The Mero 3 HISEP project will capture and inject CO2 subsea for the Petrobras-operated pre-salt field offshore Brazil. (Source: Shutterstock)

Petrobras awarded TechnipFMC an integrated engineering, procurement, construction and installation (iEPCI) contract for a subsea high-pressure separation process for the Mero 3 project offshore Brazil, TechnipFMC announced Jan. 3.

The contract, valued at over $1 billion, covers the design, engineering, manufacture and installation of subsea equipment, including manifolds, flexible and rigid pipes, umbilicals and power distribution, as well as life of field services.

The Mero 3 High Pressure Separation (HISEP) project uses subsea processing to capture CO2-rich dense gases and then inject them into the reservoir. TechnipFMC, in partnership with Petrobras, has advanced the qualification of some of the core technologies needed to deliver the HISEP process entirely subsea.

The pre-salt Mero 3 project offshore Brazil will be the first to use Petrobras’ HISEP process subsea. HISEP technologies enable the capture of CO2-rich dense gases directly from the well stream, moving part of the separation process from the topside platform to the sea floor. In addition to reducing greenhouse gas emissions, HISEP technologies increase production capacity by debottlenecking the topside gas processing plant, TechnipFMC said.

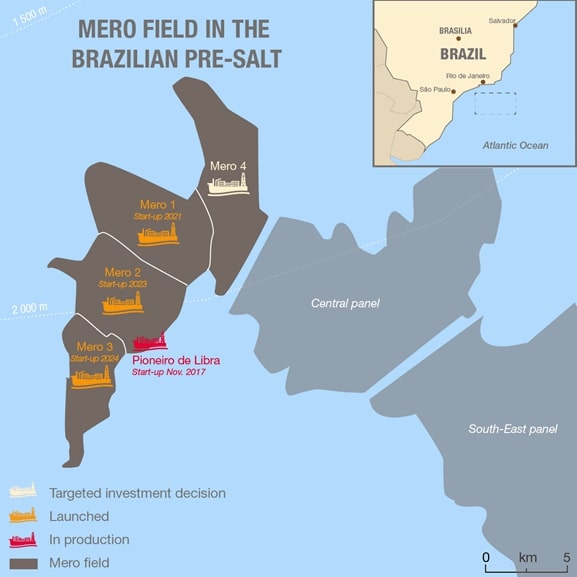

First production from Mero 3 is expected this year to the FPSO Marechal Duque de Caxias in 7,200 ft water depth in the Santos Basin.

Petrobras operates the Mero 3 project with 38.6% interest on behalf of Libra Consortium partners Shell Brasil Petróleo Ltda. with 19.3%, TotalEnergies EP Brasil Ltda. with 19.3%, CNOOC Petroleum Brasil Ltda. with 9.65%, CNODC Brasil Petróleo e Gas Ltda. with 9.65% and Pré-Sal Petróleo S.A. with 3.5% as the Brazilian government's representative in the non-contracted area.

Elsewhere in the field, Mero 2 started production, operator Petrobras announced Jan. 2.

Recommended Reading

CoolCo, GAIL Enter Long-term LNG Agreement

2024-05-16 - CoolCo and GAIL’s agreement is intended to secure long-term LNG supply in India’s market, with GAIL having an option to extend the 14-year agreement by another two years.

US to Favor Existing Investors for Venezuela Oil Licenses, Say Sources

2024-05-16 - The U.S. is preparing to prioritize issuing limited licenses to operate in Venezuela to companies with existing oil production and assets over those seeking to enter the sanctioned OPEC nation for the first time.

Crescent Energy to Buy Eagle Ford’s SilverBow for $2.1 Billion

2024-05-16 - Crescent Energy’s acquisition of SilverBow Resources will create the second largest Eagle Ford Shale E&P with production of about 250,000 boe/d, the companies said.

Diamondback’s Van’t Hof Plays Coy on Potential Delaware Divestiture

2024-05-16 - Diamondback Energy’s President and CFO Kaes Van't Hof also addressed new Permian exploration and the lack of “fun” dealing with the FTC on its deal to buy Endeavor Energy Resources.

ConocoPhillips: Permian Basin a ‘Growth Engine’ for Lower 48

2024-05-15 - ConocoPhillips views the Permian Basin as a “growth engine” within its Lower 48 portfolio, the company’s Midland Basin Vice President Nick McKenna said during Hart Energy’s SUPER DUG event in Fort Worth.