Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project. (Source: Shutterstock.com, Tellurian)

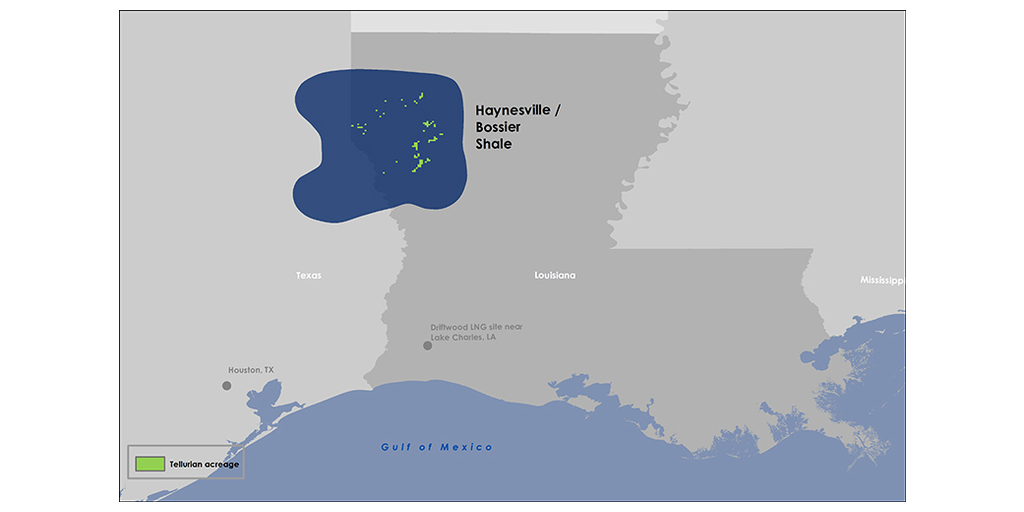

Facing financial concerns, Tellurian is exploring a sale of its upstream assets in the Haynesville Shale, the company said Feb. 6.

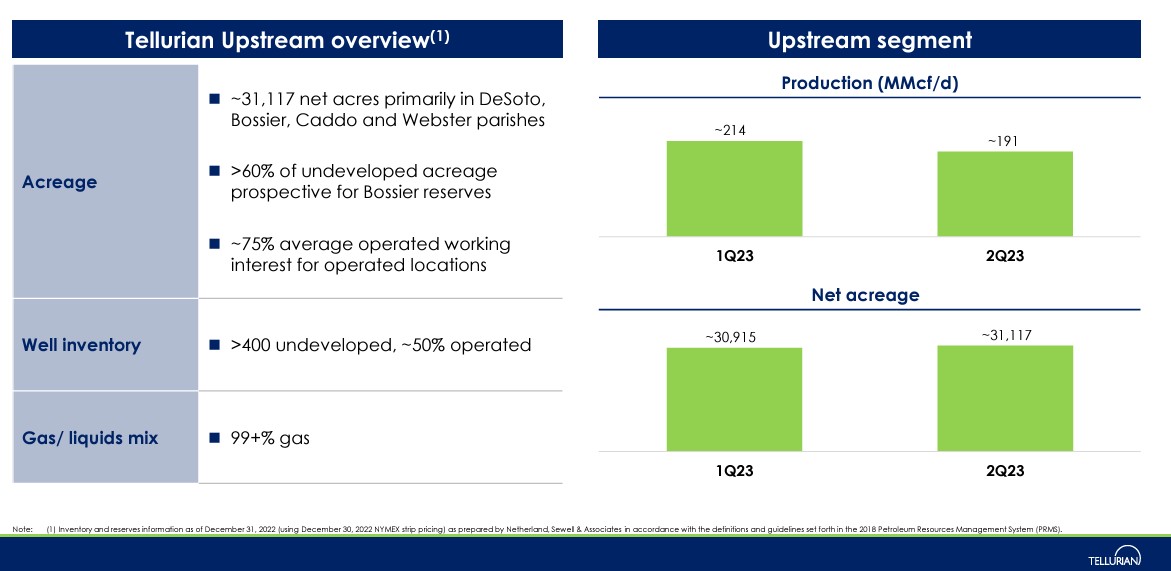

Tellurian produced 19.5 Bcf of natural gas in third-quarter 2023. Its assets, primarily in Louisiana’s DeSoto, Bossier, Caddo and Webster parishes, include 31,149 acres, interests in 159 producing wells and more than 400 drilling locations. The company said in August that it holds an average 75% working interest its operated locations.

The company plans use proceeds from any asset sale to reduce debt and expenses as well as provide extra cash on hand to continue developing the Driftwood facility. Otherwise, the company would need to issue equity to fund development in 2024.

Tellurian CEO Octávio Simões said the company, which is developing the Driftwood LNG export terminal south of Lake Charles, had decided that the upstream assets are not needed for the company’s overall strategy and directed its financial advisor, Lazard, to prepare for a sale.

“We have concluded that there are alternative gas supply strategies available to us from various basins, and our ownership of upstream assets is not necessary at this stage of Tellurian’s development,” Simões said. “We have a substantial number of drilling locations that we believe will be highly attractive to oil and gas producers that can develop them more quickly than we would.”

The move is Tellurian’s first since the company announced that the Lazard firm had been hired on Jan. 25. Tellurian downplayed rumors that the company was for sale. Tellurian has had difficulty bringing the Driftwood project, started in 2016, to completion. The project already has Department of Energy approval, meaning it does not fall under the Biden Administration’s pause for LNG projects initiated on Jan. 26.

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.