Hess-Bakken Operations. (Source: Hess Corp.)

Chevron Corp. agreed to purchase Hess Corp. in a $53 billion deal, the latest massive deal inked in a bona fide oil and gas M&A bonanza.

The announcement comes less than two weeks after U.S. supermajor Exxon Mobil Corp. unveiled a nearly $60 billion acquisition of Permian Basin giant Pioneer Natural Resources.

Both transactions rank among the largest oil and gas deals ever signed. Exxon’s Pioneer acquisition is the fourth-largest energy-focused deal signed globally in the past 50 years, according to S&P Global data; the Chevron-Hess deal is the seventh-largest.

San Ramon, California-based Chevron’s acquisition of New York-based Hess will expand the supermajor’s portfolio both domestically and internationally.

The all-stock deal between Chevron and Hess is valued at $53 billion, or $171 per share. Under the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The total enterprise value of the deal, including Hess’ net debt, is $60 billion.

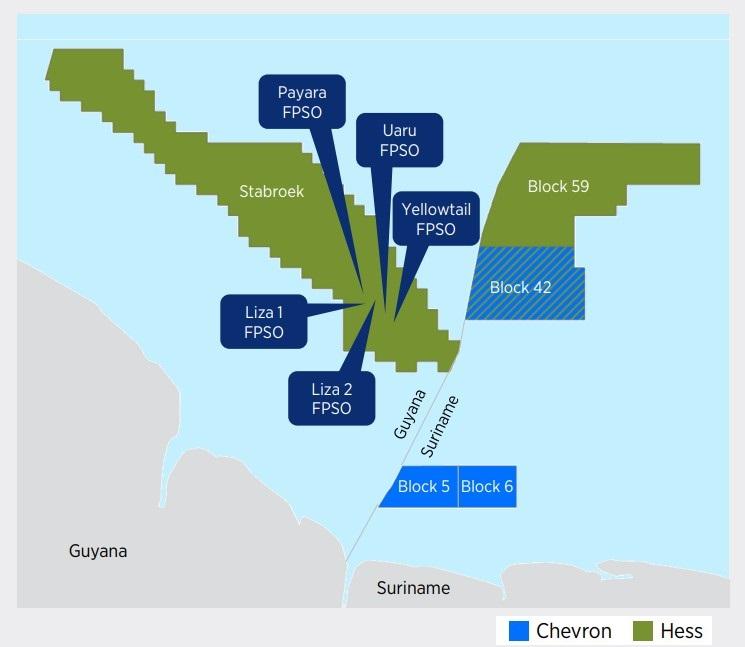

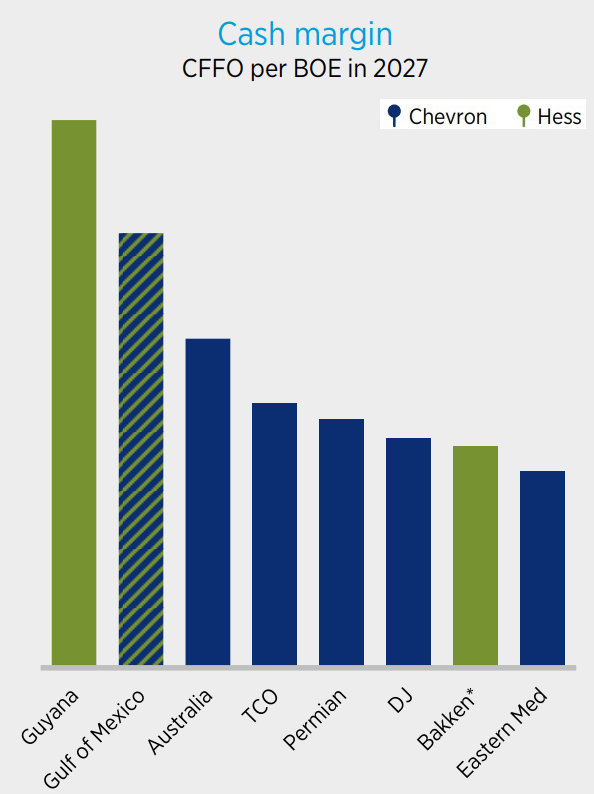

Hess’ 30% ownership interest in the Stabroek block offshore Guyana “is the crown jewel of the transaction,” said Rob Thummel, senior portfolio manager at Tortoise.

The Guyana asset includes more than 11 Bboe of gross discovered recoverable resource. Hess’ share of the Guyana asset’s net production is approximately 110,000 bbl/d, Chevron Chairman and CEO Mike Wirth said in prepared remarks on Oct. 23.

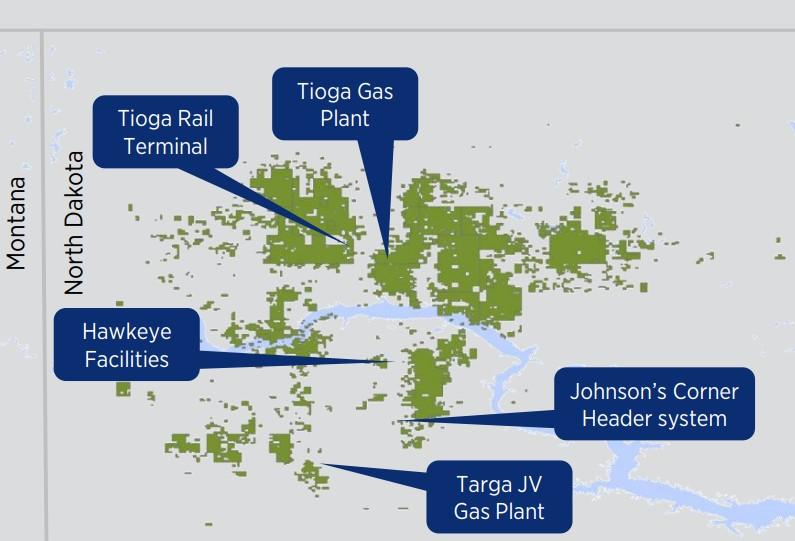

The deal also gives Chevron exposure to the Bakken Shale in North Dakota, where Hess is a leading oil and gas producer.

The deal terms imply a 10% premium to the 20-day average closing price of Hess’ stock and a 5% premium versus the close seen on Oct. 20—which some could argue seems relatively low, analysts at Truist Securities said.

Chevron anticipates realizing around $1 billion in pretax synergies within a year of closing the Hess acquisition.

The company expects the transaction to become accretive to cash flow per share in 2025, after achieving the synergy cost savings and starting up a fourth FPSO vessel project in Guyana.

RELATED

Analysts: Exxon-Pioneer Deal Could Usher in Shale M&A Flurry

Shale scale

E&Ps big and small have been jockeying for scale and working to deepen their inventories of low-cost drilling locations.

The clearest example of this trend is Exxon Mobil’s behemoth acquisition of Pioneer Natural Resources in an all-stock deal valued at nearly $60 billion, excluding Pioneer’s net debt.

Chevron scooping up Hess is another energy megadeal of a similar caliber to the Exxon-Pioneer deal.

Devon Energy Corp. has reportedly held preliminary conversations with Marathon Oil Corp. about a potential combination.

Rumors are also swirling that leading natural gas producers Chesapeake Energy and Southwestern Energy could combine in a transaction valued at around $11 billion, including debt.

“The common thread connecting these deals is majors looking to refill their pipelines to maintain production against a declining asset base as they anticipate their legacy businesses staying profitable into the 2030s,” said Andrew Dittmar, senior vice president at Enverus Intelligence Research.

Exxon and Chevron shared reasons for making their huge acquisitions, but the underlying asset bases they’re picking up are quite different, Dittmar said.

Exxon’s deal was focused entirely on deepening its inventory of low-cost unconventional drilling in the core of the Permian Basin.

Exxon expects to boost its oil and gas output from the Permian up to 2 MMboe/d (75% liquids) by 2027 after closing the Pioneer acquisition.

Chevron’s acquisition of Hess will also deliver greater scale in shale: Hess is one of the leading producers in the Bakken Shale, located within the Williston Basin of North Dakota and Montana.

Hess’ Bakken position includes production of around 180,000 boe/d (80% liquids) and a “significant core inventory” of future drilling locations, according to investor materials.

Hess’ Bakken footprint will complement Chevron’s unconventional portfolio in the Permian and the Denver-Julesburg Basin (D-J Basin) in Colorado.

Chevron scooped up 275,000 incremental acres in the D-J Basin through its $6.3 billion acquisition of PDC Energy earlier this year.

Chevron also has a large position in the Permian Basin—America’s top oil-producing region—where the company reached record oil and gas production of 772,000 boe/d during the second quarter.

But overall, Chevron’s acquisition of Hess is less about shale and more about international upside from the Guyana asset. Enverus estimates around 80% of the deal’s total value as being allocated toward Guyana.

RELATED

Exxon Mobil, Chevron Profits Slump, but Permian Itch Persists

Consolidation station

The energy sector has been caught up in a wave of M&A activity in recent months, including two of the largest upstream transactions of all time.

Experts, by and large, expect the historic wave of consolidation to continue for several reasons.

There are numerous E&Ps with a relatively limited amount of top-quality, Tier-1 drilling inventory, analysts at Truist Securities say. There are also numerous small- to mid-sized E&Ps, both publicly traded and privately held, that lack sufficient scale to compete with the majors and large independents.

And as other operators watch industry leaders like Exxon and Chevron deploy tens of billions of dollars into M&A, fear of missing out—or FOMO—could fuel other massive deals in the energy sector.

Truist believes several public E&Ps could be acquisition targets in this FOMO-fueled M&A environment, including Permian Resources, Chord Energy, Magnolia Oil & Gas, Callon Petroleum, Gulfport Energy and Southwestern Energy.

Recommended Reading

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

2024-04-26 - Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

SilverBow Rejects Kimmeridge’s Latest Offer, ‘Sets the Record Straight’

2024-03-28 - In a letter to SilverBow shareholders, the E&P said Kimmeridge’s offer “substantially undervalues SilverBow” and that Kimmeridge’s own South Texas gas asset values are “overstated.”

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.