Chevron’s $53 billion acquisition of Hess Corp. will concentrate the California major even further in upstream oil and gas production—the part of its portfolio where Chevron sees the most future upside. (Source: Shutterstock.com)

Chevron Corp. sees greater upside from oil and gas production than from its refining or chemicals segments in the future.

The California-based supermajor is pursuing large-scale M&A to shore up its upstream runway for years to come. In late October, Chevron unveiled an all-stock acquisition of New York-based Hess Corp. valued at $53 billion, excluding Hess’ net debt.

The deal will materially boost Chevron’s offshore portfolio with assets offshore Guyana and in the Gulf of Mexico (GoM). Hess also comes with a large acreage position in the Bakken Shale of North Dakota—an entirely new region for Chevron—through the transaction.

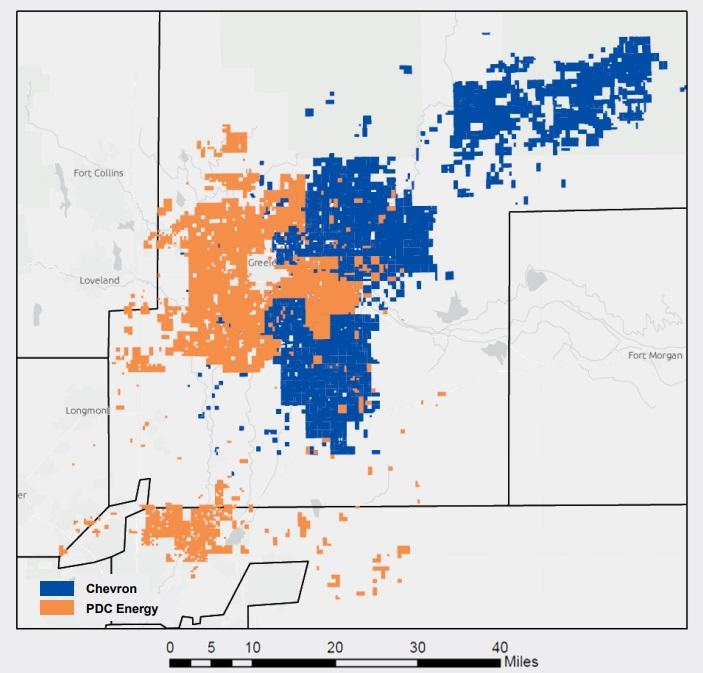

Earlier this year, Chevron purchased a large position in the Denver-Julesburg Basin (D-J Basin) through a $6.3 billion acquisition of PDC Energy. The PDC deal also delivered Chevron a bit of incremental growth in the Permian Basin, the Lower 48’s top oil-producing region.

After closing its acquisition of Hess, Chevron’s portfolio will be 85%-weighted toward upstream; the other 15% is weighted toward the company’s downstream and chemicals.

During the company’s third-quarter earnings call, Mike Wirth, Chevron’s chairman and CEO, noted that Chevron has deployed capital into its petrochemical and refining segments in recent years. But Chevron sees much more upside from upstream.

“That reflects a fundamental view. We believe that over the cycle, returns in the upstream are likely to be structurally higher than in the downstream—primarily because refineries are hard to close,” Wirth said.

Refineries get developed for reasons other than just pure economics, he said. And governments “tend to interfere” in transportation fuel markets when prices get too high, which limits the upside for refiners.

“Whereas in the upstream, you’ve got a declining resource base and you’ve got growing demand,” Wirth said.

RELATED: Exxon, Chevron Earnings Slump from Record Profits Last Year

Tales from the shale

Chevron is getting much bigger internationally through the Hess deal. But Lower 48 onshore production still makes up a large—and growing—part of its upstream portfolio.

An extensive portion of Chevron’s tight oil production growth is coming from the Permian, where the major has amassed more than 2 million net acres.

Chevron is aiming to boost its total Permian production up to 1 MMboe/d in 2025.

After reaching record-setting levels during the second quarter, Chevron’s third-quarter operated production from the Permian was essentially flat at an average 777,000 boe/d; Jeffries analysts estimated the company’s third-quarter production would be 783,000 boe/d.

Overall volumes from the Permian were down about 2% in the third quarter, driven entirely by lower production from non-operated joint ventures, Wirth said during the call.

“Primarily, a couple of the operators had delays in putting wells online due to frac hits and some other factors,” Wirth said.

Chevron’s non-op production also experienced some pipeline takeaway constraints during the quarter that resulted in unplanned downtime.

Overall, Chevron’s third-quarter oil-equivalent production was up 6% from last quarter—primarily due to two months of legacy production from PDC Energy.

Organic third-quarter capex included approximately $200 million for PDC’s legacy operations after Chevron closed the acquisition in August, CFO Pierre Breber said.

Chevron expects production from PDC’s portfolio to come in at around 265,000 boe/d during the fourth quarter. The company anticipates deploying around $300 million in fourth-quarter capex to continue developing the PDC portfolio.

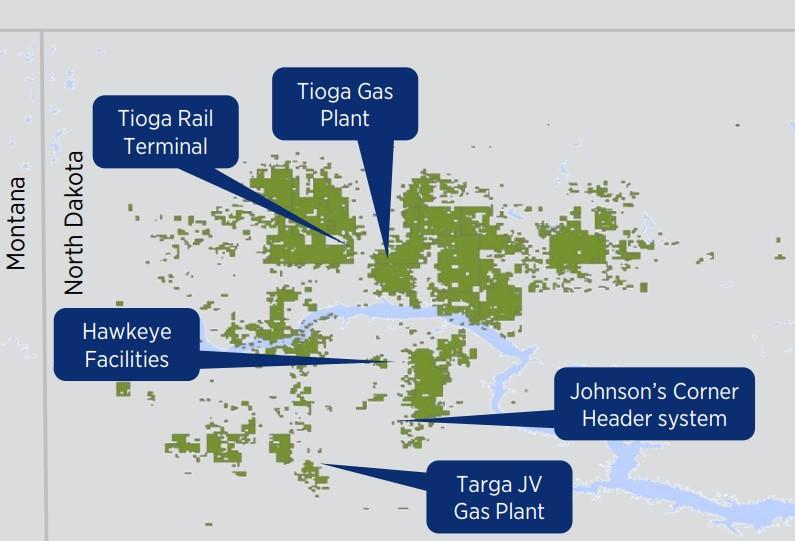

As Chevron closes the Hess acquisition, the company will enter North Dakota’s Bakken Shale in a big way.

Hess’ net combined oil, natural gas and NGL production in the Bakken was close to reaching its peak during the third quarter.

The company’s Bakken production is expected to average 200,000 boe/d by 2025, before plateauing around that level for nearly a decade, executives have said.

Bakken output averaged 190,000 boe/d in the third quarter, up 14% compared to 166,000 boe/d during the same period a year ago.

Chevron’s acquisition of Hess is expected to close during the first half of 2024.

RELATED: Which Assets Will Chevron Shop After $53B Hess Deal?

Guyana growth

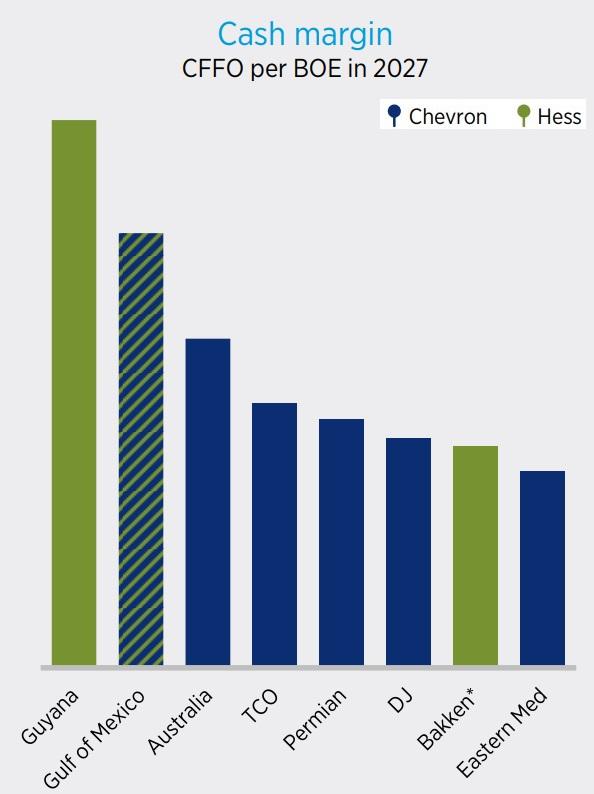

Chevron’s acquisition of Hess Corp. gives the major much greater domestic scale in the GoM and the Bakken. But Hess’ existing position offshore Guyana, the world’s hottest oil growth play, was the real crown jewel of the multibillion-dollar transaction.

Analysts have ascribed between 70% and 80% of the entire deal’s value toward Hess’ Guyana position.

Hess owns a 30% interest in the prolific Stabroek Block offshore Guyana. Exxon Mobil Corp. and its subsidiary Esso Exploration and Production Guyana Ltd. hold a 45% interest; China’s CNOOC Group owns the remaining 25%.

The Guyana asset includes over 11 Bboe of gross discovered recoverable resource. Hess’ share of the asset’s net production is approximately 110,000 bbl/d.

The asset’s first two offshore developments, the Liza Phase 1 (Destiny FPSO) and Liza Phase 2 (Unity FPSO), have average gross production of about 400,000 bbl/d.

A third offshore development, Payara, is expected to add another 220,000 bbl/d of incremental supply by early fourth-quarter 2023.

The Guyana consortium is planning to develop a total of six FPSOs in the Stabroek Block with gross production of more than 1.2 MMbbl/d by the close of 2027.

Chevron anticipates that its acquired Guyana asset will lead cash flow generation per flowing barrel across its entire portfolio.

RELATED: Chevron-Hess Deal Creates American “Dream Team” Offshore Guyana, Surprises Analysts

Recommended Reading

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Exxon Versus Chevron: The Fight for Hess’ 30% Guyana Interest

2024-03-04 - Chevron's plan to buy Hess Corp. and assume a 30% foothold in Guyana has been complicated by Exxon Mobil and CNOOC's claims that they have the right of first refusal for the interest.

Petrobras to Step Up Exploration with $7.5B in Capex, CEO Says

2024-03-26 - Petrobras CEO Jean Paul Prates said the company is considering exploration opportunities from the Equatorial margin of South America to West Africa.