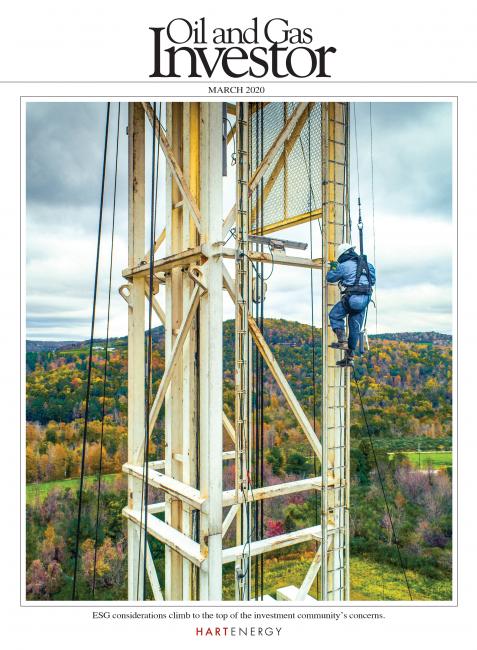

Oil and Gas Investor Magazine - March 2020

Magazine

Ships in 1-2 business days

Download

Getting your arms around environmental, social and governance (ESG) issues can be quite some task, writes Oil and Gas Investor's Senior Financial Analyst Chris Sheehan. As one observer noted, current criteria used to evaluate ESG issues are “highly diverse on a massively complex subject.”

ESG issues have never before claimed such importance. Public companies, no matter in what sector they may operate, “ignore this at their peril,” according to Pavel Molchanov, an energy research analyst at Raymond James & Associates Inc.

On the environmental issue alone, the divide is wide—very wide—in terms of opinions. As one industry magnate summed up, there are two sets of people: one that denies climate change is occurring and another that “thinks it will be easy to solve.”

Also in this issue:

- Permian crude oil mover Oryx Midstream Services accepted a $3.6 billion takeover bid last year and is now recapitalized to go so much further. What that might look like is left to the imagination of its founding team.

- E&Ps, some for the first time in years, are returning to what’s always been considered the hinge point for the Powder River Basin: the Niobrara Formation.

- Say goodbye to growth investors; value investors have risen as the industry’s best opportunity. But to woo this market effectively, energy companies must make some critical changes. And fast.

Cover Story

ESG And Energy

Some say broader environmental, social and governance measures are a must in support of a global decarbonization campaign.

Feature

Attracting Value Investors

Say goodbye to growth investors; value investors have risen as the industry’s best opportunity. But to woo this market effectively, energy companies must make some critical changes. And fast.

Completion Technology: The Art Of Diversion

From increasing unconventional oil and gas reservoir access to fortifying well defenses, the time of diverters has arrived.

Executive Q&A: A New Dawn For Oryx Midstream

Permian crude oil mover Oryx Midstream Services accepted a $3.6 billion takeover bid last year and is now recapitalized to go so much further. What that might look like is left to the imagination of its founding team.

Lario’s Legacy

A rich history of refining and E&P, with a noteworthy patriotic role as well, guides the fourth generation to run this family-owned E&P.

Powder River Basin: In the Zone

E&Ps, some for the first time in years, are returning to what’s always been considered the hinge point for the Powder River Basin: the Niobrara Formation.

Spend Less, Smile More: Midstream Stocks To Watch

These four midstream companies have captured analysts’ favor by heeding investor demands to generate free cash flow.

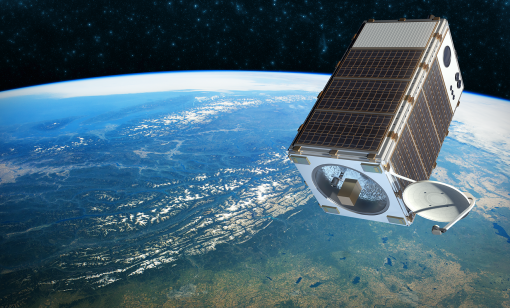

Views From Above: Methane-detecting Satellite Mission

The Environmental Defense Fund has teamed up with industry experts and scholars to launch a methane-detecting satellite within two years, aiming to cut 45% of emissions from oil and gas facilities by 2025.

A&D Trends

A&D Trends: Cash Incinerator

Just a couple of months into the year, M&A for the upstream oil and gas sector already looks to be in for a rough 2016. You remember 2016.

At Closing

OGI at Closing: LNG Force Majeure

Gas prices have created the “perfect storm” thanks to a warm winter and the surprise hit of the coronavirus.

E&P Momentum

E&P Momentum: Frac Hit Vexation

A review of frac hits on legacy well production produces unexpected results in the southern Midland Basin.

From the Editor-in-Chief

From OGI Editor-In-Chief: Break It Down, Build It Back Right

After essentially five years of an ongoing downturn, the oil and gas industry is desperately seeking solace.

New Financings

New Financings: High-yield Hopes Quashed For Oil And Gas

The debt market door remains open for higher-rated issuers, but it slammed shut for lower-rated names, as WTI prices fell after ending 2019 north of $60/bbl.

On the Money

On The Money: ESG E&P Objectives And Ironies

Environmental, social and governance are the next indispensable objectives for E&Ps that are already striving to be self-funding, dividend-paying, balance sheet-improving companies.