Oil and Gas Investor Magazine - August 2021

Magazine

Ships in 1-2 business days

Download

In this issue:

COVER STORY:

A&D Refueled

EXECUTIVE Q&A:

A Pure Player in the Haynesville

U.S. E&P:

Bakken Reinvented

NATGAS:

Shoulder Months: Canceled?

WELL PERFORMANCE:

Is Upspacing Better?

MIDSTREAM ESG:

Navigating a New Normal

MINERALS:

Royalties When Crypto Mining

ENERGY TRANSITION:

Addressing Oil and Gas’ Bad Rap

Cover Story

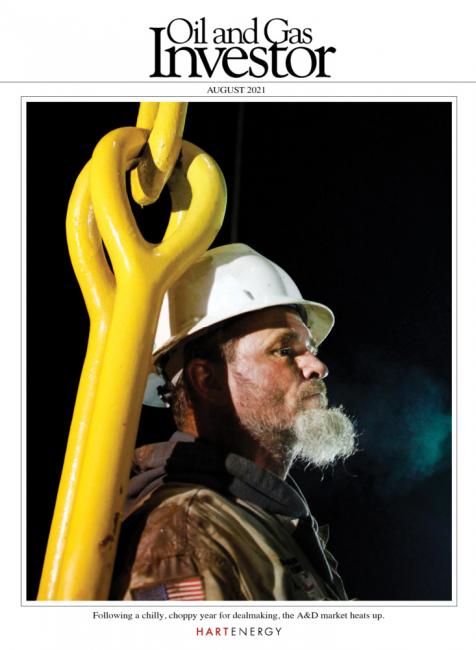

Oil and Gas Investor Cover Story: A&D Refueled

In the aftermath of 2020’s large-scale mergers and corporate transactions, the deal pantry will likely find itself overflowing with asset buyers hungry for suitable acreage.

Feature

Energy Transition: Addressing Oil and Gas’ Bad Rap

Oil and gas will be extremely important to solving the energy transition and management need to get outside their comfort zone to attract today’s generation to the sector, says Stephen Arbogast, director of the UNC Kenan-Flagler Energy Center.

Oil and Gas Investor Energy Policy: The Future of US Energy Leadership

Responding to global energy trends is critical to the future of U.S. oil and gas leadership.

Oil and Gas Investor Executive Q&A: A Pure Player in the Haynesville Shale

Prior to the $2.2 billion sale agreement to Chesapeake, Vine Energy CEO spoke with Oil and Gas Investor on why the Haynesville Shale can exceed investor expectations.

Oil and Gas Minerals: Royalties When Crypto Mining

Oil operators are using their stranded associated gas in crypto mining at well sites. Do they owe royalties on the earnings? Do they owe it in crypto coin?

Shale Well Performance: Is Upspacing Better?

Wood Mackenzie research indicates Permian Basin wells are seeing better production from wider well spacing.

US E&P Spotlight: Bakken Reinvented

The maturing Bakken play continues to struggle with various challenges following the hit it took as a result of the pandemic. Producers now see it as a cash engine rather than a growth engine.

A&D Trends

Oil and Gas Investor A&D Trends: Death by 1,000 Viruses

Expect cybersecurity to be a larger part of the way in which deals between oil and gas companies are evaluated.

At Closing

Oil and Gas Investor At Closing: Back to Square One

The industry’s fate still comes down to what level of oil demand there is now, and what it will be in the future.

From the Editor-in-Chief

From Oil and Gas Investor Editor-in-Chief: Committing to No Emitting

Reducing methane emissions in operations to as close to zero as possible is a mandate the oil and gas industry should pursue immediately and vigorously.