Lithium-ion battery recycler Redwood Materials raised more than $1 billion in its latest investment round, the company said Aug. 29, lifting total equity capital raised to nearly $2 billion with another $2 billion loan commitment from the U.S. Department of Energy (DOE).

The company, formed by former Tesla co-founder and CTO JB Straubel, plans to use the funds to expand its battery recycling efforts in the U.S. and strengthen its technical team.

“We are relentlessly focused on expanding our collection of end-of-life batteries, increasing our refining capability to recover higher quantities, and harnessing their value to make the most sustainable products,” Redwood said in a news release.

The round was co-led by Goldman Sachs Asset Management, Capricorn’s Technology Impact Fund and funds and accounts advised by T. Rowe Price Associates Inc.

Redwood’s efforts come as the U.S. works to strengthen its battery supply chain amid the push to a lower-carbon economy to reduce emissions. The Biden administration wants half of all new U.S. vehicles sales in 2030 to be electric

Considering the U.S. and its allies don’t mine or process enough critical materials needed for EV batteries, recycling is seen as a key to help meet that goal.

Redwood is focused on producing anode and cathode components from recycled batteries, building a circular supply chain.

“As the electrification megatrend continues to accelerate, building a local sustainable battery materials supply chain is more important now than ever,” said Sebastien Gagnon, a managing director in private equity at Goldman Sachs Asset Management.

Here is a look at other renewable energy news.

RELATED

Competitive Power Ventures Raises $370 Million For Renewables Pipeline

Peregrine Raises $700 Million for Energy Transition Technologies

Energy Transition Venture Capital Funding Dips, Benefitting Tech Incubators

Exxon, Shell, SLB Discuss ‘Balanced Approach’ to Energy Transition

Energy Storage

Eos’ Project AMAZE Lands Nearly $400 Conditional Loan Commitment

Long-duration energy storage provider Eos Energy Enterprises Inc. has landed a conditional loan commitment for up to nearly $400 million from the DOE for the company’s expansion project in Pennsylvania.

Called Project AMAZE, the $500 million expansion project aims to build 8 gigawatt-hours (GWh) of storage capacity by 2026. The conditional loan approval was granted as the U.S. looks to increase domestic supplies of battery materials.

“We are putting in place all the elements that will allow us to build an efficient, optimized, state-of-the-art production facility at scale to deliver on a nearly 200 GWh market opportunity,” said Eos CFO Nathan Kroeker. “We believe we can pair the conditional commitment from the DOE with private capital and state and local investment programs to meet our requirements.”

If the DOE’s Loan Programs Office finalizes the loan, it would fund 80% of Eos’ planned expansion, according to Eos, which returned its production and supply chain to U.S. from China in 2018. The company aims to meet increased long-duration energy storage demand, driven by the Inflation Reduction Act (IRA), by producing more of its zinc-based energy storage systems.

“Domestic production better positions Eos to access the 45X advanced manufacturing direct pay tax credits available under the IRA,” Eos said in a news release. “The Eos Z3 battery is based on Eos’ 15-year history of developing the Znyth battery technology, which uses earth-abundant raw materials in its manufacturing and is intended to overcome many limitations in other stationary energy storage solutions.”

Hyundai, LG to Spend $2B More on Georgia Battery Plant

Hyundai Motor Group and LG Energy Solution will boost their joint investment in a Georgia battery manufacturing plant by $2 billion and add 400 additional jobs, the companies and the state said Aug. 31.

The facility, a joint venture (JV) between the two companies, now includes a total investment of $4.3 billion and eventually will be able to produce about 300,000 electric vehicle (EV) batteries annually, the companies said.

Hyundai, the world’s third-largest automaker by vehicle sales, said the two companies now plan to spend a total of $7.59 billion and create 8,500 new jobs over eight years in Bryan County, Georgia. That figure includes the battery plant, which has an annual production capacity of 30 GWh, as well as a separate EV manufacturing plant.

The auto manufacturing plant is scheduled to begin producing vehicles in January 2025 and will build 300,000 vehicles annually.

The two manufacturing facilities, known collectively as the “Metaplant,” have been incentivized by $7,500 consumer tax credits including in the IRA. The law also includes hefty U.S. battery production tax credits.

Auto parts maker Hyundai Mobis will assemble battery packs using cells from the plant, then supply them to Hyundai Motor manufacturing facilities in the U.S. for production of Hyundai, Kia and Genesis electric vehicles.

DOE Set to Dole Out $15.5B in Grants, Loans

The U.S. Department of Energy is making $15.5 billion in loans and grants available to companies enabling the transition to EVs.

The DOE said Aug. 31 the funding package includes $2 billion in grants and up to $10 billion in loans to support automotive manufacturing conversion projects. Preference will be given to projects likely to retain collective bargaining agreements and those with an existing high-quality, high-wage hourly production workforce.

Projects selected for funding to convert and retrofit manufacturing plans must also contribute to the Justice40 Initiative, “which aims to advance diversity, equity, inclusion, and accessibility in America’s workforce and ensure every community benefits from the transition to a clean energy future.”

The DOE said it intends to make available $3.5 billion in funding to expand domestic manufacturing of batteries for EVs and electric grids.

The notice of intent comes thanks to the IRA and the Bipartisan Infrastructure Law. Both funding opportunities will be administered by the U.S. Office of Manufacturing and Energy Supply Chains.

Hydrogen

World Energy GH2 Secures Crown Lands for Green Hydrogen Project

World Energy GH2 was among four companies that secured land approvals from Newfoundland and Labrador (NL) regulators for hydrogen projects, according to an Aug. 30 news release.

The company’s planned commercial-scale green hydrogen Project Nujio’qonik, which includes two 1-GW wind farms and a hydrogen/ammonia plant at the Port of Stephenville, is expected to begin producing hydrogen in late 2025.

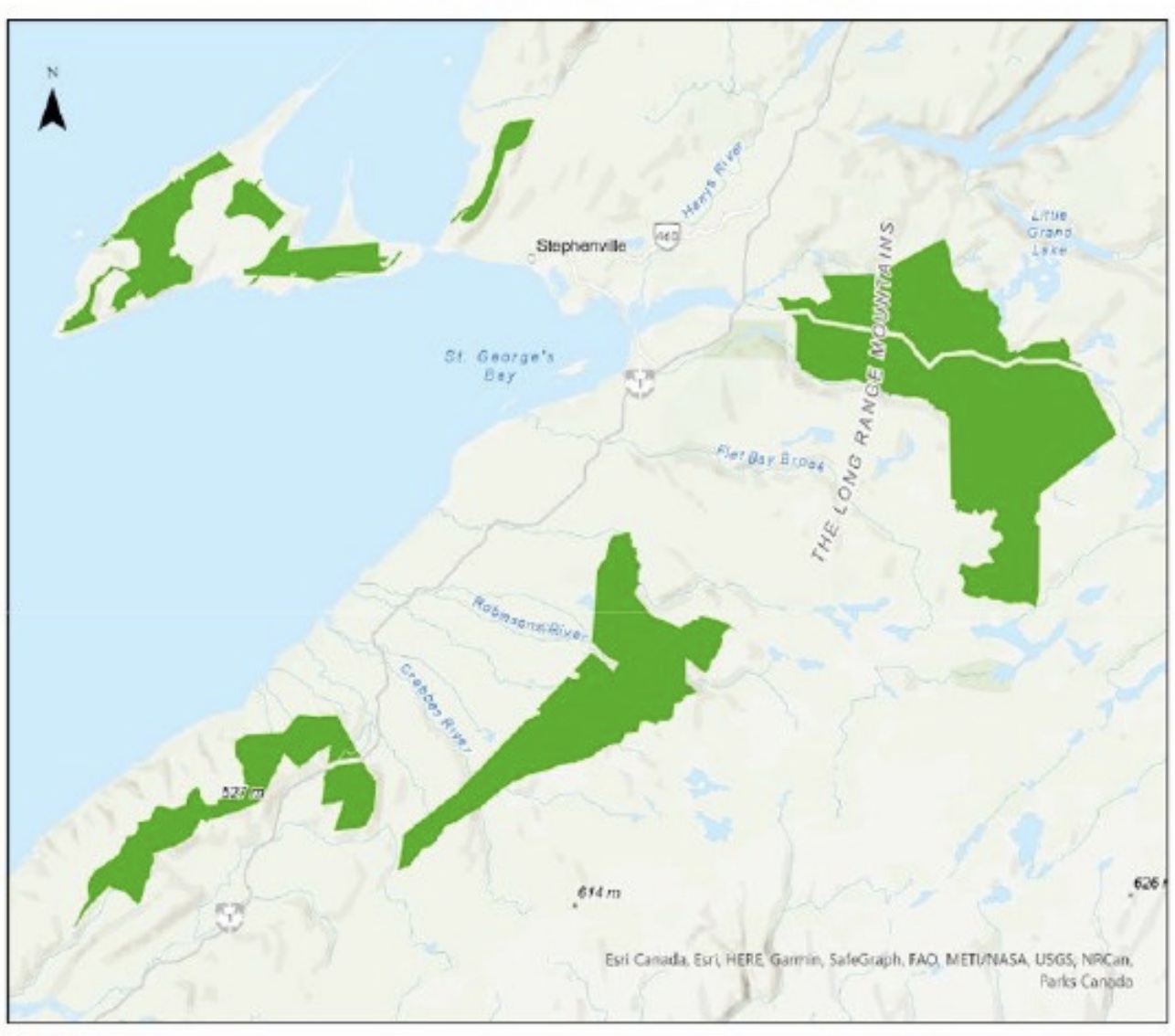

Approval was granted for sites in Port au Port and the Anguille Mountains/Codroy area for the project’s initial phases, and expansion sites in the Long Range Mountains and along the Burgeo Highway, the company said in a news release.

“Crown land leases are contingent upon proponents completing the provincial Environmental Assessment process and Project Nujio’qonik is currently the only green hydrogen project in NL that has conducted required analysis and submitted an Environmental Impact Statement (EIS) requiring over 15 months of field and desktop studies; an EIS is the most stringent Environmental Assessment level in the province,” the company said.

The Newfoundland government said EverWind NL Co., Exploits Valley Renewable Energy Corp, ABO Wind and World Energy GH2 can apply for approval to use government land, subject to environmental assessment. The list had been narrowed from 24 bids.

Japan’s Mitsui, Others to Jointly Study Hydrogen, Ammonia Supply Chain

Japan’s Mitsui & Co., Mitsui Chemicals, IHI Corp. and Kansai Electric Power Co. will conduct a joint study for establishing a hydrogen and ammonia supply chain in the Osaka coastal industrial zone, the companies said.

The announcement on Aug. 30 comes a day after Eneos and Osaka Gas said they would study the construction of a large e-methane facility—based on green hydrogen—and to be located in the Osaka Bay area.

The four companies would study options for receiving, storing and supplying ammonia—which can be used in power generation among other fields— in the Osaka area to potentially expand its usage in the Kansai and nearby Setouchi regions.

Separately, Tokyo Gas Co., Osaka Gas Co., Toho Gas Co., Mitsubishi Corp. and Sempra Infrastructure Partners LP would study e-methane exports to Japan from the U.S., they said on Aug. 30.

The project would comprise a facility that would produce 130,000 metric tons of e-methane per year in Texas or Louisiana in the U.S. to be liquefied at the nearby Cameron LNG terminal and exported to Japan from 2030.

The capacity of the proposed facility is equivalent to 1% of the annual gas demand of Tokyo Gas, Osaka Gas and Toho Gas, the five companies said in the joint statement, without providing an investment figure.

RELATED

Technip Energies Awarded Hydrogen Production Contract for BP Biorefinery

Solar

Summit Ridge Energy, HASI Plan to Expand Solar Portfolio

Solar and energy storage developer Summit Ridge Energy and investor HASI plan to build a 250-megawatt (MW) community solar portfolio in Illinois and Maryland, doubling the size of their existing JV partnership, the companies said Aug. 29

During the next two years, Summit Ridge—with financing from HASI—will grow its pipeline of ground-mounted and rooftop community solar projects in the states. The projects could avoid more than 51,000 metric tons of CO2 emissions annually, which Summit said is equivalent to eliminating the amount of carbon emissions generated from 118,000 bbl of crude oil.

Since Summit partnered with HASI in 2019, the two have developed a 255-MW portfolio.

“This latest transaction underscores our commitment to delivering scalable and repeatable transactions to our clients as they seize the tremendous opportunity of the energy transition,” said Susan Nickey, chief client officer for HASI.

Recurrent Energy Signs PPA for North Fork Solar

Canadian Solar said Aug. 31 its subsidiary Recurrent Energy has sealed a 15-year power purchase agreement with the Oklahoma Municipal Power Authority (OMPA).

All of the energy produced at the 160-MW North Fork Solar project being developed in Oklahoma will be purchased by OMPA, according to a news release.

The solar project is Recurrent’s first in Oklahoma and in the Southwest Power Pool.

Located about 100 miles southwest of Oklahoma City, the project will produce enough electricity to power 35,000 homes when it begins operations in 2024. Canadian Solar also said the project secured $112 million in financing.

AWCA Reaches Financial Close for Ombo Solar in Egypt

Saudi power company ACWA has reached financial close for the 200-MW Ombo solar project in Egypt, the company said Aug. 30.

The $182 million utility-scale project is expected to begin commercial operations in January 2024, serving 130,000 households and moving Egypt closer to its goal of generating 42% of its electricity from renewables by 2035.

European Bank for Reconstruction and Development, OPEC Fund for International Development, African Development Bank, AfDB’s Sustainable Energy Fund for Africa, Green Climate Fund, Arab Petroleum Investments Corporation and Arab Bank were listed in a news release as financing institutions for the project.

RELATED

Summit Ridge Energy, HASI to Expand Solar Portfolio

Enlight Co. to Provide Arizona Utility with Solar Power

Wind

Statkraft Buys 39 Wind Farms in $440 Million Deal

Norway’s Statkraft said on Aug. 31 it has acquired the wind power portfolio of Breeze Two Energy, consisting of 39 wind farms in Germany and France, for about NOK4.7 billion (US$440 million)

The company has a goal to develop 4 GW in wind, solar and battery storage by 2030.

Statkraft said it aims to optimize operations at the wind farms, 35 of which are located in Germany, as technology has advanced since the wind farms were constructed 15 to 21 years ago.

“We’re excited by the opportunity to use our considerable experience to extend the lifetime of these wind farms,” said Barbara Flesche, executive vice president, Europe, for Statkraft. “Replacing old turbines with new, more efficient ones can double the energy output of the sites, contributing to the energy transition in Europe.”

Huisman, Dong Fang Offshore Sign LoI For Cable Carousel

The Netherlands-based Huisman said Aug. 29 it has expanded its position in the cable-lay equipment market, having signed a letter of intent with Dong Fang Offshore (DFO) to deliver a cable carousel with an option for a cable-lay system.

DFO plans to deploy the cable carousel, with an existing Huisman vertical-lay system, for subsea cable-laying projects for fixed and floating wind offshore. Delivery of the cable carousel, which has a storage capacity of 3,000 mt, is scheduled for the first-half of 2024.

The agreement “symbolizes our shared vision of pushing the boundaries of what’s technically possible in offshore construction,” Timon Ligterink, commercial director for Huisman, said in the release.

The carousel’s proposed design aims to optimally utilize DFO’s Ocean Adventurer’s hold capacity for cable- and pipe-laying, Huisman said.

RELATED

Ørsted Plunges 20% on Risk of $2.3B in US Impairments

First GoM Wind Lease Sale Lures Just One Winning Bid

EVREC Granted Right to Pursue Newfoundland & Labrador Wind Project

Hart Energy Staff and Reuters contributed to this report.

Recommended Reading

Kimmeridge Fast Forwards on SilverBow with Takeover Bid

2024-03-13 - Investment firm Kimmeridge Energy Management, which first asked for additional SilverBow Resources board seats, has followed up with a buyout offer. A deal would make a nearly 1 Bcfe/d Eagle Ford pureplay.

Laredo Oil Subsidiary, Erehwon Enter Into Drilling Agreement with Texakoma

2024-03-14 - The agreement with Lustre Oil and Erehwon Oil & Gas would allow Texakoma to participate in the development of 7,375 net acres of mineral rights in Valley County, Montana.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-21 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Oil and Gas Chain Reaction: E&P M&A Begets OFS Consolidation

2024-04-26 - Record-breaking E&P consolidation is rippling into oilfield services, with much more M&A on the way.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.