Located in the Libra Block, 180 km off the coast of Rio de Janeiro in the presalt Santos Basin, the project lies in water depths between 1,800 and 2,100 meters. (Source: Shutterstock)

Petrobras began the second phase of production on its Mero project in Brazil, the company announced Jan. 2.

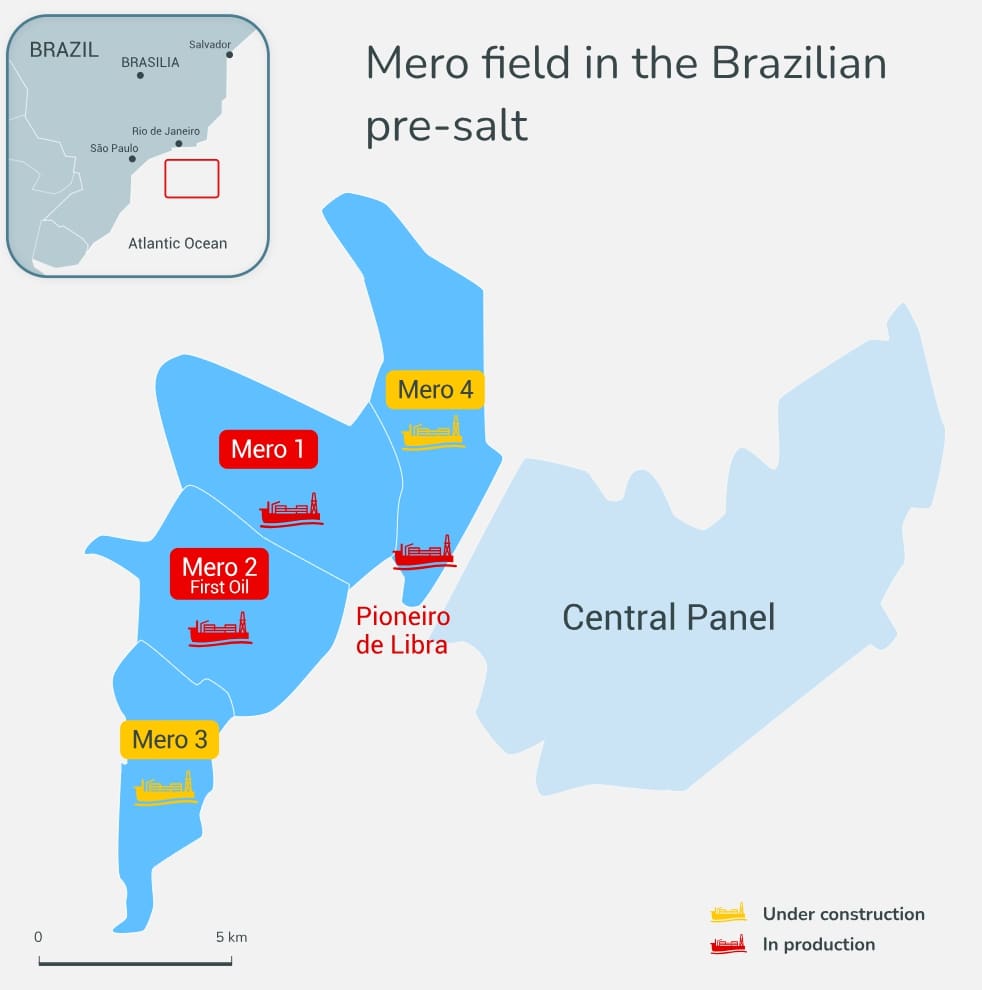

Located in the Libra Block, 180 km off the coast of Rio de Janeiro in the presalt Santos Basin, the project lies in water depths between 1,800 and 2,100 meters.

Sanctioned in 2019, “Mero-2” includes the FPSO Sepetiba, which has an operational capacity of 12 MMcm of natural gas and 180,000 bbl/d of oil. Sepetiba is part of a production system that is planning a total of 16 development wells, including eight producer wells and eight water and gas injection wells that will be interconnected to the unit. The FPSO also has CCUS capabilities designed to reduce emissions and increase efficiency.

With Mero-2 coming online, the Mero field will reach a production capacity of 410,000 bbl/d of oil. Mero-3 and Mero-4, two additional development phases producing 180,000 bbl/d of oil each, are currently under construction, with start-ups expected by 2025.

Petrobras is the operator of the field, with a 38.6% stake, with TotalEnergies and Shell Brasil each holding a 19.3% stake in the field. CNPC and CNOOC each have a 9.65% stake in the field, while and Pré-Sal Petróleo S.A (PPSA) holds the remaining 3.5%.

Recommended Reading

VAALCO Acquires 70% Interest in Offshore Côte D’Ivoire Block

2025-03-03 - Vaalco Energy announced a farm-in of CI-705 Block offshore West Africa, which it will operate under the terms of an acquisition agreement.

Partners Group to Buy California NatGas Power Plants for $2.2B

2025-03-18 - Partners Group will purchase 11 natural gas-fired power plants in California as well as battery energy storage systems from a fund managed by Avenue Capital Group.

Validus Pays $850MM for 89 Energy as Midcon M&A Heats Up

2025-03-24 - Elliott Investment Management-backed Validus Energy continues to roll up Midcontinent assets, closing an $850 million acquisition of 89 Energy III.

Glenfarne Deal Makes Company Lead Developer of Alaska LNG Project

2025-03-28 - Glenfarne Group LLC is taking over as the lead developer of the Alaska LNG project with the acquisition of a majority interest in the project from Alaska Gasline Development Corp.

Inpex to Acquire Renewable Energy Portfolio in Australia

2025-02-06 - Inpex Corp.’s JV will acquire a 4-gigawatts portfolio that includes wind, solar and battery energy storage system assets in Australia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.