The lone provisional winner of the Lake Charles lease area was RWE Offshore US Gulf LLC, which placed a high bid of $5.6 million. (Source: Shutterstock)

Results of the first-ever wind sale for development rights in the U.S. Gulf of Mexico (GoM) show few are ready to test the oil-dominant region for wind: only one of the three lease areas made available were awarded.

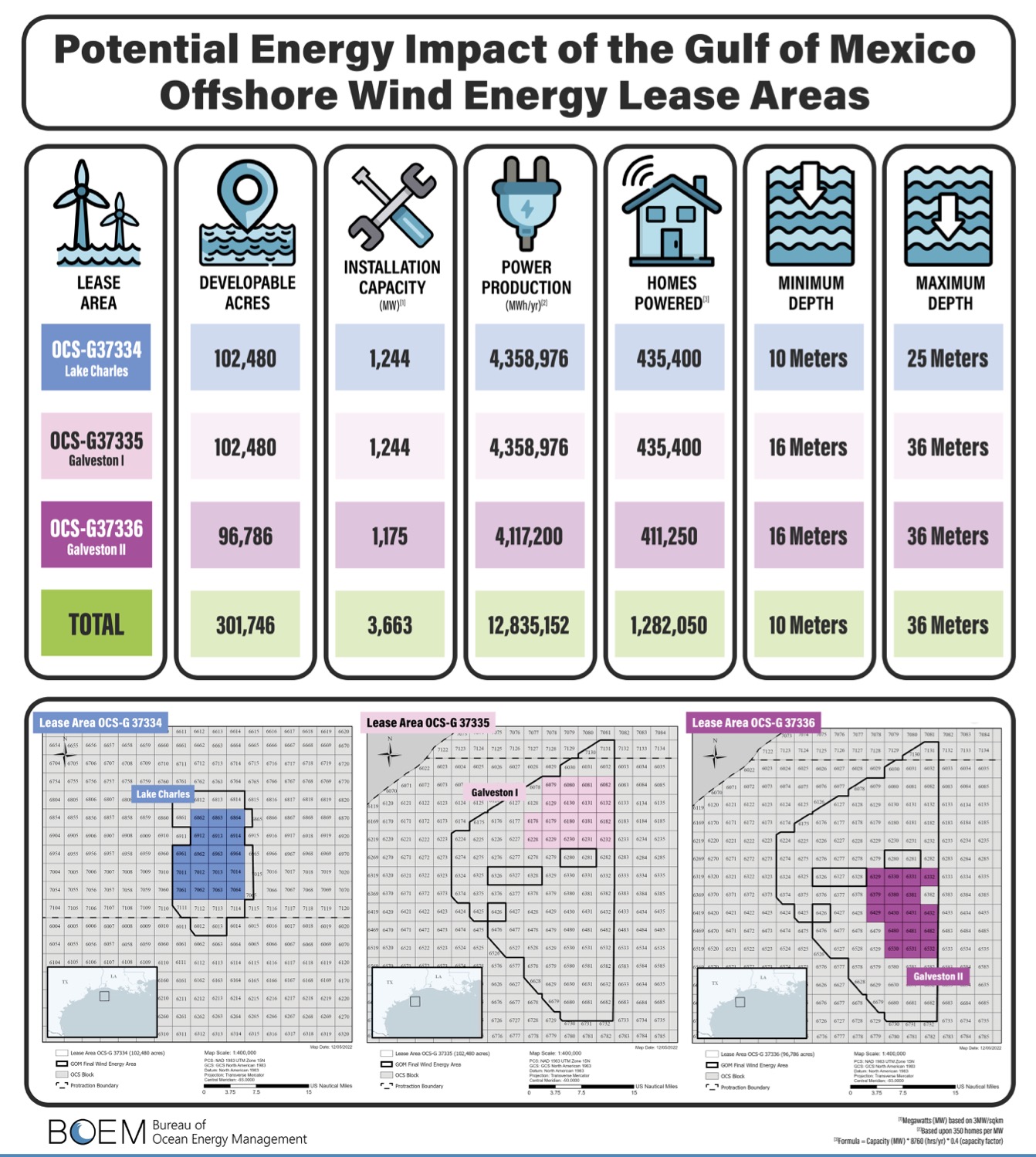

The lone provisional winner of the Lake Charles lease area, which if fully developed has the potential to generate about 1.24 gigawatts (GW) of offshore wind energy capacity and power about 435,400 homes, was RWE Offshore US Gulf LLC. The company is a subsidiary of Germany-based RWE, which owns and operates about 3.3 GW of offshore wind turbines across Europe. The company placed a high bid of $5.6 million.

The bid was far below what other wind sales offshore the U.S. have attracted, including the record-setting New York Bight lease sale that brought in $4.4 billion in winning bids from six companies in February 2022 and more than $757 million in winning bids for five lease areas in the U.S.’ first Pacific Ocean sale in December. Unlike the Pacific wind sale, which had more than seven hours of bidding on the sale’s first day, the GoM wind auction ended in about two hours.

The poor showing for the GoM sale is likely a reflection of the Texas market, an analyst said, and the region may yet have the potential for more wind generation.

RWE aims to have GoM wind turbines spinning by the mid-2030s if permitting and regulatory approvals are secured. Water depths in the area are between 10 m and 25 m, making it suitable for fixed wind turbines that are secured to the seabed.

“In 2022 we entered the U.S. offshore market and quickly expanded from coast-to-coast,” RWE Offshore Wind CEO Sven Utermöhlen said. “Entering a new region in the Gulf is an exciting milestone to further deploy over 20 years of expertise across the value chain and deliver a new energy resource into the region.”

Like the U.S., Louisiana has been aggressively pursuing offshore wind energy development with a state goal to reach 5 GW of offshore wind capacity by 2035.

No bids offshore Galveston

RWE was one of two companies that placed bids on the 102,480-acre area offshore Lake Charles. The two other available lease areas—102,480-acre and 96,786-acre sections both offshore Galveston, Texas—received no bids.

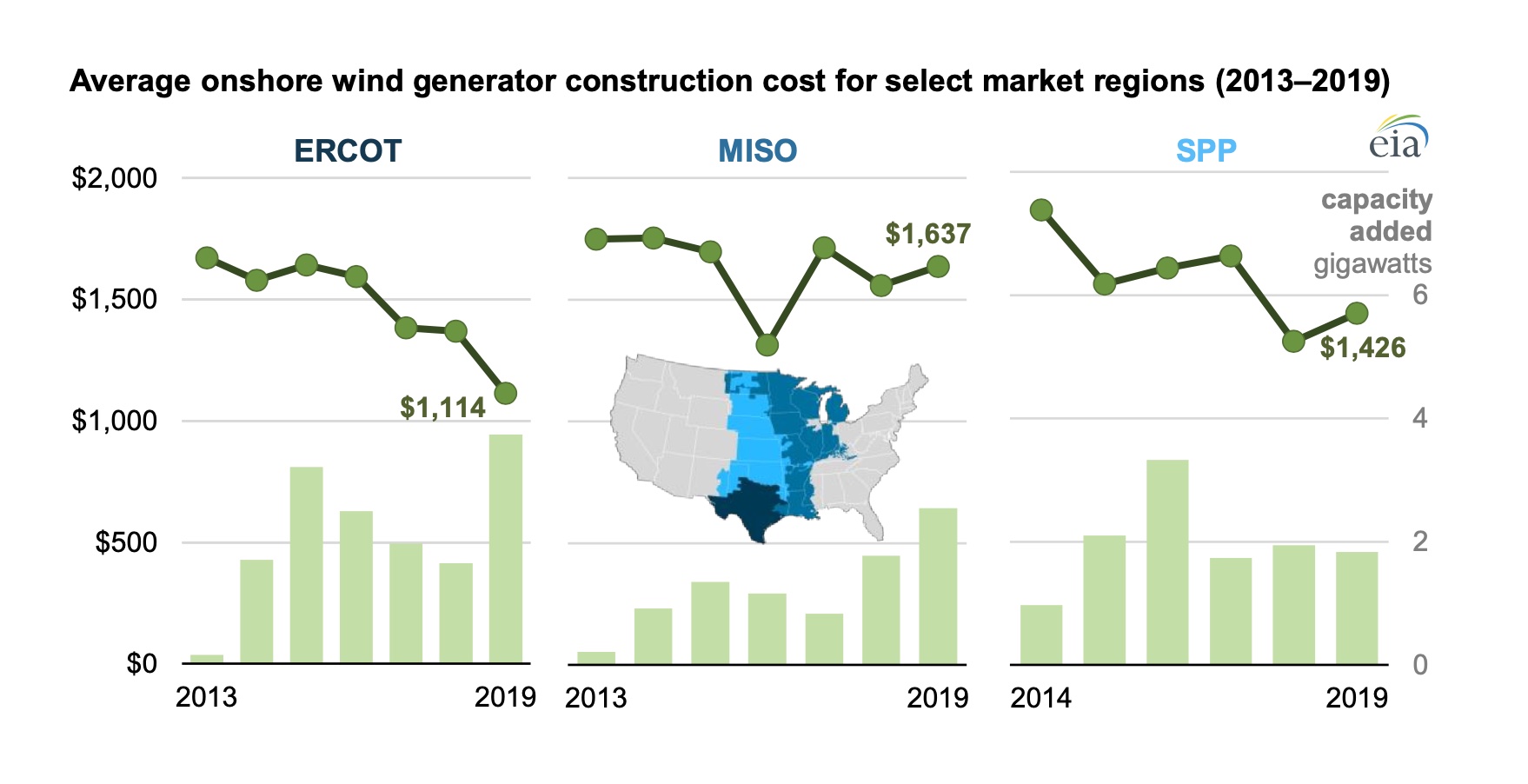

Becky Diffen, a Houston-based project finance partner at Norton Rose Fulbright, told Hart Energy that questions about how the economics work in the GoM, especially when compared to low-cost renewables onshore, may have been a factor. So, too, might have been the Electric Reliability Council of Texas, or ERCOT.

“If you’re looking at sites that you’re going to interconnect into ERCOT, like down off the coast just south of Houston for example, those projects will have to compete against onshore renewable energy—wind and solar—which, of course, in Texas is remarkably cheap,” Diffen said. “I don’t think you can afford the kind of really high pricing…that we saw in other parts of the country because power prices are just lower here.”

Projects must be economical because they are competing for capital not only against other offshore wind projects but other forms of electricity as well, she added.

However, farther around the bend offshore Louisiana, there is the Midcontinent Independent System Operator (MISO) and the Southwest Power Pool (SPP).

“Those are very different electricity markets. …ERCOT power’s super cheap [with] lots of renewable energy available. But if you build farther north in some of the other places where potential future growth could be, then possibly it becomes more competitive in those markets,” Diffen said, adding power would have to be moved longer distances. There is “demand for renewable energy in those markets that maybe doesn’t have the same type of competition as renewables have in the ERCOT market.”

Though lower power prices could make higher-cost offshore wind development a tough sell at the moment for some companies looking to seal electricity contracts later, the GoM’s shallow water and wind profile still makes the region attractive. Diffen pointed out the GoM has the ability to generate more on-peak energy, which could be valuable for the ERCOT market.

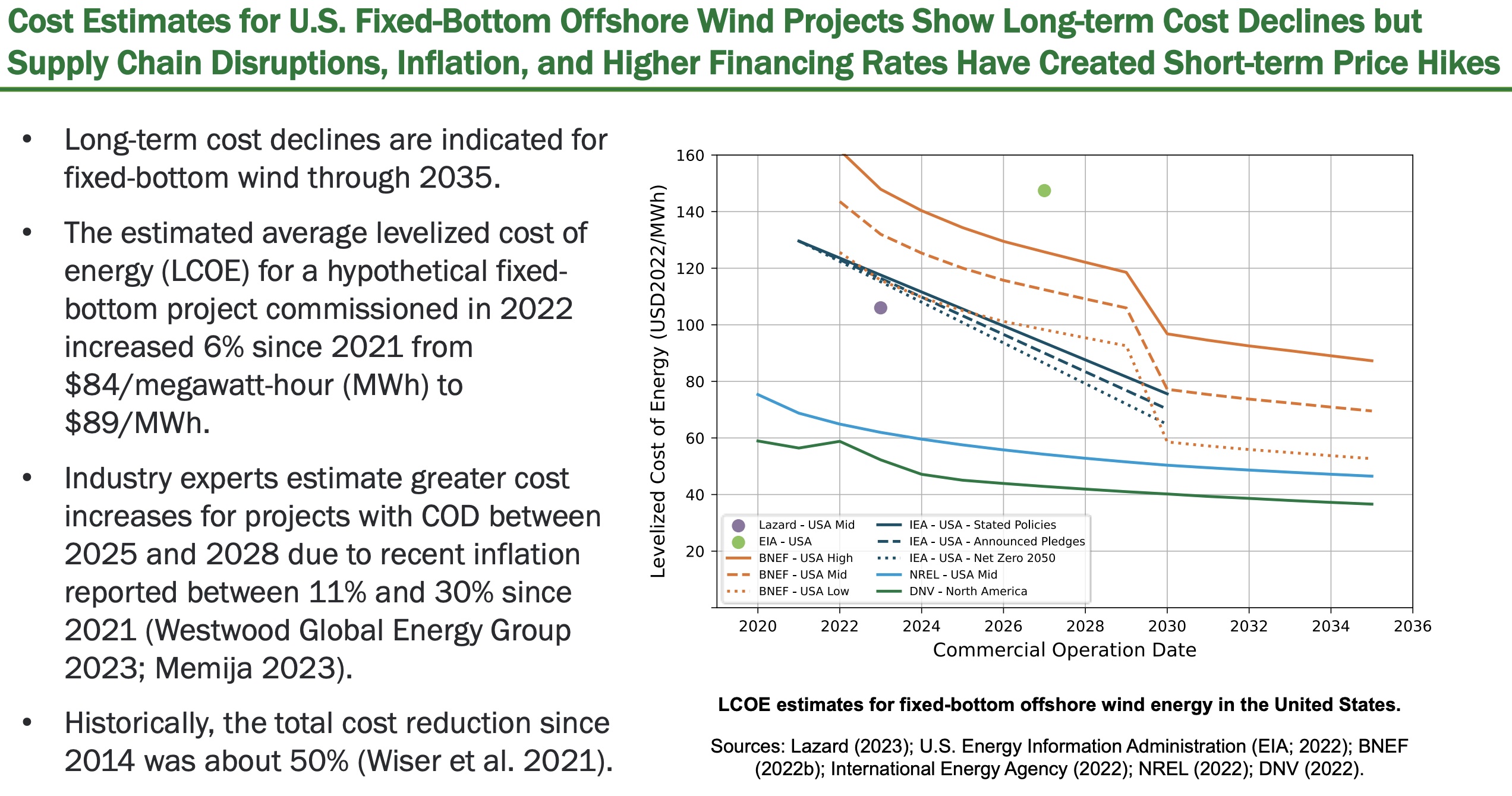

Yet, results of the Aug. 29 auction show low interest amid continued headwinds. The global offshore wind sector has been facing challenges involving supply chain issues, inflation and rising cost of capital.

About 15 companies qualified to participate, according to information from the Bureau of Ocean Energy Management (BOEM), which conducted the sale.

RELATED: Offshore Wind Developer Ørsted Eyes Challenges, Remains Optimistic

Key moment in history

Though the auction fell short of expectations, clean energy and offshore industry groups called the auction a critical step and a key moment for offshore energy development.

“Offshore wind can thrive in this region by capitalizing on existing infrastructure, well-developed ports, a skilled maritime workforce and innovative markets for clean energy,” Josh Kaplowitz, vice president of offshore wind for American Clean Power Association, said in a release. “The Gulf is a pioneer region. Much like the Atlantic coast a decade ago, it will take steadfast local, state and national support for the market to fully mature.”

The GoM region took a step forward to expand its energy portfolio, furthering its status as an energy hub, National Ocean Industries Association President Erik Milito said.

“As the Gulf of Mexico continues its evolution into a broad-based and integrated energy hub, encompassing segments such as oil and gas, wind, and with future prospects of carbon sequestration and hydrogen, the opportunity for the first offshore wind project will be a marker for the region,” Milito said.

BOEM Director Elizabeth Klein called the lease sale “an important milestone for the Gulf of Mexico region—and for our nation—to transition to a clean energy future.”

The Biden administration aims to increase offshore wind capacity to 30 GW by 2030 as part of a wider effort to have a carbon-free electricity sector by 2035. Construction is underway for two approved major wind projects off the Northeast Coast, the 800-megawatt (MW) Vineyard Wind and the 132-MW South Fork Wind, and more are forthcoming.

The 704-megawatt (MW) Revolution Wind project being jointly developed by Ørsted and Eversource offshore Rhode Island was approved earlier this month by the BOEM, becoming the fourth commercial-scale wind farm approved by the Biden administration. It followed approval of Ørsted’s planned 1.1-GW Ocean Wind 1 offshore New Jersey.

The Biden administration said in July that investments in U.S. offshore wind have quadrupled since 2021, rising to $21.6 billion. The figure includes $7.7 billion since the Inflation Reduction Act was signed into law, paving the way for nearly $370 billion in clean energy incentives. The White House said data shows more than 4,100 companies in all 50 states are looking to support the U.S. offshore wind industry.

Recommended Reading

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

Houston Natural Resources to Rebrand to Cunningham Natural Resources

2024-11-08 - Now rebranded as Cunningham Natural Resources Corp., the company will continue its focus on traditional oil and gas opportunities and energy transition materials.

US Oil, Gas Rig Count Holds Steady for Record Third Week

2024-11-08 - The oil and gas rig count was steady at 585 in the week to Nov. 8, Baker Hughes said on Nov. 8. Baker Hughes said that puts the total rig count down 31 rigs, or 5% below this time last year.

SM, Crescent Testing New Benches in Oily, Stacked Uinta Basin

2024-11-05 - The operators are landing laterals in zones in the estimated 17 stacked benches in addition to the traditional Uteland Butte.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.