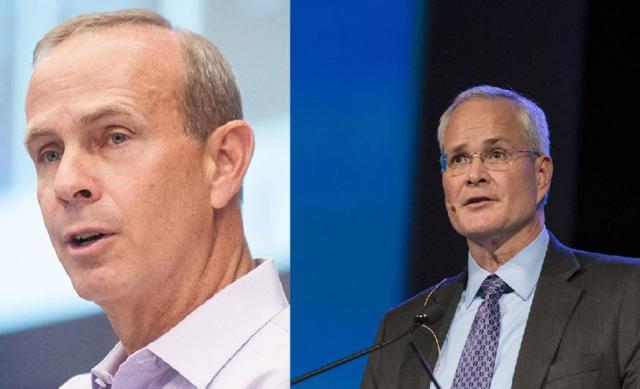

Chevron CEO Mike Wirth, left, and Exxon Mobil CEO Darren Woods (Source: Hart Energy, CERAWeek)

Earnings for Exxon Mobil and Chevron fell drastically in the third quarter after the U.S. oil giants raked in record profits during the same period a year ago.

Exxon Mobil Corp. brought in third-quarter earnings of $9.1 billion, or $2.25 per share, the Spring, Texas-based major reported before markets opened on Oct. 27.

That’s down over 50% from the same quarter a year ago, when Exxon raked in record earnings of $19.7 billion, or $4.68 per share.

Chevron Corp. reported third-quarter earnings of $6.5 billion, or $3.48 per share, the morning of Oct. 27.

The California-based major’s earnings fell nearly 40% compared to last year, when Chevron brought in earnings of $11.2 billion, or $5.78 per share, during the same period.

Analysts had anticipated the sharp drops in earnings for both oil companies—Exxon was expected to deliver quarterly earnings of between $2.10 and $2.34 per share, according to Yahoo Finance data; Chevron was expected to bring in between $2.58 and $3.74 per share.

Both companies cited a collapse in oil and gas prices for the lower earnings. Average Brent crude spot prices fell around 14% from $100.53/bbl during third-quarter 2022 to $86.64/bbl during third-quarter 2023, according to Energy Information Administration data.

Natural gas prices have seen even greater volatility: Average Henry Hub spot prices fell over 67% year-over-year from $8.30/Mcf to $2.69/Mcf last quarter, per EIA figures.

Exxon’s earnings dropped by $5.7 billion compared to the same quarter last year, on an adjusted basis, due to a nearly 60% decrease in natural gas realizations and a 14% decrease in crude realizations.

Chevron also cited lower upstream realizations and lower refined product margins as headwinds to profitability during the third quarter.

However, recent increases in commodity prices provided upsides for both companies’ E&P operations.

Rising oil prices contributed as much as $1.3 billion to Exxon’s third-quarter earnings compared to the second-quarter, the company disclosed in a Securities & Exchange Commission filing earlier this month.

Upside in natural gas prices added as much as $600 million to Exxon’s current earnings versus the second quarter.

A confluence of geopolitical and macroeconomic factors has lifted oil prices in recent months, including the Israel-Hamas war, market concerns over broader Middle Eastern instability and production cuts by Saudi Arabia and the OPEC cartel.

RELATED

Exxon Mobil, Chevron Profits Slump, but Permian Itch Persists

M&A mayhem

October has been a big month for large-scale M&A in the oil and gas industry, with Exxon and Chevron each inking some of their largest acquisitions ever.

Exxon is paying nearly $60 billion in stock to acquire Pioneer Natural Resources, which is expected to deliver Exxon more than a decade of top-tier drilling runway in the heart of the Permian Basin.

The massive merger combines Pioneer’s over 850,000 net acres in the Midland Basin with Exxon's 570,000 net acres in the Delaware and Midland. Combined, the companies will have an estimated 16 Bboe resource in the Permian, the nation’s top driver of oil production growth.

Chevron agreed to acquire Hess Corp. in a $53 billion all-stock transaction, drilling deeper offshore and in the emerging hotspot of Guyana.

Both transactions rank among the largest oil and gas deals ever signed. Exxon’s Pioneer acquisition is the fourth-largest energy-focused deal globally in the past 50 years, according to data from S&P Global; the Chevron-Hess transaction is the seventh-largest.

RELATED

Chevron Buys Hess for $53B as Historic M&A Bonanza Continues

Recommended Reading

How Chevron’s Anchor Took on the ‘Elephant’ in the GoM’s Deepwater

2024-08-22 - First oil at Chevron's deepwater Anchor project is a major technological milestone in a wider industry effort to tap giant, ultra-high-pressure, high-temperature reservoirs in the Gulf of Mexico.

E&P Highlights: Aug. 26, 2024

2024-08-26 - Here’s a roundup of the latest E&P headlines, with Ovintiv considering selling its Uinta assets and drilling operations beginning at the Anchois project offshore Morocco.

E&P Highlights: Sept. 23, 2024

2024-09-23 - Here's a roundup of the latest E&P headlines, including Turkey receiving its first floating LNG platform and a partnership between SLB and Aramco.

Seadrill to Adopt Oil States’ Offshore MPD Technology

2024-09-17 - As part of their collaboration, Seadrill will be adopting Oil States International’s managed pressure drilling integrated riser joints in its offshore drilling operations.

E&P Highlights: Sept. 16, 2024

2024-09-16 - Here’s a roundup of the latest E&P headlines, with an update on Hurricane Francine and a major contract between Saipem and QatarEnergy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.