Occidental Petroleum Corp. entered a merger agreement with Anadarko Petroleum Corp. on May 9, bringing to an end Occidental’s pursuit for The Woodlands, Texas-based independent that included a takeover battle with oil major Chevron Corp.

RELATED: Chevron Bows Out Of Anadarko Takeover Battle With Occidental Petroleum

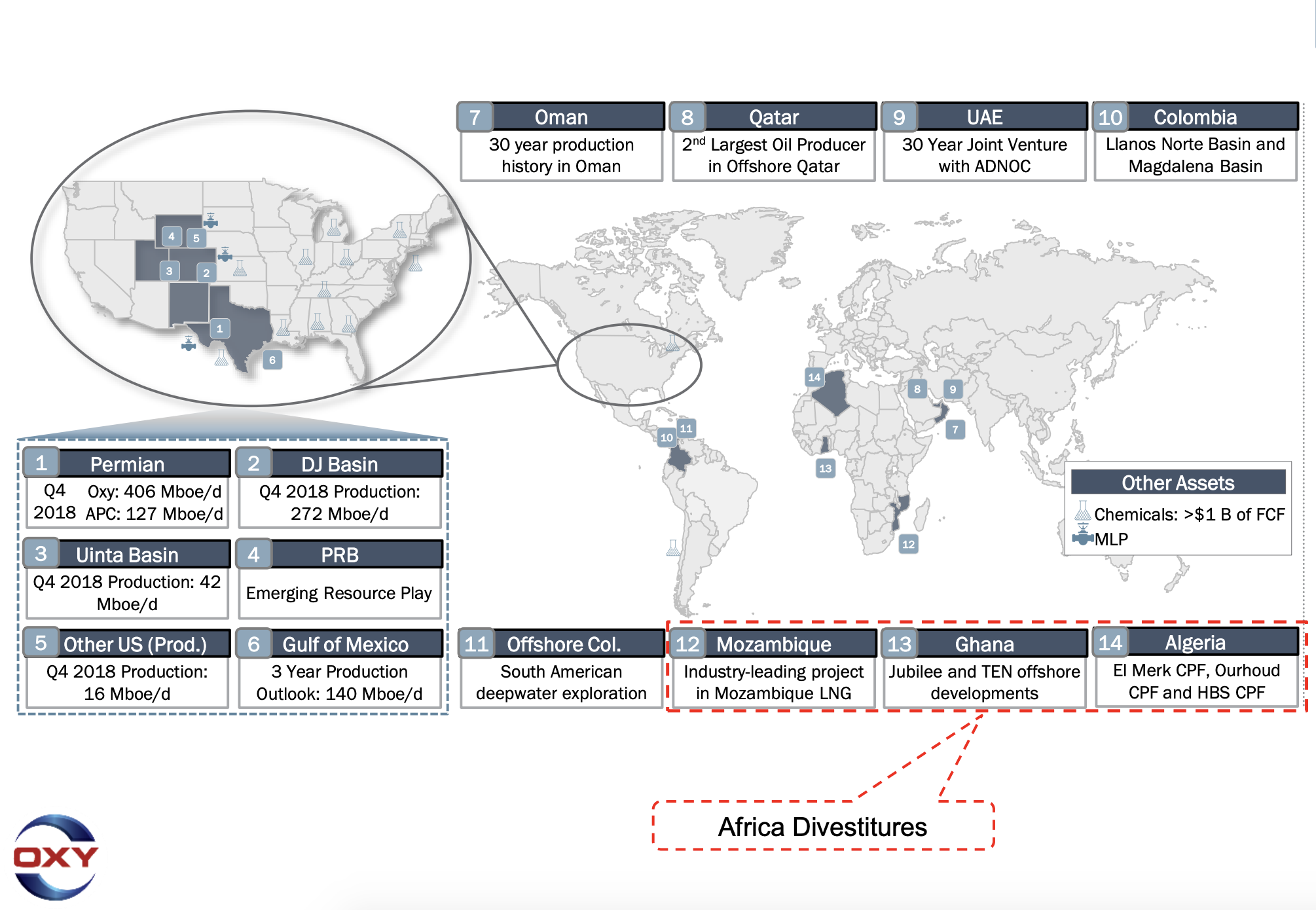

Largely believed to be key to the takeover battle is Anadarko’s nearly 600,000 gross-acre position in the Permian’s Delaware Basin. The portfolio of Anadarko—one of the world’s largest independent E&P companies—also includes deepwater projects offshore Africa and in the U.S. Gulf of Mexico plus a position in Colorado’s Denver-Julesburg Basin.

“This exciting transaction will create a global energy leader with a world-class portfolio, proven operational capabilities and industry leading free cash flow metrics,” Vicki Hollub, president and CEO of Occidental, said in a statement. “This transaction further establishes Occidental as a premier operator in prolific global oil and gas regions with the ability to deliver production growth of 5% through investment in projects with industry-leading returns.”

Anadarko had originally agreed to be acquired by San Ramon, Calif.-based Chevron on April 12 in a 75% stock and 50% cash transaction worth roughly $33 billion plus the assumption of $15 billion net debt. Though, a takeover battle soon erupted when Occidental took its own roughly $57 billion offer, including debt, for Anadarko public on April 24.

Anadarko eventually concluded Occidental’s bid, which was comprised of 78% cash and 22% stock, was superior to Chevron’s offer and gave Chevron four days to make a counterproposal. Chevron, however, declined to enter a bidding war and said May 9 it will not increase its offer for Anadarko. As a result, the previous merger agreement between Anadarko and Chevron was terminated, which required Anadarko paying Chevron a $1 billion breakup fee.

Occidental said it expects the acquisition of Anadarko will create a more than $100 billion global energy leader with 1.3 million barrels of oil equivalent per day of production. The company also anticipates $2 billion of annual cost synergies and $1.5 billion of annual capital reductions, which Hollub said will drive returns to Occidental and Anadarko shareholders.

“With greater scale, an unwavering focus on driving profitable growth, and our commitment to growing our dividend, we are creating a unique platform to drive meaningful shareholder value,” she said.

(Source: Occidental Petroleum Corp. May 6, 2019 Presentation)

Occidental is targeting to reduce debt over the next 24 months with between $10 billion and $15 billion of divestitures including its $8.8 billion sale of Anadarko’s African assets to Total SA. The company also received an investment from Warren Buffet’s Berkshire Hathaway Inc. worth up to $10 billion, contingent to its acquisition of Anadarko, which will be used to fund the cash portion of the combination.

The transaction is expected to close in the second half of 2019 and is subject to customary closing conditions, including approval from Anadarko’s shareholders and the receipt of regulatory approvals.

Bank of America Merrill Lynch and Citi are Occidental’s financial advisers for the transaction. Cravath, Swaine & Moore LLP is the company’s legal counsel. Goldman Sachs & Co. LLC, Evercore and Jefferies LLC are financial advisers to Anadarko. Wachtell, Lipton, Rosen & Katz is the company legal adviser.

Glenn Vangolen, Occidental’s senior vice president of business support, will lead an integration team that will include representatives from both Occidental and Anadarko, according to the Occidental press release.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

ONEOK CEO: ‘Huge Competitive Advantage’ to Upping Permian NGL Capacity

2024-03-27 - ONEOK is getting deeper into refined products and adding new crude pipelines through an $18.8 billion acquisition of Magellan Midstream. But the Tulsa company aims to capitalize on NGL output growth with expansion projects in the Permian and Rockies.

As ONEOK Digests Magellan, Sets Stage for More NGL Growth in 2024

2024-02-28 - ONEOK is continuing the integration of its newly acquired Magellan assets in 2024 as the company keeps an eye out for M&A opportunities and awaits regulatory approvals for certain projects.

Making Bank: Top 10 Oil and Gas Dealmakers in North America

2024-02-29 - MergerLinks ranks the key dealmakers behind the U.S. biggest M&A transactions of 2023.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

US Proposes Second GoM Wind Lease Auction

2024-03-20 - Combined, the four proposed areas for offshore wind have the potential to power about 1.2 million homes if developed, according to the Interior Department.