Consolidation in the Permian Basin should continue for several years as E&Ps such as Pioneer Natural Resources search for inventory, executives Scott Sheffield and Richard Dealy told Hart Energy.

The pair fielded questions a day after Pioneer announced that Sheffield would step down as CEO at the end of the year, with Dealy sliding in to run the show. Both men will serve on the board of directors.

Producers are facing a competitive market for core Permian inventory. Large publics, including Ovintiv Inc., Matador Resources and Diamondback Energy, spent billions of dollars signing deals with private E&Ps in the Permian in the past year.

Pioneer has itself been the subject of recent rumors as both acquirer of Range Resources — which the company denied — and as a potential target for Exxon Mobil.

Sheffield was asked during an April 27 earnings call about reports that Exxon Mobil was in talks to buy Pioneer. He repeatedly refused to comment.

At the same time, smaller E&Ps in the Permian are also searching for scale. In an exclusive interview, Sheffield said sellers—including Parsley Energy, Double Point Energy and Concho Resources—thought they needed to be part of a larger company to compete in the Permian.

The trend of Permian M&A should continue as buyers look for inventory runway and sellers look for scale.

“As companies don’t have a large amount of inventory, they will have to go out and do deals to replenish inventory,” Sheffield said. “I’d say since late ’21, early ’22, that’s where the companies are focused now. And they’ll probably be focused on things like that for the next two or three years.”

RELATED

Pioneer’s Scott Sheffield to Retire

Pioneer eyes M&A opportunities

Pioneer President and COO Rich Dealy, who will succeed Sheffield as CEO effective Jan. 1, 2024, said Pioneer will continue to consider accretive M&A of its own in the Permian.

Pioneer will look at bolt-on opportunities that can add lateral length, working interest or net revenue interest to its portfolio.

“You’ve seen us do that over the last couple of years. It’s never a big number, in terms of $100 million to $200 million a year,” Dealy said. “But that work will continue to add strong value by adding lateral length.”

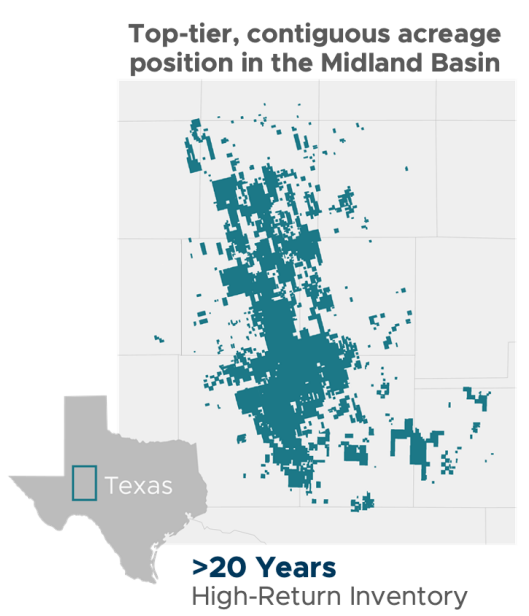

Pioneer will also evaluate larger opportunities to scoop up contiguous positions in the Midland Basin that are accretive to cash flow.

“But on bigger-sized deals, as I think we’ve talked about before, that bar is pretty high given the high rate of return that we have in the existing assets,” Dealy said.

RELATED

Pioneer Mum on Exxon Mobil Merger Speculation: ‘No Comment’

Drilling deeper for inventory depth

With more than 20 years of inventory and roughly 15,000 high-return drilling locations, Pioneer is “blessed” with the inventory it already has, Dealy said.

A premier inventory position allows Pioneer to focus on returning more capital to shareholders through dividends and share buybacks, he said.

In first-quarter earnings released on April 26, the company announced the authorization of a new $4 billion share repurchase program with plans to return at least 75% of its free cash flow to shareholders.

Pioneer is exploring its ability to add deeper wells to its portfolio in the Midland Basin. The company has set aside between $150 million and $200 million for exploration activities this year, partially related to drilling four wells in the Barnett/Woodford formation.

The four wells, planned for later this year, will be between 11,000 ft and 12,000 ft, Dealy said.

“We know they’ll be a little bit more expensive given that they’re deeper,” Dealy said. “But early indications from data we’ve gotten from others that are drilling Barnett/Woodford wells is that they’re getting higher oil cuts than maybe initially thought.”

Pioneer plans to run an average of 24 to 26 horizontal drilling rigs in the Midland Basin this year. The company is also planning a three-rig average program in the southern Midland Basin where Pioneer has a joint venture with Sinochem Petroleum USA, a subsidiary of the Chinese state-owned Sinochem Corp.

Crude oil production in 2023 is expected to come in at between 357,000 bbl/d and 372,000 bbl/d; total production is expected to be between 670,000 boe/d and 700,000 boe/d.

RELATED

Pioneer Gears Up to Test Permian’s Woodford, Barnett Zones [WATCH]

Recommended Reading

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

Acquisitive Public Minerals, Royalty Firms Shift to Organic Growth

2025-04-04 - Building diverse streams of revenue is a key part of growth strategy, executives tell Oil and Gas Investor.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

In Inventory-Scarce Permian, Could Vitol’s VTX Fetch $3B?

2025-03-28 - With recent Permian bids eclipsing $6 million per location, Vitol could be exploring a $3 billion sale of its shale business VTX Energy Partners, analysts say.

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.