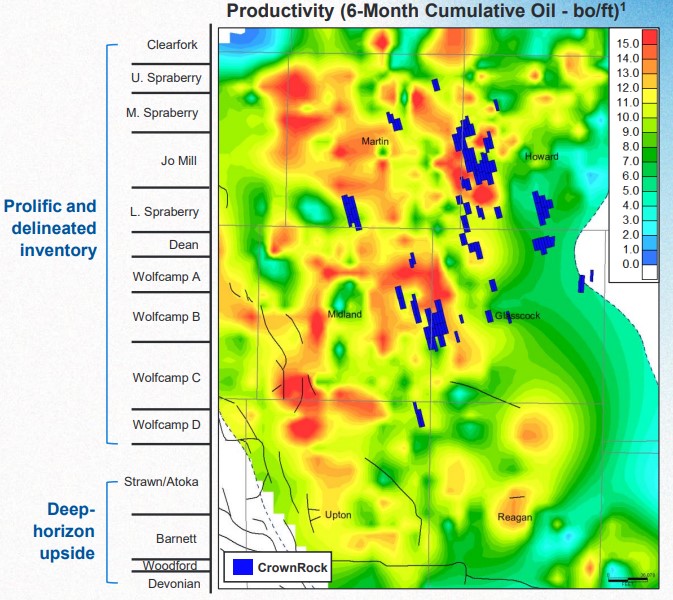

The deal includes more than 94,000 net acres of stacked pay assets and a runway of 1,700 undeveloped drilling locations across the core of the Midland Basin.

Scooping up CrownRock will also add approximately 170,000 boe/d of unconventional production in 2024, Occidental announced Dec. 11.

Occidental sees significant upside potential from CrownRock’s undeveloped acreage inventory, President and CEO Vicki Hollub said on a Dec. 11 conference call with analysts.

Around 80% of the CrownRock inventory is located within largely clean and undeveloped sections.

But Hollub said the key driver behind the transaction was the significant cash flow accretion Occidental can realize by adding CrownRock’s assets to its portfolio.

The deal is expected to generate immediate cash flow accretion, including $1 billion in the first year after closing based on a $70/bbl WTI price.

Cash flow upside from the CrownRock deal will enable Occidental to pay down at least $4.5 billion in its debt principal within 12 months of closing; the company expects to maintain its investment grade credit ratings.

The significant cash flow accretion also gives Occidental confidence to raise its quarterly dividend over 22% to $0.22/share, beginning with the February 2024 declaration.

RELATED

Occidental to Acquire Midland Basin E&P CrownRock for $12B

Midland moves

Before the CrownRock acquisition, Occidental had most of its highest quality drilling inventory in the Permian’s more western Delaware Basin.

About 80% of the company’s inventory at a sub-$40/bbl WTI breakeven price was located within the Delaware prior to the CrownRock deal, said Richard Jackson, Occidental’s president of U.S. onshore resources and carbon management operations.

“We now would have 60% Delaware Basin and 40% Midland Baisn, balancing this Tier 1 inventory,” Jackson said on the call. “Also, the Midland Basin production would move from 9% to nearly 30% of our total Permian unconventional production, based on 2023 estimated and combined totals.”

Occidental’s acquisition of CrownRock is the latest in a deluge of high-profile—and expensive—Permian Basin M&A activity this year.

In October, Exxon Mobil Corp. announced plans to acquire Pioneer Natural Resources and its premier Midland Basin position in a $60 billion acquisition. Several other smaller public E&Ps, including Civitas Resources, Vital Energy, Permian Resources and Matador Resources, have added scale in both the Midland and Delaware basins through M&A.

Scarcity of top-quality drilling inventory in the Permian, America’s hottest oil play, is driving up prices for acreage and assets across the basin.

Occidental is paying more than $50,000 per acre after discounting for the value of existing production. Andrew Dittmar, senior vice president at Enverus Intelligence Research, said the purchase price “shows valuations have fully reclaimed the highs last seen during a frenzy of buying in 2017 [through] 2019 and are inching towards records.”

Occidental was also an active M&A participant during that period when it acquired Anadarko Petroleum Corp. for $38 billion in 2019.

The price for the CrownRock acquisition nears the levels of the Anadarko deal, which valued Anadarko at nearly $60,000 per acre, Dittmar said.

RELATED

Feds Dig Deeper into Chevron-Hess Merger Amid Oil, Gas M&A

Drilling deeper

The CrownRock acquisition adds top-tier, low-breakeven drilling opportunities to the Occidental portfolio—but it also adds greater upside from target zones deeper underground.

Occidental plans to continue developing its deep horizon Barnett well performance on the CrownRock asset.

Though Occidental is still in the early days of developing Barnett opportunities, the company is “seeing really strong results” from its work so far: New Barnett well production was 34% better than the basin average, Jackson said.

The company is also evaluating opportunities in other deep zones like the Strawn, Woodford and Devonian formations.

Occidental also sees potential for EOR with CO2 injection on the CrownRock asset. The company has overseen a CO2 EOR pilot in the Midland Basin for several years.

RELATED

Exclusive: Scott Sheffield Offers Peek Behind the Permian’s M&A Curtain

Chopping block

Analysts at Truist Securities believe Occidental is able to pay more than others for CrownRock, assuming oil prices remain stable and drive material free cash flow accretion in the near term.

But proceeds generated through Occidental’s new asset divestiture program are also expected to support the purchase.

In conjunction with the CrownRock deal, Occidental announced new plans to divest between $4.5 billion and $6 billion of less competitive assets.

Hollub emphasized that all of the newly divested assets will be from the company’s domestic U.S. portfolio.

“Just because we’re divesting of something doesn’t mean that it’s not a quality asset,” Hollub said. “It just means that it doesn’t fit with our development plans and where we are, and doesn’t deliver the margins that we might need but might work for someone else.”

Occidental CFO Sunil Mathew said the company is confident it can meet its divestiture targets to support deleveraging its balance sheet.

RELATED

Recommended Reading

CERAWeek: Large Language Models Fuel Industry-wide Productivity

2024-03-21 - AI experts promote the generative advantage of using AI to handle busywork while people focus on innovations.

The Pandora's Box of AI: Regulation or Self-governance?

2024-04-04 - Experts urge policymakers to learn from the failure to rein in the internet and move quickly to regulate AI.

AI in Oil: Revolution’s Coming, but Tech Adoption Remains Tentative

2024-04-05 - CERAWeek experts say AI will disrupt oil and gas jobs while new opportunities will emerge as the industry braces for an AI-driven workflow transformation.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

Exclusive: Halliburton’s Frac Automation Roadmap

2024-03-06 - In this Hart Energy Exclusive, Halliburton’s William Ruhle describes the challenges and future of automating frac jobs.