D–J Basin

Earnings , Acquisitions & Divestitures , Crude Oil , Natural Gas

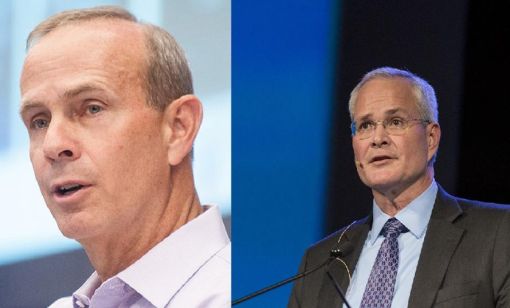

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Acquisitions & Divestitures

Sitio Royalties Dives Deeper in D-J with $150MM Acquisition

Sitio Royalties is deepening its roots in the D-J Basin with a $150 million acquisition—citing regulatory certainty over future development activity in Colorado.

Lease Sales

Marketed: Stone Hill Minerals Holdings 95 Well Package in Colorado

Stone Hill Minerals Holdings has retained EnergyNet for the sale of a D-J Basin 95 well package in Weld County, Colorado.

Acquisitions & Divestitures

Civitas, Prioritizing Permian, Jettisons Non-core Colorado Assets

After plowing nearly $7 billion into Permian Basin M&A last year, Civitas Resources is selling off non-core acreage from its legacy position in Colorado as part of a $300 million divestiture goal.

Lease Sales

Marketed: Private Seller Certain Royalty Properties in D-J Basin

A private seller retained RedOaks Energy Advisors for the sale of certain royalty properties in the D-J Basin.

Earnings , Shale Plays , Crude Oil

Exxon, Chevron Tapping Permian for Output Growth in ‘24

Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.

Investment , Private Equity , Exploration & Production

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Exploration & Production , Acquisitions & Divestitures , Shale Plays

Prairie Operating Acquires More D-J Basin Assets for $94.5MM

Houston-based Prairie Operating Co. is scaling its D-J Basin footprint with a $94.5 million acquisition of Nickel Road Operating LLC.

Shale Plays , Private Equity , Acquisitions & Divestitures

PE-backed Ellipsis Acquires Interests in Permian, Other US Basins

Ellipsis U.S. Onshore, backed by private equity firm Westlawn Group, bolted on more assets in the Permian Basin and expanded its reach into Colorado and Louisiana.

Shale Plays , Mergers , Exploration & Production

Shale Outlook: Scarce Inventory to Drive Upstream M&A in ‘24

Permian Basin well productivity has trended down. Top-tier drilling locations are scarce. Capital is at a premium. E&Ps need low-cost inventory and scale, and they’re willing to pay big bucks to get them.