Lapis Energy CEO Reg Manhas sees “massive” CCS opportunity in a stretch of Louisiana plagued by emissions and a high cancer rate. (Source: Hart Energy)

The best place for Lapis Energy to operate might be one of the worst places in the country to breathe air.

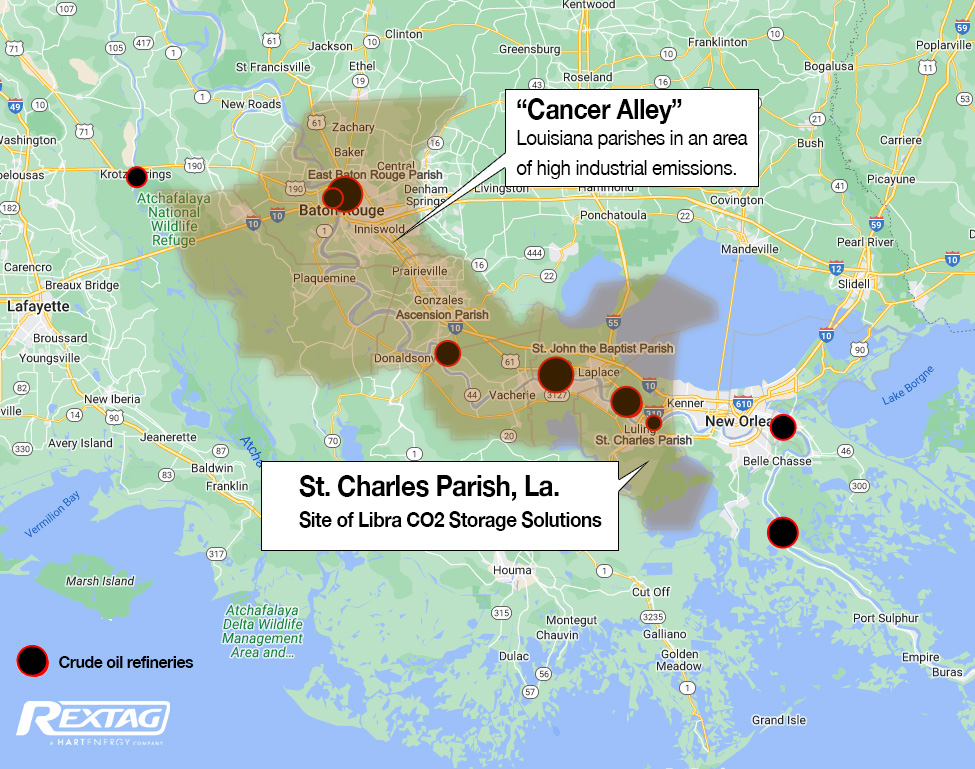

Lapis has selected a site in Louisiana’s notorious “Cancer Alley” for its Libra CO2 Storage Solutions carbon sequestration project. The location is in St. Charles Parish, within an 85-mile stretch between New Orleans and Baton Rouge and home to more than 200 petrochemical plants and refineries. The extreme levels of emissions are blamed for some of the highest per capita cancer rates in the country.

“It is a massive opportunity,” said Reg Manhas, Lapis co-founder and CEO, at Hart Energy’s Carbon & ESG Strategies conference in Houston on Aug. 30. “There’s a lot of issues, obviously, in that part of the state in terms of emissions.”

The U.S. Energy Information Administration ranked Louisiana No. 6 among U.S. states in CO2 emissions in 2021, with 186.6 million metric tons.

The opportunity stems from a slew of corporate commitments from emitters in the region to decarbonize their operations, Manhas said. But the process of capturing emissions is not uniform, either in pollutants or cost.

“Not all carbon is equal,” he said. “You’ve got emissions from an ammonia facility such as (Illinois-based) CF Industries, which is very valuable CO2. Because it’s processed CO2, it’s 97% pure. You’ve got refineries, you’ve got power plants where it’s post-combustion CO2, where it’s going to be much more expensive to capture that CO2.”

The 14,000-acre Libra project is expected to ultimately hold as much as much as 200 million tons of CO2. It’s also privately owned, so Lapis can avoid contracting the land from the state. The company expects to file for Class 6 permits by year-end or early 2024.

Libra is a 50:50 joint venture between Lapis and Denbury Inc. announced in late June, a little more than two weeks before Exxon Mobil announced its $4.9 billion acquisition of Denbury. Depending on the scale of agreements with emitters, Denbury plans to connect the site to its existing CO2 pipeline network in southeast Louisiana with a 45-mile pipeline connection.

Manhas said he was excited about Exxon Mobil’s acquisition of Denbury.

“We’re really proud of the fact that for a relatively small company, we’ve been partnering with blue chip companies,” he said. “LSB (Industries) is a blue chip, NYSE company. Denbury is blue chip, and now that blue chip has just gotten bigger with Exxon coming on board. And so, we’re looking forward to working with Exxon.”

LSB is Lapis’ first project. The Oklahoma City-based company is one of the top ammonia producers in the U.S. and has “broad ambitions to become a leader in both blue ammonia and green ammonia, starting with their flagship facility in El Dorado, Arkansas,” Manhas said. The project is intended to capture 400,000 tons to 500,000 tons of CO2 per year.

The project is a self-contained unit, in that the injection well, pipeline and capture units will be on the LSB plant site itself. Injection will begin at about 6,000 ft below the surface of the plant.

While some emitters have indicated they want to handle CO2 capture themselves, LBS turned everything over to Lapis. The company will do everything from connecting the flange, to dehydration, compression, piping, injection, restoration and monitoring.

“Lapis will then apply to the IRS for the 45Q credit, the $85 per ton,” Manhas said. “We monetize that either through direct pay or through tax equity. And then, we essentially pay LSB a fee per ton for their carbon. So, they’re taking a waste product and they’re turning it into revenue stream.”

While Libra is much larger, the success of Lapis hinges on the success of the LBS project.

“I think that we need to demonstrate that we can get this business off the ground,” he said. “For us as a company, I think the LSB project is a flagship. It’s a small project, but I think that getting it off the ground, getting that Class 6 permit and beginning injection, which, if we are on the right timeline with the EPA, we could be injecting CO2 by mid-2025. I think that will really unlock things.”

Recommended Reading

ShearFRAC, Drill2Frac, Corva Collaborating on Fracs

2024-03-05 - Collaboration aims to standardize decision-making for frac operations.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Technip Energies Wins Marsa LNG Contract

2024-04-22 - Technip Energies contract, which will will cover the EPC of a natural gas liquefaction train for TotalEnergies, is valued between $532 million and $1.1 billion.

Exclusive: Carbo Sees Strong Future Amid Changing Energy Landscape

2024-03-15 - As Carbo Ceramics celebrates its 45th anniversary as a solutions provider, Senior Vice President Max Nikolaev details the company's five year plan and how it is handling the changing energy landscape in this Hart Energy Exclusive.

E&P Highlights: April 22, 2024

2024-04-22 - Here’s a roundup of the latest E&P headlines, including a standardization MoU and new contract awards.