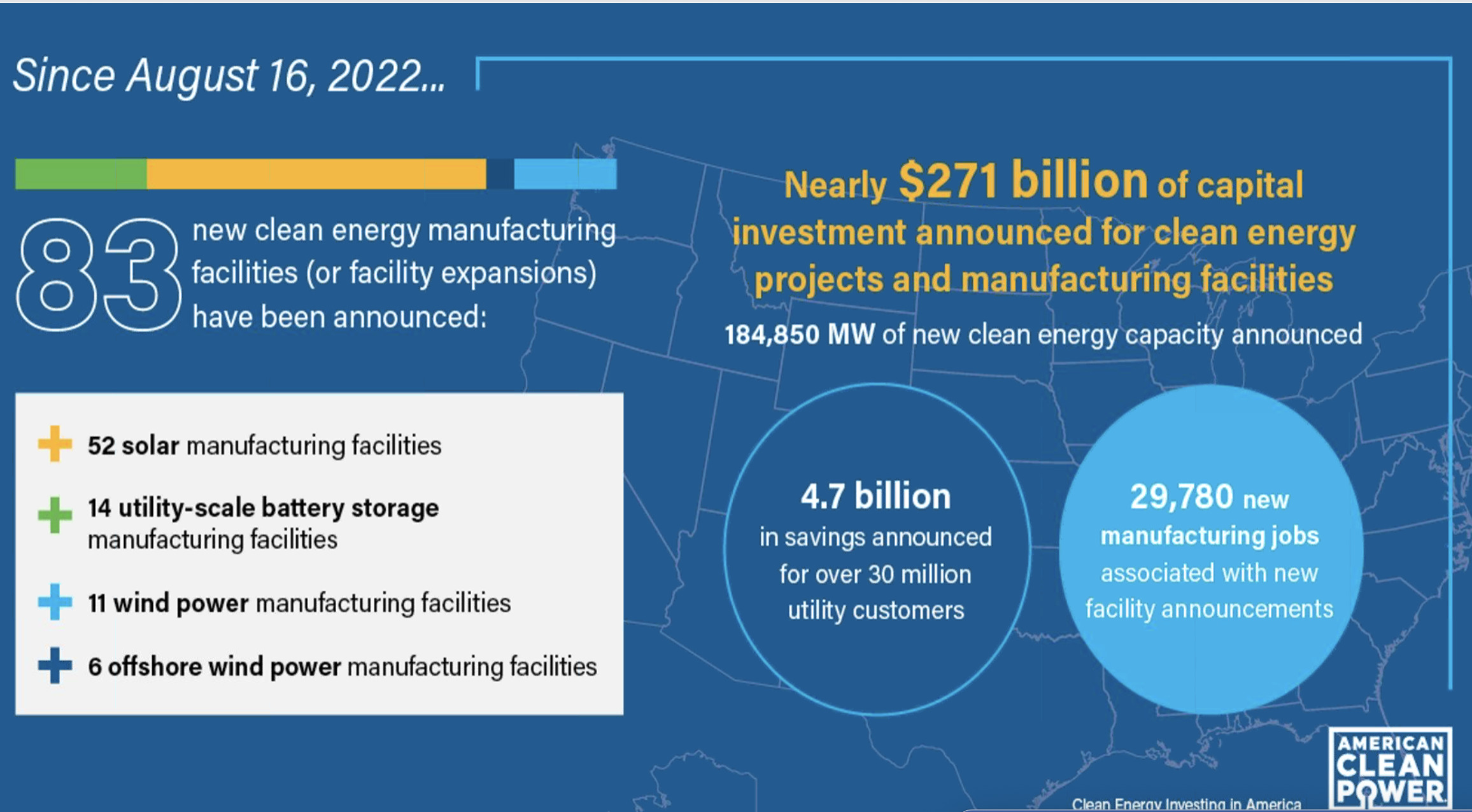

Nearly $271 billion in capital investment has been announced for clean energy projects and manufacturing facilities since Aug. 16, 2022, according to the American Clean Power Association. (Source: Shutterstock.com)

The Inflation Reduction Act (IRA) has fueled a manufacturing boom, helping to pave the way to hundreds of billions of dollars in clean energy investments as the U.S. moves toward lower carbon energy resources to combat climate change.

A year after the act was signed into law, energy players and watchers are reflecting on how the IRA’s nearly $370 billion in incentives for clean energy and climate-related spending is transforming renewable energy and setting an example for the world to follow.

However, despite those efforts—some of which remain to unfold as parts of the energy industry awaits further guidance on parts of the law—concerns remain about whether the U.S. will hit its 2030 goal to cut carbon emissions by about 40%.

Jason Grumet, CEO of the American Clean Power Association (ACP), described the past year as a story of “promise and peril.”

Representing about 750 companies specializing in utility-scale solar, wind, energy storage, green hydrogen and transmission, ACP said this week nearly $271 billion in capital investment has been announced for clean energy projects and manufacturing facilities since Aug. 16, 2022. The figure, which equates to about 184,850 megawatts (MW) of new clean energy capacity, includes 83 new manufacturing facilities or expansions. More than half are solar.

“Our nation has demonstrated in the last 12 months what the private sector can do well when it is supported by a strategy that is focused on innovation, strong capital markets and America’s workforce,” Grumet said during an ACP webinar Aug. 15. “The significant laws passed last Congress, basically for the first time in our nation’s history, put us on a real course toward a low carbon future. We’ve basically shifted away from 20 years of debate over regulation and taxation with a little dose of deprivation mixed in for fun, and we focused on what really makes this country thrive, which is focusing on innovation and investment.”

Solar incentives in the IRA include an advanced manufacturing production tax credit that can be applied to the domestic production of components such as modules, photovoltaic cells and wafers and solar-grade polysilicon, among other items.

The IRA established new advanced manufacturing production tax credits for offshore wind energy structures and vessels made in the U.S. It includes a 10% credit for vessel retrofits, as well as credit for production of components such as blades, foundations, nacelles and towers.

Hydrogen incentives in the IRA include a 10-year production tax credit with a maximum value of $3/kg for hydrogen produced with nearly no emissions.

The law also provides incentives for carbon sequestration, which is used for blue hydrogen. Provisions include a tax credit of $85/ton for sequestering CO₂ produced by industrial activity — up from $50/ton. It also adds a tax credit of $180/ton for direct air capture.

Plus, there is more on the consumer side with direct rebates on heat pumps and energy efficiency upgrades for appliances among other benefits.

The IRA narrowly passed the Senate last year, with votes roughly split along party lines. Every Democrat in the House voted in favor of the bill, which also included an extension of Affordable Care Act subsidies and an estimated $300 billion deficit reduction.

“While the debates over climate have often been very polarized politically, it’s worth noting that 80% of the total investment made in the last year is going into congressional districts that are currently held by Republicans,” Grumet said. “And 60% of all of the investment in new manufacturing is going into congressional districts that are currently led by House Republicans. That is the story of the resiliency of this effort. These are American jobs in American communities providing domestically produced clean American power. And that, I think, is the fundamental strength of this process and, I think, of the American innovation story.”

Setting the pace globally

While helping the U.S. stay the course to lower emissions, the IRA has also had a global impact. Other countries initially called the IRA unfair due to its heavy emphasis on domestic production and manufacturing. But others eventually devised plans of their own with high-dollar clean energy incentives to lower emissions and boost their global competitiveness.

The EU adopted the Green Deal Industrial Plan and Canada has unveiled billions of dollars in clean energy incentives as well. Canada has even tied some action to how the IRA plays out. Performance incentives jointly made available by the Canada and Ontario governments for the Stellantis-LG Energy Solutions joint venture and Volkswagen Group’s planned electric vehicle and battery plants are linked on the IRA.

The Canada and Ontario governments called its incentives a “direct response to incentives offered by the U.S. government.” In a joint statement about the auto manufacturers news, the two said “the performance incentives are contingent on, and proportionate to, the production and sale of batteries from each project, and should the incentives offered under the U.S. IRA be reduced or cancelled, so would the performance incentives under the agreement.”

Other countries are following a similar model to the IRA, said Colin Leyden, the Texas director for the Environmental Defense Fund.

“It’s really sort of spurred competition at the global level. I don’t think anyone honestly thought that would happen,” Leyden told Hart Energy. “But it has, and I think that’s a great thing. … One of the big things that was hoped from the Inflation Reduction Act was it would spur private industry investment, and we’ve absolutely seen that in the U.S., and we’ve seen it in Texas.”

Getting bigger

The IRA is strengthening the energy sector in Texas, which leads the U.S. in not only oil and gas production but also wind energy.

“All of the different pieces of IRA are playing out in Texas,” Leyden said. “We’ve had multiple announcements for solar manufacturing jobs and plants opening, as well as some on the EV front as well. Then, of course, there’s the hydrogen tax credits that we talked about. There’s a $4 billion investment from Air Products and AES industry announcement for a mega scale green hydrogen production facility.”

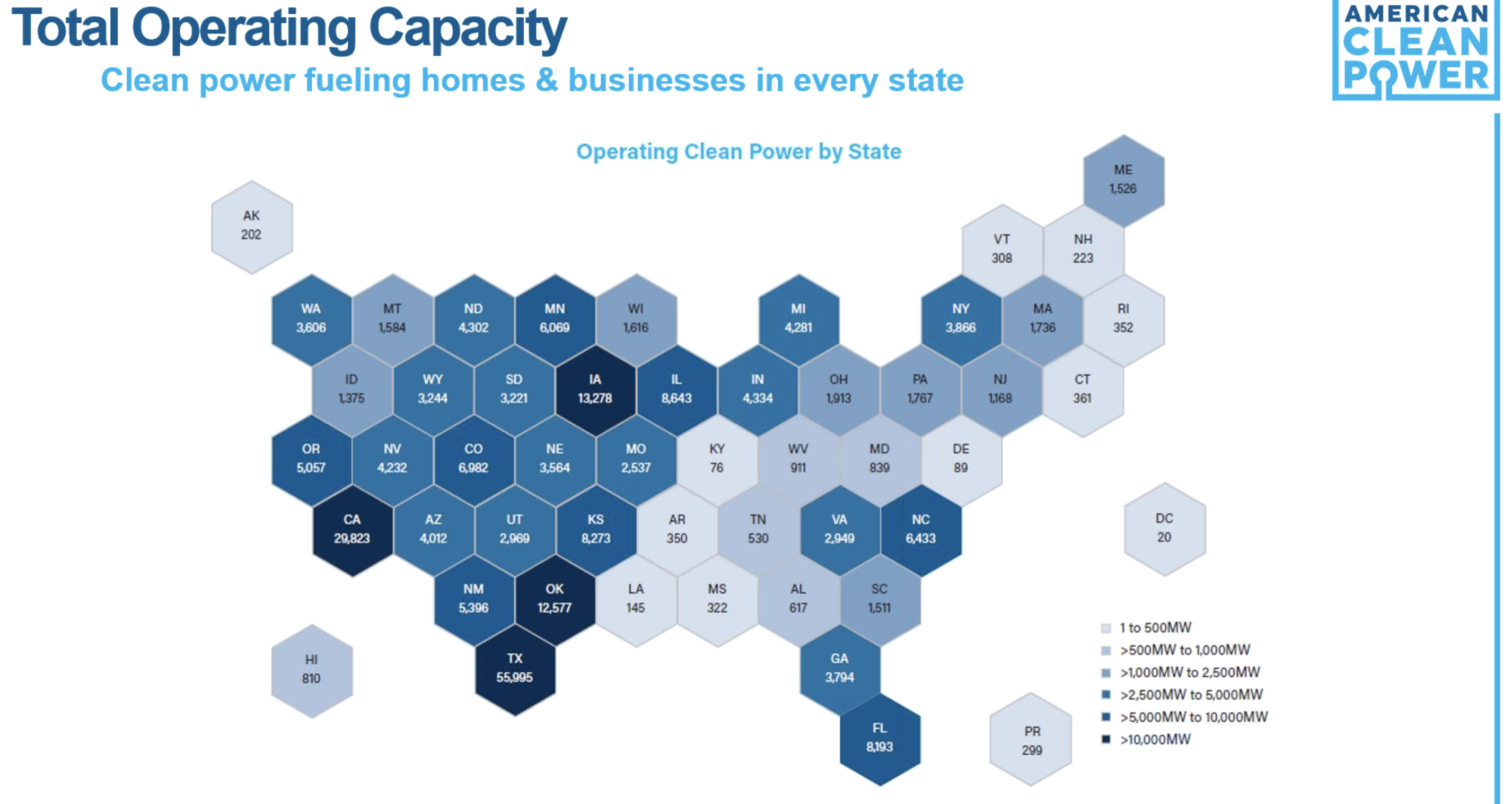

John Hensley, vice president of research and analytics for ACP, called Texas the clean power hub — given that it has nearly 56 GW of operating clean power capacity.

“Texas has more than 26 gigawatts in development, enough to increase the state’s total operating capacity by 47%,” Hensley said after noting how the clean power development pipeline is now beginning to see the influence of the IRA.

California, which ranked No. 1 in solar production in the U.S., also has seen gains.

Ed Hirs, an energy economist and fellow at the University of Houston, pointed out how moves by legislators in California are making green hydrogen more economical.

“We get a $3 a kilogram tax credit or payment from the federal government [in the IRA] and $2 a kilogram out of California,” Hirs told Hart Energy. “That now comes costs down to $1, which is equivalent to the cost of hydrogen from a steam methane reformer. Still, we’ve got to build infrastructure to use it.”

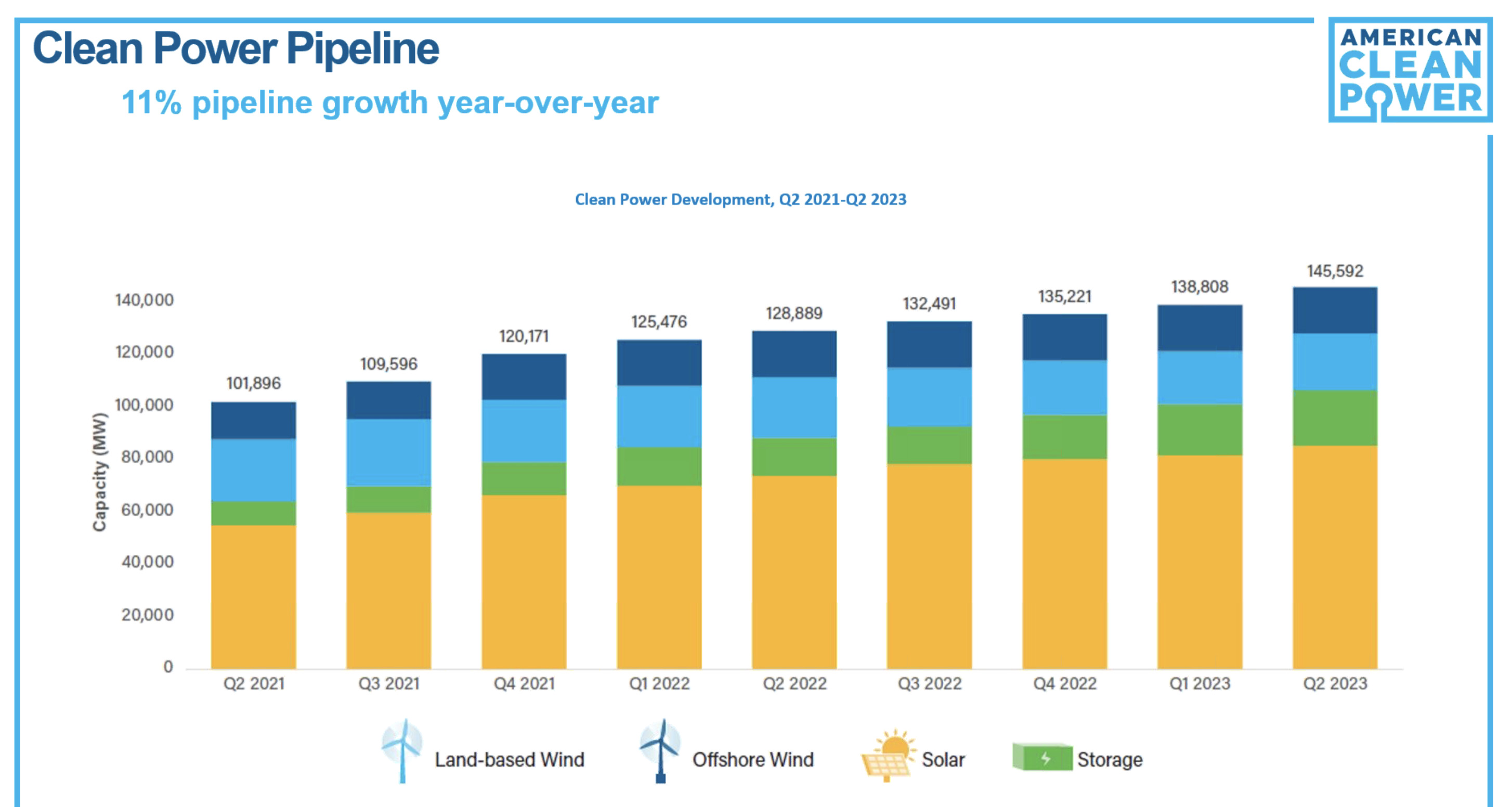

The clean power pipeline has grown 13% over the last quarter and has risen 43% compared to the same period in 2021, reaching about 146 gigawatts (GW) of projects, Hensley said. The pipeline includes more than 1,200 projects, consisting of 85 GW of solar projects, 21 GW of land-based wind projects, 21 GW of battery storage projects, and roughly 18 GW of offshore wind projects.

“We’ve seen the battery storage pipeline grow the most significantly within the last year, with capacity in development more than doubling over the past 48 months,” Hensley said, adding clean power development is now taking place in every state.

Despite the progress, there is still much to be done as parts of the industry awaits more guidance on parts of the law. Direction is needed on more specifics around green hydrogen and domestic content requirements for critical materials needed for EV manufacturers to qualify for certain credits.

“We are moving faster than ever before towards a sustainable, nationally secure and economically viable, low carbon economy, and we’re not moving nearly enough to achieve those goals by mid-century,” Grumet said.

Long way to go

By ACP’s estimates, the U.S. needs to install about 100 GW of non-carbon power annually for the next 30 years to reach a net-zero economy.

“But we’re moving about a third as fast as we need to move. … The ambition of scale [and] a number of structural challenges are being revealed,” Grumet said.

Permitting, transmission, supply chain and workforce are on the list.

Addressing permits, he acknowledged some progress was made in the debt ceiling debate. “But the job is not done.”

Similar concerns were shared by others, including Hirs.

“We’ve been reading a lot about the queue for interconnections. Obviously, one can’t join the market unless one’s given access to the market,” Hirs said. “You don’t want to be building a Starbucks in the desert without any roads nearby. That’s the same sort of something here. Solar farms require transmission to be built.”

Political risks could also prevent the IRA from reaching its full potential, according to Leyden, as is usually the case with big pieces of legislation.

“There’s certainly been talk about trying to roll back some of the IRA from folks running against the current administration. That’s certainly a risk,” Leyden said. “But one of the hopes to mitigate that political risk is a lot of the benefits from the Inflation Reduction Act are going to red states, Republican-led states, because that’s where a lot of these resources are. I’m optimistic that the benefits from the Inflation Reduction Act, as it plays out over the next year or two, will help mitigate some of that political risk.”

Recommended Reading

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

ProPetro Reports Material Weakness in Financial Reporting Controls

2024-03-14 - ProPetro identified a material weakness in internal controls over financial reporting, the oilfield services firm said in a filing.

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.