Analysts expect Tellurian’s upstream assets to fetch strong competition by Haynesville E&Ps looking to get ahead of growing LNG export capacity on the U.S. Gulf Coast. (Source: Shutterstock/ Telurian)

Tellurian’s upstream gas assets are expected to fetch “strong competition” from producers looking for scale in the Haynesville Shale, experts say.

With Haynesville operators including Chesapeake Energy, BPX Energy, Aethon Energy and Comstock Energy — as well as newcomers — let the speculation begin.

On Feb. 6, Houston-based Tellurian Inc. directed its financial adviser, Lazard, to explore opportunities to sell Tellurian’s upstream natural gas assets.

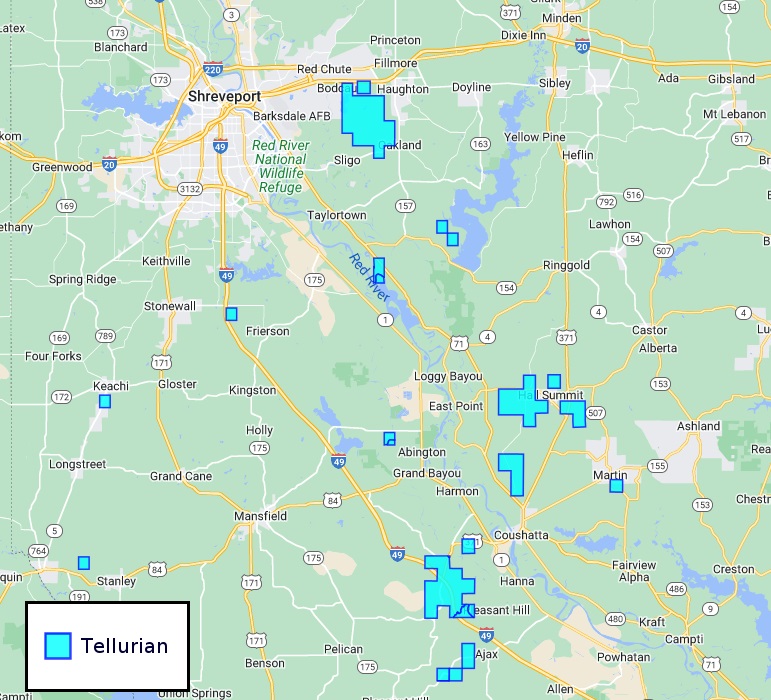

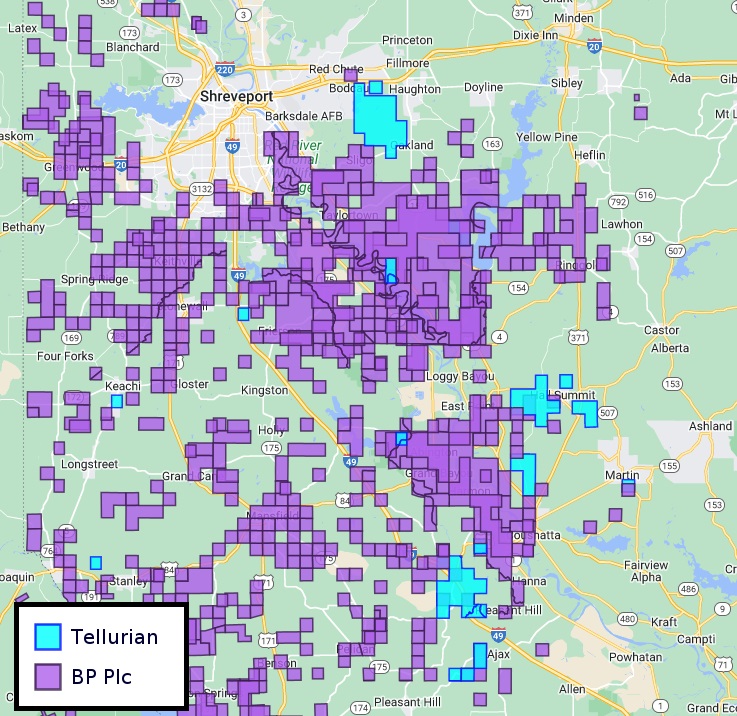

The company’s upstream arm includes 31,149 net acres, more than 400 undeveloped drilling locations and interests in 159 producing wells—primarily within Louisiana’s DeSoto, Bossier, Caddo and Webster parishes. Third-quarter gas volumes totaled 19.5 Bcf.

Tellurian, which is working to develop the Driftwood LNG export project south of Lake Charles, Louisiana, wants to direct proceeds from a potential upstream sale toward reducing debt and administrative costs.

And additional cash generated through a sale would also better position Tellurian to develop Driftwood LNG. Otherwise, the company would need to issue equity to fund development in 2024.

In a Feb. 6 press release, Tellurian CEO Octávio Simões said monetizing the company’s upstream assets “is more attractive” than issuing additional equity to finance development and working capital needs.

“We have concluded that there are alternative gas supply strategies available to us from various basins, and our ownership of upstream assets is not necessary at this stage of Tellurian’s development,” Simões said.

Tellurian started developing an upstream portfolio in 2017 by acquiring 11,629 net acres from Rockcliff Energy LLC for about $85 million.

In 2022, Tellurian bolted on Haynesville Shale gas assets from privately held EnSight Energy Partners LP for $125 million.

RELATED

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

Gas M&A reopens

A historic amount of M&A activity swept over the U.S. upstream sector last year, fueled by megadeals like Exxon Mobil’s acquisition of Pioneer Natural Resources and Chevron’s acquisition of Hess Corp.

Other large producers, including Occidental, Apache, Permian Resources and Ovintiv, have been consigning billions of dollars in cash and stock into Permian Basin acquisitions.

In the Permian, essentially all of the deal activity has focused on oil-weighted assets. But due to volatile up-and-down swings in natural gas prices, gas-weighted M&A activity was largely shut-in over the past year.

But as E&Ps try to prepare themselves for a wave of new LNG export terminals coming online on the U.S. Gulf Coast, the frozen market for upstream gas M&A has started to thaw.

“The Haynesville is really the play that’s situated to feed those LNG facilities from a resource quality perspective, infrastructure perspective and proximity to where the projects are being put in place,” said Andrew Dittmar, senior vice president of Enverus Intelligence Research. “So there’s a lot of excitement around gas.”

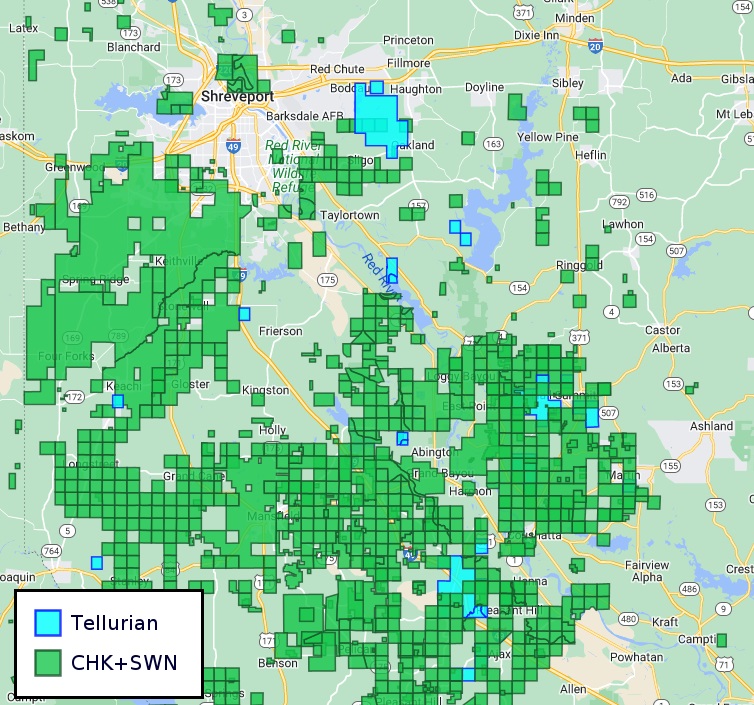

Chesapeake Energy and Southwestern Energy agreed to combine in a $7.4 billion merger, a move that would combine two of the top gas producers in Appalachia and Louisiana.

Late last year, Tokyo Gas Co. and partner Castleton Commodities inked a $2.7 billion deal to acquire Texas Haynesville player Rockcliff Energy II.

The Rockcliff deal brought 970 MMcf/d of net production and around 200,000 net acres in the East Texas gas play, said Brian Lidsky, director of Houston-based Energy Advisors Group.

“As the recent Chesapeake and Tokyo Gas deals indicate, multiple types of buyers are attracted to the Haynesville, primarily driven to get ahead of an expected additional 6.5 Bcf/d on Gulf Coast LNG capacity coming online from 2025 to 2027,” Lidsky told Hart Energy.

In view of the recent Tokyo Gas and Chesapeake transactions, Tellurian’s assets “may fetch in the range of $800 million and could go up or down depending on how gas prices progress from here,” Lidsky said.

RELATED

Aethon’s Far Western Haynesville: Three Wells, 17.5 Bcf and Still Roaring

Nosy neighbors

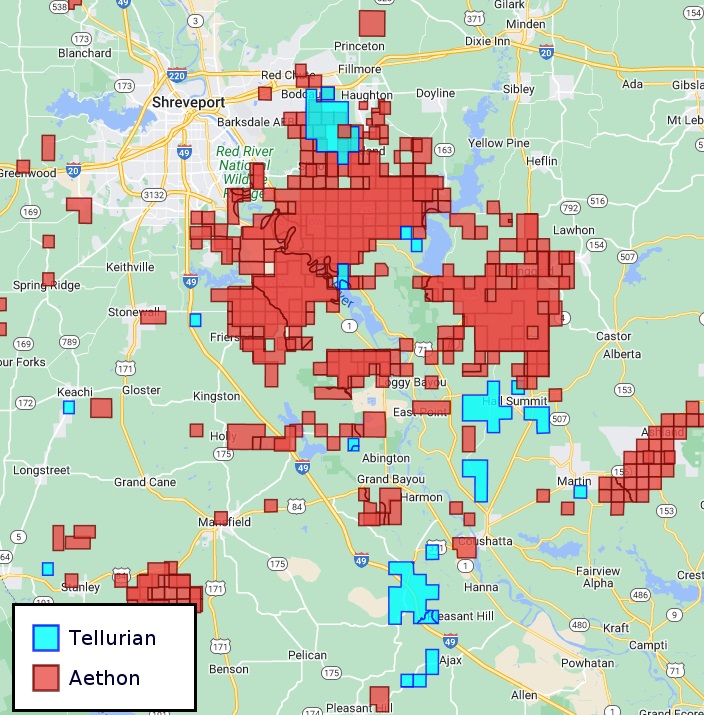

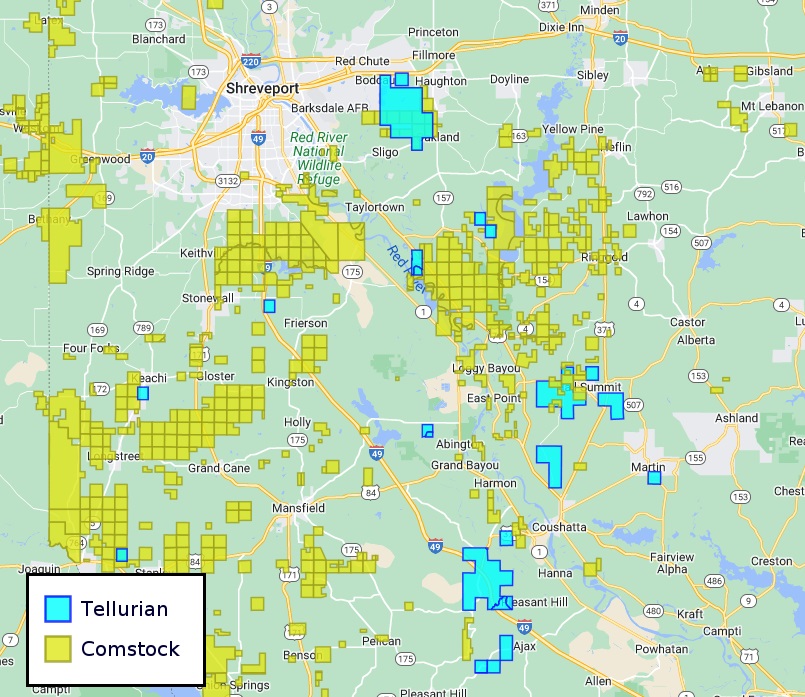

Energy Advisors Group expects to see “strong competition” for the Tellurian upstream assets from both large existing Haynesville producers—as well as recent entrants or new entrants to the basin.

The Haynesville is home to several large public and private E&Ps. On the private side, Aethon Energy is one of the top natural gas producers in the basin.

Privately held Comstock Resources, the Dallas-based operator majority owned by Cowboys owner Jerry Jones, is also a massive Haynesville player.

Chesapeake Energy and Southwestern Energy are expected to become the nation’s largest gas producer after completing a multibillion-dollar merger. With nearly 8 Bcfe/d of production on a pro forma basis, the combined company will have access to over 25 unique natural gas sales points across the Gulf Coast, Appalachia and the Northeastern U.S.

And BP Plc’s U.S. onshore arm, BPX Energy, is also an active player in the Haynesville.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.