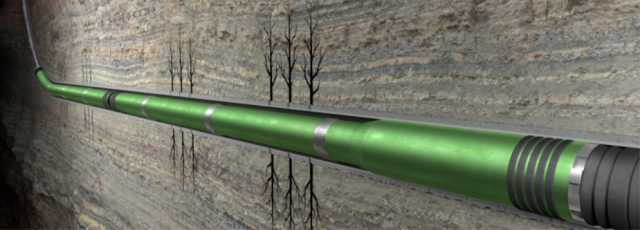

Enventure’s Eseal RF liners are designed to extend the life of a well and enhance production in poor performing wells. (Photo Courtesy of Enventure)

[Editor's note: A version of this story appears in the March 2020 edition of Oil and Gas Investor. Subscribe to the magazine here.]

The heterogeneous nature of the subsurface across U.S. unconventional oil and gas plays requires operators to engineer well completion schemes that can vary wildly from location to location, even in the same geographical region.

The cocktails are catered to allow maximum reservoir stimulation without jeopardizing the integrity of the well itself. The hydraulic fracturing process is designed to separate and free hydrocarbons from shale rock allowing them to flow freely to the surface, but it is a process that must be managed efficiently and economically to reap the greatest reward.

No two fractures are alike. Some penetrations into the reservoir can move great distances from the wellbore, while others may not migrate as far due again to the overall formation makeup.

In order to achieve a more uniform completion, operators can employ different equipment and techniques to ensure each fracture point, or well perforation, touches as much of the reservoir as possible. One of these techniques is the use of diverters.

Diverters are becoming more and more popular with operators looking to increase fracture complexity as well as defending existing fissures from detrimental frac hits.

According to Halliburton Co. Permian Basin technical manager Faraaz Adil, diverter market penetration is up around 60% to 70% with usage continuing to evolve to benefit connectivity.

“There has been a lot of development on different types of diverters available in the market now,” he told attendees at the Hart Energy DUG Permian conference in 2019. “It is critical on how you apply it. You need to understand how it is going to benefit you versus just designing it and pumping it down.”

Indeed, the “pump and pray” mantra of days past is starting to give way to a much more focused approach to the application of diverters.

Diverters come in various shapes, sizes and forms, but most can be separated into two main categories—mechanical or chemical—and are utilized to redirect (or divert) fluid from one part of the well completion to another. Each have their champions. Supermajor Royal Dutch Shell Plc, for example, prefers mechanical diverters. Both types temporarily block targeted sections of the well in order to get treatment to other areas. Think of a diverter as a sort of a downhole traffic cop, directing fluid where it is most needed to achieve the best reservoir coverage for the well, and it can be stationed for near-field, mid-stage or far-field duties.

A near-field mechanical system would be something like Enventure’s ESeal ReFrac (RF) liner, an intra-well system used to isolate perforations and allow the operator greater customization over any planned refrac options.

A far-field chemical-based diverter is a product such as Schlumberger’s Broadband Shield. The service uses a composite fluid system with a proprietary engineered far-field diversion pill that bridges at the fracture tip to prevent excessive growth of fracture length and height, thus creating a barrier to prevent communication between wells.

Complexity within reach

One of the newer entries in the world of chemical diversion is the introduction by contractor BJ Services of its patented REACH Complete solution. The company has long been a provider of diversion products, but with REACH Complete, BJ Services has combined its top-tier degradable particulate diverters with a mixture of light density proppant.

The REACH Complete far-field diverter blend is tailored to use with slickwater fluid to transport the diverter pill with minimum settling far into the formation—propagating fracture complexity and increasing conductivity. It is injected into the reservoir formation to plug up the micro-fracture network and create new fractures while at the same time keeping existing fractures open and eliminating risk of near wellbore choke and restricted production.

“That’s the whole idea behind the concept, so we added light density proppant into it so when the particulate diverter dissolves and goes we still have the frac open by the light weight proppant,” explained Shafeeq Khan, manager of engineering and technology for BJ Services.

REACH Complete began field testing around the middle of 2019 with an unnamed oil company client with wells in the Haynesville shale play of East Texas and northwestern Louisiana. Earlier, BJ laboratory tested the solution as a far field diverter with aims to create a permeability barrier at the fracture tip to contain fracture length growth.

Mid-stage use was also explored to control growth of secondary fractures to allow redistribution of fluid with the rock to increase complexity. The laboratory tests proved that by controlling the particle size of the engineered proppant and diverter mixture, the system could be tailored to plug different fracture widths.

In addition, conductivity tests showed that by using an engineered mixture of nondegradable, ultra-lightweight proppant and degradable material, conductivity in the fracture was maintained after particle degradation, which is critical when applied in the middle of a stage to increase fracture complexity.

“For BJ, the composition itself is more unique because of the patented light weight technology and also from an application point of view,” explained Dan Fu, vice president, engineering and technology at BJ Services.

“When you look at diversion, you always talk about near wellbore and far field. Near wellbore you try to divert the flow from one set of clusters to another. Far field you really try and control where the fluid is going at the reservoir level. Now people realize the far field is important because it creates that complexity, but also it prevents frac hits, frac interference. People are using this technique more to prevent interference between the child well and the parent well during completion. So the lightweight component of the REACH family is important.”

Fu continued: “The industry is moving to a more slickwater type of fluids which is [the] standard transport medium for particles for a well. That is why the lightweight nature of the technology is extremely important. For the particles to work, they need to go where the fluid goes. It needs to move deeper into the fracture. So having a particle, like sand and proppants, to be that much more effective, you have to use a crosslink fluid, and that really increases the complexity of the operation itself. This is why we believe that REACH is very much suitable for today’s environment.”

As of mid-January 2020, REACH Complete had been pumped in over 330 stages across a series of Haynesville wells, and results have been encouraging from both an increased fracture complexity point-of-view and mitigation of frac hits from infill wells. A full commercial roll out of the technology is expected later in the year with eyes on most of the North American unconventional market.

“I think by default creating complexity means you don’t grow a single dominant fracture and prevent a frac hit,” said Fu. “In reality, we should see both the production from the parent and child … the parent well should not be impacted at the time of completion of the child well. Also, you should see an overall production increase if you truly created the additional complexity. This is what we saw with our client in the Haynesville. They have not seen any impact on the parent’s production.”

The diverter market, in general, continues to remain in flux on both sides of the operator/contractor equation. Operators have continued to explore and seek out the true benefits of diverter use, while contractors adapt and adjust diverter cocktails to maximize their potential.

“For the last couple of years I think operators have been experimenting with different diverter materials,” said Fu. “Some believe in them. Some don’t. But we’ve always been pumping diverters. I think the overall level of diverter use will remain the same, but I think we will see a gradual shift from near wellbore to far field based on discussions we’ve had with some of our clients. Overall I think the diverter market is flat but stable. We’ve had some customers who have tried them and not seen an impact, so they dropped them. We have other customers that pump them regardless—every single stage. It really depends on where you are and who you talk to.”

With operators around U.S. unconventionals transitioning toward full field development, all eyes have continued to focus on the issues caused by aggressive downspacing with detrimental results in some cases for both primary and infill well production.

“A lot of the operators have been having issues with frac hits, so they are looking into the technologies that can prevent those, and diverters are one of the cheapest and easiest to mitigate frac hits,” said Khan.

“Right now, based on how the things are going, we think we have a pretty good system that will differentiate us,” said Fu. “Since this is only six months in the making we need to make sure we understand the performance, understand the value and understand where we need to improve before actually doing any research on this part.

“I think as the industry is moving toward more wells per pad and in closer spacing, I think the far field and the issue of frac interference is going to be driving the use of diverters.”

Diversion … with a twist

Thru Tubing Solutions’ SlicFrac diverter uses a proprietary, dissolvable fibrous material to create a near-wellbore mechanical diversion system that can be used for both mid-stage diversion and as a bridge plug replacement. SlicFrac Perf PODs are knot-like, designed with a solid core to seal inside the dominant perforation and tangible ends to catch the turbulent flow path. The Perf PODs wedge themselves into the dominant perforation, thus diverting the fluid/stimulation to the remaining under or unstimulated perforations. The result is a more effective stimulation due to the increased cluster efficiency.

“Our engineering department designed the SlicFrac product in-house and have continued to optimize the materials and design to match industry needs” explained Jenna Robertson, SlicFrac production line manager for Thru Tubing Solutions.

“The idea for SlicFrac originated with finding a way to replace the industry’s need of bridge plugs and provide a cost saving to the customer. Using the Perf PODs as a mid-stage diverter has shown to increase cluster efficiency and optimize the stimulation, which leads to increased production. By implementing SlicFrac Perf PODs for zonal isolation, some or even all bridge plugs can be removed from the standard plug-and-perf completion design, which can equate to large time- and cost-savings for the operator,” Robertson said.

The SlicFrac Diverter System commercialized in 2016 with its first job, and to date the system has been pumped in over 2,000 wells worldwide. The Perf PODs can be deployed from surface or downhole, depending on the job or application. Thru Tubing Solutions has continued development of these deployment mechanisms, allowing for more precise placement of the PODs during the frac for better results.

“The differentiating factor when comparing our Perf PODs with other styles of diverter is the ability to fully seal the perforation and remain inside the wellbore,” said Robertson.

“The PODs remain inside the pipe and can wedge into both round and irregularly shaped holes. The SlicFrac POD material is degradable, which means after the fracture stimulation is complete they will degrade in the presence of water and bottomhole temperature.

Alternatively, a milling assembly can also be utilized to clean out the wellbore, which will circulate all wellbore debris and POD material back to surface.”

SlicFrac Perf PODs are available in many different sizes and material compositions; however, they can be fully customized to suit each wellbore scenario. They can be utilized for new completions as well as remedial or restimulations, where you might have washed or eroded perforations that require larger PODs.

Thru Tubing Solutions provides field personnel as well as engineering support for all applications, from setting up the job all the way through execution in the field. Adjustments to the program or POD design can be made as needed.

“In terms of cost savings, we see the most impact where stage lengths are stretched and bridge plugs eliminated,” said Robertson. “By altering the current well design, to combine stages and/or eliminate bridge plugs, we see a large reduction in standby time for frac equipment and all associated services. This is helping the operator complete the wells days sooner than anticipated. Although cost savings vary widely with differing jobs and applications, there have been savings reported in the range of $750,000.”

With operators extending stages—from 150 to 200 feet up to 250 to 350 feet-plus—and eliminating extra wireline runs, PODs are taking over as a complete zonal isolation mechanism.

“The product continues to progress with new applications and uses as well as continued support from our growing customer base,” explained Robertson. “With the industry focus on cost savings and improved efficiency, we feel SlicFrac can be the solution to keep operators profitable in such a tight market.”

An open and shut case

Refracturing older wells is a practice operators can use to give an existing lateral a second life.

Well completions of a certain vintage were conducted with older technologies and philosophies that have since been replaced with better, more consistent methods. A refrac can address clusters that were underutilized after the initial completion work as well as re-excite fractures that may have not reached their full potential the first time around. It is also, in some cases, a more economic answer for boosting EURs than drilling and completing an entirely new well.

Expandables specialist Enventure has a mechanical diversion system designed to isolate old perforations providing more flow and power to the reservoir during refrac operations.

ESeal 3.0 RF liners are the latest generation of this expandable diverter that provide the industry’s highest strength and temperature ratings and translate into a faster payback on an investment and extended production life of a reservoir.

“It [ESeal] is one continuous length using premium expandable connections,” said Mark Villarreal, director of sales for Enventure. “The result is one continuous ID [internal diameter]. Depending on application, the burst ratings range from 14,500 to 17,000 psi, allowing an operator to perform high-volume, high-pressure refracs in most basins.”

With the new world order of oil and gas companies focusing on living within cash flow with the aim to reengage an undermotivated investment community, being able to add new production at the highest rate of return is crucial.

With completion costs making up a healthy portion of overall well costs, operators have turned more frequently to refracture opportunities to add barrels and protect the bottom line. Enventure has positioned its ESeal diverter as a viable solution and possible difference maker in the refrac market.

“Although expandable diverter systems have an upfront cost greater than most mechanical diverter methods, we provide a cost savings of at least 2.5x that cost difference,” said Villarreal.

Focused on the future

Diverter use is up across most operations, but the technology remains in motion as tweaks to existing systems as well as all new tools are developed with the goal of driving down completions costs.

There is no one-size-fits-all solution when it comes to diversion, so the pot of gold at the end of the rainbow is forever a moving target. The benefits and drawbacks will also vary by location and application. Chemistry will continue to play a key role as will the ability for companies to either see or accurately predict the downhole condition of wells prior to diverter use.

A clearer picture of the post-frac geology can show operators where the diverter needs and doesn’t need to go with respects to both optimizing cluster efficiency near field and assisting with damage mitigation from migrating fractures from an adjacent well far field.

Recommended Reading

Hess Midstream Announces 10 Million Share Secondary Offering

2024-02-07 - Global Infrastructure Partners, a Hess Midstream affiliate, will act as the selling shareholder and Hess Midstream will not receive proceeds from the public offering of shares.

Venture Global Acquires Nine LNG-powered Vessels

2024-03-18 - Venture Global plans to deliver the vessels, which are currently under construction in South Korea, starting later this year.

Imperial Oil Shuts Down Fuel Pipeline in Central Canada

2024-03-18 - Supplies on the Winnipeg regional line will be rerouted for three months.

Hess Midstream Subsidiary to Buy Back $100MM of Class B Units

2024-03-13 - Hess Midstream subsidiary Hess Midstream Operations will repurchase approximately 2 million Class B units equal to 1.2% of the company.

Apollo Buys Out New Fortress Energy’s 20% Stake in LNG Firm Energos

2024-02-15 - New Fortress Energy will sell its 20% stake in Energos Infrastructure, created by the company and Apollo, but maintain charters with LNG vessels.