Presented by:

Editor’s note: This interview appeared in the August 2021 issue of Oil and Gas Investor prior to Vine Energy’s sale agreement with Chesapeake Energy announced on Aug. 11.

It’s been a longer-than-anticipated wait, but Dallas-based natural gas producer Vine Energy Inc. finally found its home in the league of public players. This spring, the Haynesville Shale-focused operator relaunched its IPO after having first tested the waters in 2017, becoming only the second pure-play producer in the basin. Notably, Vine is the first E&P to IPO since Jagged Peak Energy in 2017.

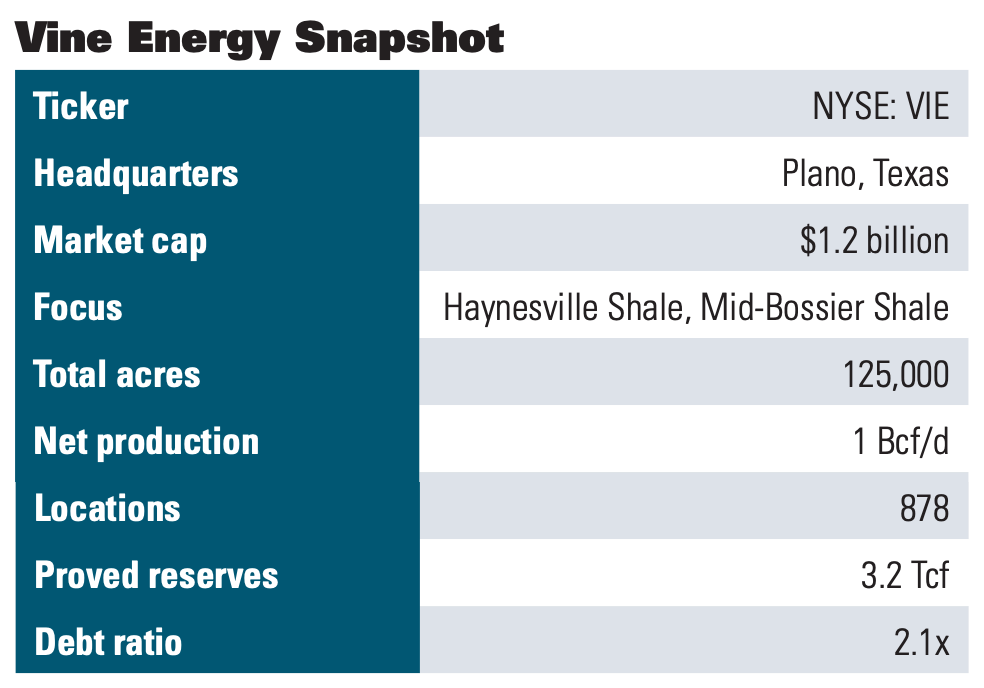

Despite the oil and gas sector being in the penalty box the previous four years due to a run of poor sector returns over the past decade and energy transition headwinds, Vine was able to raise some $350 million with a little help from sponsor The Blackstone Group and management, which backstopped the offering and continues to control 73% of shares. It enters the public arena with a $1.2 billion market cap.

Vine’s story began rather dramatically in 2014 when the startup, funded by Blackstone, acquired Royal Dutch Shell Plc’s 102,000-net-acre position in the Haynesville Shale for $1.2 billion. The venture was and continues to be led by Eric Marsh, a former executive at Encana Corp. (now Ovintiv), which held a 50% working interest in the same acreage with Shell at the time.

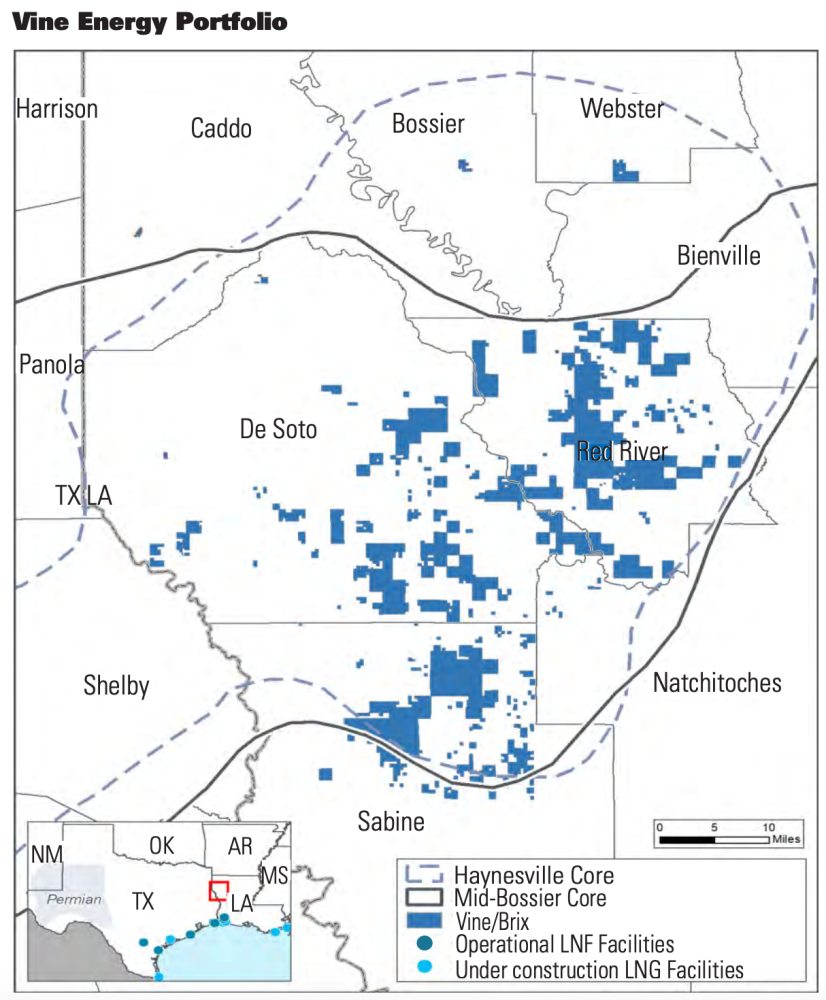

The IPO rolled up three affiliated entities: Vine Oil & Gas, Brix Oil & Gas Holdings and Harvest Royalties. The combined portfolio includes 125,000 net acres primarily in Red River, DeSoto and Sabine parishes in Northwest Louisiana prospective for both the Haynesville and Mid-Bossier shales. Proved reserves are 3.2 Tcf with some 900 drilling locations remaining, or 25 years of inventory at a four-rig pace.

Immediately following the IPO, Vine completely refinanced the company via a new reserve-based loan with a borrowing base of $350 million and a $950 million bond offering. Oil and Gas Investor visited with Marsh in June.

Investor: As the first E&P IPO in four years, what do you think the market now wants from a natural gas producer?

Marsh: Between the IPO roadshow and the bond run shortly after, we held over 150 investor meetings where we had the opportunity to hear from the investment community and what they want, and they were loud and clear. They want a low-growth profile company that manages their balance sheet well.

They want lower debt, certainly sub 2.0x net debt to EBITDA and preferably heading toward 1.5x. They think 2.0x is a beginning point. Most will tell you that something with one handle on it is pretty much going to be required of us. You can’t get a new RBL unless you’re sub-2.0x today.

They don’t want production growth; they want you to be flat, and they want free cash flow growth. What they want for us to do is to drill cheaper, to operate cheaper and to reduce our G&A and make more margin on every Mcf a day we produce.

They want the company to generate a meaningful amount of free cash flow and preferably have a good cash flow yield. They are looking for the natural gas companies in the future to look like perhaps a ramped-up utility that provides returns to their shareholders on a quarterly basis. To attract the generalist investor back into the industry, these are the kinds of things that we as an industry have to do. That’s a story that we all, as an industry, need to begin to embrace and move forward on.

We were also constantly told we need an additional investable Haynesville company. “We don’t want to put all our money in the Northeast.” We heard it repeatedly.

Investor: Do you feel like the market was ready?

Marsh: A couple of years ago we filed a confidential S-1 because we felt that we needed to be ready if the market was ready. We waited for the market to appreciate a natural gas company. We thought all along that a number around $350 million was a target for what we wanted to raise and, in general, we got that accomplished. We had a very good reception from the investing community because we have a very good story.

Skepticism of being the first IPO in about four years was manifested in perhaps some smaller orders than what we thought. The stock price was obviously a bit on the low side so we were a little disappointed in that, but overall we were pleased to get it done because it did a lot more for us than just make us a public company. It allowed us to merge three entities that we had created over the last seven years and solve each company’s financial challenges. Most of all we created a balance sheet that was very solid.

“If a company can generate meaningful free cash flow, continue to pay down debt and also provide a very strong dividend to the investor, I believe the generalist investor will come back.”

Investor: So do you think anti-fossil fuel sentiment on Wall Street was a headwind to going public at this time?

Marsh: I think it was, but I actually think the bigger headwind is each company’s approach. Companies need to recognize that they’ve got to have a meaningful quantity of free cash flow that they’re going to deliver over a period of time. If a company can generate meaningful free cash flow, continue to pay down debt and also provide a very strong dividend to the investor, I believe the generalist investor will come back.

The oil and gas space has had a pretty good year in 2021, at times one of the better investments that any industry provided. So people are a lot more interested in it, especially the natural gas side of the equation being a cleaner investment. We think the generalists are looking at it because it definitely is a transition fuel that will allow us for the next 20 to 25 years to provide the energy that we all need.

Investor: As a private company you’ve been on a growth trajectory. As a public company, will Vine continue to be an organic growth story? What’s your strategy on production growth to gain scale?

Marsh: In 2020, we grew production in two companies at a pace of 29%. We were on pace to get to what we thought was the minimum size that we felt we needed to be at, and that was around 1 Bcf/d and at the same time generate free cash flow. But going forward our plan is to have very modest growth, meaning probably less than 5% a year, and maintain that 1 Bcf/d and grow it just slightly. We do not expect to be on any kind of growth trajectory that was anything like what we were in the past.

But really our goal is to increase the growth in free cash flow. What would drive down our well costs, our lease operating expense? We’re more focused on those items than growing production.

Investor: Do you have a reinvestment of cash flow target?

Marsh: Yes, 65% to 75% of operating cash flow would be reinvested.

Investor: How do you plan to use the free cash flow? What are your priorities?

Marsh: Priorities are straightforward in that we would have part of it go to debt pay down, because even though we talked about one and a half times leverage in 2022, we ultimately would like to get that down to the 1.0x range or less. We think natural gas companies in the future need to have less leverage. It allows you to deal with the commodity cycles that we have.

The other half would be to pay our shareholders with a nice dividend. We have not determined the exact formula on the dividend yet, but we’ve thought a lot about a fixed component and then a variable component to the dividend. We don’t see ourselves hitting our target leverage ratio of 1.5x until probably the end of the second quarter, maybe mid-third quarter of 2022. At such a time we hit that target, then we would begin to contemplate a dividend strategy.

We believe we’ll be one of the few natural gas companies that can institute a meaningful dividend in the relatively near term, and it’s going to be a primary focus of the management team and our board.

Investor: You also have a pretty robust hedging program. Can you explain your strategy behind that?

Marsh: As a private company, Vine at the time was a bit over-levered, and we felt it was very important that we had our gas sold forward. It was very common for us to have two to three years of hedges in front of our program.

Now on the practical side, the way I think about it, I believe that we’re making a capital investment in drilling a well that will typically pay out in around 12 months. So I like the hedging profile to provide certainty of that gas price so that I know exactly when that well is going to pay out and I have a return on that capital. We’ve been real active hedgers over the years, typically 80% to 85% hedged on our future production profiles, to solidify the returns that we generated year over year.

But going forward, as we pay down more debt and we have a better balance sheet, we will probably have a bit more exposure to the commodity price. So instead of being 80% and 85% hedged, we might choose to be more like 60% hedged. As you look at our 2022 program right now, we only have about 60% of our gas production hedged.

Investor: Have the hedges limited your upside in a rising market?

Marsh: We’re on the wrong side of it this year, but in the previous six years we’ve been on the right side of it. It’s been a real blessing for us to be able to keep a steady four-rig program running since 2016.

We bought this asset from Shell when it was 20% developed and 80% to be developed. We started out at a very high leverage ratio when we first bought the asset and it hadn’t really been worked on for much of a year or two. We needed to drill wells to grow the asset and grow our PDP reserve base.

We did that by having certainty of our gas price. Having two, three years of hedges out in front of us to keep the program running allowed us to delever Vine materially. So, sometimes taking a little lower gas price and being able to keep our program running and growing the asset allowed us to survive in a really a rough industry.

Investor: Does that include last year as well? Did the black swan events of 2020 have any effect on your program?

Marsh: It didn’t, for the most part. We knew what the commodity price was, and we knew what our returns were. We were generating 80% rates of return at a $2.50 deck, which is where we had our gas hedged or a little better. So it made no sense for us to lay down a rig. We just plowed through it and continued to do what we do, and that is grow the asset and drill high-quality Haynesville and Mid-Bossier shale wells. From an operating perspective, 2020 had no effect on our program.

Investor: How long have you worked in the Haynesville, and why have you stayed here so long?

Marsh: The latter part of my career with Encana I was over the Midcontinent business unit (that included Haynesville assets), so I was very familiar with the Haynesville with our program we had had at Encana.

I have always felt that the Haynesville was underappreciated. A lot of that had to do with well costs being abnormally high in the early days, the 2009 to 2011 time period. We did not have the technology that we have today that allows us to drill wells as fast as we do. We have made remarkable improvements in well costs and, because of that, these wells that were marginally economic back in 2010 and 2011 are now highly economic, perhaps some of the highest return wells in North America.

And what makes it unique is this: The reservoirs that we deal with are the highest pressured reservoirs in North America. We have some of the deepest and hottest acres, at least on the Louisiana side of the play. Because of that high pressure, our wells often start out flowing at 9,000 to 10,000 psi well head pressure. On average, a well will produce eight months without decline in production volume.

“[The Mid-Bossier] is a core asset to Vine, no different than the Haynesville.”

We have wells that have produced 24 months without production decline. Now, during that time the pressure drops, but the production stays flat, so it allows you to capture a large quantity of that well’s EUR in the first couple of years of its production, thus generating very high returns and quick capital investment payouts.

I’ve always felt the Haynesville was the premier natural gas play. When we look back at the economics, the asset is exceeding our expectations.

Investor: Encana was a 50:50 partner with Shell in the Haynesville while you were there. Is that the reason you focused here when you launched Vine with the Shell acquisition?

Marsh: Absolutely I was familiar with the asset. As executive vice president, I had teams that worked on that asset in the Haynesville.

But I’ve been a natural gas guy across North America. I’ve worked from Northern Alberta to the Gulf Coast and developed huge plays such as Jonah [Field], the Piceance Basin and we had a Marcellus position. I’m very familiar with all the gas plays in North America.

When we partnered with Blackstone we had the opportunity to get in the top natural gas play in North America. “Where would you go, Eric?” was the question. And I said, “Clearly, the Haynesville.” We had an opportunity to go to any other basins and that’s the basin we chose because of the strong economics that I thought would ultimately play out, which they have. And they’ve played out even better than what we thought.

Investor: What is the breakeven price for your program?

Marsh: The breakeven across our entire portfolio of 878 wells is $1.91 per MMBtu at PV10, or with a 10% return. That’s not cherry picking the lowest ones. Our breakevens are as low as probably $1.45 on the low end, but that’s the average breakeven for our portfolio.

Investor: Do you feel that the Mid-Bossier is an underappreciated formation in Vine’s portfolio? How do economics compare to the Haynesville?

Marsh: Investors just don’t know about it. There are not a lot of companies that have the Mid Bossier. Indigo has it and Southwestern saw the value of the Mid-Bossier (as part of its pending merger with Indigo). They even talked to it in their conference call. To a lesser degree GeoSouthern [Haynesville] has some Mid-Bossier. But for a lot of the companies that work out to the northwest and north of us, it’s not very prospective.

There’s a fine line where the Mid Bossier works and doesn’t work, and it’s about 25% to 30% of the basin, primarily in the southeast portion where it works best. If you go too far north it’s too clay filled and it just doesn’t produce as well. We are blessed to have these two intervals.

Investor: How important is it in your portfolio?

Marsh: It’s a big piece of our portfolio. It’s a core asset to Vine, no different than the Haynesville. We probably drill on average 35 wells each year and typically 60% would be Haynesville and 40% would be Mid-Bossier. The Haynesville has slightly higher economics than the Mid Bossier, but very similar. The Mid-Bossier is probably a couple of notches down, but 80% versus 85% rate of return. Overall, the Mid-Bossier is comparable.

Today virtually every well we drill in the Mid-Bossier is at least 10,000 ft in length, and I think in the future it will be 15,000 ft in length; the longer the lateral, the better the economics. So on average, if your Haynesville well is 7,500 ft in length and your Mid Bossier is 10,000 ft in length, you generate similar returns.

Investor: So are you codeveloping these? What does that look like?

Marsh: We are. A typical pad has either three or four wells on it and typically half are Mid-Bossier and half are Haynesville.

Our strategy is a little bit diverse in that we develop that pad, get it on production and then we don’t come back to that section for a year or so. We don’t like to have these wells shut in for any length of time. We see some reservoir damage from that and we don’t want to disturb their flow. Maybe it’s a year, a year and a half later, we come back to that section to build another pad to finish the development out. We call it our rolling development. So we drill across all areas of our acreage each year.

Investor: Would you look to gain scale via acquisitions now that you’ve gained the public platform?

Marsh: Our market cap is about $1.2 billion, and we definitely recognize that scale matters. However, we have developed a very good business that has 25 years of high-quality inventory, so we are not in a hurry to go out and acquire. We’re more interested in turning in some good quarters, quarter after quarter hitting our free cash flow targets.

But on the other side of the coin, if we could find an asset that would bolt onto ours and have similar quality then, yes, we’re definitely interested. We see the bigger gas companies trading at a higher multiple, and we would sure like to trade at a higher multiple. It has to be balance sheet accretive and shareholder value enhancing.

But I’d also tell you that we could do it organically as well. Even though that asset produces 1 Bcf/d today, if there was an environment where you really wanted to do that, the asset certainly could produce 1.5 or 2 Bcf a day, not a problem. We could get there fairly quickly.

Investor: What’s your forward view of the LNG opportunity as well as other gas demand drivers around the Gulf Coast? Is the Haynesville advantaged from that perspective?

Marsh: Yes, very much so. We think there’s about 4 Bcf more demand today than there was a year ago, and that’s driven primarily by LNG export, more gas to Mexico and better power generation with natural gas. We see that 4 Bcf a day tightening month over month, and we would expect natural gas to be in strong demand this winter and into 2022.

We think there is some modest growth out of the Permian and that will be pipeline capped. That could be another Bcf a day, maybe a Bcf and a half, but that’s far short of the 4 Bcf incremental demand we’re seeing.

What you’re really seeing happen in the industry is companies like ours are going to keep their growth profiles at a minimum pace. They’re working on getting their balance sheets corrected and generating free cash flow. They are not going to grow production materially. As a matter of fact, year-to-date, we’re about a half a Bcf a day less production in ’21.

So, overall, what has to give is prices will have to be a bit higher to spur demand from perhaps other basins or from companies that would want to change their strategy. We’re not going to be that company. We’re going to say stay focused on modest growth.

Investor: Is Vine contracting directly with LNG export facilities?

Marsh: We do. We’ve been a seller to the LNG facilities for some time. We do not hold any firm transport, and we market our gas through fixed sales. We sell our gas to credit worthy counterparties which could be a utility, an LNG producer or a petrochemical facility.

It’s not uncommon for us to have 60% to 65% of our future gas production sold in fixed contracts. We do that on a regular basis. We think it’s super important to be able to get paid when you do sell your gas.

That’s why typically our basis differential is less. Normally it’s been around 18 cents, and this [first] quarter it was 13 cents.

Investor: Are you seeing a push in the market for sourcing “clean” gas?

Marsh: We are hearing it from the LNG producers that are more in tune with the international buyers of LNG. The world’s LNG consuming nations increasingly desire to source supply from low emissions basins and low emissions cargoes. That’s where Vine can differentiate itself through its ESG leadership. We’re working in concert with them to provide a product that they want.

“It’s not uncommon for us to have 60% to 65% of our future gas production sold in fixed contracts. We do that on a regular basis. We think it’s super important to be able to get paid when you do sell your gas.”

If you think about certified Angus beef, people pay a little extra for that. Perhaps there could be a little extra if you had certified gas as well. We’re working on becoming a responsibly sourced gas-focused company and will do the necessary things to be a part of that.

We think over the next two to three years natural gas producers will certify their gas as responsibly produced, and we think that there’s more LNG cargoes that will source responsibly produced gas. I think that will be something that the future will hold, and so we want to be a part of that. We think it’s important.

Investor: How are you implementing ESG considerations in your strategy?

Marsh: We’ve made great progress with our ESG strategies. To date, it has really been focused on emissions. We’ve actually had reductions in emissions since 2017, so it’s not anything really new to us. We’ve reduced our methane emissions by 62% since 2017, and we’ve reduced our greenhouse-gas emissions by 35% since 2017. So we’re making good progress on that.

For instance, we use LDAR [leak detection and repair] technology to look for any leak in any flange. So when we turn on a new set of wells, within 30 to 60 days we’re out there with a LDAR camera looking for any minute leak. By the end of this year we’ll have virtually all our wells [monitored by] LDAR.

Sometimes an older well will load up and need to be released to a tank for a period of time. We use AI [artificial intelligence] technology to reduce the amount of time you’d have to blow a well to the tank, and it’s reduced the number of times that that well will have to go to tank. That really cuts down on our emissions as well.

Our drilling rigs and our frac fleet are all bi-fuel. We use natural gas as well as diesel, but more natural gas to drill our wells and frac our wells. We think that’s the best solution. We also are working toward having our produced water flow via pipelines instead of trucks, reducing the amount of diesel emissions that occur in our area.

Investor: What is your view of the role of natural gas in the push for an energy transition?

Marsh: Natural gas will play a meaningful role for the next 20 to 25 years. We’re seeing electricity usage expand. As people drive more electric cars, as more things are electrified, more natural gas is going to be needed to provide the electricity.

“We see natural gas playing a very meaningful role in the clean energy transition.”

When the wind doesn’t blow, it doesn’t generate any electricity. Batteries can help a bit, but they’re not advanced enough to be able to fill the space when the wind doesn’t blow. Same story with solar. Solar is an intermittent source of electricity. Combining ultralow emission renewables that are intermittent by nature, with reliable low emissions natural gas, is a powerful combination.

Natural gas is a relatively clean and versatile fuel with an extremely low delivered cost that doesn’t require subsidies or mandated usage. We see natural gas playing a very meaningful role in the clean energy transition.

What people really need to recognize is the incredible progress we’ve made in our air quality in the U.S. Since 2007 energy related CO₂ emissions have decreased by 15%, which has largely been due to natural gas displacing coal. Now you take what we’ve done here in the United States by displacing coal and you apply that worldwide, we can achieve the same results worldwide.

Even though it’s great that we’ve reduced our emissions here in the United States, it’s a worldwide phenomenon. What we’ve been able to achieve the rest of the world is going to want to achieve. And I think natural gas plays a meaningful role in that.

Recommended Reading

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.

Everywhere All at Once: Woodside CEO Touts Current Global Portfolio

2024-03-05 - Meg O’Neill, the CEO of Australian energy giant Woodside Energy, is overseeing the “next wave” of growth projects around the globe, including developments in the Gulf of Mexico, offshore Senegal and further LNG expansion.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.