Prairie expects the undeveloped drilling locations to pay out in about a year after beginning production. (Source: Shutterstock)

Prairie Operating Co. is getting deeper in Colorado with the acquisition of Nickel Road Operating LLC.

Houston-based Prairie Operating is acquiring the assets of Nickel Road Operating (NRO) for a total consideration of $94.5 million, the company announced Jan. 11.

The consideration includes $83 million in cash and $11.5 million in deferred cash payments.

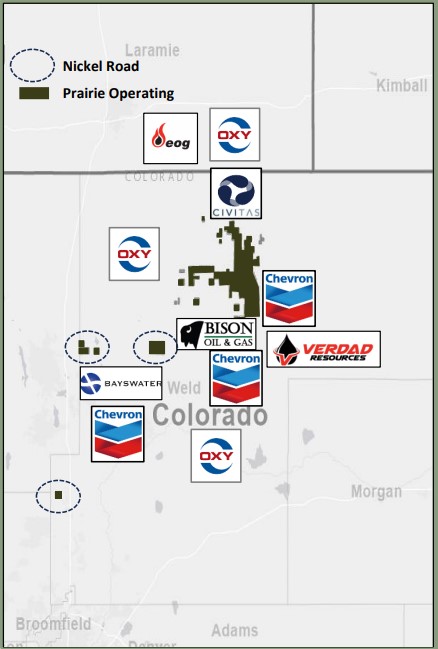

NRO’s assets are operations located near Prairie’s existing footprint in the Denver-Julesburg (D-J) Basin—largely in rural Weld County, Colorado.

The deal includes 5,500 net contiguous acres (90% HBP) and 62 permitted undeveloped drilling locations.

The liquids-weighted assets produce approximately 3,370 boe/d (84% liquids; 66% oil) from 26 operated horizontal wells.

The assets include third-party proven reserves of around 22.2 MMboe, representing a PV-10 value of $254 million.

Prairie expects the undeveloped drilling locations to pay out in about a year after beginning production. The low-cost drilling locations are also expected to breakeven below a WTI price of $30/bbl.

“This acquisition increases and strengthens our overall position within a top-tier U.S. shale basin and aligns with our strategy of creating value through accretive acquisitions,” said Prairie Operating Chairman and CEO Ed Kovalik.

The acquisition is expected to close in the first half of 2024.

After closing, Prairie will have around 45,000 acres in Weld County, offset by high-profile operators like Chevron Corp., EOG, Occidental Petroleum and Civitas Resources, the company said in investor materials.

“Today’s target rich environment gives us ample opportunity to continue executing our acquisition strategy,” said Prairie’s President Gary Hanna. “These assets strategically enhance our existing operations, enabling us to capitalize on operational efficiencies in the D-J Basin.”

Hanna, a veteran of the oil and gas industry, has served as president and a board director at Prairie since May 2023, regulatory filings show. Hanna was previously chairman and interim CEO of Delaware Basin E&P Rosehill Resources.

Prairie Operating was formed last year between the merger of Creek Road Miners Inc., a publicly traded company using stranded gas assets to power cryptocurrency mining operations, and Prairie, a vehicle to acquire and develop oil and gas assets.

In conjunction with the merger, Prairie acquired undeveloped leasehold acreage in Weld County from Exok Inc. Prairie later exercised an option to acquire additional D-J Basin acreage from Exok.

After closing the Exok transactions, Prairie controlled approximately 37,189 acres in Weld County.

In December, Prairie received approval to list its common stock on the Nasdaq Capital Market exchange.

RELATED

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.