Total announced that it would not renew its 2021 membership with the API following a detailed analysis of the climate positions of the organization. (Source: Total logo by dvoevnore / Shutterstock.com)

Presented by:

[Editor's note: A version of this story appears in the March 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

Intro

Total announced that the company would not renew its 2021 membership with API following a detailed analysis of the climate positions of the organization.

Total assesses the industry associations each year to ensure they are aligned with the group’s climate positions. The company cites environmental considerations including a science-based position linking human activity and climate change; the support of the Paris Agreement objectives; implementation of carbon pricing; the role that gas plays in the energy transition; and policies and initiatives that promote the development of renewable energy and support for CO₂ capture and storage development.

Total also noted that API is part of a group that opposes electric vehicle subsidies and how API gave its support during the recent elections to candidates who argued against the U.S.’s participation in the Paris Agreement.

RELATED:

API Reportedly Weighing Support of Carbon Pricing

The move by Total is the biggest split yet between European-headquartered multinational oil majors and U.S.-based trade groups over climate policy.

In February 2020, BP left three American groups over climate policy differences—American Fuel & Petrochemical Manufacturers, the Western States Petroleum Association and the Western Energy Alliance. In March 2020, Equinor left the Independent Petroleum Association of America due to differences over climate policy.

—Larry Prado

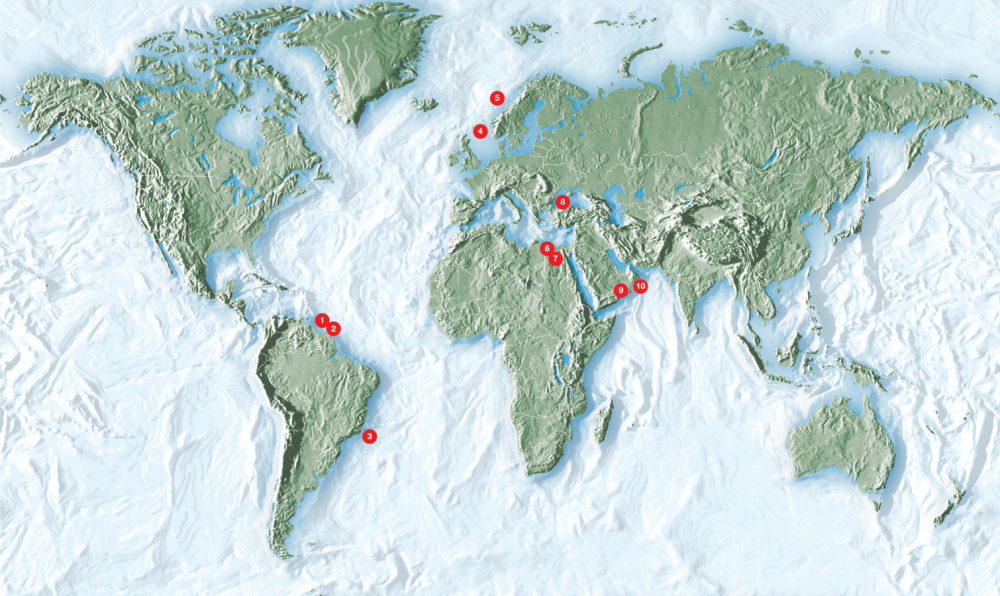

1. Guyana

Exxon Mobil is under way at exploration well #1-Bulletwood in the Canje block of offshore Guyana. According to the company, Bulletwood is a 500 MMbbl bbl oil prospect of Late Cretaceous Campanian age and is comparable to Exxon Mobil’s Liza Field channel complex in the Stabroek Block. The well will evaluate Upper Cretaceous prospects in the Liza play fairway with some possible deeper reservoir targets. The Canje block will be the first block offshore to test prospects on the basin floor, which have the potential to contain larger accumulations of recoverable hydrocarbons. Irving, Texas-based Exxon Mobil is the operator and holds a 35% interest with partners with Total (35%), Mid-Atlantic Oil & Gas (12.5%) and Westwood Energy (7.2%).

2. Suriname

Paris-based Total completed a new oil and gas discovery in offshore Suriname Block 58 at #1-Keskesi East. According to the company, the well hit a 63-m zone of net oil pay with 58 m (net) of black oil, volatile oil and gas pay in Campano-Maastrichtian reservoirs, along with 5 m (net) volatile oil pay in Santonian reservoirs. The well was drilled in approximately 725 m of water, and the rig is drilling ahead to a deeper Neocomian aged targets. Total assumed operatorship of Block 58 and #1-Keskesi East in 2020 with a 50% working interest, and Apache Corp. holds the remaining 50%.

3. Brazil

Exxon Mobil has scheduled its first offshore Brazil exploration well in almost 10 years. The presalt formation venture will be the #1-Opal wildcat in Block C-M789 in the Campos Basin. The company also announced plans for a second wildcat at #1-Titan in the Tita pre-salt Santos Basin, which will be drilled after #1-Opal.

4. Norway

Chrysaor Norge has been granted a drilling permit to drill wildcat well #15/12-25 in production license PL 973. The area in this license is part of Block 15/12, which is about 7 km northwest of Rev Field. London-based Chrysaor Norge is the operator with an ownership interest of 50% along with partners OKEA (30%) and Petoro (20%). This will be the first exploration well to be drilled in the license.

5. Norway

An oil discovery was announced by Houston-based ConocoPhillips in offshore Norway production license PL 891 at wildcat well #6507/5-10 S. The discovery is north of Heidrun Field in the Norwegian North Sea. The well encountered a total oil column of 270 m in Åre and Grey Beds formation, with 90 m of sandstone layers with very good reservoir properties. The preliminary calculation of the size of the discovery is about 4.1-11.3 MMbbl of recoverable oil equivalent. The objective of the well was to prove petroleum in reservoir rocks from the Early Jurassic Age (Åre) and Triassic Age (Grey Beds). No formation tests were conducted, and additional testing, sampling and assessment are planned. This is the first exploration well in production license PL 891. The venture was drilled to 2,179 m, and the true vertical depth is 2,214 m. Area water depth is 355 m, and the well will be permanently plugged and abandoned.

6. Egypt

An oil discovery was reported in Egypt’s Western Deseret by Apex International Energy in the Southeast Meleiha Concession. The #11X-SEMZ hit approximately 65 m of oil pay in the Cretaceous sandstones of Bahariya and Abu Roash G. An initial flow test of Bahariya had a peak rate of 2,100 bbl of oil per day with no water. According to the Houston-based company, additional uphole pay exists in the Bahariya and Abu Roash G that can be added to the production stream. The venture is about 10 km west of Zarif Field and was drilled to a total depth of 1,759 m. The #11X-SEMZ is the second of a three-well exploration program. The first well, #1-SEMZ, was drilled to about the same depth and flowed 100 bbl of oil per day. The company plans to fracture-stimulate #1-SEMZ at a later date. A third well is planned at #3-SEMZ and is targeting Bahariya.

7. Egypt

In the Western Desert of Egypt in the Meleiha Concession, an oil discovery was reported by Eni. The well, #9-Arcadia, drilled on the Arcadia South structure just south of Arcadia Field. It encountered an 85-ft oil column in the Cretaceous sandstones of Alam El Bueib 3G. During a 24-hour test, it flowed approximately 5,500 bbl of oil per day. Two development wells, #10-Arcadia and #11-Arcadia, were recently completed. The #10-Arcadia hit a 25-ft oil column in Alam El Bueib 3G and 20 ft of oil pay in the overlying Alam El Bueib 3D. The #11-Arcadia encountered an 80-ft oil column in Alam El Bueib 3G. Eni, based in Rome, holds a 38% interest in the Meleiha concession with Lukoil holding 12% interest and Egyptian General Petroleum Corp. holding a 50% interest.

8. Turkey

Turkish Petroleum Corp. has reported that the #1-Tuna venture has now been estimated to contain more than 405 Bcm of gas after identifying an additional 85 Bcm of gas. The deepwater exploration well is located in Block AR/TPO/KD/C26-C27-D26-D27 in the Black Sea. It was drilled 2,115 m of water to a total well depth of 4,525 m. It encountered more than 100 m of gas-bearing reservoir in Pliocene and Miocene sands. The Ankara-based company had previously announced that the well data and geophysical studies at #1-Tuna showed a potential of 320 Bcm of lean gas. It is currently the largest discovery in the Black Sea.

9. Oman

Tethys Oil is drilling an onshore Oman exploration well in Block 49 in the Governorates of Dhofar in the Wilayat Province of Muqhsin. The #1-Thameen has a planned depth of 4,000 m. It will be targeting Late Ordovician Hasirah Sandstone at approximately 3,500 m with a secondary target in the mid-Ordovician Saih Nihayda Sandstone at approximately 3,700 m (true vertical). The venture will also test the shallower Gharif Sandstone. Nine exploration wells have been drilled in the block by several operators, and many have encountered oil shows. Stockholm-based Tethys holds a 50% interest in the license.

10. Oman

Masirah Oil is under way at a second development well, #2-Yumna, in offshore Oman’s Yumna Field in Block 50 in the Arabian Sea. A wildcat venture, #3-Yumna, is also planned in the same block. The original block discovery at #1-Yumna initially flowed more than 8,000 bbl of oil per day. Recently, a mobile offshore production unit was installed in the field along with a 75,000 bbl capacity storage tanker. Muscat, Oman-based Masirah Oil is the operator of Block 50 and the Yumna Field with 100% interest, with Rex International holding an effective interest of 86.37%.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.