Venture capital deal counts and values for carbon and emissions tech dipped in the second quarter, according to PitchBook, but experts said there is little cause for concern as energy transition funding remains high in areas that advance energy transition efforts. (Source: Shutterstock.com)

Venture capital deal counts and values for carbon and emissions tech dipped in the second quarter, according to PitchBook, but experts said there is little cause for concern as energy transition funding remains high in areas that advance energy transition efforts.

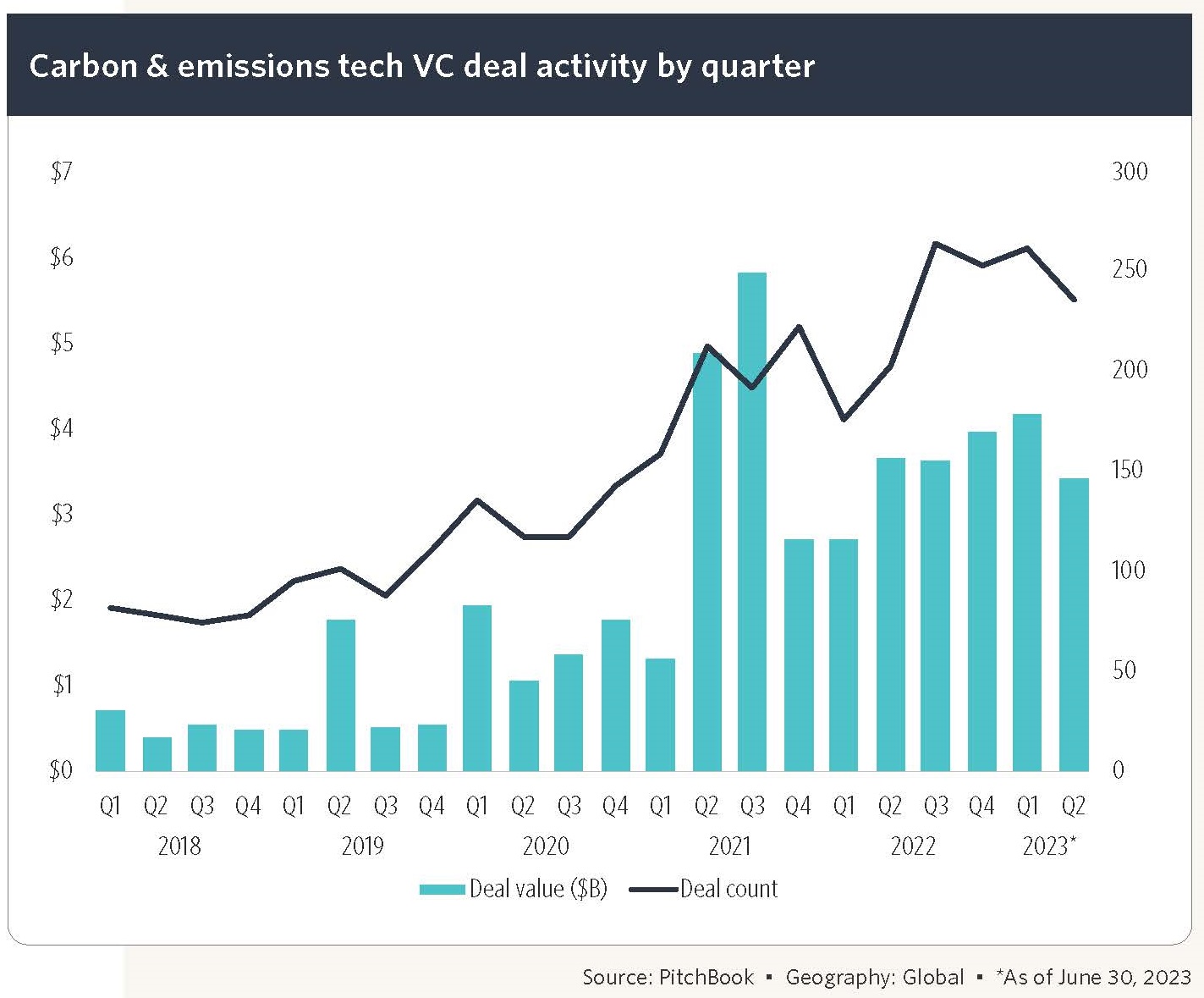

The number of deals from the first quarter to the second quarter dropped from 262 to 237, and the deal value dropped from $4.2 billion to $3.4 billion.

John MacDonagh, a senior analyst of emerging technology at PitchBook, said venture capital funding is still significant, it just seems slightly lower compared to recent highs.

“Last year was the largest year in terms of deal value in the space that we’ve seen,” he said. “Some of that was from particularly large deals.”

He said in the first half of this year, $768 million of venture capital funding went into direct air capture, source carbon capture, biological carbon capture and carbon utilization.

Some of the decline in energy transition venture capital is partly attributable to major oil and gas companies’ shift away from their in-house venture capital companies to incubators.

This trend was recognized by Rachel Schelble, head of corporate carbon management and infrastructure at the global research and consultancy group, Wood Mackenzie. She said major oil companies are motivated to invest in energy transition startups as a way to keep tabs on emerging technologies rather than for a return on investment.

“If you talk to some companies, they’ll say, ‘We don’t invest in startups so that we can make money. We invest in startups to understand the flow of technology where things are heading,’” she said.

Schelble said the companies are decisively shifting away from venture capital and to tech incubators and accelerators because they give the energy companies even better insight into emerging technologies.

Schelble noted that the French energy giant TotalEnergies SE shut down its corporate venture arm completely to instead fund an accelerator incubator. Exxon Mobil Corp. is the only other major company to not have a venture capital arm. However, Schelble said, the supermajor made the strategic choice to engage with startups as a customer, not as an investor.

Peter Durante, head of technology and innovation at Macquarie Asset Management, said he has noticed that energy transition venture capital has dropped somewhat, but it’s also entering into a new phase that can spur more innovation.

He said more than $1 trillion dollars a year is now being spent globally on the energy transition. The large majority of this investment is focused on the deployment, or installation, of new clean technology, largely renewables, energy storage and electric vehicles. Durante said as newer technologies are deployed and become more familiar, they start to follow a new learning curve that brings another wave of improvements and efficiencies.

He added that people should be mindful of the “hype cycle” in which new technology possibilities take off in popularity, but then crash when high expectations are not met within certain time frames. Dashed hopes—and sometimes poor investment returns—are so dramatic that many people miss the following plateau of long, slow, steady improvements that eventually bring the technology at least somewhat near the original hopes.

“There’s going to be a lot of these that go through the hype cycle, get overvalued, and may never see the light of day, which is the nature of venture capital,” he said. “There’s a few that are going to start working their way through the trough and look to be adopted by major producers.”

Recommended Reading

Phillips 66 to Acquire Pinnacle Midstream for $550MM

2024-05-21 - Phillips 66 said the deal to acquire Pinnacle Midstream was a strategic move to expand its natural gas gathering and processing assets in the Midland Basin.

Energy Transfer-Sunoco JV Forms Monster Permian Network

2024-07-17 - The joint venture between midstream operators Sunoco and Energy Transfer’s crude gathering in the Permian Basin should prove to be mutually beneficial, analysts say.

Permian Takeaways: Rebuilding the Most Prolific Paradigm in the US

2024-06-03 - Midstream companies and E&Ps may have different priorities, but continued pipeline development is crucial for the basin’s future.

Energy Transfer to Buy Permian Midstream Player WTG for $3.25B

2024-05-28 - Energy Transfer has agreed to purchase WTG Midstream Holdings’ assets, including Midland Basin core infrastructure, from Diamondback Energy, Stonepeak and the Davis Estate in a cash and stock deal.

Study: Time Running Out for FID on Next Permian NatGas Pipeline

2024-06-14 - To meet natural gas takeaway demand by 2026, a final investment decision on a new Permian Basin pipeline will be needed before the end of the year, according to Enverus analysis.