Presented by:

[Editor's note: A version of this story appears in the August 2021 issue of Oil and Gas Investor magazine. Subscribe to the magazine here.]

It seemed, in early 2020, as if the vast ocean of M&A deals had crashed down for a final time, and the waves had stilled. Was this how the world of oil and gas cashed out?

By fall, the industry’s shut-in wellbores—overfilled at times with panic and a worthless commodity—slowly came to life. News of a COVID-19 vaccine restored some faith, and gradually rising commodity prices restored a little more.

With prices in the $5/bbl range, the Permian Basin and other favored plays began to create giants as consolidation deals ruled in 2020 and so far this year are still playing a major role in transaction value. More is likely to come.

With nearly $3 billion worth of transactions in the past 12 months, Southwestern Energy Co. CEO Bill Way said consolidation within the energy industry continues to be necessary as companies work to pursue a disciplined and comprehensive strategy.

“In order to attract and retain investors, the industry has needed consolidation,” Way said. “While the commodity price outlook has improved, there is still demand for companies with greater scale and resilience, so I expect consolidation to continue.”

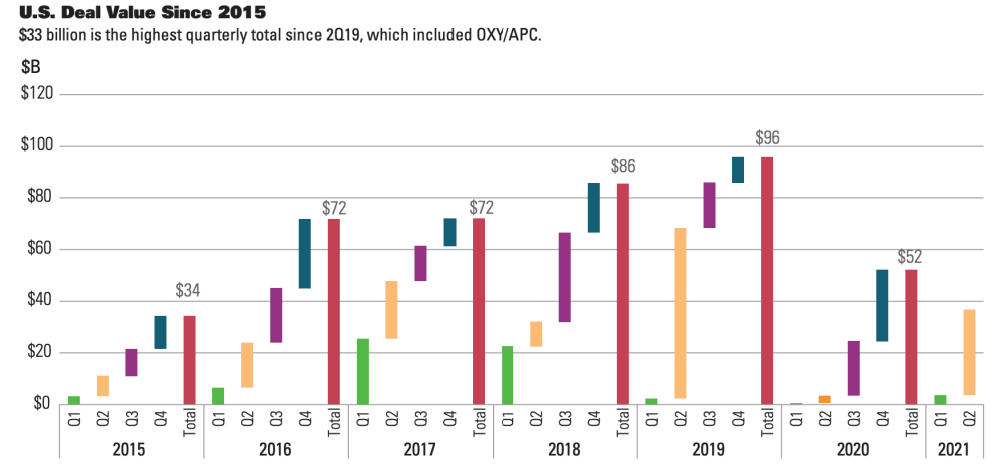

A scarcity of cash made all-equity deals the fashion of the pandemic season. In the second half of 2020, about $49 billion in oil and gas deals were struck, with 90%—$44.4 billion— carved out from corporate deals, according to Enverus data.

Now, asset deals are emerging and will continue to emerge in the next 18 months, investment advisers and E&P managers said.

Thanks to the M&A of last year, the 2021 to 2022 A&D engine is freshly refueled. Where Chevron Corp. bought Noble Energy Inc. and Devon Energy Corp. bought WPX Energy Inc.—anywhere there were large-scale mergers—castoffs will emerge.

Public companies are already starting to eschew mergers with other public companies and instead have purchased large private companies, including Pioneer Natural Resources Co.’s $6.4 billion deal for DoublePoint Energy LLC, EQT Corp.’s purchase of Alta Resources LLC for $2.9 billion and Southwestern’s deal to buy Indigo Natural Resources LLC for $2.7 billion.

Typically, in the aftermath of a merger not all assets fit in the new company. Analysts and dealmakers think that those castoffs will create an aftermarket of second-hand acreage for independents and private equity companies.

For now, those asset deals are discussions. Eventually, they will start to transact, said Craig Lande, head managing director at RBC Richardson Barr.

“The biggest thing is the capital markets have opened up, and the high-yield [bond market’s] are on fire,” Lande said. “People with debt can really help their leverage problems.

“The asset market always flourishes when the capital markets are open. And right now you’re seeing several deals where publics are now buyers of assets,” Lande said.

However, after a lull in the first quarter of 2021, those asset deals are still on the shelf of being shopped, possibly as oil prices have skyrocketed to more than $70/bbl and caused some sellers to second guess when they will see maximum valuation.

But purchases of an accretive asset can also be a catalyst to issuing equity and high-yield financing, Lande said. “That’s been incredibly constructive and very de-levering for the folks that have done that,” he said.

Companies such as Northern Oil and Gas Inc. have followed well-received deals, such as the company’s Permian Basin acquisition, with secondary offerings. In June, Northern Oil and Gas offered 5 million shares worth up to $87.5 million. In April, Enerplus Corp. announced it had increased its unsecured bank credit facility to $900 million from $600 million after agreeing to acquire Hess Corp.’s Williston Basin assets for $312 million.

“Several public companies have done that, and the market has rewarded almost everyone for their acquisitions, basically, in 2021,” he said.

Asset deals are also likely to be favored because they’re generally easier and simpler to put together than the complication of a merger.

“All these asset deals, generally have a big slug of PDP and cash flow and all the things that make the deal accretive and … the publics are trying to fill an inventory.”

After a negligible showing in the first quarter of 2021, corporate mergers again soared in the second frame with $28.7 billion in deals—nearly 87% of all second-quarter transactional value.

Second-quarter corporate deals showed considerable life with deals, including Southwestern’s June 2 deal to enter the Haynesville Shale through the acquisition of Indigo Natural Resources.

Southwestern’s Way said the Indigo deal was an extension of the company’s efforts last year to expand in the Marcellus and Utica plays with the acquisition of Montage Natural Resources. The $213 million all-stock deal added about 325,000 net acres to Southwestern’s portfolio, with its total net acreage position at roughly 787,000.

“Both the Montage and Indigo transactions met the objectives in this framework,” Way said. “They were accretive to key financial metrics, accelerated the delivery of our goals, strengthened our balance sheet, provided tangible synergy opportunities and leveraged our core competency in large-scale natural gas development,” he said. “The Indigo acquisition expands our operations into Haynesville and the growing Gulf Coast demand centers.”

After closing, Southwestern will have core acreage positions in the two largest natural gas basins in the U.S.

Offering hints

Southwestern had hinted at its interest in expanding into the Gulf Coast region. Following the acquisition of Montage, the company studied natural gas-focused plays, which included Appalachia and the Haynesville.

During that process, Southwestern started a dialogue with Indigo on what a combination of the two enterprises might look like. Indigo’s high-margin production, the strength of its balance sheet and quality of its acreage position were natural fits.

The Indigo deal increases Southwestern’s free cash flow output to about $1.2 billion by 2023, the company said. It also expands 2022 estimated margins by 12% as Southwestern realizes low-cost access to premium markets in the growing Gulf Coast LNG corridor.

After the dust settles, Way said the company will evaluate the portfolio to see what belongs with the company long term.

Asset acquisitions are generally “solved for a lot of things,” Lande said. They keep valuations strong. The A&D market is typically healthier when publics are the buyers.

And private equity continues to play a role in A&D transactions.

“Most people thought [private equity] was left for dead, or had shifted to renewables and alternatives,” Lande said. “There’s certainly less private equity, but private equity is still very, very strong. It still has a lot of dry powder. And you’re seeing that some of these big, big deals have been bought by private equity.”

Any doubts of private equity’s remaining buying power have quieted. In February, EnCap Investments LP, through its portfolio company, Grayson Mill Energy, agreed to buy Equinor ASA’s Bakken E&P and midstream assets for $900 million.

In May, Sabalo Energy LLC, another EnCap-sponsored company, sold Howard County, Texas, acreage to Laredo Petroleum Inc. for $715 million in cash and stock. In March, Pontem-backed Validus Energy agreed to purchase Ovintiv’s Eagle Ford Shale assets for $880 million.

“Those are significant size, $500 million, $1 billion deals, and private equity is telling you, ‘We are not dead,’” said Lande.

Generally, private equity firms are buying behind the scenes through larger public companies that Lande described as “neglected assets.”

“The bigger guys just can’t do everything,” Lande said, “particularly on assets they’re not focused on. That’s what private equity does. They take neglected assets, they spend capital, they make them better.”

And private equity firms’ shift to distributing cash flow to their limited partnerships has driven acquisitions an order of magnitude larger.

“They want significant PDP and cash flow with basically de-risked assets from the get go,” he said.

Horror show

From the perspective of A&D advisers, 2020 started out like a horror show and steadily improved to lackluster.

In 2020, EnergyNet, which markets assets as well as government lease sales, saw about $500 million in assets transacted—a significant dip from 2019 and 2018.

CEO Chris Atherton said the company’s transactions were down 30% by volume, with about 1,660 deals in 2020. Values were down about 50%. A typical $10 million package the year before was reduced to $5 million because of depressed commodity prices.

The company eked out its existence, in part, by marketing deals for larger companies. That included sales assets sold by XTO Energy Inc. in the Eagle Ford, Austin Chalk and Uinta Basin last year, as well as Chevron Corp.’s assets in Texas, Carter Knox Field in Oklahoma, Jo-Mill/Spraberry fields, as well as other large independent producers.

“We were fortunate to get some of those deals on the market and closed, and they had a lot of robust buyer interest and participation,” he said.

Chevron also bought buyers—at least 30— for a package worth $25 million.

Long story short, “2020 was bad. Everybody just kind of froze up and didn’t want to do anything.”

Deals that did close were straightforward, based on PDP, and lacked much nuance or value when accounting for potential upside value.

“It was all the uncertainty. What’s going to happen here? Is the industry going to be here? Is the company going to survive?” he said. “In hindsight it looks like it was kind of at the bottom of a very long downcycle.”

What did sell in 2020 was conventional assets. Atherton said they outpaced shale assets four to one. There were a slew of reasons for the pullback, he said. The shale asset market overheated, wasn’t perceived as resource-rich as originally thought because of parent-child well issues, and conventional assets are generally more predictable.

“And that was partly due to the … prices. It wasn’t economic to buy acreage to drill a $10 million well,” he said. “So, there was kind of a pivot back to more conventional or at least mature shale assets.”

Sentiment finally began to change around November and December as uncertainty around the presidential election eased and the announcement of a COVID-19 vaccine brought more stability. The sense, generally, was that “we’ve been through hell, and now we can see the light at the end of the tunnel,” Atherton said.

First-quarter 2021 deal activity was robust as life began to shift back to some version of normalcy. April, May and June also mirrored deal volumes EnergyNet saw in 2019.

Now EnergyNet and other buyers and sellers can look to the next year and a half of deals that seem rife with opportunity. Consolidation by large companies is likely to start an asset-sale landslide as the megamergers of 2020, such as Pioneer Natural Resources Co. and Parsley Energy, Chevron Corp. and Noble Energy, Devon Energy and WPX Energy and others begin to sort out what they will retain or jettison.

“I think the surviving entities are still somewhat getting their arms around what their portfolio looks like and what is core and what is noncore,” he said. “Because of the rapid increase in commodity prices … people seem to be bullish.”

Atherton speculates that had prices remained lower, say in the $50 range, the push to sell off noncore assets might have gone faster.

Now, “there’s no penalty to hang onto [an asset] for six more months,” he said. However, the megamergers will probably result in significant asset sales within the next two years.

“We are starting to see some of that interest,” he said.

EnergyNet plans to continue its place as a “vendor of choice for Chevron for the best noncore assets,” adding the company was at work in June closing a merger for the company in New Mexico.

“I think we’ll see that from other large sellers that did large acquisitions, as well,” he said.

Spread fears

Darrin Henke, Penn Virginia Corp.’s president and CEO, bounded down the stairs at the Hart Energy’s DUG Permian Basin and Eagle Ford Conference and Exhibition in Fort Worth in July, exalting about his company’s deal to buy fellow Eagle Ford operator Lonestar Resources US Inc.

In an interview, Henke didn’t want to speculate on why Lonestar was willing to sell, though COVID-19 fatigue from 2020 is surely one cause. Another: Lonestar’s finances. Lonestar’s market cap of roughly $75 million is swamped by its $260 million debt.

Based on July 9 pricing, Penn Virginia will pay $370 million for the company, including 5.9 million shares of stock and the assumption of about $236 million in debt.

The spring in Henke’s step was clear: Penn Virginia sees an opportunity to add acreage and longer laterals at a price of $30,000/boe, all while increasing projected 2021 free cash flow per share by 30%.

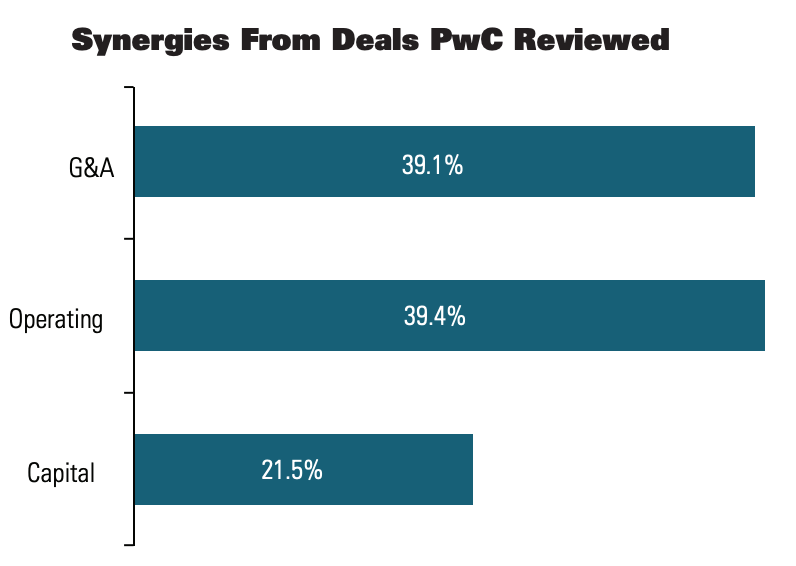

Henke also said Lonestar’s contiguous acreage position will afford operational and G&A synergies worth at least $20 million while adding 13,000 boe/d for a combined 38,000 boe/d in combined sales.

Henke acknowledged the deal would likely have been far different had Penn Virginia paid cash instead of using stock. But through an equity transaction, Penn Virginia increases its position by more than 50% from 90,000 net acres to 143,000 net acres.

“It’s tremendous accretion on basically every front. Net asset value, free cash flow. And we’re doing that at a discount to PV10,” he said. “So we’re paying roughly about $370 million for this acquisition.”

Even as prices rebound, buyers continue to find attractive pricing. Whether the seller’s market shrinks as commodity prices—crude oil was in the $70s in mid-July—remains a key question.

Seenu Akunuri, the leader for PwC’s U.S. energy and mining valuation practice, said the focus for companies in years past was to engage in deals that expanded inventory and replaced reserves.

WARM AND FROSTYThere’s something about January—especially when they aren’t cold—that puts a chill in the oil and gas A&D market. By spring, however, M&A in the U.S. had regained its footing with a sizzling $33 billion second-quarter from more than 40 deals—seven worth at least $1 billion, according to Enverus.  Andrew Dittmar, senior M&A analyst at Enverus, said that investor pressure to operate leaner made consolidation a priority. “With three extremely active quarters out of the last four, there has been more than $85 billion announced in upstream M&A during the prior 12 months,” he said. But the targets for mergers and acquisitions shifted in second-quarter 2021. During 2020, consolidation between public companies focused on operational and G&A synergies. In 2021, only two public company combinations were tallied at more than $1 billion: Bonanza Creek Energy Inc.’s $1.4 billion purchase of Extraction Oil & Gas Inc. in Colorado’s Denver-Julesburg Basin and Cabot Oil & Gas Corp.’s merger with Cimarex Energy Co. in a deal that valued Permian Basin and Midcontinent producer Cimarex at $9.3 billion. Only the Bonanza Creek merger offers operational synergies. Public companies instead turned to the private market:

“The uptick in acquisition activity targeting private equity-backed E&Ps is likely a welcome relief for sponsors that were challenged to find exit opportunities over the last few years,” Dittmar said. “The deals targeting private E&Ps are less about cost-cutting synergies and more about adding inventory. That can be in a buyer’s home basin, like Pioneer/DoublePoint, or entering a new area as Southwestern did by acquiring Indigo in the Haynesville Shale.” Private equity sponsors are receiving mostly buyer’s equity in these sales, with stock constituting about 70% of the value paid with the balance made up of cash and debt assumed. In past years, private sellers typically only wanted cash. “Following a rally in equities that raised the valuation for public E&Ps, their stock represents an attractive currency to buy private and PE-backed counterparts,” Dittmar said. |

||||

Second-quarter 2021 Deals by Value |

||||

| Date | Buyer | Seller | U.S. Play | Value ($B) |

| 5/24/21 | Cabot Oil & Gas |

Cimarex Energy |

Delaware/Midcon | $9.25 |

| 4/1/21 | Pioneer Natural Resources | DoublePoint Energy | Midland Basin | $6.45 |

| 6/8/21 | Contango Oil & Gas | Independence Energy | Multiple | $4.48 |

| 6/2/21 | Southwestern Energy | Indigo Natural Resources | Haynesville | $2.98 |

| 5/6/21 | EQT | Alta Resources | Marcellus | $2.9 |

On its face, a $70 barrel oil price is a clear bonus for the oil and gas industry that for the past five or more years has worked to shape its operations into survivability at $50 oil prices.

“That means a lot of excess cash that allows companies to strengthen their balance sheets and focus on core versus noncore,” said Seenu Akunuri, the leader for PwC’s U.S. energy and mining valuation practice. “There’s still a lot of companies out there that have highly levered balance sheets.”

Akunuri expects to see consolidation that will focus on taking advantage of companies that may have over leveraged balance sheets.

However, bid-ask spreads will become a factor as CEOs start to see $75 oil and projection that oil will go even higher.

“They’re going to say my portfolio right now is worth a billion dollars, but at a hundred dollars it’s at what? $2 billion. So I’m not going to sell it at a billion,” Akunuri said.

The drawback to the crystal ball methodology of dealmaking is that it doesn’t work, particularly if OPEC changes its quotas or some other unlikely event (a pandemic, for example) fouls up the world’s supply and demand.

“As we have seen, that crystal ball has befuddled all of us, right? There will always be situations where some companies will say, no, we will not do this deal because we believe the prices are going to go up.”

C-suite executives still see the need for few companies, which will lead to more M&A, Lande said. But the urgency for deals, spurred by higher commodity prices and high leverage, has been tempered. But larger consolidation moves and asset deals will undergo a more thoughtful process.

“You just don’t have the fire underneath you to have to do something right now,” Lande said.

Atherton agreed that the deal dynamics will change because of uncertainty or volatility. While prices may not be volatile, the rolling boil of oil values can change expectations.

“Just because buyers’ and sellers’ expectations are trying to align, it can cause a little bit of a pause or delay in deals going on in the market,” he said, adding that sellers can be more patient.

For public companies focused on capital discipline and free cash flow generation, their sights are likely set on longer-term strategy. “So the divestments from the larger public will probably continue,” he said.

The deals that have transacted in the past six to nine months have largely benefited both sides of mergers and acquisitions. Those companies have further lowered breakeven costs while commodity prices and companies were valued poorly.

The ability to share in the potential rise in stock prices has been beneficial to anyone who held onto certain stocks, Akunuri said.

Deals, for instance, that were announced in January and closed in the spring have reaped significant returns.

“If an investor held onto their share, those prices are 30%, 40% more because stock prices went up,” he said. “So that’s kind of how the view needs to be as opposed to a billion-dollar company that is at a much higher risk of if the commodity prices do not go to $100 but actually go back to $40.”

The ESG in A&D

The rumors running wild in the Permian Basin in July were that Royal Dutch Shell Plc was considering a sale of its Permian assets. The reason: ESG.

Shell was ordered by a Dutch court to speed up its plans to cut greenhouse-gas emissions faster than it originally intended, Reuters reported.

Shell’s Permian Basin position could be worth more than $10 billion. The acreage includes 240,000 net acres in the Delaware Basin and 2020 net production of 197,000 boe/d, according to Enverus.

But ESG hasn’t become just an impetus for dealmaking, but part of the fabric of transactions as more and more E&Ps examine their emissions and how their investors view them.

RELATED:

What’s Driving Some to Consider a Permian Basin Exit

Historically, ESG was, if not an afterthought, just part of a checklist item during the signing portion of a deal. Now, ESG due diligence is being brought to the front and center of the sales process, PwC said.

The interest buyers take in ESG is not confined to carbon emissions but also carbon capture, “as well as thinking about the long run. Should you have a portfolio that includes some amount of renewables?” Akunuri said.

A focus on ESG in the deal room is partly driven by oil and gas companies that want to be part of the portfolios of general energy investors that make ESG a priority.

A commitment to making ESG part of deals will continue to be important “if you’re focused toward all types of investors, not just only those core investors” in oil and gas, he said.

ESG has become a focal point for public companies and private equity firms. RBC has an ESG group that it works with to analyze a transaction’s potential environmental impact.

“Look, ESG is here to stay,” Lande said, adding, “I will say when oil is $70, I hear a lot less about ESG than when oil is $30. But the reality is it’s here to stay.”

Lande said there’s been a shift in thinking about ESG in general. “Whether it’s a private equity company trying to get LPs to join or, if you’re a public company, just showing that you’re good stewards to the environment, that’s not going away,” he said.

Lande said at the end of the day, ESG is now part of the data rooms. “It used to be in the back of the book. Now it’s in the front of the book,” he said.

Atherton said ESG is central to the E&P executive teams that are considering asset deals. Still, he said the value proposition of some assets, along with good stewardship, is still the ultimate proposition on the table.

“What’s somewhat interesting to me is some of the pivots by companies that are divesting of fossil fuels are shifting away,” he said. “They’re going to sell those assets to someone else. It doesn’t really fix the problem.”

Recommended Reading

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

E&P Highlights: Feb. 16, 2024

2024-02-19 - From the mobile offshore production unit arriving at the Nong Yao Field offshore Thailand to approval for the Castorone vessel to resume operations, below is a compilation of the latest headlines in the E&P space.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.

Stena Evolution Upgrade Planned for Sparta Ops

2024-03-27 - The seventh-gen drillship will be upgraded with a 20,000-psi equipment package starting in 2026.