Occidental Petroleum is taking a multibillion-dollar leap into direct air capture (DAC), recently inking a $1.1 billion deal to acquire technology partner Carbon Engineering. But can the company bring down costs for its DAC dreams? (Source: Occidental)

With a $1.1 billion bid to acquire Carbon Engineering Ltd., Occidental Petroleum further cemented direct air capture (DAC) as a major pillar of its low-carbon strategy—but DAC costs need to come down to make that strategy viable long term.

Houston-based Occidental Petroleum Corp. this week announced plans to acquire British Columbia-based technology firm Carbon Engineering for $1.1 billion in cash. Through its DAC-focused subsidiary 1PointFive, Occidental has worked with Carbon Engineering since 2019 to deploy the startup’s proprietary carbon removal technology on a commercial scale.

1PointFive is currently building its first commercial DAC project in the Permian Basin; the “Stratos” facility in Ector County, Texas, is expected to remove up to 500,000 tons of CO2 per year once operational in mid-2025.

Also this month, 1PointFive was selected to receive federal grant funds to build a larger DAC and CO2 sequestration project in South Texas. The funding from the U.S. Department of Energy’s Office of Clean Energy Demonstrations will support developing a DAC hub on the King Ranch in Kleberg County, Texas.

The future South Texas project is expected to include the world’s first DAC plant capable of removing up to 1 million tons per year of CO2.

But as Occidental takes a giant leap into DAC development and navigates the nascent carbon dioxide removal (CDR) credit market, driving down cost remains a key priority for the company, Occidental President of U.S. Onshore and Carbon Management Operations Richard Jackson said during the company’s second-quarter earnings call.

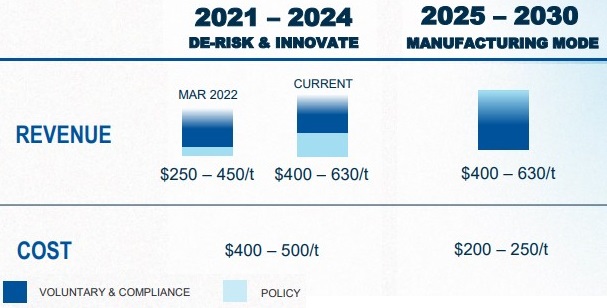

Occidental originally expected its first DAC project in the Permian to cost between $800 million and $1 billion. At the time, the company expected to generate revenues of between $250 and $450 per ton of CO2 through DAC and carbon sequestration, Othe company laid out in its latest investor presentation.

Due to inflationary pressures on construction materials and labor, the company later raised its capex outlook for the first plant up to $1.1 billion. Occidental said costs range between $400 and $500 per ton to develop and operate its DAC and sequestration business.

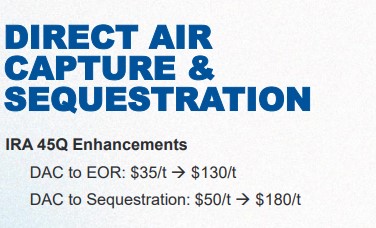

But enhancements to tax credits passed under the Inflation Reduction Act last year have improved the economics for the E&Ps’ DAC plans. Provisions of the law include a tax credit of $85 per ton for sequestering CO2 produced by industrial activity—up from $50 per ton—and adds a tax credit of $180 per ton for DAC.

Occidental now expects DAC and sequestration to generate revenues of between $400 and $630 per ton.

And as the company looks out over the next decade, Occidental aims to bring its DAC and sequestration capital spend down to between $200 and $250 per ton.

However, analysts on the earnings call questioned whether Occidental’s equity partners might delay future DAC investment decisions until they see capital and operating costs drop for the the company’s other DAC projects.

Occidental recently inked a memorandum of understanding with the Abu Dhabi National Oil Company (ADNOC) to consider developing DAC hubs in the U.S. and the United Arab Emirates.

“I think that ADNOC will be prepared to move forward with us sooner than waiting on what happens with Stratos,” Occidental President and CEO Vicki Hollub said on the earnings call.

"There's never been a technology that's worked and been adopted in large way without having gone through the same kind of thing that we'll go through with our direct air capture,” she said.

RELATED: IRA One Year Later: Progress, But a Long Way to Go

EOR optionality

As Occidental builds out its first commercial-scale DAC project in the Permian, the company has options for how to use the CO2 captured by the plant.

The company has multiple zones across its large Permian acreage footprint to use CO2 sequestration for EOR—where CO2 is injected under pressure into reservoirs to maximize hydrocarbon recovery from an oil field. Occidental has been using CO2 to improve oil recovery for nearly 50 years, Hollub said.

In reality, the majority of CO2 sequestration and storage actually happening today around the globe is through EOR processes to produce fossil fuels, according to data from the International Energy Agency. That’s slated to change this decade as more and more dedicated CO2 storage capacity comes online.

EOR is the core business of Denbury Inc., which is being scooped up by Exxon Mobil Corp. in a $4.9 billion acquisition announced earlier this summer. But Denbury’s EOR business, with its 47,000 boe/d of incremental production, wasn’t the main driver behind Exxon’s acquisition, CEO Darren Woods said: it was access to Denbury’s 1,300-mile CO2 pipeline network and access to 10 onshore sequestration sites.

“If you think about the broader opportunity, it's really around carbon capture storage, sequestration and keeping the carbon under the ground,” Woods said during Exxon’s second-quarter earnings call in July. “That’s the longer term play for us.”

Occidental is also planning to permanently store CO2 in subsurface saline reservoirs not used for oil and gas production.

Under an agreement with Japanese airline All Nippon Airways (ANA), 1PointFive will sell 30,000 tons of CDR credits captured and sequestered with the Stratos system over three years. But the CO2 captured for ANA will be sequestered in saline reservoirs not used for hydrocarbon recovery, Occidental specified.

“We’re really focused on that, both in the Permian and in the Gulf Coast, around really developing that subsurface for sequestration,” Jackson said.

RELATED: Occidental Petroleum to Acquire Carbon Engineering for $1.1B

Recommended Reading

NOG Closes Utica Shale, Delaware Basin Acquisitions

2024-02-05 - Northern Oil and Gas’ Utica deal marks the entry of the non-op E&P in the shale play while it’s Delaware Basin acquisition extends its footprint in the Permian.

Vital Energy Again Ups Interest in Acquired Permian Assets

2024-02-06 - Vital Energy added even more working interests in Permian Basin assets acquired from Henry Energy LP last year at a purchase price discounted versus recent deals, an analyst said.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

Tellurian Exploring Sale of Upstream Haynesville Shale Assets

2024-02-06 - Tellurian, which in November raised doubts about its ability to continue as a going concern, said cash from a divestiture would be used to pay off debt and finance the company’s Driftwood LNG project.