Chevron Corp. is entering the Bakken Shale in a big way through its $53 billion acquisition of Hess Corp.

The California-based supermajor’s acquisition of New York-based Hess is mostly about Chevron picking up greater international scale in Guyana, the world’s hottest oil growth play.

Analysts have ascribed somewhere between 70% to 80% of the $53 billion all-stock transaction’s value toward Hess’ premier Guyana asset.

But scooping up Hess’ Bakken portfolio adds another leading U.S. shale position to Chevron’s positions in the Permian and Denver-Julesburg (D-J) basins.

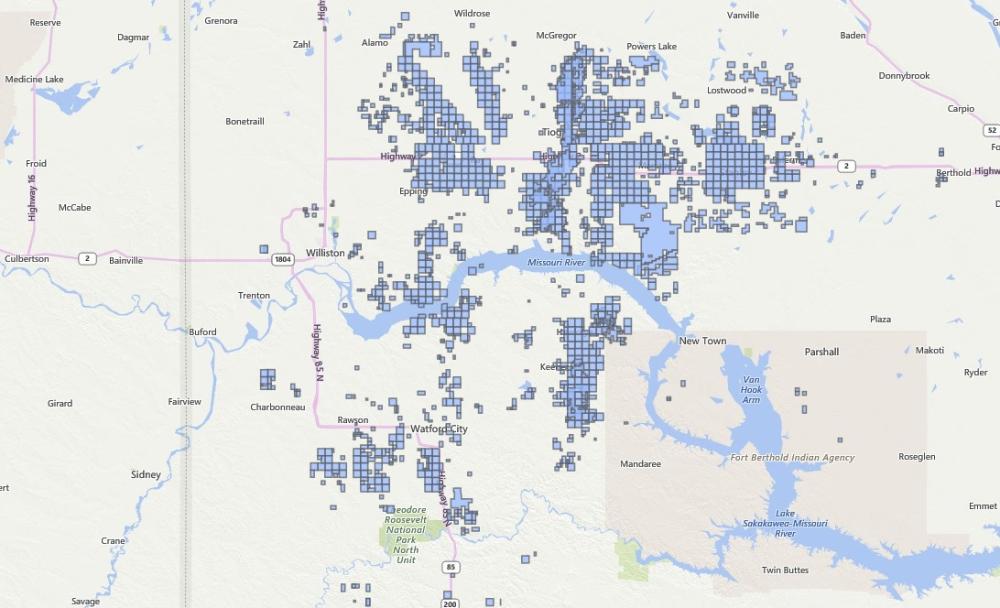

Hess’ position in the Bakken includes approximately 465,000 net acres and production of about 180,000 boe/d (80% liquids).

Adding the Bakken will deliver “a mature large-scale, cash-generating operation” to Chevron’s portfolio in the Lower 48, according to David Clark, vice president of corporate research at Wood Mackenzie.

Mike Wirth, chairman and CEO at Chevron, compared entering the Bakken to the company’s entrance to the D-J Basin through its $5 billion acquisition of Noble Energy in 2020.

Chevron dug itself even deeper roots in the D-J with its $6.3 billion acquisition of PDC Energy earlier this year.

“As we added the D-J Basin to our portfolio, we were pleasantly surprised,” Wirth said on an Oct. 23 conference call with analysts.

“It turned out that both the people that joined us from Noble and from PDC were doing a better job that we might have imagined in terms of developing that resource,” he said.

Wirth is anticipating similar upside in the Bakken after integrating and leveraging Hess’ expertise from operating in North Dakota.

Based on the company’s due diligence, Chevron sees at least 15 years of drilling inventory from Hess’ Bakken acreage at a four-rig cadence, Wirth said.

“This is a very attractive asset that can deliver plateaued production and strong cash flow for many, many years to come,” Wirth said.

RELATED: Chevron Buys Hess for $53B as Historic M&A Bonanza Continues

Applying Permian learnings

Chevron’s acquisition of Hess will add 400,000 boe/d in net production in 2024, according to figures from Rystad Energy.

Nearly half of that incremental production will come from Hess’ tight oil operations in the Bakken. Thirty-three percent will come from deepwater assets in Guyana and the Gulf of Mexico and 18% will come from Hess’ position in Southeast Asia.

Output from U.S. shale, particularly from Chevron’s Permian footprint, makes up a considerable part of the company’s global production mix.

Chevron produced an average 3 MMboe/d across its entire portfolio during the second quarter. More than a quarter—772,000 boe/d—came from the Permian, where Chevron has consolidated more than 2 million net acres.

The company remains on track to boost Permian output up to 1 MMboe/d in 2025, Wirth reiterated on the call.

Chevron’s goal with its D-J and Bakken assets is to keep production relatively flat and generate free cash flow for years to come.

The company is developing a suite of technologies intended to improve resource recovery from shale, many of which are being piloted in the field in Chevron’s Permian operations.

“As those [technologies] mature and improve up, we would apply those across our entire portfolio, including the Bakken,” Wirth said.

RELATED: Full Throttle: Chevron Hits Record Permian Production in 2Q

On the chopping block?

After closing on the Hess acquisition, Chevron expects to increase its asset divestiture target to generate $10 billion to $15 billion in pre-tax proceeds through 2028.

Analysts wonder whether there are parts of Hess’ asset portfolio that could hit the market once the company combines with Chevron.

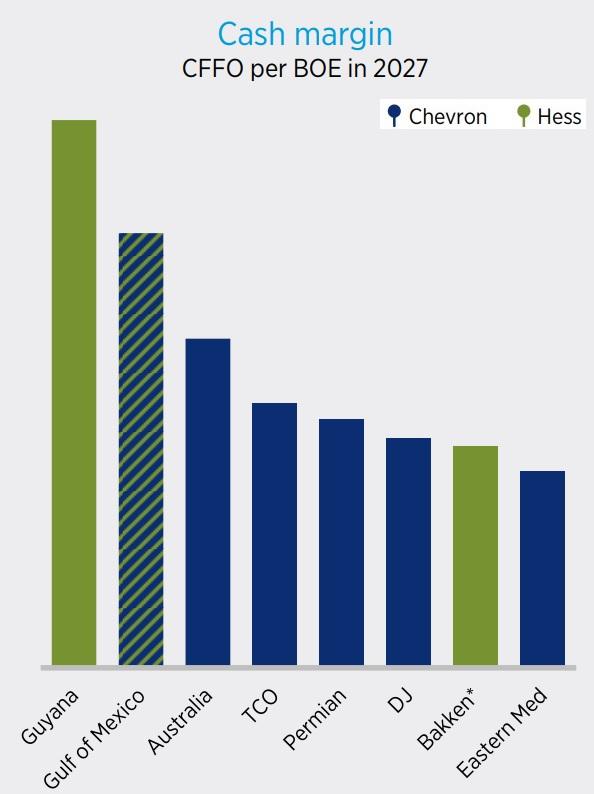

Compared to the Permian or the D-J, the Bakken is a mature shale oil play that’s already been heavily developed. Chevron expects the Bakken to generate less cash flow per oil-equivalent barrel than its other U.S. shale assets.

It’s also a completely new basin for Chevron, so there aren’t that many existing operational synergies that the supermajor can leverage in the region.

But Fernando Valle, senior oil and gas equity analyst at Bloomberg Intelligence, has a gut feeling that Chevron will end up staying in the Bakken.

“What they could do is sell Hess Midstream,” Valle told Hart Energy. “[Chevron] typically hasn’t been keen to keep midstream operations, so that is something that could make up those $10 to $15 billion in asset sales by 2028.”

Hess Midstream LP operates crude oil, natural gas and NGL pipelines as well as associated produced water infrastructure across North Dakota in McKenzie, Williams and Mountrail counties, according to regulatory filings.

As of the end of 2022, Hess Corp. had approximately 41% consolidated ownership interest in Hess Midstream, regulatory filings show.

In the future, Chevron might also monetize Hess’ natural gas assets offshore Malaysia and Thailand.

“We’ve also discussed Southeast Asia being a possible sale from the Hess portfolio that doesn’t match as well with the rest of Chevron’s portfolio,” Valle said.

RELATED: Chevron-Hess Deal Creates American ‘Dream Team’ Offshore Guyana, Surprises Analysts

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Buffett: ‘No Interest’ in Occidental Takeover, Praises 'Hallelujah!' Shale

2024-02-27 - Berkshire Hathaway’s Warren Buffett added that the U.S. electric power situation is “ominous.”