Natural gas refinery plant in Alberta, Canada. (Source: Shutterstock)

The Montney and Duvernay shale plays in Canada are drawing attention from E&Ps on both sides of the border searching for low-cost drilling inventory.

While much of the consolidation in the Lower 48 is focused on oil-producing basins, the Montney and Duvernay regions are primarily natural gas and NGL plays. Natural gas production is important for Canadian shale, but condensate production plays a key role in the economics of the play’s core.

The Lower 48 saw a historic amount of upstream deals during 2023, with the bulk of the transactions focused in the Permian Basin.

But after the deluge of E&P consolidation last year, the number of potential acquisition opportunities “has grown short” in the Permian, said Enverus Intelligence Research Senior Vice President Andrew Dittmar.

That’s forcing producers to look outside the Permian—and for some E&Ps, even outside of the U.S.

Amid this scramble for low-cost inventory, companies could increasingly turn their eyes north toward Canada.

“Canada stands out for U.S. companies as offering a large resource base in a developed and stable country,” Dittmar said. “The Montney, which offers almost twenty years of high-quality drilling inventory at current development rates, will likely get some close looks from U.S. companies concerned about the scale and quality of inventory left to buy at home.”

Wood Mackenzie has increasingly fielded questions from E&Ps about the viability of investing into Canadian shale plays, WoodMac’s Director of U.S. Upstream Research Ryan Duman said during Hart Energy’s Executive Oil Conference and Exhibition last November.

After recently buying international exposure in Guyana through its $60 billion acquisition of Hess, Chevron Corp. sees an opportunity to monetize part of its Canadian onshore footprint.

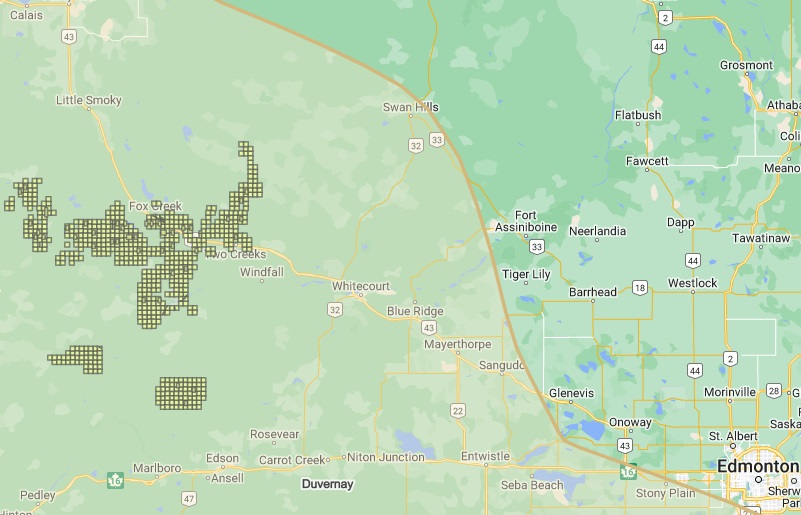

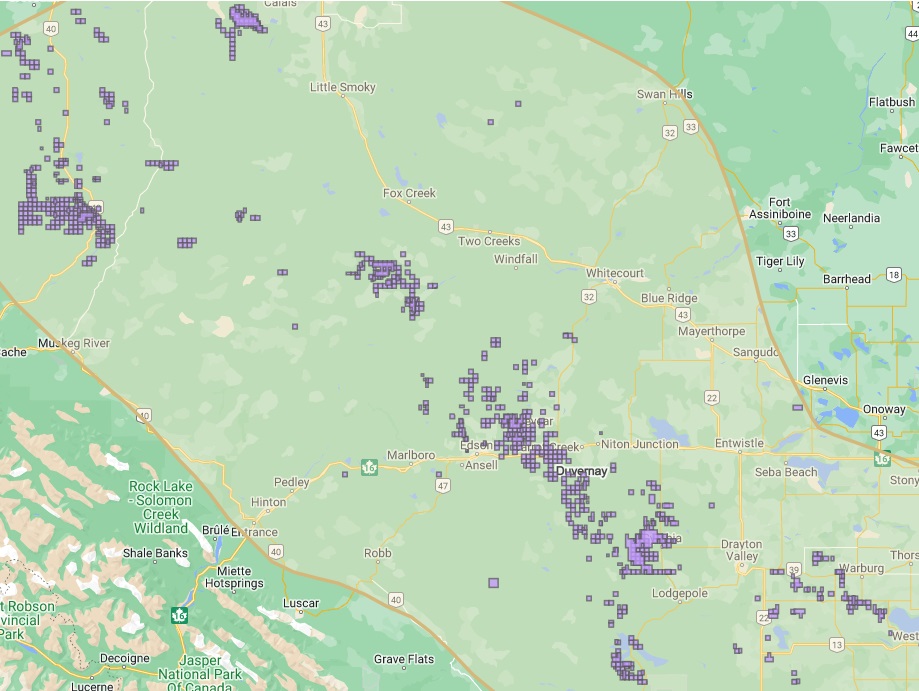

Chevron announced plans earlier this month to market the company’s entire 70% working interest in its Duvernay shale acreage—roughly 238,000 net acres, according to Houston-based Energy Advisors Group.

The remaining 30% non-operated interest is owned by KUFPEC Canada Inc., a subsidiary of the Kuwait Foreign Petroleum Exploration Co.

Chevron’s net production from the partnership was 38,500 boe/d (45% liquids) in 2022.

A total of 243 wells had been tied into production facilities on the asset as of the end of 2022, Chevron said in its most recent annual report.

“For perspective, Chevron gained 190,000 boe/d of mostly oil production in the U.S. Bakken with its $60 billion buy of Hess back in October 2023, adding a third core area in the Lower 48 alongside the Permian and the D-J Basin,” said Brian Lidsky, director at Energy Advisors Group.

Based on previous transactions in the region, Chevron’s Duvernay position could fetch a purchase price in the range of US$900 million (CA$1.21 billion), Lidsky said.

Experts think a handful of mid-sized Canadian E&Ps with existing operations in the region are most likely to end up making a deal with Chevron.

RELATED

Production from Canada’s Montney, Duvernay Gains Momentum

In the neighborhood

Calgary-based Crescent Point Energy has been an active consolidator in the region in recent years.

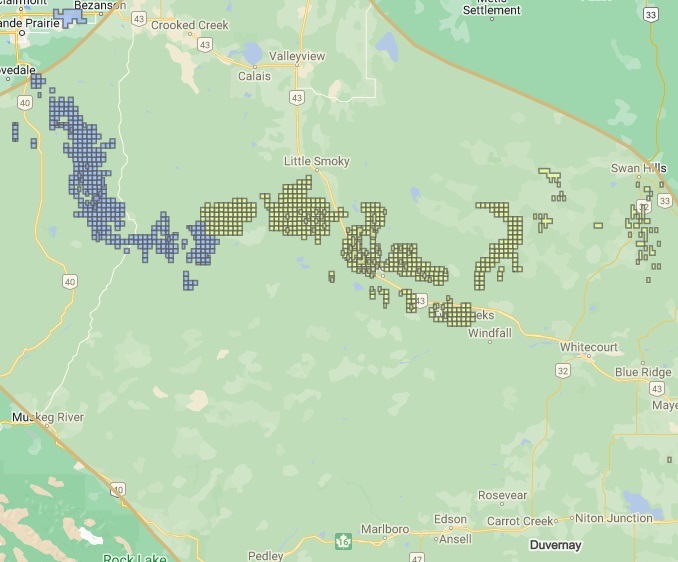

Crescent Point entered the Duvernay in February 2021 by acquiring Shell’s position for CA$707 million (US$525 million), which brought in 30,000 boe/d.

Last year, Crescent Point gained greater scale in the Duvernay through a $1.86 billion (CA$2.55 billion) acquisition of Hammerhead Energy, adding another 800 incremental drilling locations to its portfolio.

But Crescent Point is reportedly not interested in bidding for Chevron’s Duvernay assets. Hart Energy has reached out to the company for more information.

Over the past few years, Crescent Point—Canada’s seventh largest oil and gas producer—has transformed its portfolio to focus on developing consistent production growth in the Kaybob Duvernay and Montney shale plays. The company’s 2024 production forecast for the Duvernay is 50,000 boe/d, compared to when it entered the play at around 30,000 boe/d.

Paramount Resources has also been an active Duvernay buyer and is currently producing 17,000 boe/d in the Kaybob region, Lidsky said.

Paramount grew its core Montney land position with the addition of 10 net sections of new land during the third quarter, the company reported in its most recent earnings.

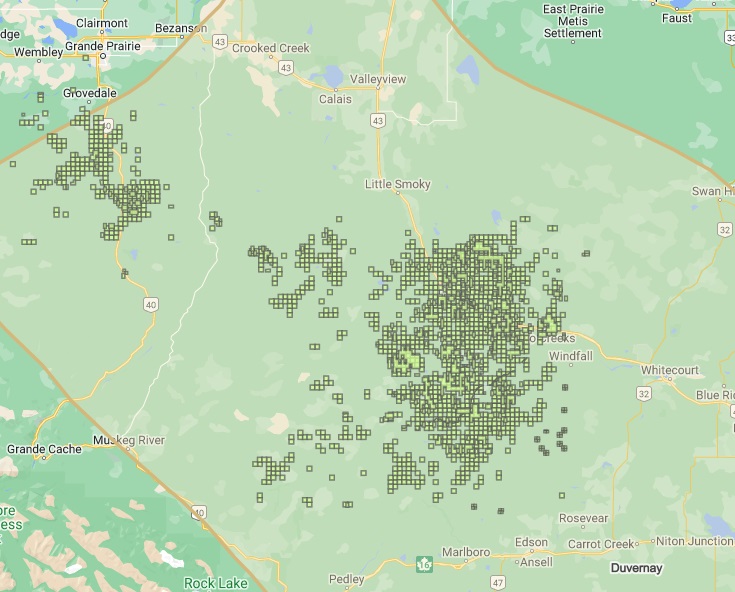

Analysts have also put forward Whitecap Resources as a potential buyer from Chevron, given the company’s nearby footprint.

During the third quarter of 2022, Whitecap bolted on 639,000 net acres and 32,000 boe/d of production in the Duvernay and Montney formations through the CA$1.9 billion (US$1.48 billion) acquisition of XTO Energy Canada.

Outside of the Duvernay play, Chevron also holds a 20% non-operated interest in the Athabasca Oil Sands Project, and the associated Quest carbon capture and storage project, in Alberta. Chevron also has working interests in Northeast British Columbia.

The company has a significant offshore presence in eastern Canada with producing assets offshore Newfoundland and Labrador.

Chevron’s full Canadian footprint produced an average of 139,000 boe/d during 2022, including 109,000 bbl/d of crude, condensate and synthetic oil volumes.

RELATED

Crescent Point Buying Alberta Montney E&P in $1.86 Billion Deal

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.